Here are the latest market charts and analysis for today. Check them out and know what’s happening in the market today.

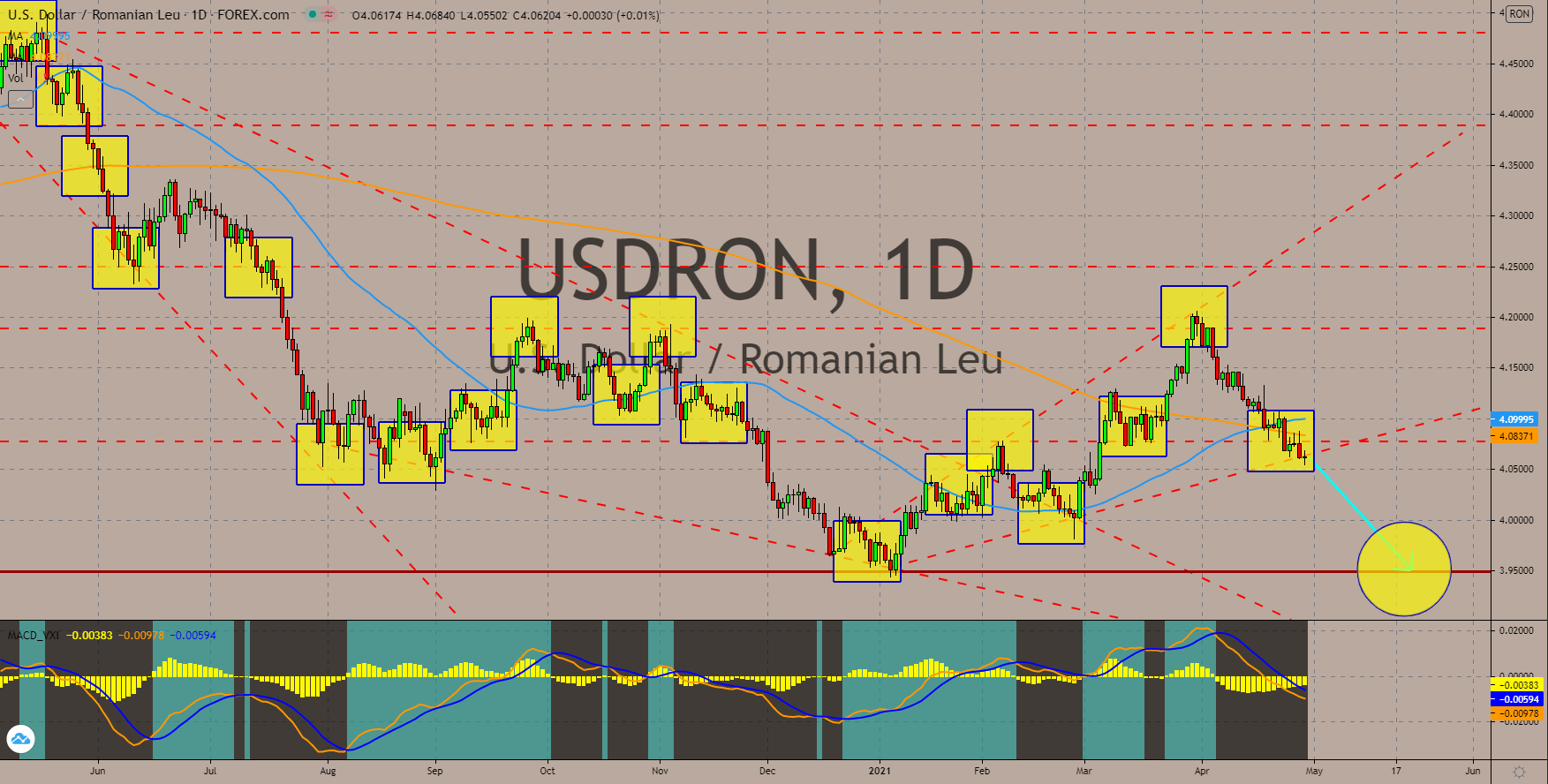

USDRON

The US Federal Reserve reaffirmed their commitment to continue supporting the local economy despite the improved macroeconomic data. On Wednesday’s meeting, April 28, Jerome Powell retained the benchmark interest rate of 0.25% and announced that the central bank will continue purchasing US treasury bills. The Fed’s chief move highlighted the declining economic activity as seen on the API crude inventories last week. The figures came at 4.319 million barrels. The move contrasted with market expectations of tighter monetary policy. Last week, the unemployment benefit claimants rose by 547,000, which was the lowest reported data since the coronavirus outbreak in March 2020. Meanwhile, PMI numbers were all higher from their prior results. The 50 and 200 MAs are expected to continue a bearish trend despite the recent formation of a “Golden Cross”. The same is expected for the MACD indicator to extend its fall in coming sessions.

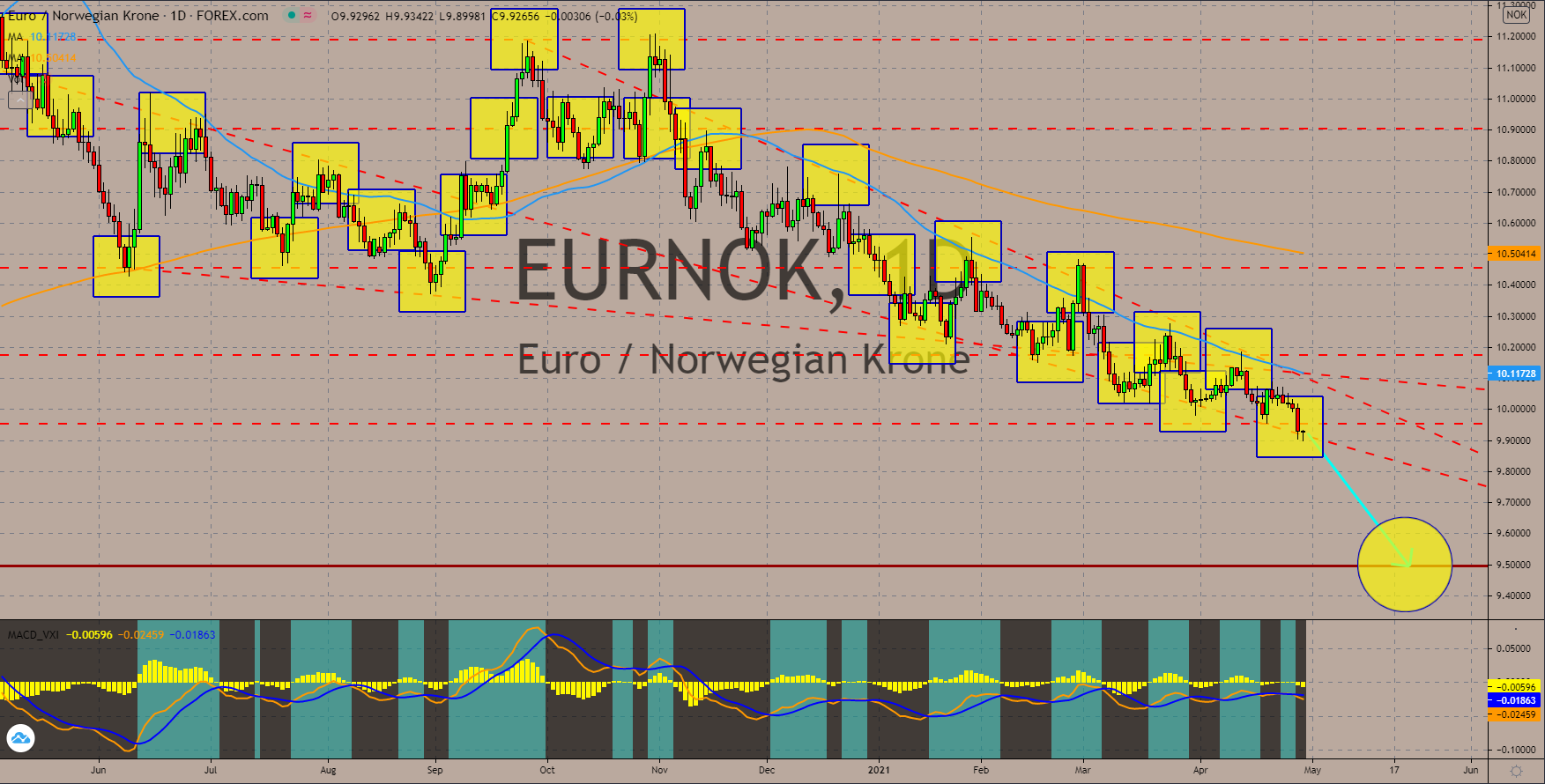

EURNOK

Analysts are optimistic that Norway will resume its pre-pandemic monetary policy in sessions as the IMF expects the Nordic country to return to its normal level prior to COVID-19 before the year ends. Oslo was among the first in Europe to impose national lockdown and lower its rates to prevent a steep decline in economic activity. As a result, the International Monetary Fund anticipates a 3.2% economic expansion this 2021 to recoup its losses last year when Norway contracted by -2.5%. Some positive data supports the continued recovery in the country. Industrial confidence rose to its highest record since 2018 of 8.2 points in the first 3 months of 2021. This was a huge progress from Q4 2020 with 3.1 points. The report had its steepest decline during the same period last year when the figure turned to negative with -17.5 points. The EURNOK failed to break out from the 50-day moving average in mid-April while the MACD will extend its decline.

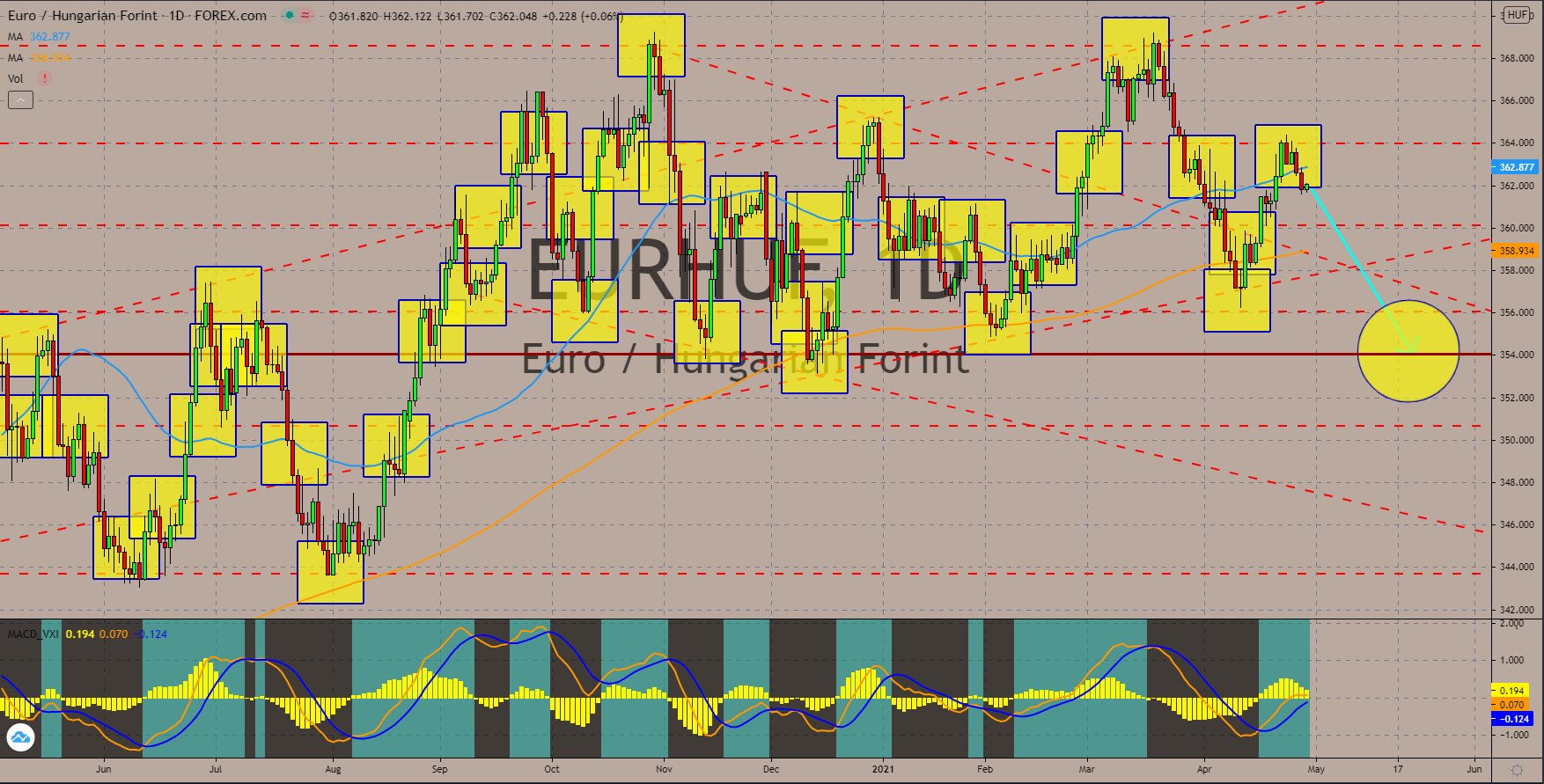

EURHUF

The lifting of several restrictions in Hungary will further cut unemployment figures in the second quarter of 2021. Budapest is now allowing restaurants to operate in a bigger capacity amid the continued vaccination rollout in the country. Hungary ranked third in the list of European countries with the highest vaccination rate at 54.54% against the UK on the second spot at 68.13%. Meanwhile, Malta topped the list with 70.56% rate. As a result, Prime Minister Viktor Orban has lifted some restrictions since the start of April. During the first three (3) months of the year, unemployment declined to 4.5% from 5.0% in the last quarter of 2020. With the easing of COVID-19 restrictions, analysts are optimistic for a better number in Q2. On a technical note, the pair failed to move past the key resistance area at 364.000 and is now trading below the 50 MA at 362.875. Meanwhile, the MACD and Signal lines have a huge possibility of forming a “bearish crossover”.

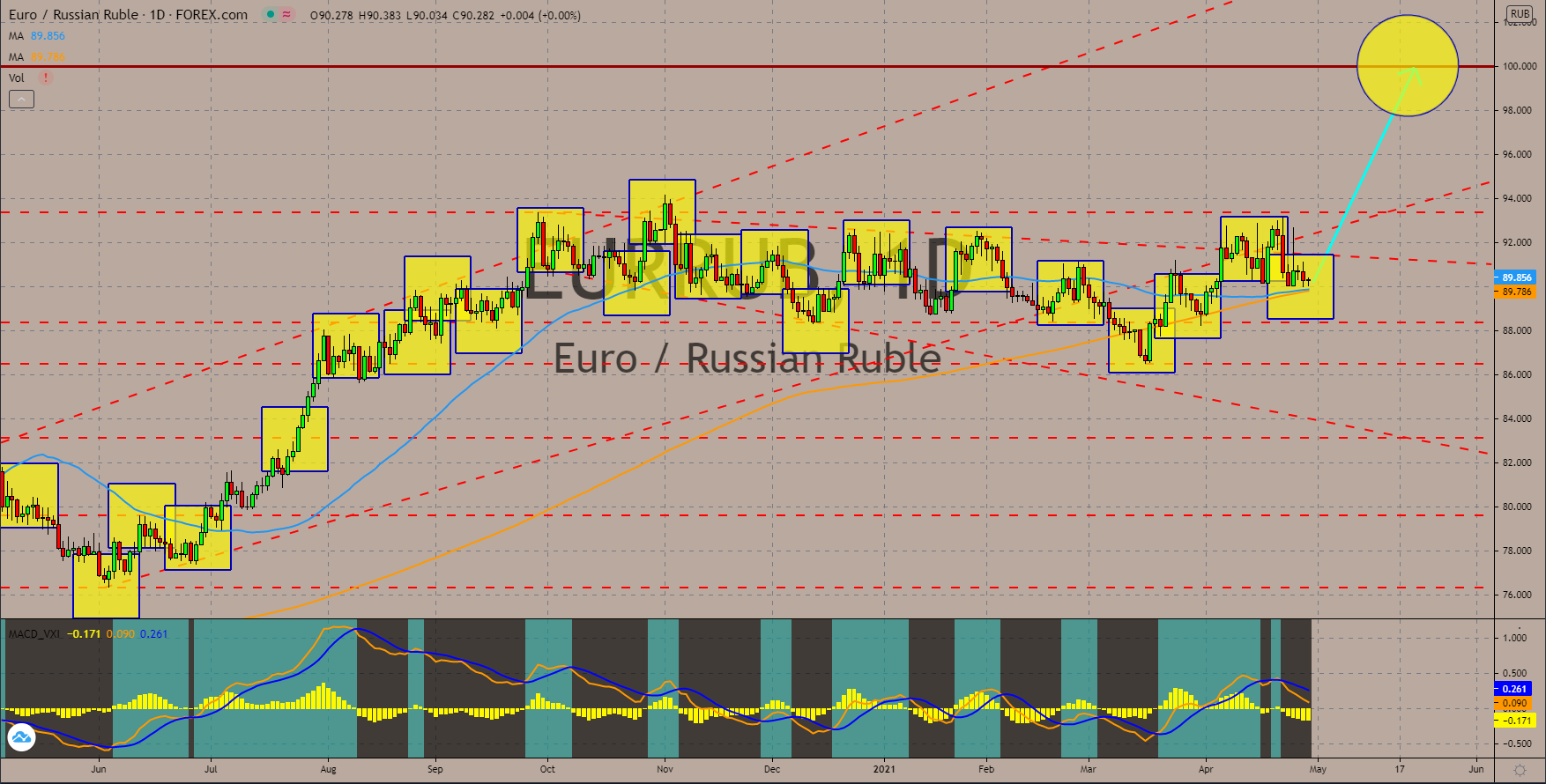

EURRUB

German Finance Minister Olaf Scholz announced the allocation of its 34.0 billion share on the 2.2 trillion 7-year recovery budget by the European Union. Scholz said 90% of the budget will be invested on green projects to meet its climate goals and on the digitalization of Europe’s largest economy. This was bigger than the initial proposal of 37% on climate change and 20% on digital economy. The finance minister anticipates the investments to contribute 0.5% employment in Germany and an increase of 2% in gross domestic product (GDP). The announcement came after a series of disappointing data from Berlin. Consumer Climate for the month of May was down to -8.8%, lower from estimates of -3.5% and prior result of -6.1%. Also, the recovery in the EU might take some time as Finland loses a majority vote to pass the EU budget on the parliament. The 50-day and 200-day moving averages are expected to fail to form a “bearish crossover” in sessions.

COMMENTS