Here are the latest market charts and analysis for today. Check them out and know what’s happening in the market today.

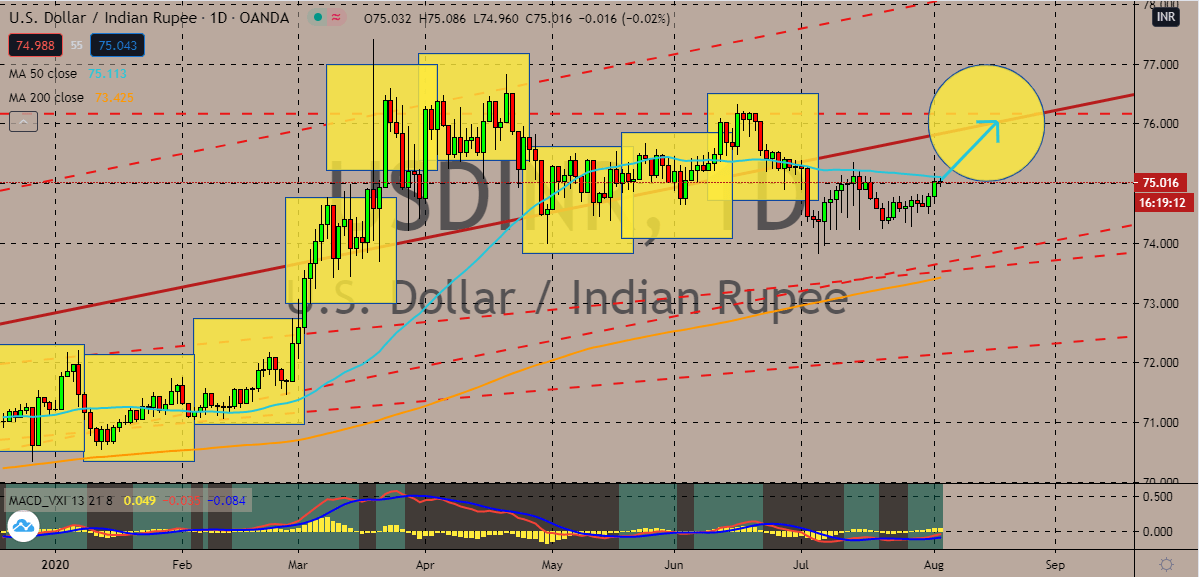

USDINR

The Indian rupee is on the defensive against the US dollar. And despite the broader weakness faced by the greenback, the rupee is significantly weaker. Hence, signs say that the trading pair will climb up higher to its resistance level in the coming days. That, without a doubt, keeps the 500-day moving average higher against the 200-day moving average. The Indian rupee’s main weaknesses come from the lackluster performance of the country’s equity markets and the concerns of investors over the rapid spread of the coronavirus there. If the safe-haven appeal of the greenback fails to work against other currencies, it’s luck against the Indian rupee is slightly better. Aside from that, another fundamental that’s causing the rupee to falter is the expectations of another rate cut from the Reserve Bank of India. Later this week, experts believe that the RBI will unleash a 15-basis point rate cut, bring down its interest rate from 4.00% to 3.75%.

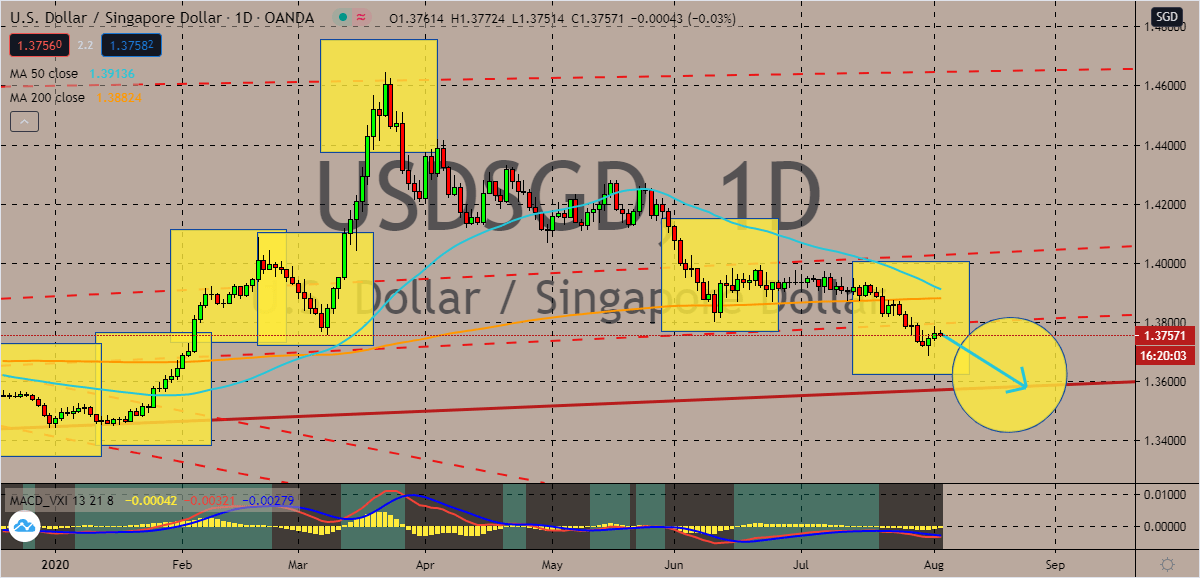

USDSGD

Over the recent days, it appears that the greenback is finally recovering against the Singaporean dollar. However, most analysts believe that the downside potential of the pair is still looming. As of writing, it’s clear that the US dollar is having difficulties in trying to prop up the trading pair. This suggests that it could eventually just bounce off and bears would continue to pull prices lower towards their support. That move should finally force the 50-day moving average lower against the 200-day moving average, signaling a bearish market for the exchange rate. The strong figures presented by the Singaporean economy recently could be a sign of improvement and it could further strengthen the Singaporean dollar. Just yesterday, it was reported that the country’s manufacturing PMI for July rose from about 48.0% to around 50.2%. Although economists are arguing that Singapore’s economy needs more measures to support itself.

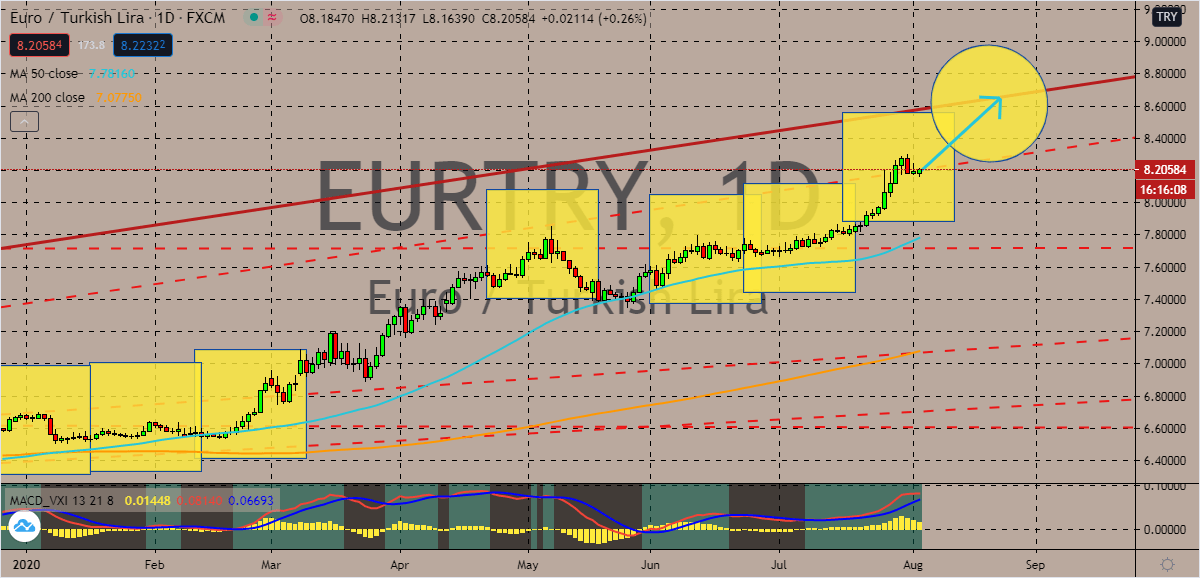

EURTRY

The euro to Turkish lira trading pair slipped on the last day of July. And as of today, the pair struggling to break past its resistance level in the trading sessions. Unfortunately for bearish investors, the trading pair is widely projected to continue climbing higher in the coming days due to the weakness and hindrances faced by the Turkish lira. The pair should reach its resistance by the latter half of the month, hitting record-setting ranges and further pushing the 50-day moving average higher against the 200-day moving average. Just recently, it was reported that former German Ambassador to Ankara, Martin Erdmann said that the European Union should not lose Turkey. Adding that the bloc must keep its accession process ongoing to keep the nation, this is despite the recent developments in the country. Concerns over this and potential sanctions from the EU has caused the Turkish lira to struggle even further against major currencies.

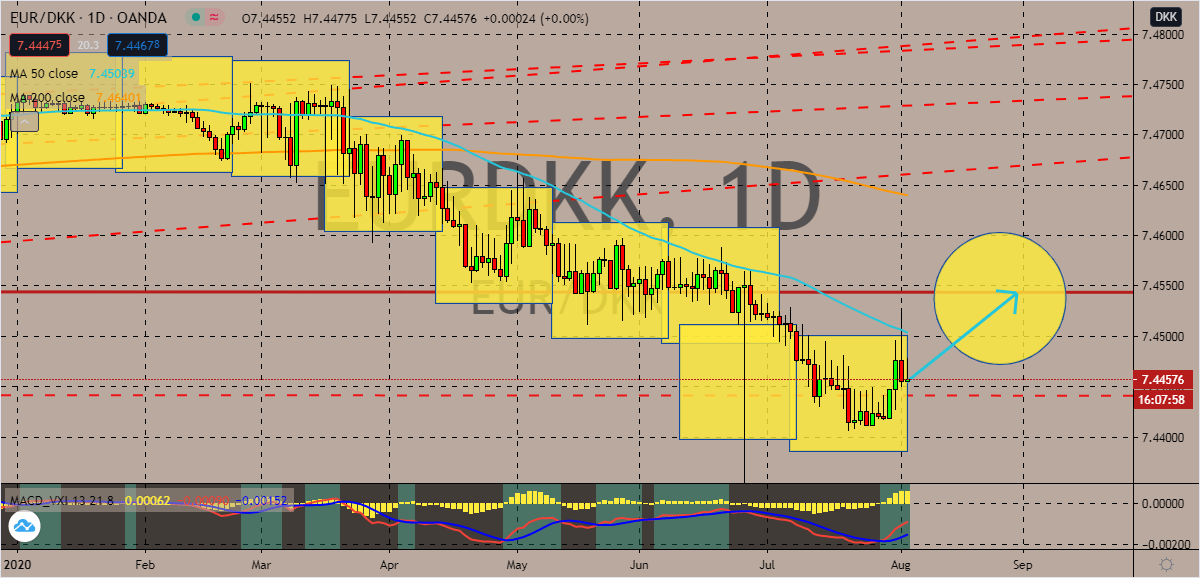

EURDKK

The commendable performance of the Danish stock market and the country’s economy has helped bearish investors drag the pair. The euro may have been seen recovering or rallying against major currencies, the Danish krone is still significantly stronger. Yesterday, Denmark’s stock market closed higher, and it caused the trading pair, which at that time looked like its starting to recover, to go down in the trading session. The rally was led by the country’s technology, financial, and oil & gas sector. Also, it was recently reported that Denmark saw an improvement in its unemployment rate. According to official figures from the country, the percentage of jobless people went down from 5.4% to around 5.1%. And as for the euro, it’s giving bears a tough time as it gathers power from the modest expansion of the bloc’s manufacturing activity. Experts say that this is the first time that the eurozone manufacturing activity recorded growth since early 2019.

COMMENTS