Here are the latest market charts and analysis for today. Check them out and know what’s happening in the market today.

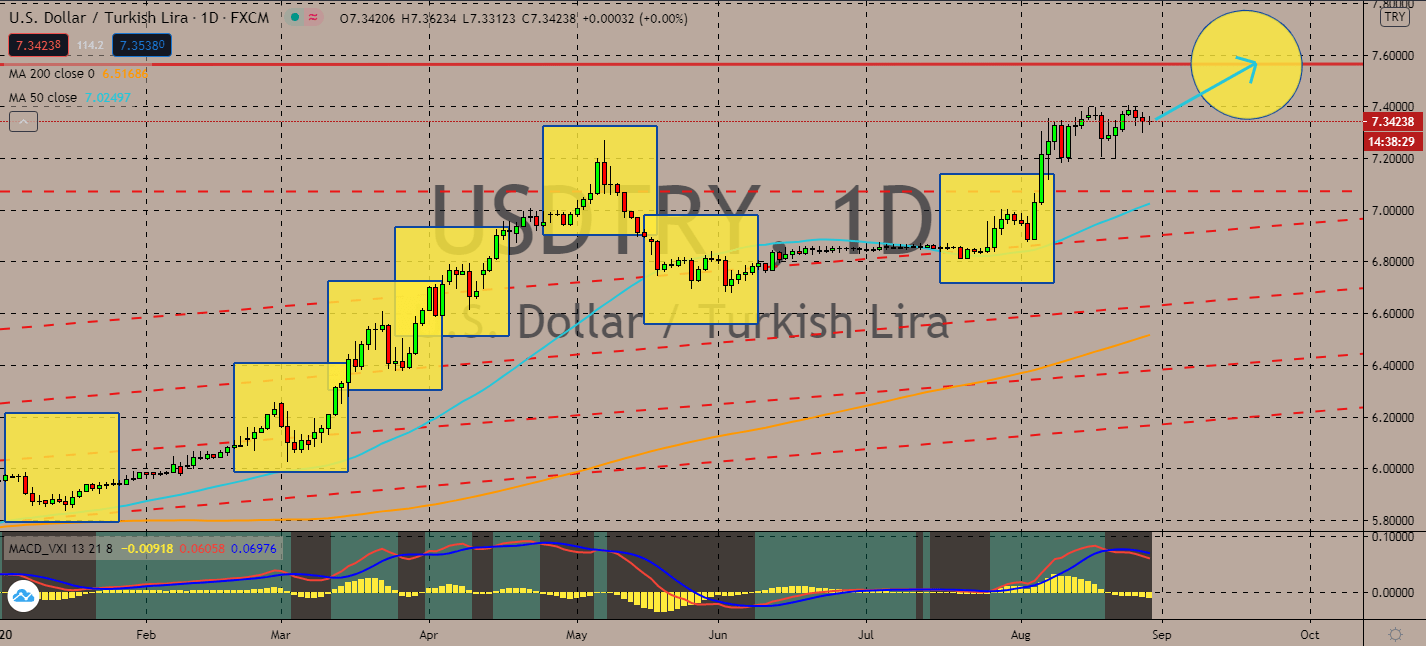

USDTRY

The greenback might be struggling to recover itself in the forex market, but it looks like the Turkish lira is going to experience a worse path. The USDTRY’s 50-day moving average experienced a sharp incline in recent trading when it was already above the 200-day moving average, indicating that the bullish market has taken full control of its near-term trend. Turkey has been complacent about the recent lira plunged to a new low earlier this month. Now, economists are worried that the sharp downturn heightened the risk of the country’s economic collapse. It had surged prices for imported goods such as medicine and fuel, alarming investors with an array of cheap credit previously used to prop up the lira and buoy its economic growth. Turkey’s geopolitical conflict with France and Greece is projected to hurt the currency. The country’s heightened inflation is also projected to trigger selling pressure for the Turkish lira until its government acts now.

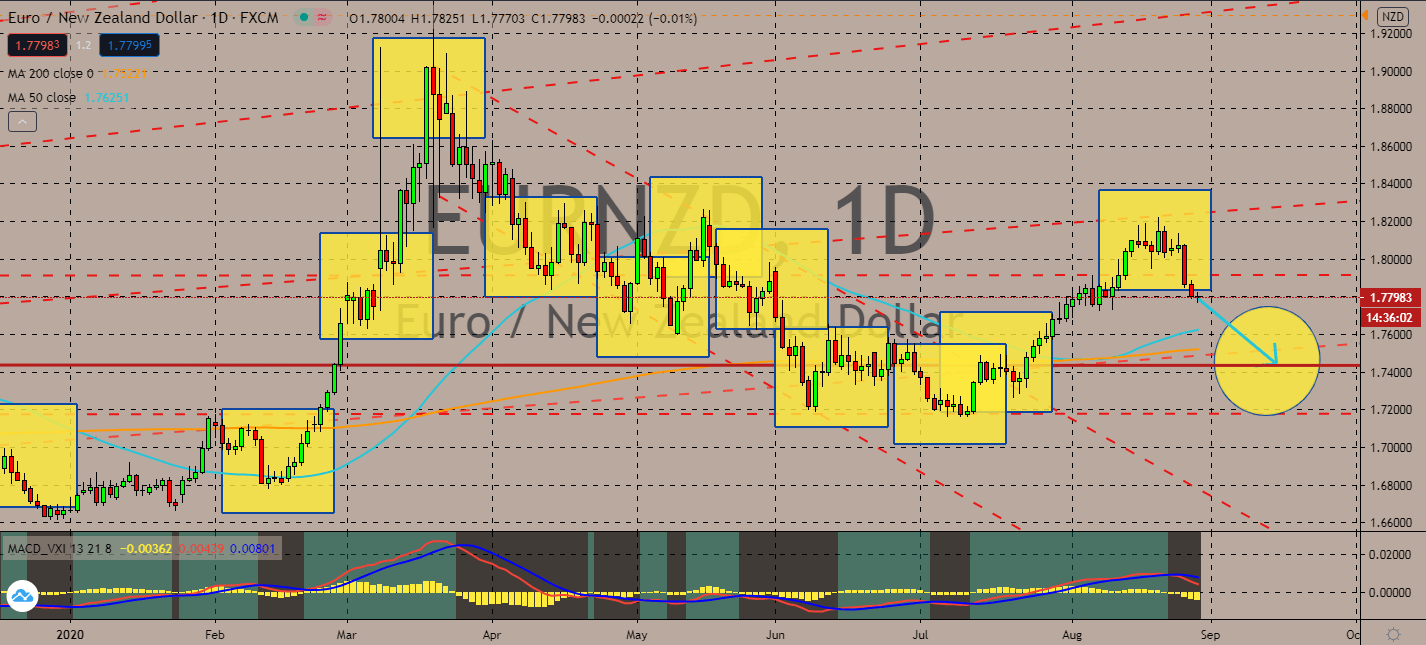

EURNZD

It’s going to be an eventful day in the eurozone market today, and it’s not going to be good for the single currency. Investors are waiting for France to confirm their quarterly gross domestic product projections of a 13.8% decline for the second quarter, much lower than the already low 5.3% decline seen it the first quarter. This announcement will come just hours after the World Health Organization reported a 10% uptick in new novel coronavirus cases in Europe with 32 out of 55 state parties and territories included. Even though the pair’s 50-day moving average inched upward in recent trading, bearish traders still have a chance to pull it down to the increasing 200-day moving average. Moreover, revolving about the economic effects of this uptick will drive the market toward the New Zealand dollar. Meanwhile, the Reserve Bank of New Zealand claims that although it’s on a nationwide lockdown, a change in its official cash rate is necessary.

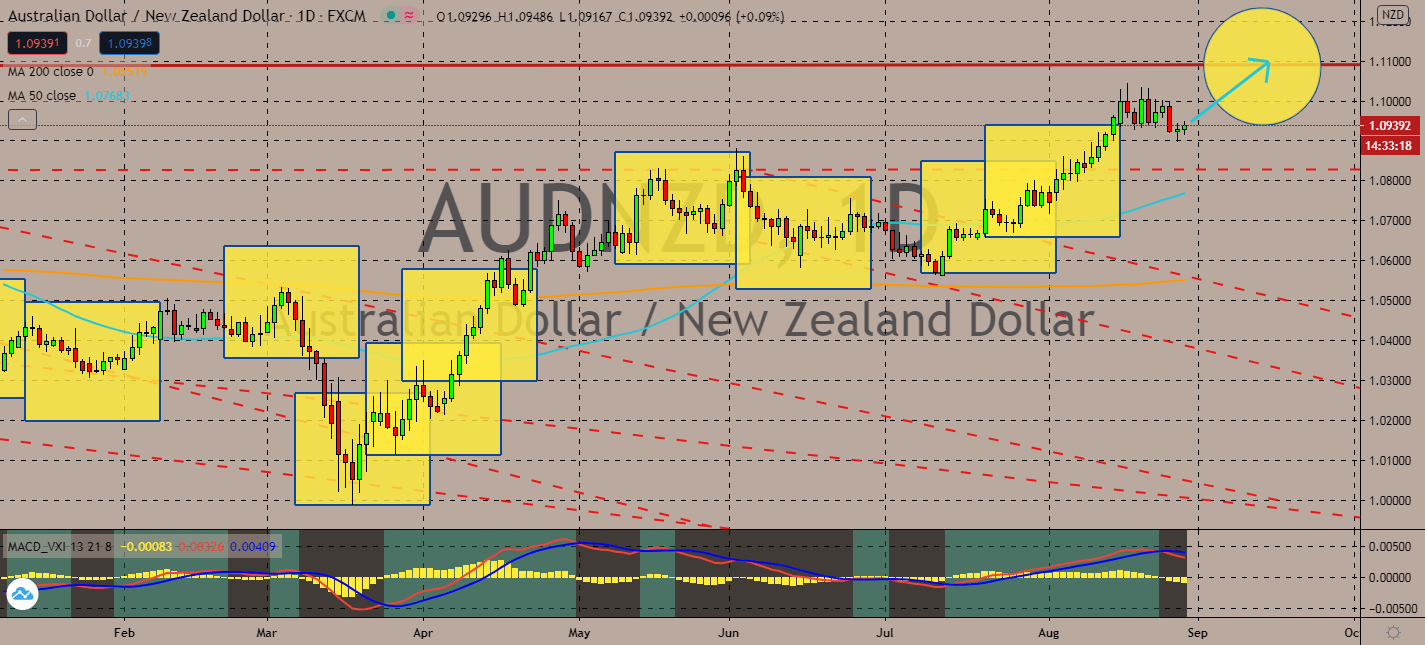

AUDNZD

New Zealand has been quiet in the forex market lately. Risk sentiment is bound to benefit the Aussie dollar due to other geopolitical stimuli in Asia. Japan’s Kirin Holdings and China Mengniu Dairy Co withdrew their plans to buy Lion-Dairy, an Aussie dairy firm. Asia-Pacific stocks are projected to prop up the Australian dollar near-term with optimism surrounding the US-China phase trade deal. The exchange rate’s 50-day moving average went through an uptick from a stagnant run above its 200-day moving average, which indicates that the AUDNZD pair is bound to side with the bulls near-term. Massey University also showed an estimated 16% quarter-on-quarter decline in nominal GDP in New Zealand for the second quarter. NZ is prompted to feel the full blow of the economic effects of the coronavirus as soon as the announcement comes out in September with exports and tourism at its forefront.

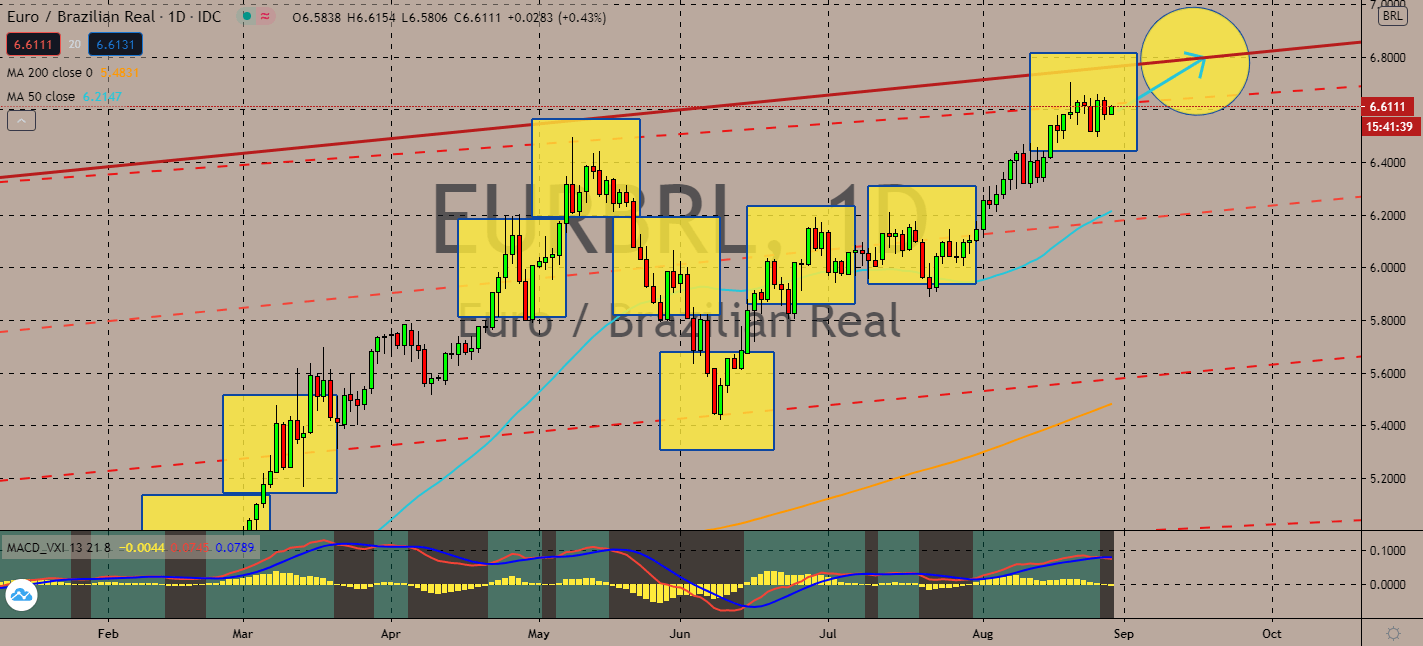

EURBRL

Consumer confidence in several countries in the Eurozone are expected to retain their previous records despite rising coronavirus cases in key countries. This boosted optimism in the forex market, helping the euro’s 50-day moving average to step further up from the 200-day moving average. Brazil reported 44,235 new infections yesterday and its death toll reached 118,649, and despite claims that its economy is recovering thanks to its reopening, investors are putting Brazil’s government under increasing pressure to alter its mandated spending cap. It had previously helped Brazil as a fiscal anchor, but consumers are demanding that they should spend more to boost its economy. This began fears of another fiscal crisis in its business sector and damage Brazilian assets, as well as weaken its exchange rate across most major currencies. Its instability will make it harder for the currency to increase in the long-term, as well.

COMMENTS