Here are the latest market charts and analysis for today. Check them out and know what’s happening in the market today.

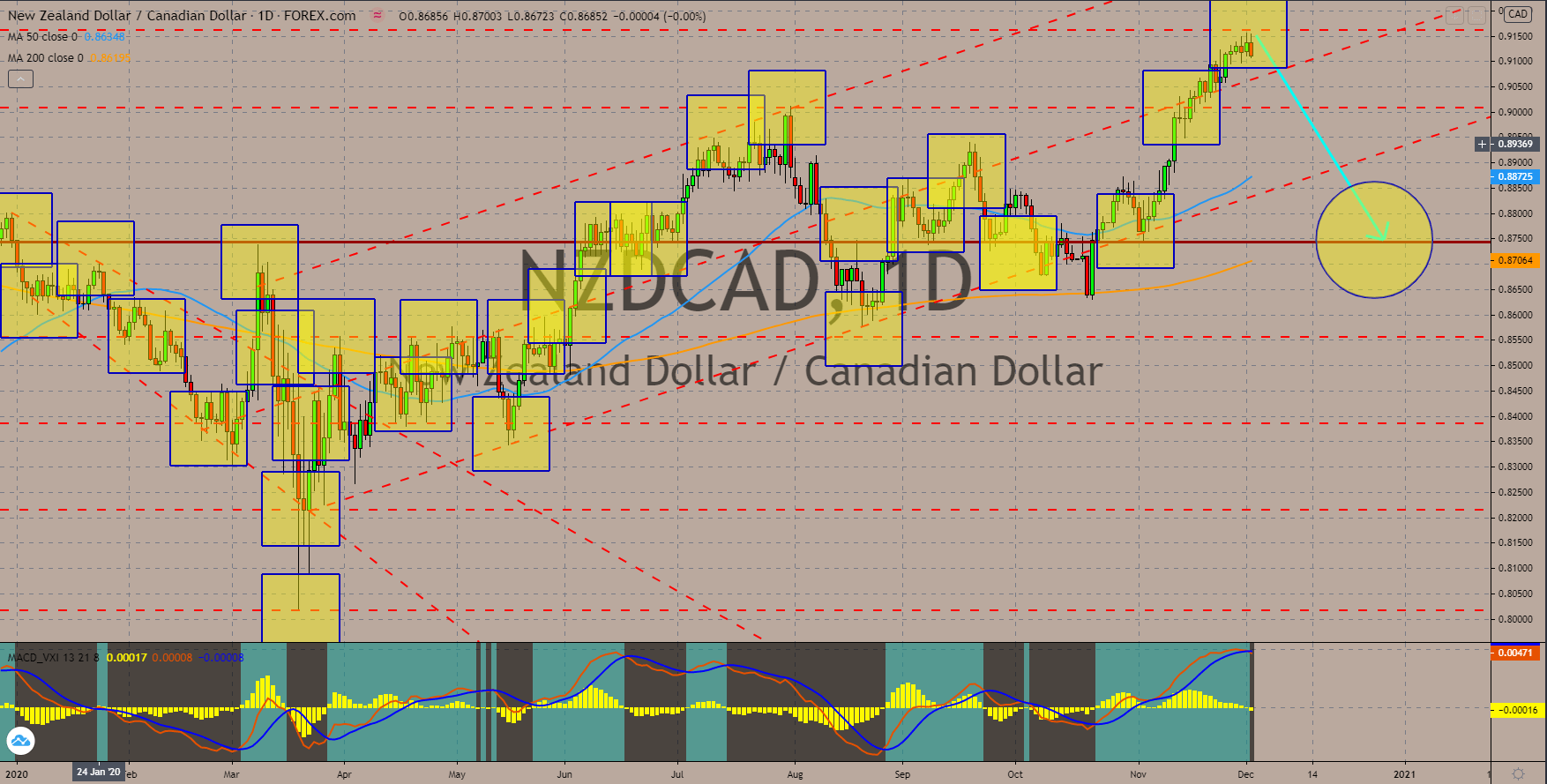

NZDCAD

New Zealand’s unexpected decline in imports and exports prices will take a toll on the New Zealand dollar. The figures for imports and exports prices reports were -3.7% and -8.3%, respectively. With regards to the later report, the decline on the third quarter result represents its lowest figure since the report began in the third week of 2014. Meanwhile, trade volume surged by 5.6% in Q3. The reported figures suggest that there has been a build up in inventories in the country as New Zealand remains isolated from the rest of the world. The country took a strict measure in containing the coronavirus, but this success was paid by the weak figures from economic and earnings reports. The NZDCAD pair will move between the 50 and 200moving averages. Meanwhile, the MACD and the signal line’s crossover confirmed the pair’s correction in the coming days. The Histogram is also at the base line.

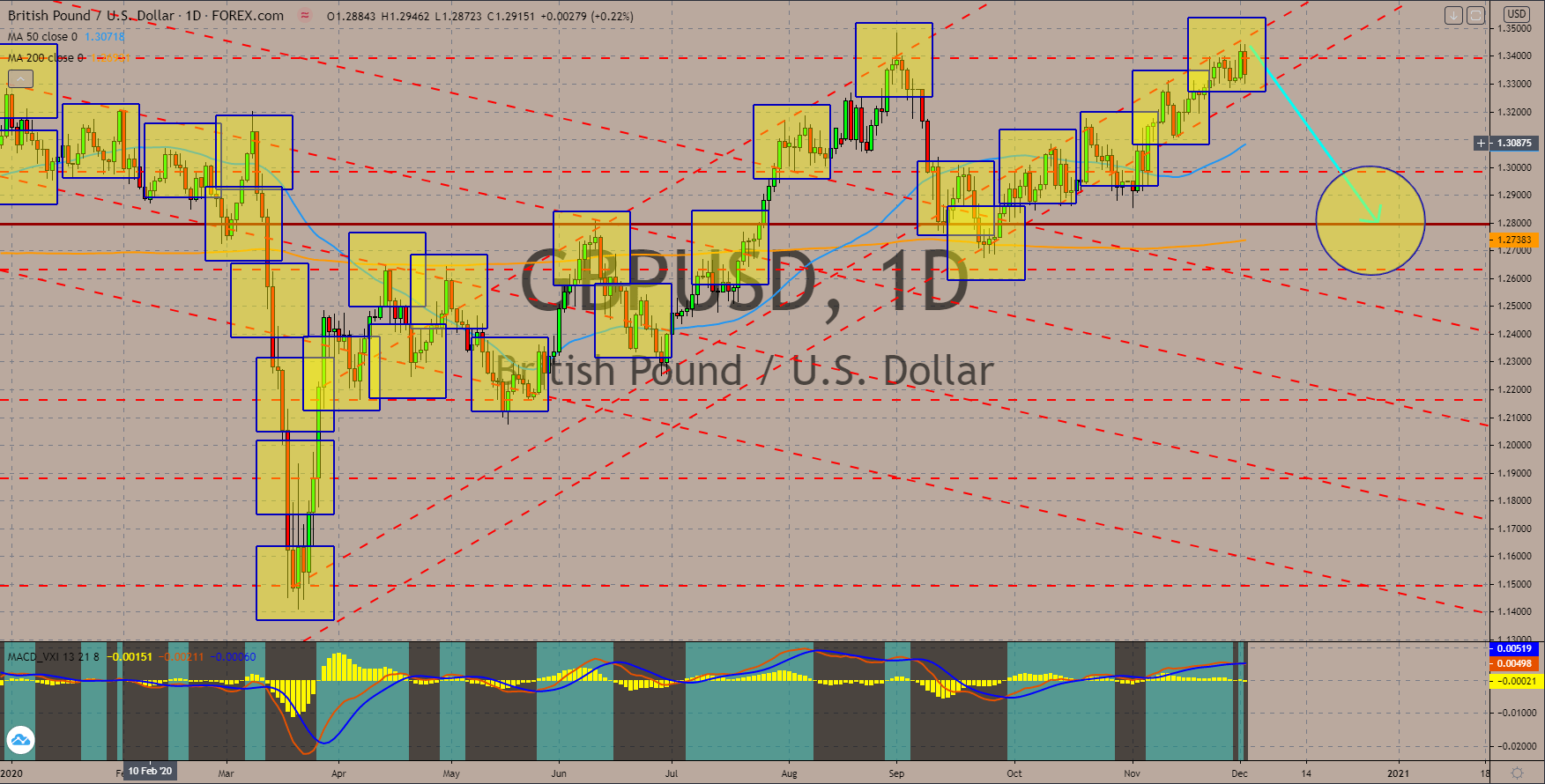

GBPUSD

The US dollar will outperform the British pound in coming sessions despite the weak outlook on the US economy. The main catalyst for the pound’s weakness was the increasing uncertainty in business and economic environment due to the resurgence of COVID-19 in the region and the looming withdrawal of the UK from the EU. Out of eight (8) countries in the list of countries with the highest number of COVID-19 infections, four (4) or half of them are from Europe. France, Spain, the United Kingdom, and Italy placed fifth to eight in chronological order. Although the UK has seen lower records of daily infections, the spike in cases in other EU member states will indirectly affect the UK’s economy. Also, this could play a large role in drafting the post-Brexit agreements between the UK and the EU. A correction towards the 200 MA is expected and is confirmed by the crossover between the MACD and signal line.

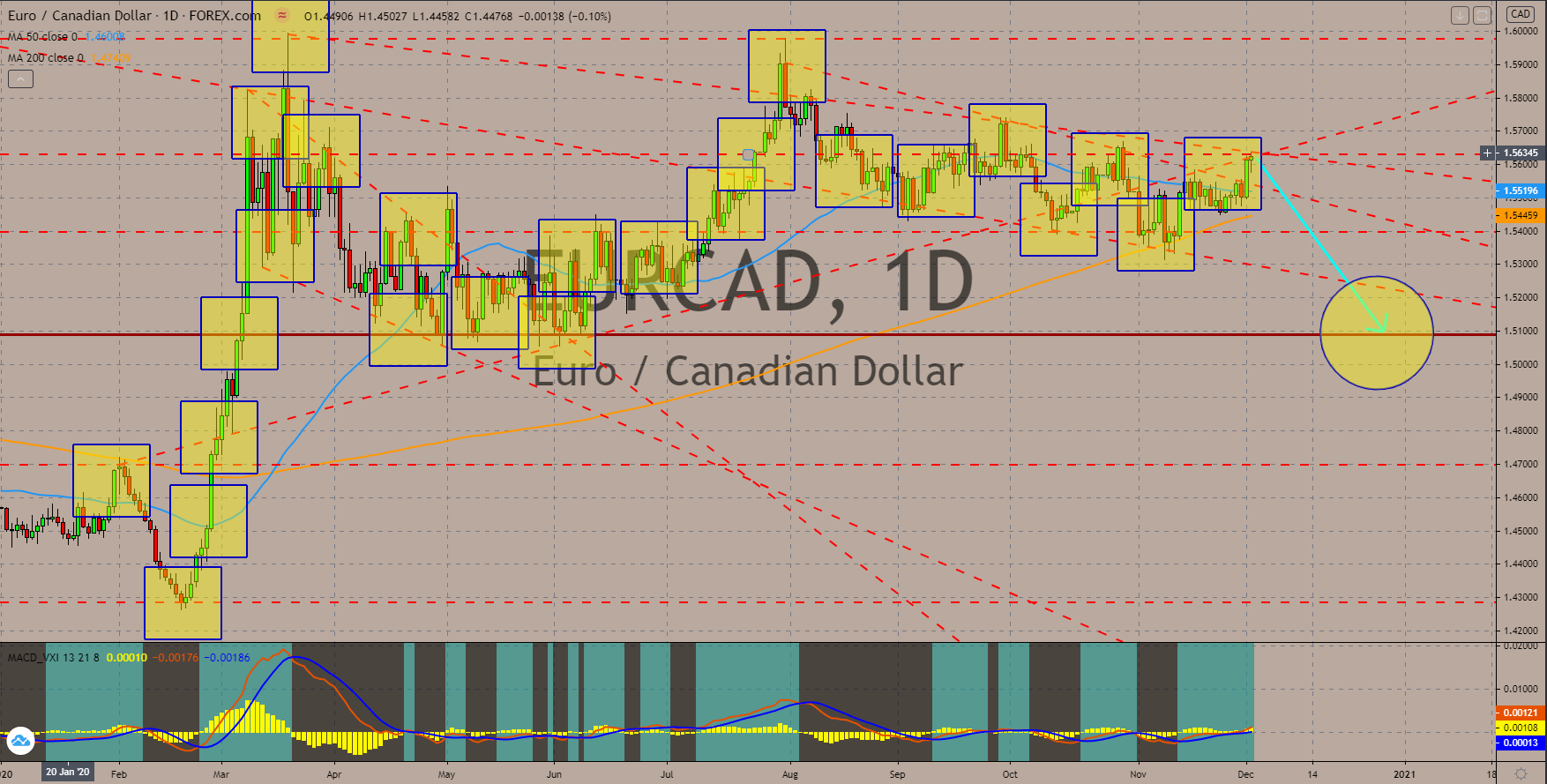

EURCAD

The European Union and its member states have mixed results in their most recent reports. However, the increasing cases of COVID-19 in some EU member states will drag the pair lower. Germany and Italy posted above 50 points figures for their Manufacturing PMI report on Tuesday, December 01. The numbers were 57.8 points and 51.5 points, respectively. On the other hand, France and Spain’s figures were 49.6 points and 49.8 points. Italy also released its Q3 GDP on the said date. The QoQ figure was 15.9% while the GDP declined by -5.0% on an annual basis. These figures were a major improvement from their previous data. However, the monthly unemployment rate of 9.8% was lower than the 9.9% expected. The 200 and 50 moving averages are near to crossover and form the “Death Cross”, a bearish signal for investors. Meanwhile the MACD indicator remains flat amid weak figures from both the EU and Canada.

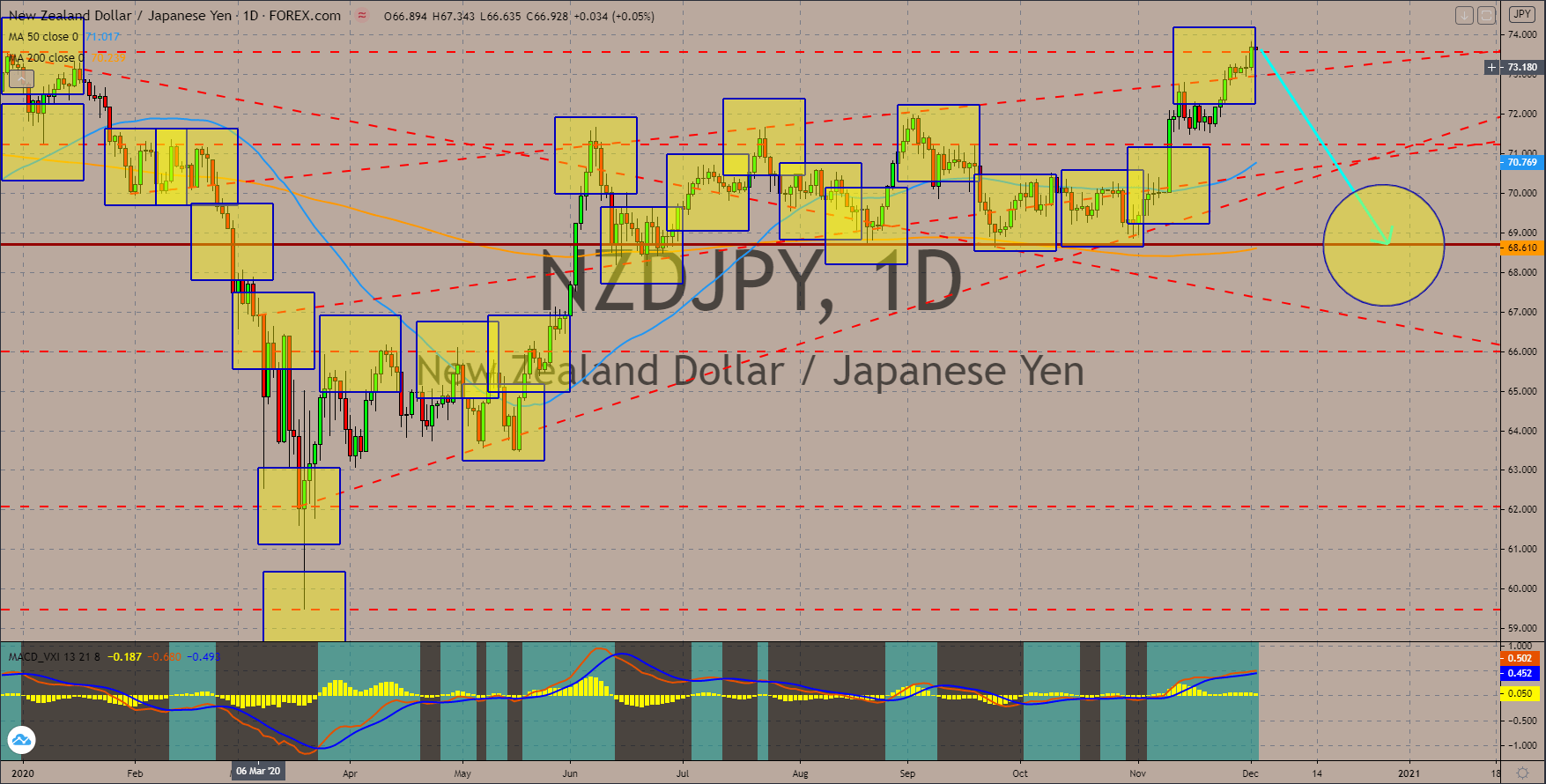

NZDJPY

The Japanese government’s effort to create jobs is expected to pay off this month with an advance in the yen against the New Zealand dollar. Japan’s unemployment rate inched higher on Monday’s report, November 30, from 3.0% in September to 3.1% in the succeeding month. Despite this, more jobs are now available for those that are retrenched due to the coronavirus pandemic. There are now 104 available jobs for 100 persons looking to be employed. The previous record was 103 jobs for every 100 individuals. The white-collar jobs are expected to benefit from this as seen in the recent Construction Orders YoY. The figure for the report was -0.1%, which is already a major improvement from the -10.6% figure in September. The current candle was a “doji”, which represents indecision on a major resistance line. Meanwhile, the MACD is showing some weakness as the MACD line and signal line nears to potentially crossover.

COMMENTS