Here are the latest market charts and analysis for today. Check them out and know what’s happening in the market today.

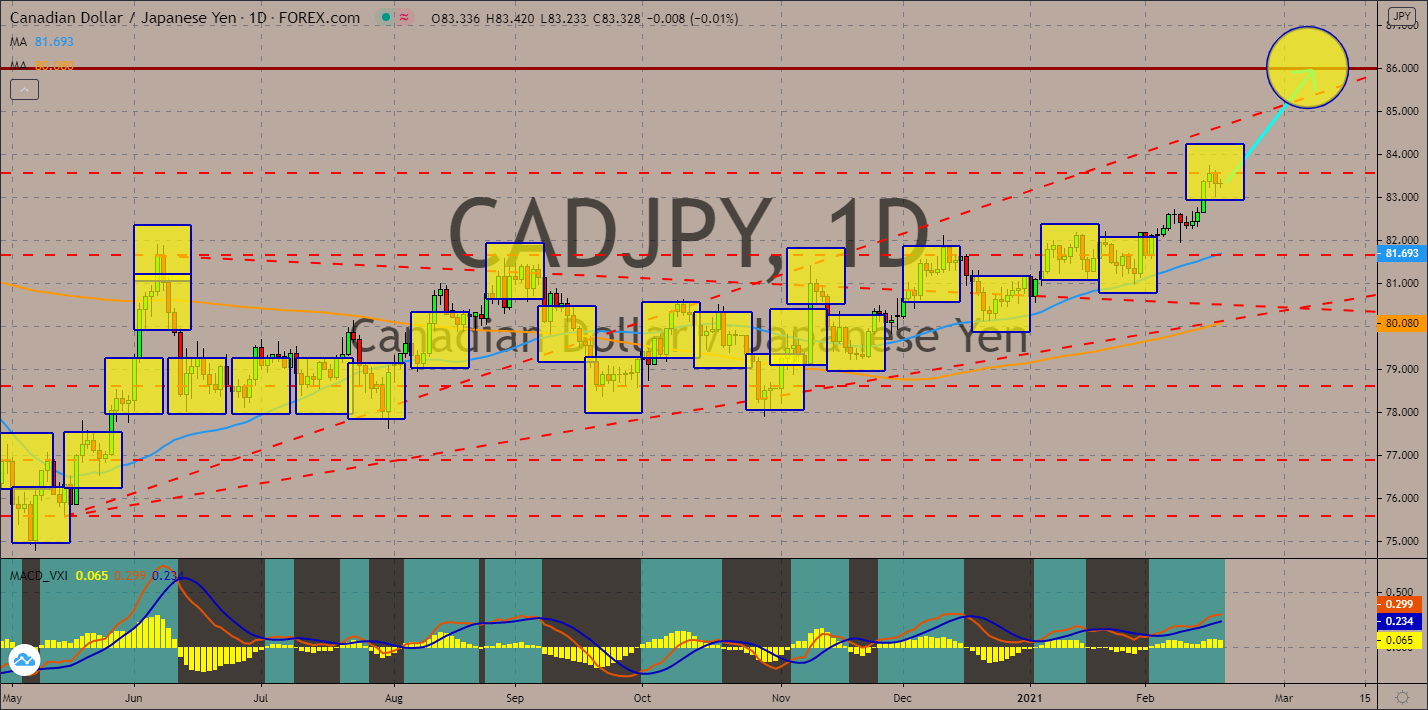

CADJPY

The yen will continue to underperform against the Canadian dollar following a trade deficit report for the month of January. On Tuesday, February 16, Japan posted a -323.9 billion trade balance report which was preceded by a 749.6 billion surplus in December. This was despite a continued decline in imports of -9.5% year-over-year. Meanwhile, exports fell below estimates of 6.6% with the 6.4% final result. Smart money is also leaving the Japanese economy after foreign bonds and stock buying slowed down to 447.1 billion and 330.1 billion, respectively. As for Thursday’s report, February 18, readings for the National Core CPI report is a new decline of -0.7% for the month of January. Meanwhile, in Canada, Core CPI inched higher to 1.6% from the 1.5% record in December. Analysts have a 1.4% reading. The 50 and 200 moving averages continue to move higher, which is supported by the Signal and MACD lines. The histogram remains positive.

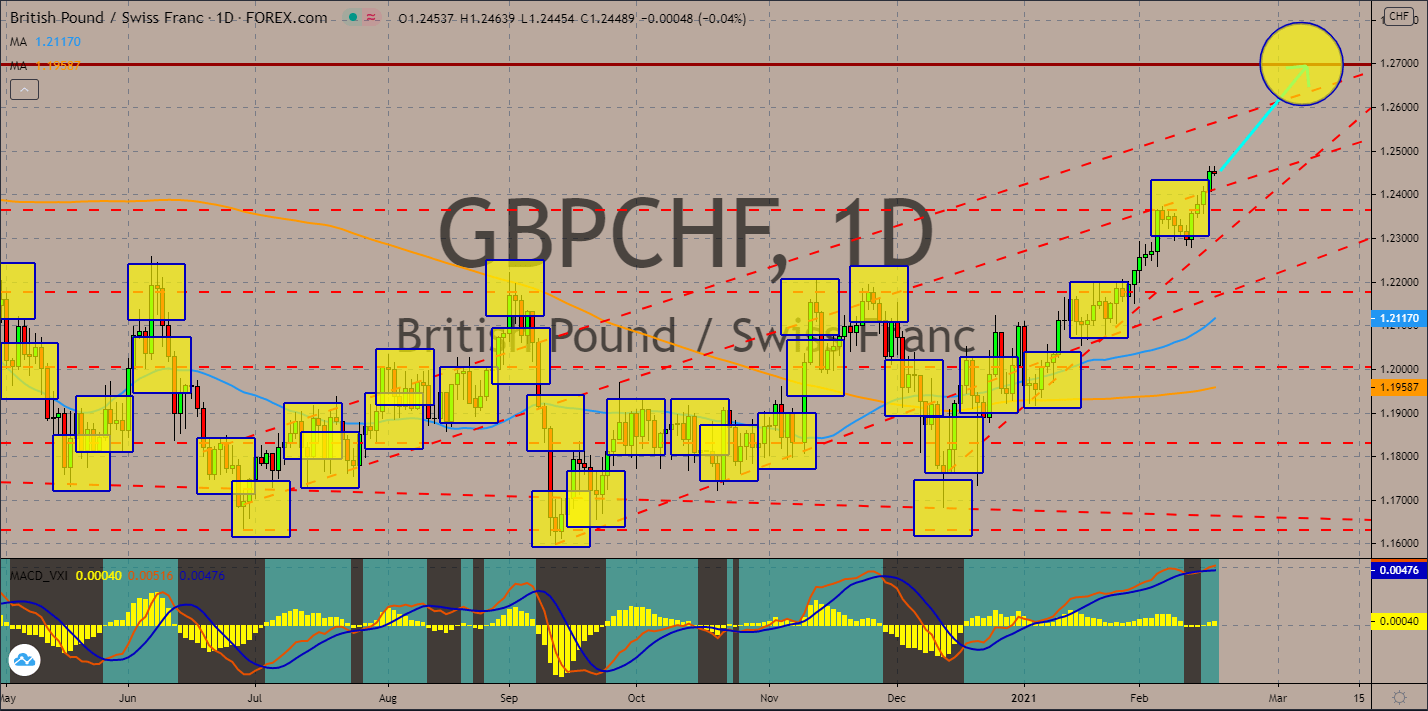

GBPCHF

The Swiss government’s budget was shuttered by the pandemic. In fiscal 2019, Switzerland has a budget surplus of 3.6 billion francs. In 2020, however, the country incurred 10.8 billion in deficit and an additional 2.2 billion to support self-employed individuals. Meanwhile, government officials are now planning to pass a record budget deficit for the current year of 20 billion to kickstart economic recovery. Along with this was the plan by the Swiss authorities to lift some restrictions to ease the burden by local businesses. The deficit will send the local currency lower against the British pound. In other news, Switzerland dethroned the Netherlands in the UNCTAD B2C E-commerce Index. As for the United Kingdom, the consumer price index (CPI) report shrank by -0.2% on Wednesday’s report, February 17. The signal line and MACD line showed a bullish extension after the lines failed to form a bearish crossover. The histogram is also going up.

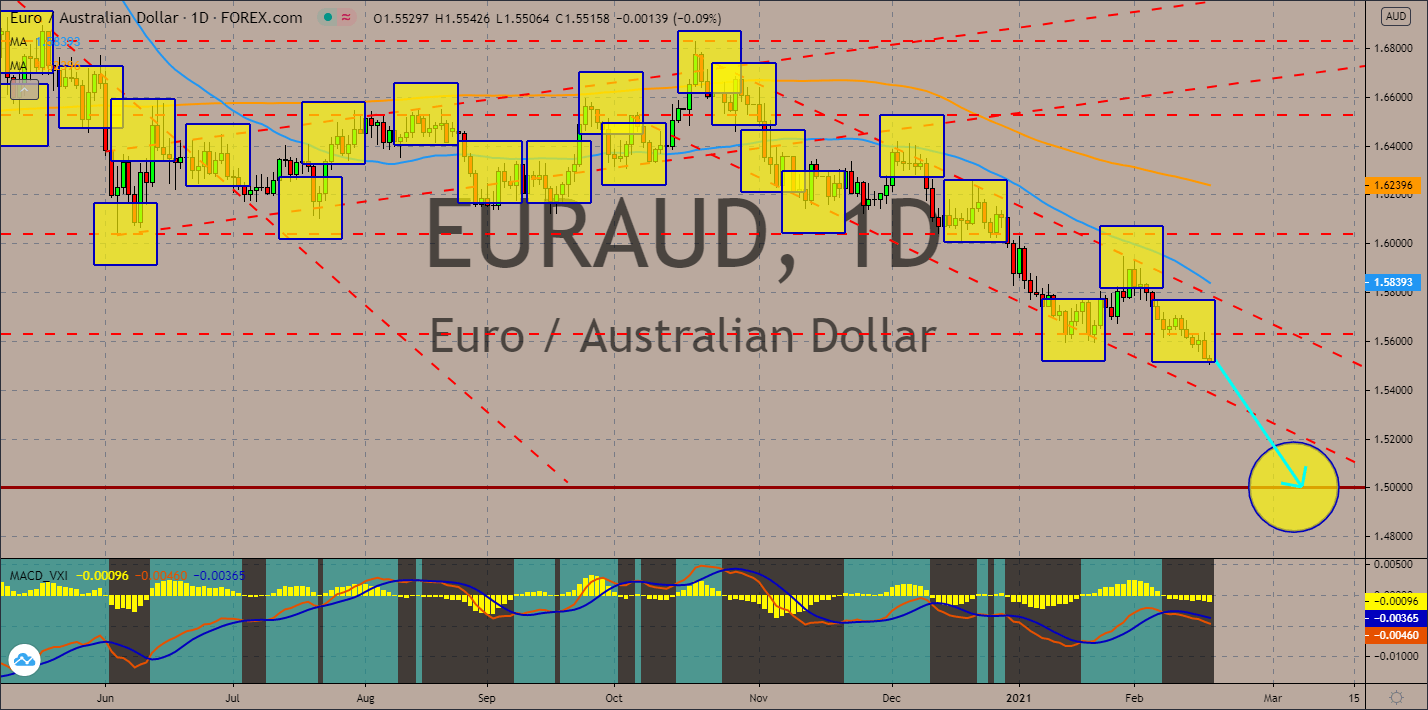

EURAUD

Despite the lower jobs addition for the month of January of 29.1K, Australia still managed to make some improvement on its unemployment rate. In the first month of fiscal 2021, there were fewer unemployed individuals at 6.4% against 6.6% in December. Meanwhile, analysts were only looking for a 6.5% result. In the EU, car registration in Germany and France dropped significantly in January by 45.5% and 32.2%, respectively, amidst the pandemic. This indicates a continued slowdown in the Eurozone, In the fourth quarter of 2020, the currency bloc tumbled by -0.6% for the preliminary report risking the possibility of a double-dip recession if Q1 2021 drop anew. Another key report which will affect the recovery of the European Union is Industrial Output. For the December report, the output had its steepest decline for the past eight (8) months. All technical indicators were pointing to continued bearish performance of the EURAUD pair.

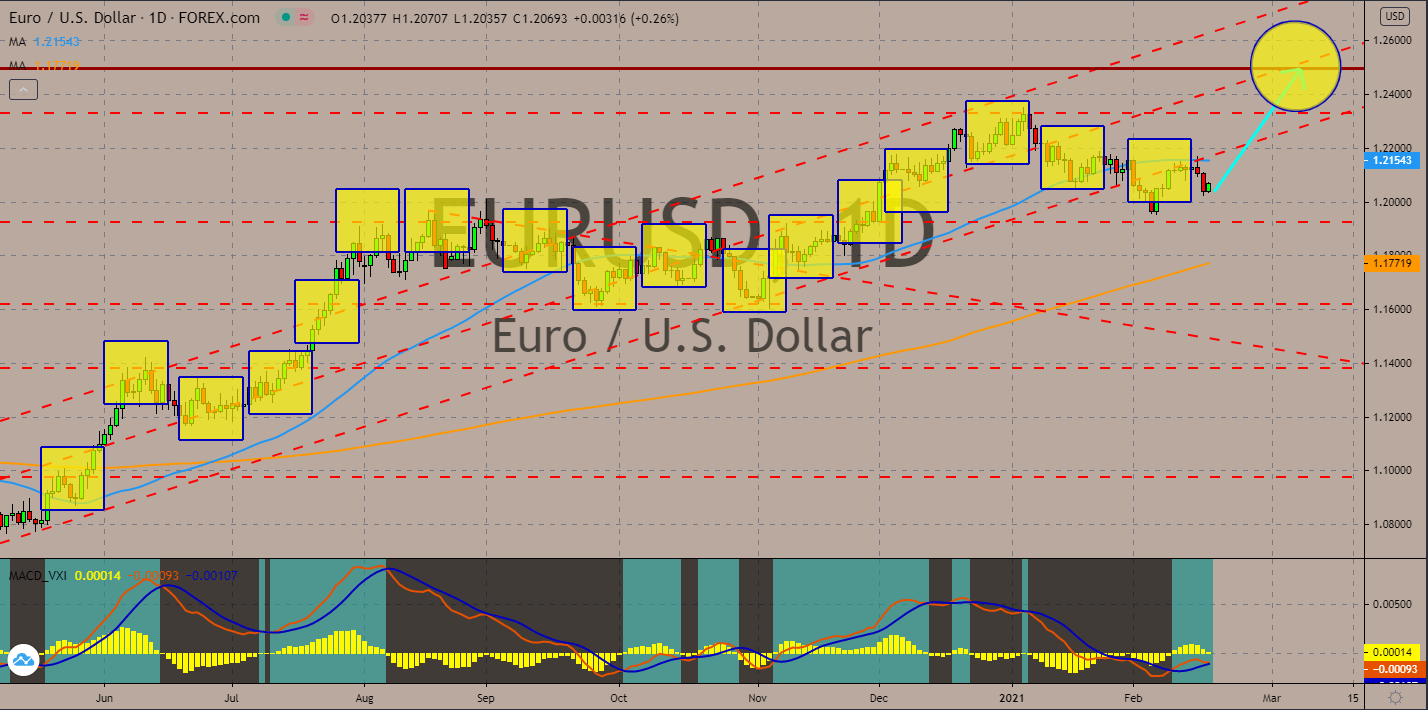

EURUSD

The $1.9 trillion economic aid proposed by President Joe Biden remains the main driver for the EURUSD pair. Earlier this month, House Speaker Nancy Pelosi said that the US Congress will pass the second-largest stimulus package in US history by the end of February following the disappointing labor data. The urgency in passing the bill puts pressure on the US dollar. Right now, the focus has shifted to crude oil prices. The black gold has been roaring due to increased demand in the southern part of the United States due to cold temperatures. While a high price of oil is generally beneficial to the US dollar, the current scenario is not favorable for the greenback. The largest oil-producing US state has suspended its oil drilling operation amid the deep freeze. Prices of EURUSD now trade below the 50 MA, but a key support line is expected to hold. Meanwhile, analysts are expecting a bullish extension for the Signal line and MACD line.

COMMENTS