Here are the latest market charts and analysis for today. Check them out and know what’s happening in the market today.

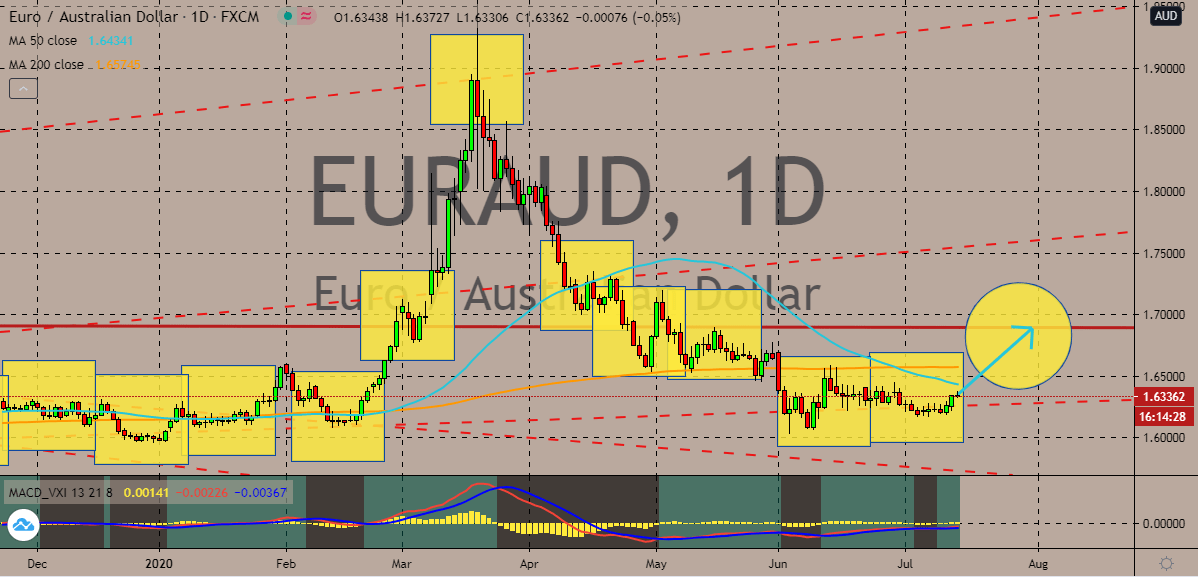

EURAUD

The euro to Australian dollar trading pair slightly eases this Tuesday as bearish investors gain support from the better than expected performance of the Australian economy last month. Despite that, the pair’s trajectory is predicted to remain bullish as the Australian dollar gets more and more pressured by the increasing number of infections in the country. The pair’s prices are widely projected to eventually make its way to its resistance level before the month ends. That should help bullish investors regain the momentum by propping up the 50-day moving average back up against the 200-day moving average. The Australian dollar gained support from the notable improvement in Australia’s NAB business confidence report from June. According to official figures from yesterday, Australia’s June business confidence went up from an alarming -20% to about 1%, a marginal improvement from the coronavirus=struck antipodean country.

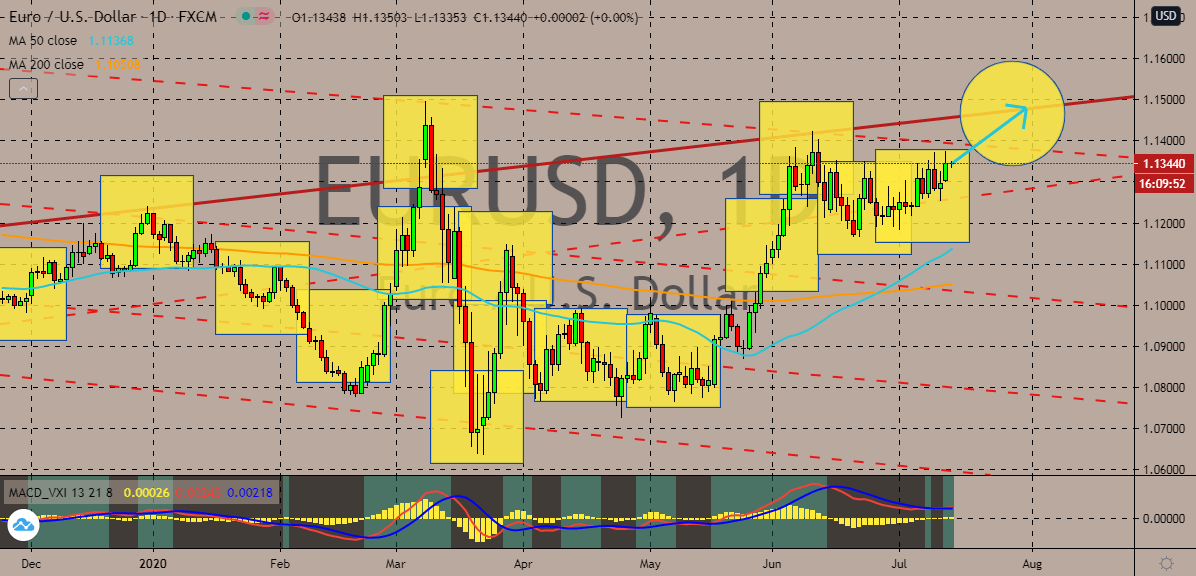

EURUSD

The recent prediction from Citibank, an American financial servicing company, has caused the euro to US dollar trading pair to slow down this Tuesday. Although the forecast from the bank isn’t for this month, it still slightly moved the confidence of bullish investors. Nevertheless, the trading pair remains on track to reach its resistance level as the euro is also predicted to gain more this July. Bullish investors are hoping to end the month on their own terms thus helping the 50-day moving average gain altitude against the 200-day moving average. Moreover, experts from Citibank believe that the renewed or increasing political uncertainties in the eurozone, mainly in Italy will ultimately pressure the single currency. Aside from that, the concerns surrounding the UK and EU’s divorce could also put some downside risk to the euro in the coming months according to Citibank. Still, bulls are looking for short-term gains from the pair.

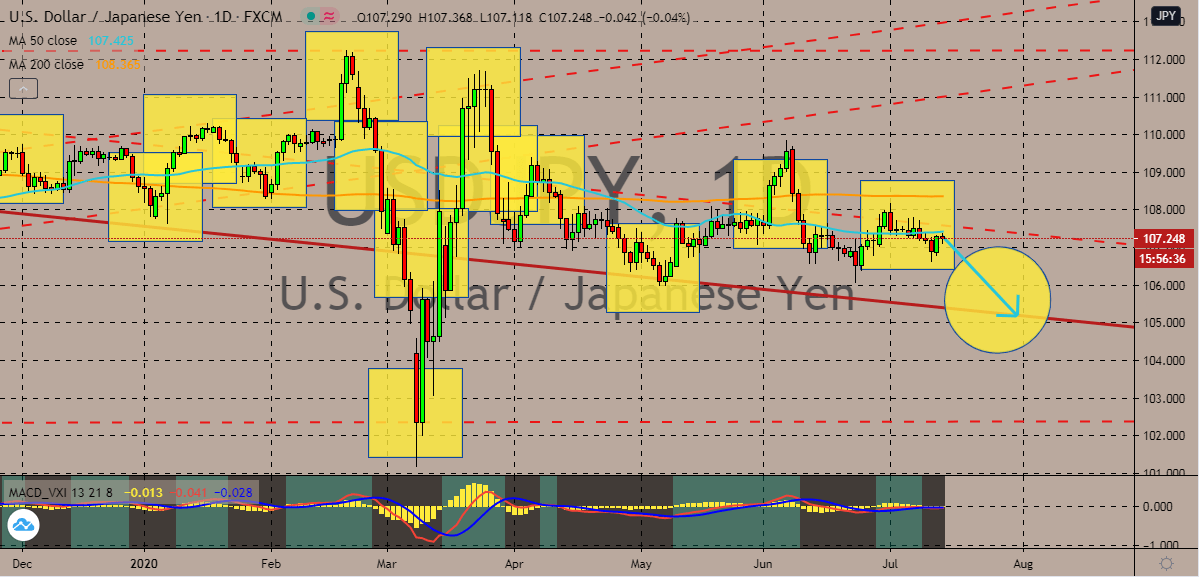

USDJPY

The US dollar continues to show signs of weaknesses against the Japanese yen. The USDJPY trading pair continues to see downside despite what seemed like a recovery attempt from the bullish investors. The US dollar to Japanese yen exchange rate is on track to go down towards its support thanks to the constant reassurance that the Japanese yen receives. Prices should hit the levels last seen in March, further pushing the 50-day moving average lower against the dominant 200-day moving average. Moreover, investors of the trading pair are patiently waiting for the Bank of Japan’s outlook report due later today. Despite the poor forecasts from the Bank of Japan for all the country’s regions, the Japanese yen remains favorable among investors of the USDJPY pair. The Bank of Japan is widely expected to hold on to its current monetary policy throughout the year, which will include the current negative interest rate at -0.10%.

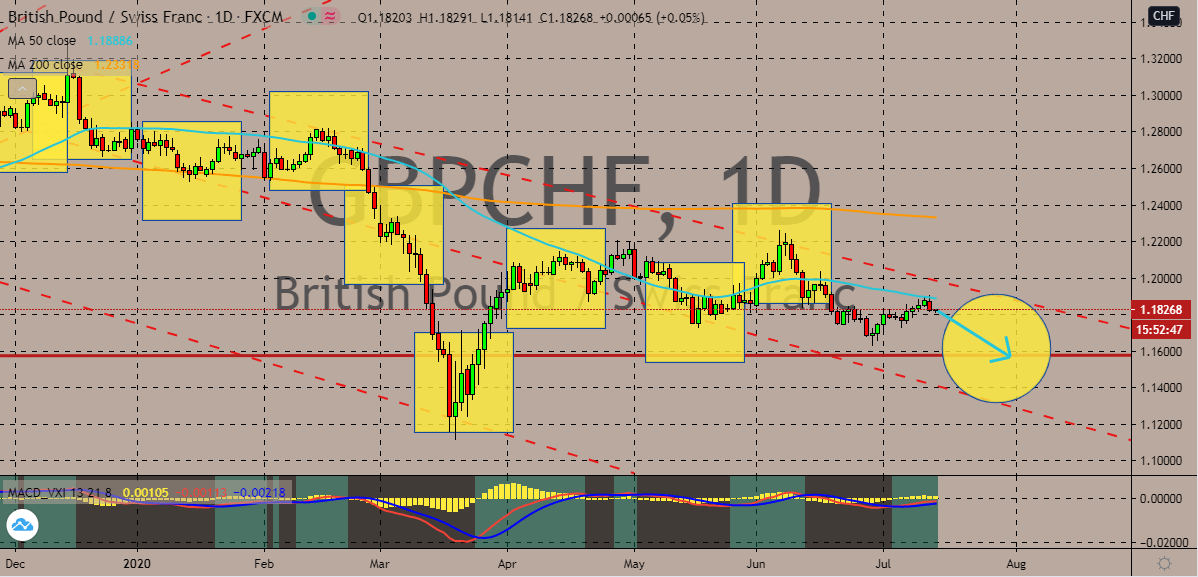

GBPCHF

Brexit uncertainties are increasing the gravitational pull of the Swiss franc against the British pound. The British pound to Swiss franc trading pair’s prices is projected to gradually head down to its support levels in the coming sessions, forcing the 50-day moving average significantly lower against the 200-day moving average. That should maintain the strong bearish sentiment for the pair this month. However, as of writing, it’s evident that the British pound is working hard to prevent the Swiss franc from dominating. In fact, the British pound finally received support yesterday from the strong and impressive results from the United Kingdom’s economy. According to official figures, Britain’s monthly gross domestic product climbed from -20.2% to 1.8%. Aside from that, the British monthly manufacturing production report also showed an impeccable improvement from just -24.4% to approximately 8.4% in the month of May.

COMMENTS