Here are the latest market charts and analysis for today. Check them out and know what’s happening in the market today.

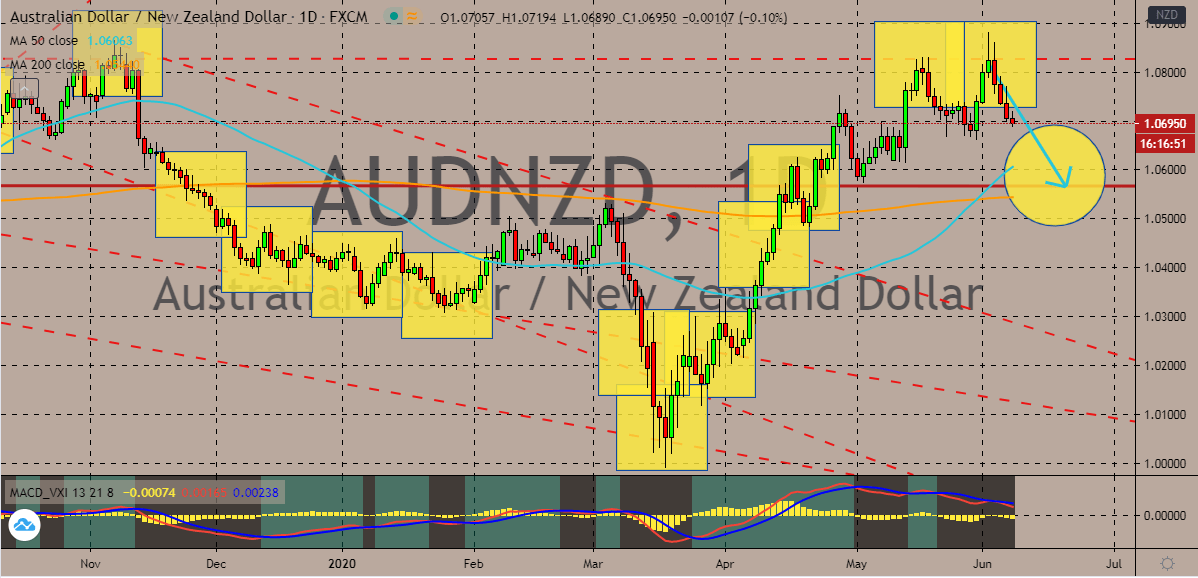

AUDNZD

The Australian dollar to New Zealand dollar exchange rate continues to head down in session. Bearish investors extend their momentum from last week amidst the success of the Aussie against other currencies. The pair should decline to its support levels in the latter half of the month. Bearish investors immediately take the momentum in just the right timing as the 50-day moving average has just recently climbed up against the 200-day moving average. The massive contraction in the Australian retail sales data that was reported last week has failed to support the Aussie against the kiwi. The uncertainties regarding the intense trade tensions between the United States and China. Looking at it, the trade tension comes along with the growing optimism for the recovery of the global economy from the unfortunate coronavirus pandemic. Perhaps the promising gross domestic product results from New Zealand gave the kiwi its much-needed support.

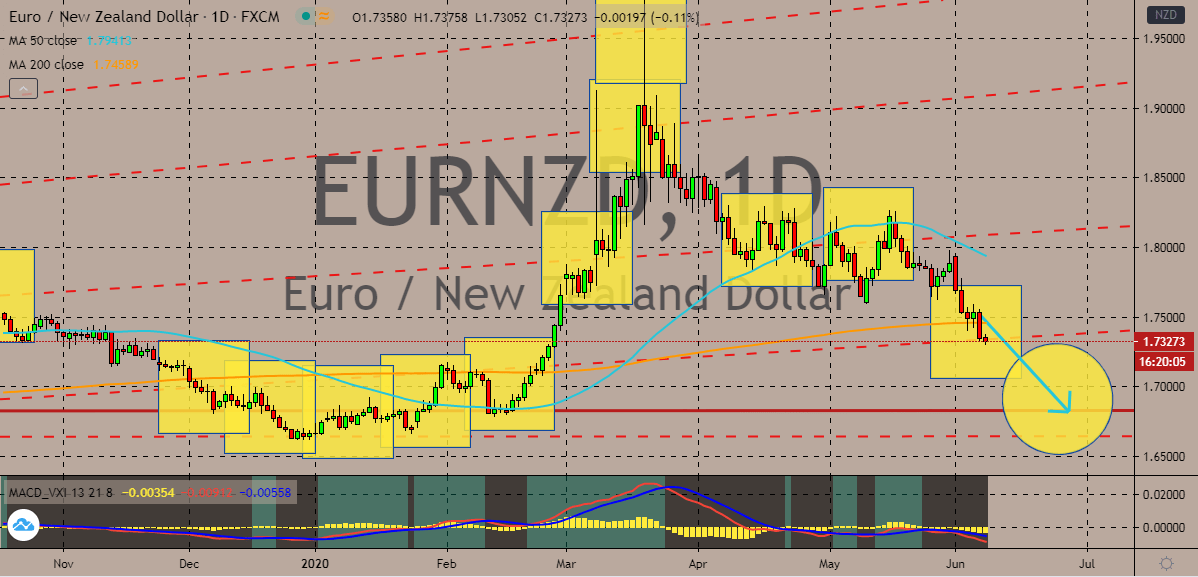

EURNZD

The New Zealand dollar stands successfully strong against the euro. In fact, the single currency is greatly performing against other currencies, but it was not successful against the strong kiwi. The euro to New Zealand dollar exchange rate should reach its support levels in the coming sessions. Looking at the economic landscapes faced by both currencies, the kiwi definitely has the upper hand thanks to the impressive coronavirus response by the New Zealand government, successfully saving its economy. The antipodean country now has zero active coronavirus cases and its gross domestic product came in just as projected. New Zealand finally lifts its coronavirus lockdown after the country’s last patient recovered. Prime Minister Jacinda Ardern announced the news earlier this week and said that the government will continue to stay alert against the coronavirus. Ardern also promised to rebuild the economy that’s been struck by the pandemic.

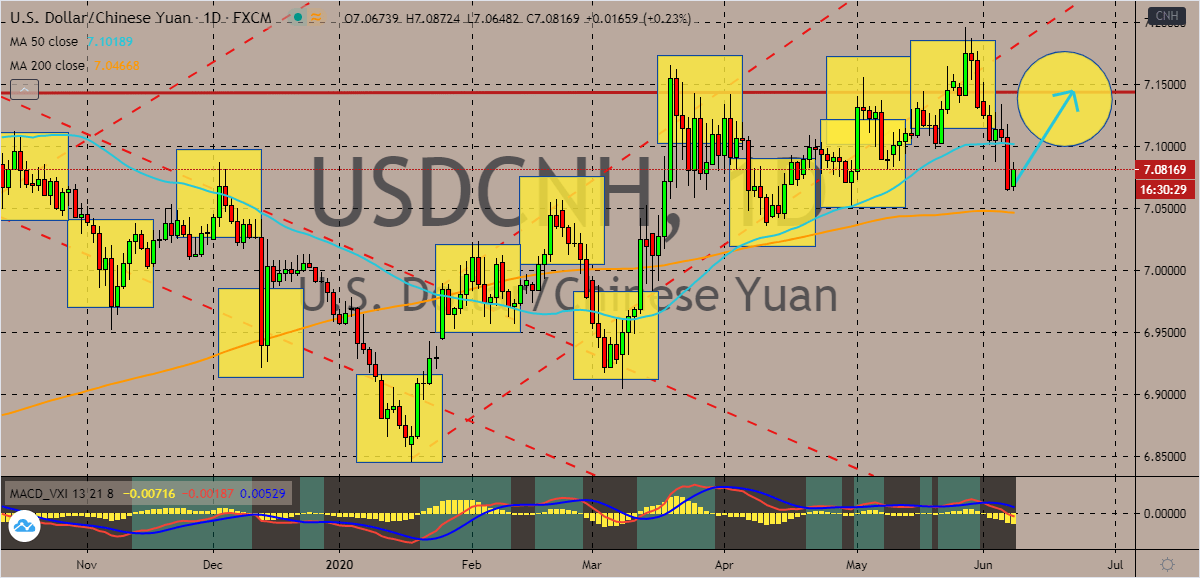

USDCNH

The Chinese yuan eases against the US dollar thanks to the response of the country’s former trade official regarding rolling back sanctions. This comes after the United States president threatened to inject more tariffs over unspecified Chinese goods. Thanks to today’s rally, the US dollar to Chinese yuan exchange rate immediately forms a bullish potential. The pair has great potential to climb to its resistance in the latter half of the month. Looking at the charts, it appears that the rebound of the Chinese yuan forced the 50-day moving average to take a U-turn against the 200-day moving average. However, the change of momentum now could prevent the 50-day MA from plummeting. The broader recovery of the US dollar is also reflecting on the pair. The greenback aims to take back some of its losses, tracking the pullback in the S&P500 indices. The improvement in America’s unemployment rate has backed up the US dollar.

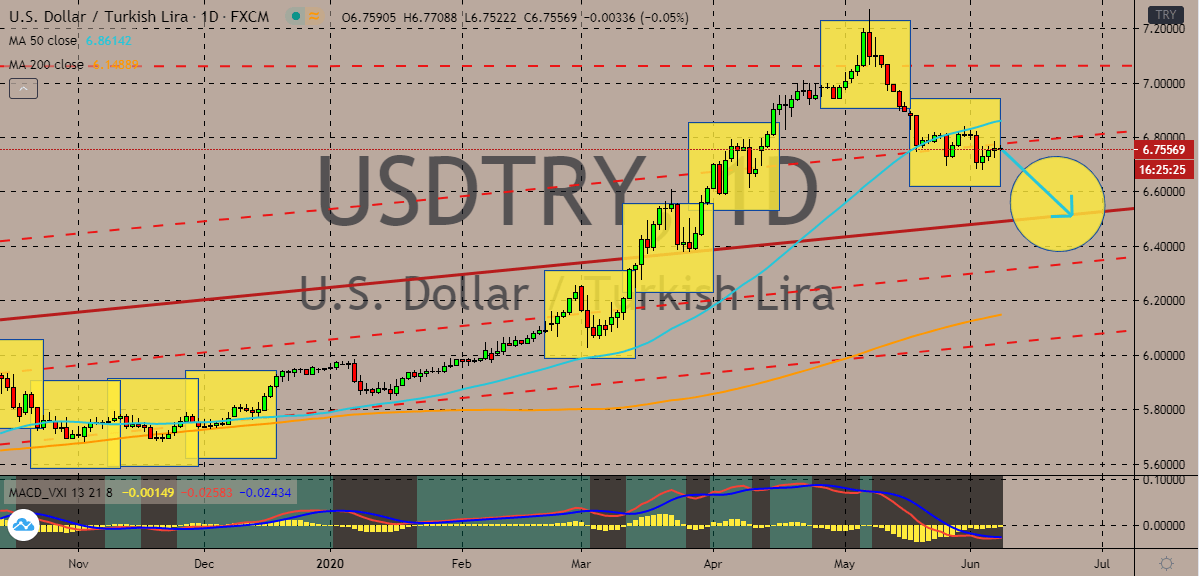

USDTRY

Based on the limited gains of the USDTRY trading pair today, it appears that the Turkish lira will continue to drag the US dollar today. The US dollar to Turkish lira exchange rate is currently testing its resistance and is doomed to bounce off it. This will help the Turkish lira to regain its major losses from the unprecedented rally of the USDTRY. Turkey is currently on its first week outside its lockdown. Major cities in the country are once again lively. The gradual decline in cases in the country has led to a steady normalization. Istanbul is the most struck city in the country, and finally, people can enjoy leisure activities over the weekend such as going to beaches and having picnics. Just this month, restaurants, cafes, and other businesses have finally reopened. Domestic flights in Turkey and intercity travel have also started this month. This return to normal is gradually saving the economy that was greatly battered by the coronavirus pandemic.

COMMENTS