Here are the latest market charts and analysis for today. Check them out and know what’s happening in the market today.

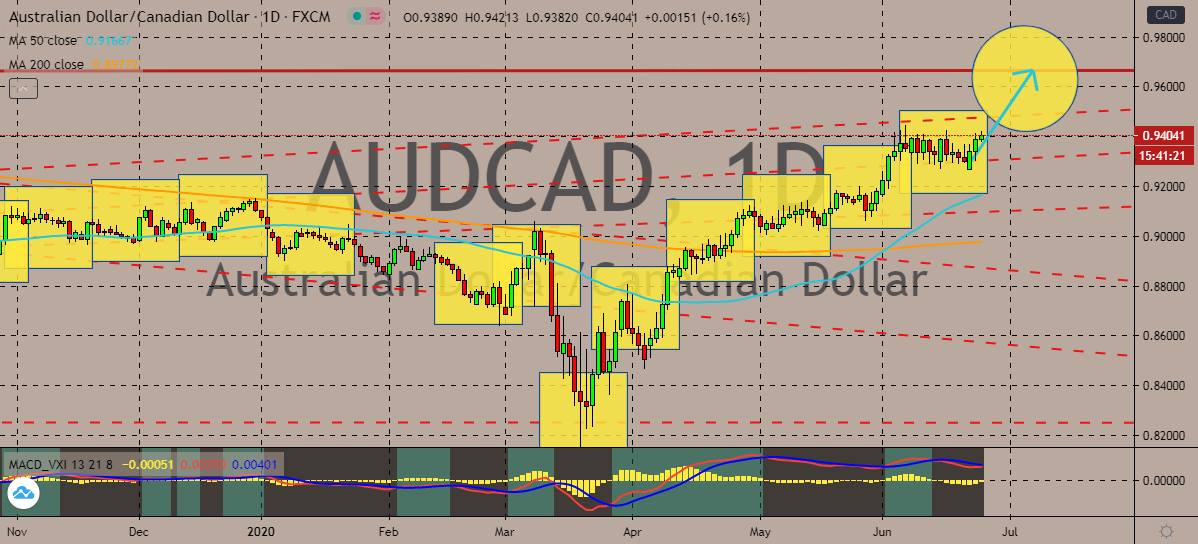

AUDCAD

The statement of Reserve Bank of Australia Governor Philip Lowe on Sunday gave bullish investors of the AUDCAD strength. Since the week began, bulls have been busy pushing the pair higher towards its resistance. On the other hand, the Canadian dollar is also seen recovering against other currencies in the market. Unfortunately for it, its strength isn’t enough to prevent the Australian dollar from gaining. The trading pair is now widely expected to climb up and reach levels that were last seen in December 2018 by the first few days of July. The rally should help bulls hold the 50-day moving average significantly higher than the 200-day moving average. As for the Canadian dollar, one of its main sources of strength amidst the global pandemic is the performance of Wall Street. But as mentioned, the Australian dollar remains significantly bullish which is further bolstered when Lowe hinted that the Aussie’s strength isn’t a problem yet.

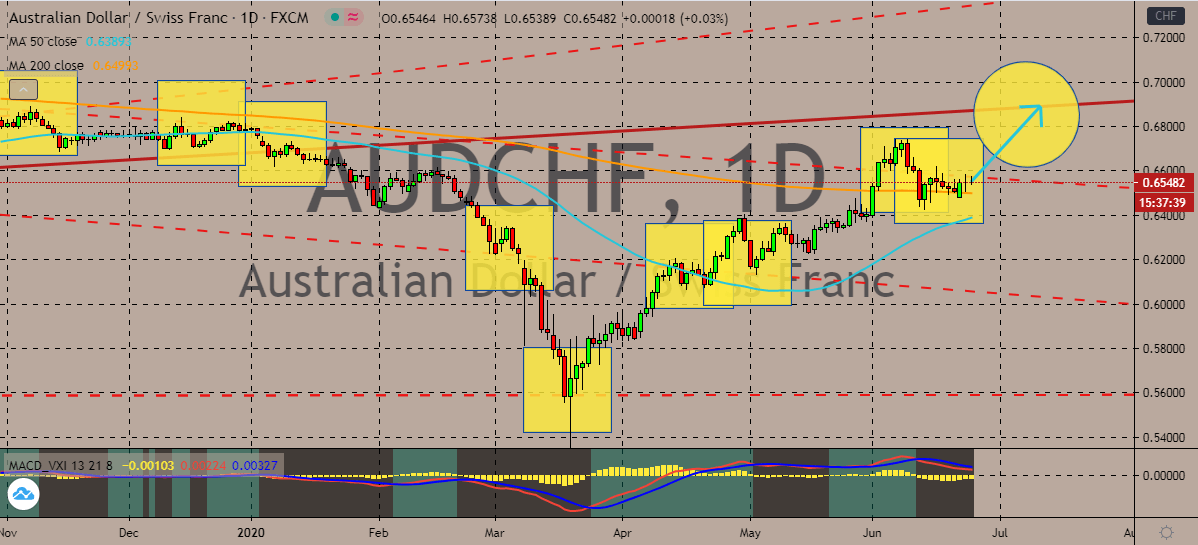

AUDCHF

As of writing, the trading pair is seen flirting with a critical resistance level which bullish investors continue to a difficult time breaking through. The pair appears to be neutral this Wednesday. Luckily for them, the Australian dollar is still widely expected to continue its climb against the Swiss franc once it finally breaks above the current levels. The pair’s prices are projected to climb to its higher resistance level by the first half of July as investors of the Australian dollar remain confident. This is after the Reserve Bank of Australia Governor Philip Lowe signaled that the strength of the Aussie isn’t a problem for the economy yet. The recent comment debunked the speculations of possible interventions from the reserve bank, giving more room for bullish investors to advance. Although based on both of the 50-day and 200-day moving averages position, the pair is still considered slightly bearish and the coming rally should shift the momentum.

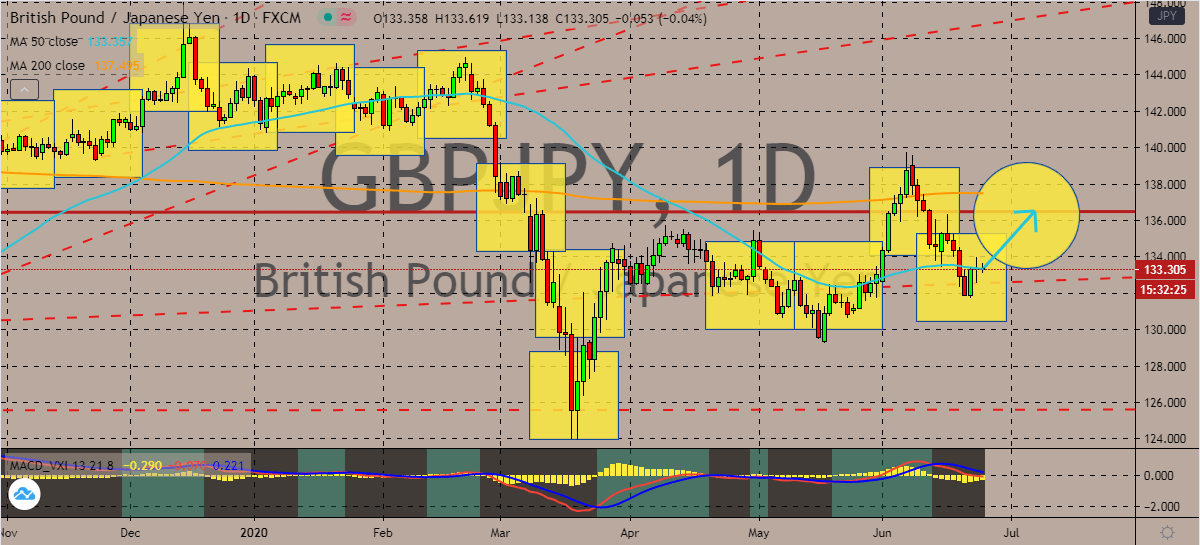

GBPJPY

Prices appear steady this Wednesday for the British pound to Japanese yen exchange rate. But that won’t last long as bullish investors prepare to propel the pair towards its resistance level in the coming sessions. The positivity from the recent reports from the United Kingdom is fueling the tanks of bullish investors. It seems that Britain is back on business after the harsh lockdown restrictions struck the economy. Just yesterday, it was reported that the composite, manufacturing, and services PMIs finally showed significant improvement. The UK composite PMI jumped from 30.0% to about 47.6%. While the manufacturing PMI leaped from just 40.7% to around 50.1%. And the services PMI surged from only 29.0% to approximately 47.0%. The significant improvements from the reports give a glimpse to the recovering economy of the United Kingdom, erasing the concerns on investors and weakening the demand for safe-haven assets there.

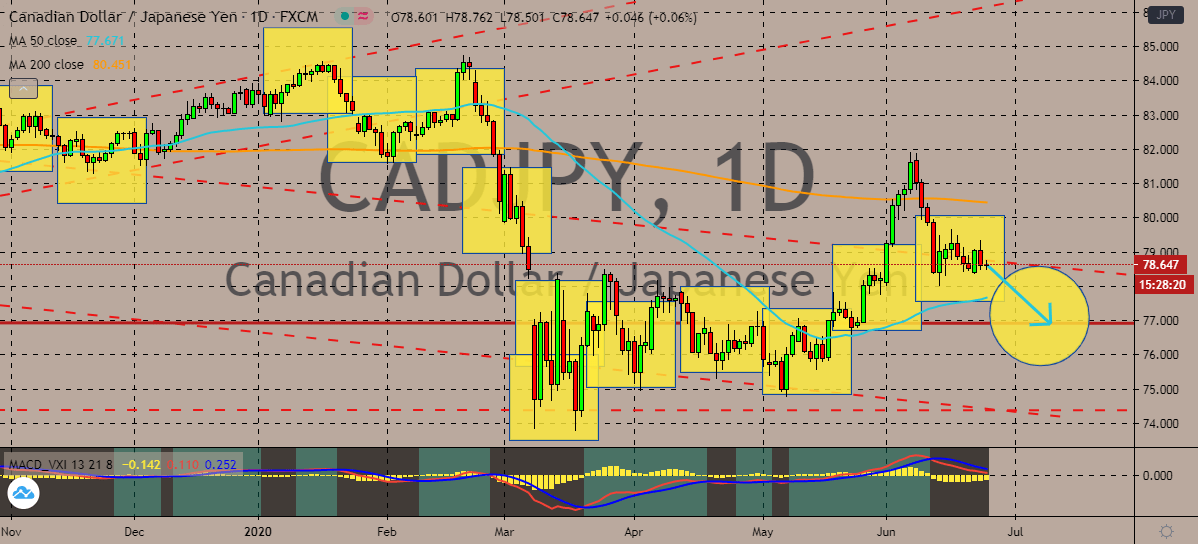

CADJPY

The Canadian dollar lost its steam as investors get more and more concerns for the economic recovery of Canada. This paved an opportunity for the Japanese yen to take advantage and force the pair even lower in sessions. However, as of today, the pair is seen trading steadily as both currencies fail to gain a good grip on the momentum. Prices are projected to drop down to their resistance, preventing the 50-day moving average from climbing towards the 200-day moving average in the process. Earlier this week, the confidence of bullish investors was damped when the Bank of Canada Governor Tiff Macklem said that the road of recovery is prolonged and bumpy. In his first speech as the governor, Macklem said that the central banks expect to see some growth from the economy in the third quarter of 2020. By then, workers should be called back to resume normal activities as strict lockdown restrictions in the country gradually eases.

COMMENTS