Here are the latest market charts and analysis for today. Check them out and know what’s happening in the market today.

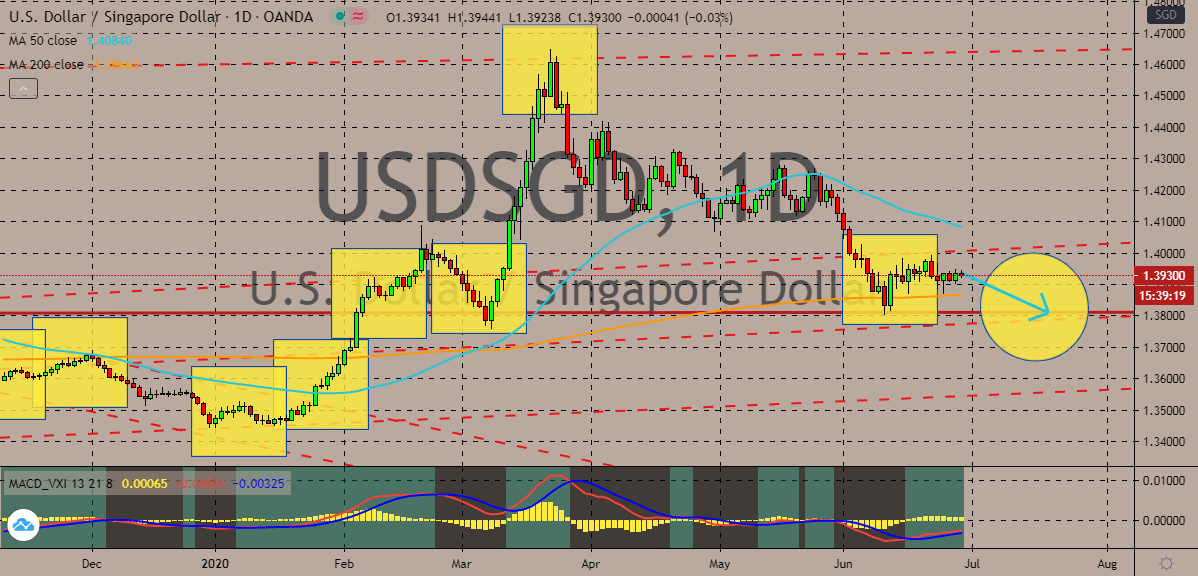

USDSGD

The Singaporean dollar saw hindrances last week after the country presented disappointing data. However, investors are holding tight and are hoping that the Singaporean dollar would remain strong. In fact, Singapore has one of the greatest numbers of confirmed cases in the region. But what supports bearish investors is that the mortality rate in the country is relatively low compared to other countries. Just recently, Morgan Stanley, an American investment banking company, gave bullish signals for Singaporean stocks. Investors are really delighted with the news as the recovery of Singapore’s stock market should help the struggling Singaporean dollar. As for the greenback, the demand for safety isn’t working well this Monday thanks to the recent news about the possible coronavirus vaccine from mainland China. The news helped move the already shifting risk sentiment and slowing down the bullish investors of the exchange rate.

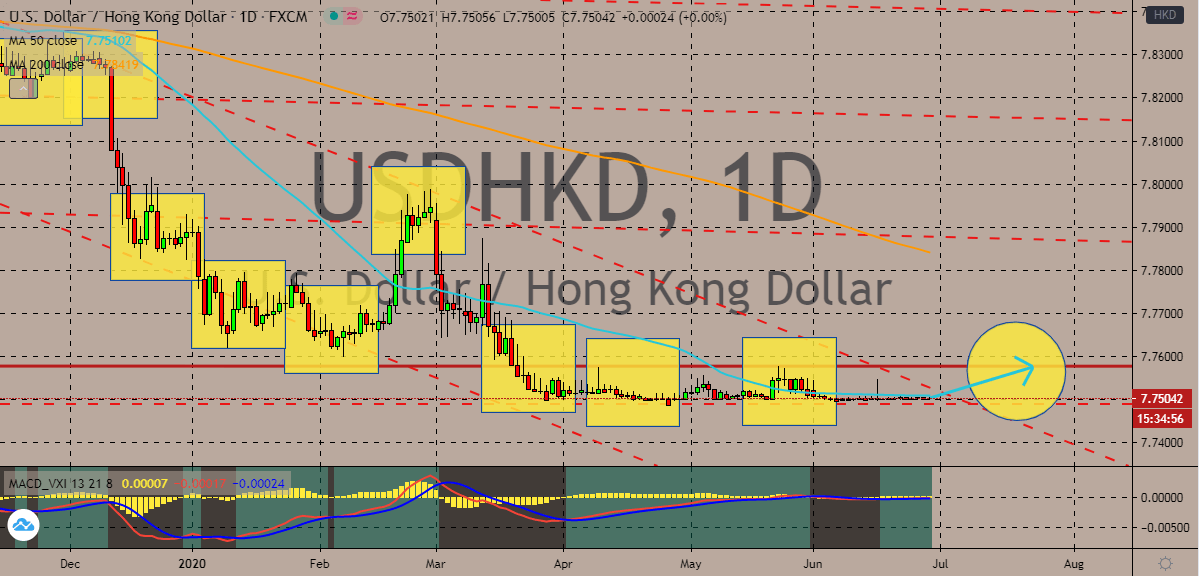

USDHKD

In the past, the highest official of the Monetary Authority of Hong Kong said that the pegged currency won’t most likely budge despite the fluctuations in the global market. However, with sheer determination, bullish investors are looking to push the pair’s prices higher in the trading sessions. Looking at the charts, it’s seen that the exchange rate has been steadily pegged since March this year thanks to the coronavirus pandemic. Although it’s worth noting that bears also had had any luck in trying to force the pair lower past its support level. The pair is considered extremely bearish since the 50-day moving average is significantly lower than the 200-day moving average. Once bullish investors push the pair’s price towards its resistance, it could lessen the bearishness of the US dollar to Hong Kong dollar exchange rate. The trade war between Beijing and Washington has little effect on the pair, so bulls will rely on other fundamentals instead.

EURTRY

The Turkish lira is trading cautiously this Monday against the euro amidst the concerns of investors about the number of rising coronavirus infections around the world. Looking at the pair, it appears that ever since bullish investors were able to regain their footing, the lira has continuously had a rough time defending some of its recovered gains from last month. Bearish investors are bracing themselves as the exchange rate is forecasted to reach its highest level since the financial crisis of Turkey. However, the pair is also seen forming a strong potential for a bearish reversal. See, investors were greatly surprised when the Turkish central bank opted to leave its official repo rate for the month of June unchanged. This could help the Turkish lira get back to its feet against the euro once the pair’s prices reach their resistance level in the coming trading sessions. And the US tariff threat against the EU also adds pressure on the trading pair.

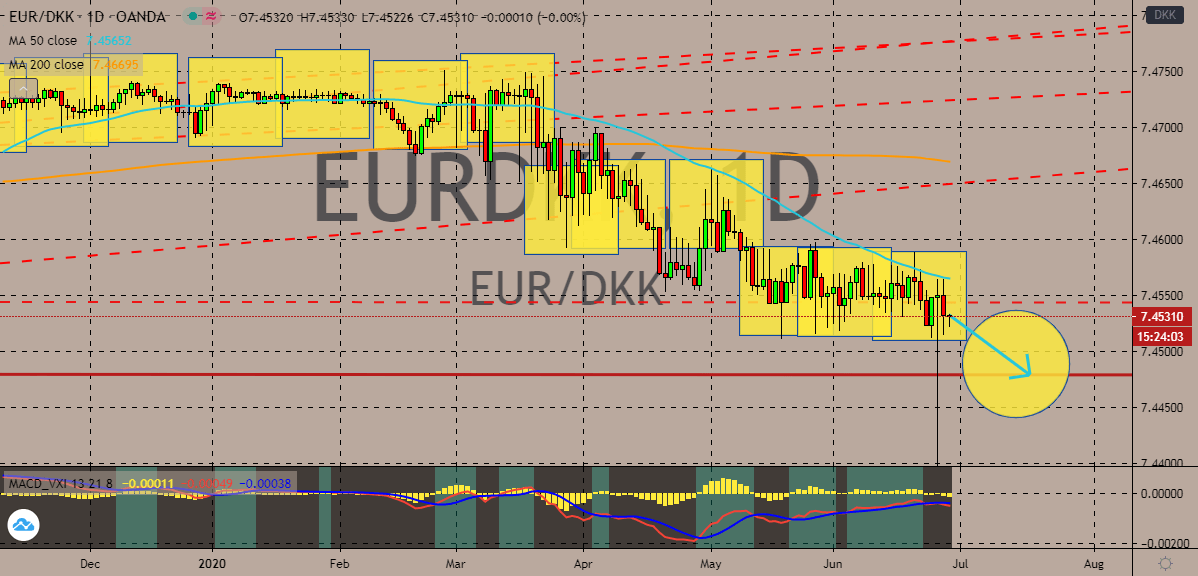

EURDKK

The impressive improvements seen from the Danish economy is bound to help the Danish krone force the euro lower towards its resistance. The euro to Danish krone exchange rate is widely predicted to remain bearish thanks to the notable recovery steps taken by the Danish economy. The pair should reach its support level by the first half of July as investors bask in the euphoria that Denmark’s economy is actually recovering. Once the pair reaches its support, the 50-day moving average would further plummet against the very dominant 200-day moving average. Moreover, it was just recently reported that Denmark’s retail sales figures finally rose from negative territories last month. Official figures from the country show that the Danish retail sales figures rose from just -2.7% to about 5.3% in May on a year-over-year basis. And aside from that, the country’s consumer confidence report for June has also slightly improved.

COMMENTS