Here are the latest market charts and analysis for today. Check them out and know what’s happening in the market today.

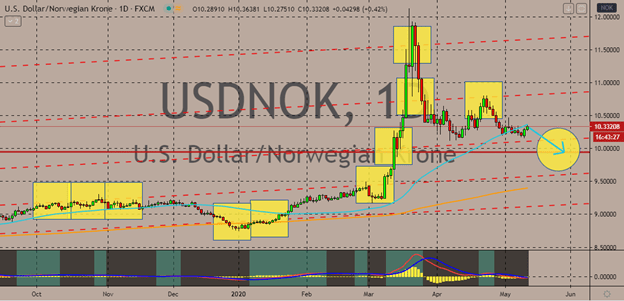

USDNOK

Thanks to the upbeat results from the Norwegian economy, the US dollar to Norwegian krone exchange rate is now projected to depreciate. The positive results from Norway’s economy are bound to strengthen the krone against the US dollar. Bearish investors are looking to turn things around and finally force the 50-day moving average to descend and get nearer to the 200-day moving average. The stronger than expected core consumer price inflation for April has supported the crown currency. Statistics Norway recently showed that the core consumer price index rose from 2.1% to around 2.8% amidst the pandemic. Investors of the pair are now holding tight as they await the results of the first quarter gross domestic product report from Norway which will give the pair either a boost upwards or downwards. Experts are expecting that the data will crash from 1.6% to just -1.5% thanks to the devastating effect of the coronavirus lockdowns.

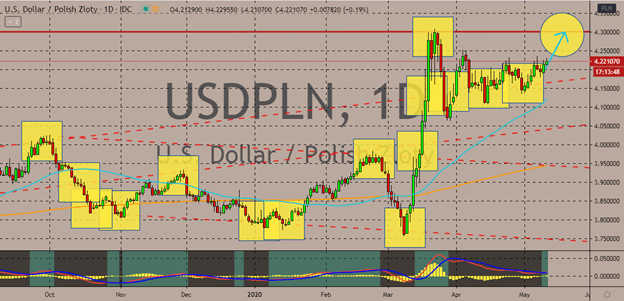

USDPLN

The Polish zloty is on the defensive against the also weakening US dollar in the trading sessions. The USDPLN pair is starting off the week on a bullish tone despite the zloty seen gaining against most other currencies. Perhaps the recent forecasts for the economic outlook of Poland have taken away some of the confidence of bearish investors. The pair is widely believed to climb higher towards its resistance in the coming sessions, forcing the Polish zloty to levels last seen in the second half of March. Bulls are hustling to propel the 509-day even higher against the 200-day moving average. Although according to some experts, the central European currency may use the opportunity to bounce back against the US dollar once it hits its resistance level. However, intense projections for the Polish economy’s GDP is also pressuring the zloty as it’s, unfortunately, expected to be the hardest hit in the whole European Union this year.

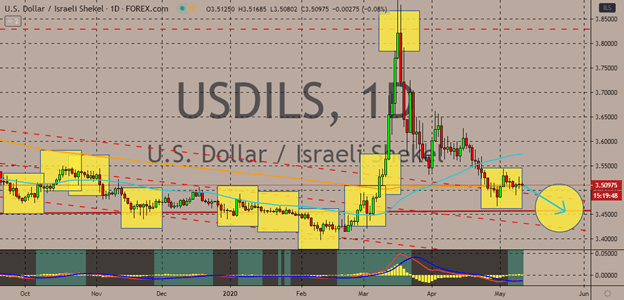

USDILS

The USDILS remains on track to gradually hit its resistance thanks to the broader weakness faced by the Israeli shekel. The pair is said to be within a falling wedge pattern since early April. Investors of the Israeli shekel are preventing the 50-day moving average from climbing higher against the 200-day moving average. It’s believed that the US dollar to Israeli shekel exchange rate will eventually decline to its support in the latter part of May. Moreover, the Israeli government has announced a series of new adoptions to the COVID-19 regulations in efforts of easing the pressure from the country’s economy. Initial data from Israel shows a significant decline in the trend of new confirmed coronavirus cases. And some of the country’s leaders apparently believe there won’t be a second of wave of infections before the winter. However, Defense Minister Naftali Bennett believes that the number of cases will somehow increase but not spike.

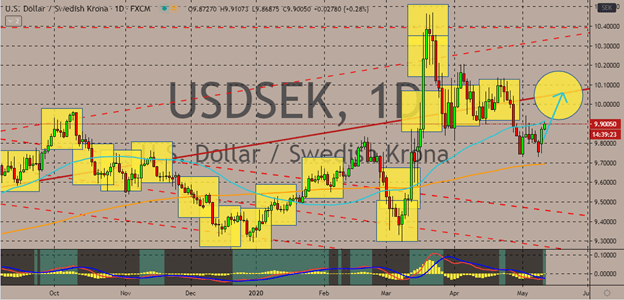

USDSEK

The US dollar has regained its footing against the Swedish krone despite the support if the pair from news about the Swedish economy. The US dollar to Swedish krona trading pair is widely believed to rally to its resistance as the safe-haven appeal of the buck shines even brighter. However, the pair would most likely bounce from its resistance after it reaches it thanks to the support from the Swedish economy. Apparently, investors are focused on the maverick-like approach of the Swedish government in handling the virus. And it seems that the krona is benefitting from it. And adding more support is the gradual and significant rebound of crude prices which are now approaching the $30-mark. But as of today, the main fundamental that’s supporting bullish investors is the heightening concerns of investors about plans of reopening the US economy which has shifted the focus on the safety of the greenback.

COMMENTS