Here are the latest market charts and analysis for today. Check them out and know what’s happening in the market today.

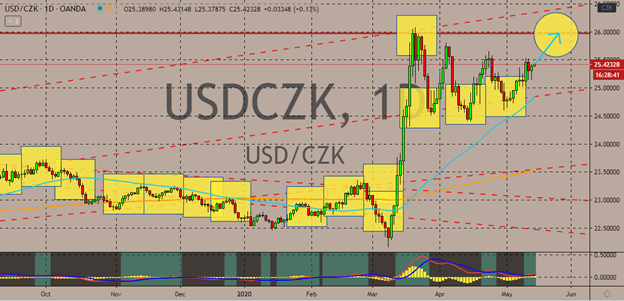

USDCZK

The USDCZK exchange rate is on track to get back up to its resistance despite the better than expected results from the Czech Republic’s economy. The main weakness of the Czech koruna is nonother than the deeper than projected rate cut from the Czech National Bank. Earlier this month, the national bank reduced its official rates to just 0.25% from 1.00%. Bearish investors were definitely shocked as the national bank was only expected to cut it to just 0.50%. The deep rate cut has offset the beneficial impact of the good consumer price index report issued just yesterday. Cesky Statisticky Urad found that the country’s CPI slipped from 3.4% to approximately 3.2%, but still slightly stronger than projections of 3.1%. Moreover, the US dollar received a much-needed boost from the recent comment of Jerome Powell, the Chairperson of the United States Federal Reserve. According to the Fed boss, negative rates weren’t on the table for the bank.

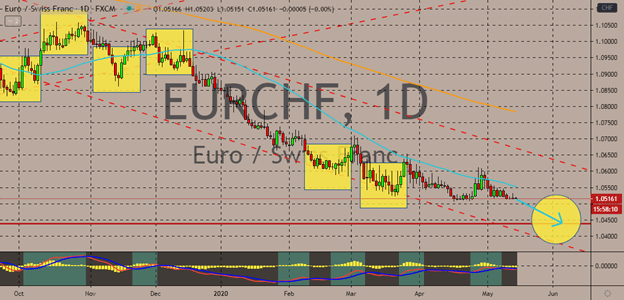

EURCHF

The Swiss National Bank (SNB) continues to get frustrated by the continuous appreciation of the Swiss franc. The euro to franc exchange rate is currently steady as of writing but is widely expected to continue its downhill run in the coming session. The EURCHF pair is now trading at levels last seen in late July 2015 and has huge potential to get even lower as the euro feels the pressure brought by the unforgiving pandemic. The single currency of the European Union has one of the worst-performing currencies among the basket of major players in the forex scene. Some experts say that the poor performance of the euro can be attributed to the failure of Brussels to set up a “joint fiscal defense”. Moreover, the SNB, according to its Chairman Thomas Jordan, has no more alternative measures for its super-loose monetary policy amidst the unstoppable strengthening safe-haven appeal of the Swiss franc thanks to the unending anxiousness in the global market.

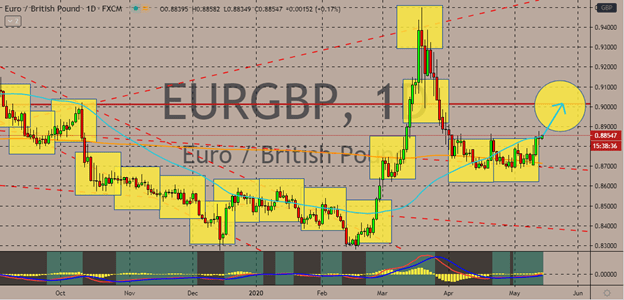

EURGBP

The euro to sterling exchange rate may have steadied yesterday, bearish investors weren’t able to take advantage or take the momentum. The reason for this? the revived Brexit woes that’s preventing the pound to regain its footing. Yesterday, the United Kingdom reported significantly stronger than projected results from its gross domestic product reports, showing the economy’s robustness amidst the crucial quarter of the fiscal year. As for the pound, investors are concerned about Brexit talks which have recently started earlier this week. A source close to the matter said that the EU insisted that it was keen on helping the United Kingdom towards a possible extension. However, this comes as Downing Street remains firm that it won’t need any extension and that it can snatch a deal by the deadline on December 31. But with the ongoing pandemic, striking a deal between both sides may be more difficult because the focus is on the virus and economic recovery.

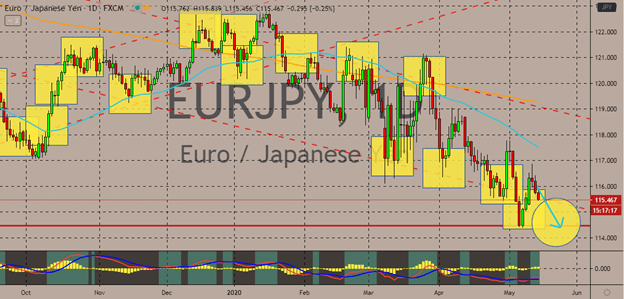

EURJPY

After attempting to recover in the previous sessions, the Japanese yen forces the EURJPY trading pair to take a sharp U-turn. The efforts of the euro seem futile as the pair remains widely bearish as evident on the 50-day moving average which continues to decline farther below the 200-day moving average. However, the fluctuating risk appetite in the global market paints much uncertainty in the trading pair’s outlook. Still, the pair appears to be heading downwards yet again towards its support level. The Japanese yen has been fortified by the latest comment from BOJ’s governor Haruhiko Kuroda. The head of the Bank of Japan assured that the bank will do whatever it can to help prevent or lessen the impact of the coronavirus. Kuroda said that the BOJ is willing to use all the available monetary tools to stimulate the Japanese economy and prevent further fallout; this includes money printing, easing rates, and even ramping up market operation tools.

COMMENTS