Here are the latest market charts and analysis for today. Check them out and know what’s happening in the market today.

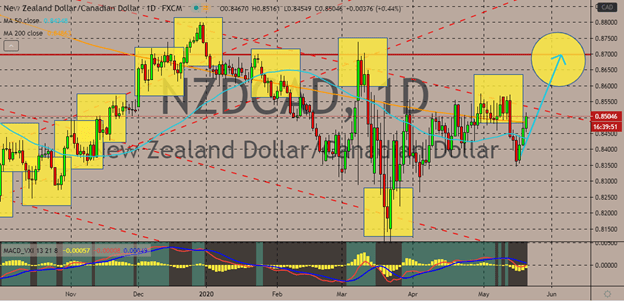

NZDCAD

News about the development of a coronavirus vaccine has propelled the New Zealand dollar this week against the Canadian dollar. But it appears that the New Zealand dollar isn’t the only one strengthening in the foreign exchange market. In fact, the Canadian dollar is also gaining against a ton of currencies, but when paired against the New Zealand dollar, it stood no chance. The reason for the loonie’s strength is also the coronavirus news that boosted the risk-on sentiment in the market. It appears that bullish investors have this in the bag as they work hard to break past the first resistance line seen to reach the higher one which currently sits at levels last seen in early March. The surge will force the 50-day moving average to climb towards the 200-day moving average, closing the gap between the two. And if the NZDCAD trading pair actually reaches and breaks its target resistance, the 50-day MA could overtake the 200-day MA.

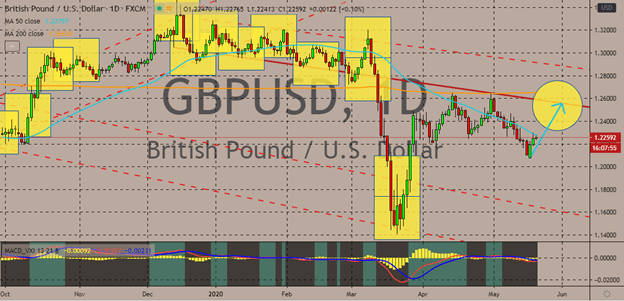

GBPUSD

Thanks to the broader weakness of the US dollar, the British pound sees another opportunity to extend its rally. Although the exchange rate is only making small movements this Wednesday, raising speculations whether it could break past its resistance or just simply bounce off from it. Looking at the performance of the sterling, it’s actually recording weaker gains compared to other currencies matched with the US dollar. Meaning that the pressure from Brexit-related news is still preventing it from running away in the market. Another reason why the British pound is struggling to outperform is the floating speculations about negative interest rates from the Bank of England to help buoy the struggling economy. However, some experts believe that the probability is rather unlikely. Still, the GBPUSD exchange rate is widely believed to climb to its resistance level in the coming sessions because the US dollar remains significantly weaker than the British pound.

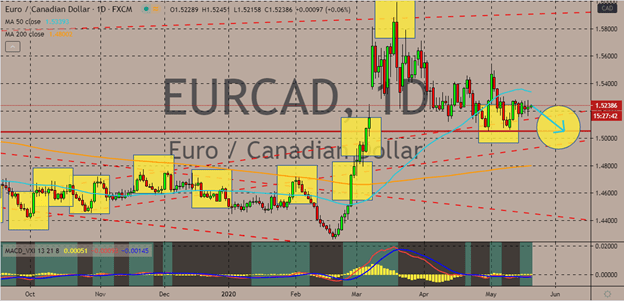

EURCAD

Despite the slight gains seen by the single currency today and in the past sessions, the Canadian dollar has more potential to take control of the direction. In fact, the pair is widely believed to take a reversal in the coming sessions as the Canadian dollar gets more support from the stabilization of the crude oil market. Based on the performance of the bloc’s common currency, it appears that it’s also struggling to seize more grounds, hinting that it’s also starting to lose some steam. As of writing, the euro is seen holding on to its gains as it receives support from the recent proposal of Germany and France for a unified stimulus program to support eurozone economies. The renewed hopes for a coronavirus vaccine from earlier this week are also helping both the euro and the Canadian dollar. Bearish investors of the exchange rate are hoping to successfully reel in lower the 50-day moving average closer to the 200-day moving average.

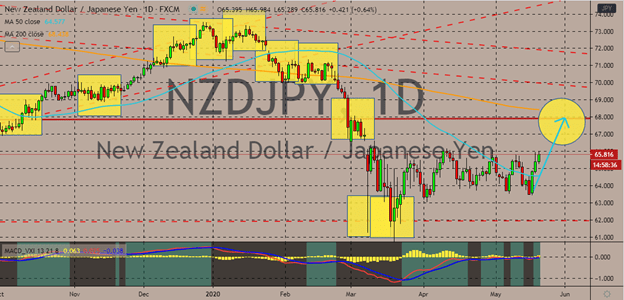

NZDJPY

The New Zealand dollar crushes the Japanese yen, taking advantage of the weakness of the beloved safe-haven asset. The bullish fate of the pair was sealed on Monday this week when the Japanese Cabinet Office announced the recession and Moderna gave its latest update on its coronavirus vaccine. The Japanese recession has taken away the safe-haven appeal of the Japanese yen as an unstable economy turns off investors. Aside from that, the economic slump can also prompt the authorities, whether it’s the government or Bank of Japan, to release more stimulus to help buoy the economy. Meanwhile, the recent announcement of Moderna’s vaccine helped awaken the risk appetite in the global market; causing stocks to surge, crude to rally, and risk-on currencies such as the New Zealand dollar to thrive. The New Zealand dollar to Japanese yen pair is expected to hit its resistance by the end of the month, reaching levels last seen in early March.

COMMENTS