Here are the latest market charts and analysis for today. Check them out and know what’s happening in the market today.

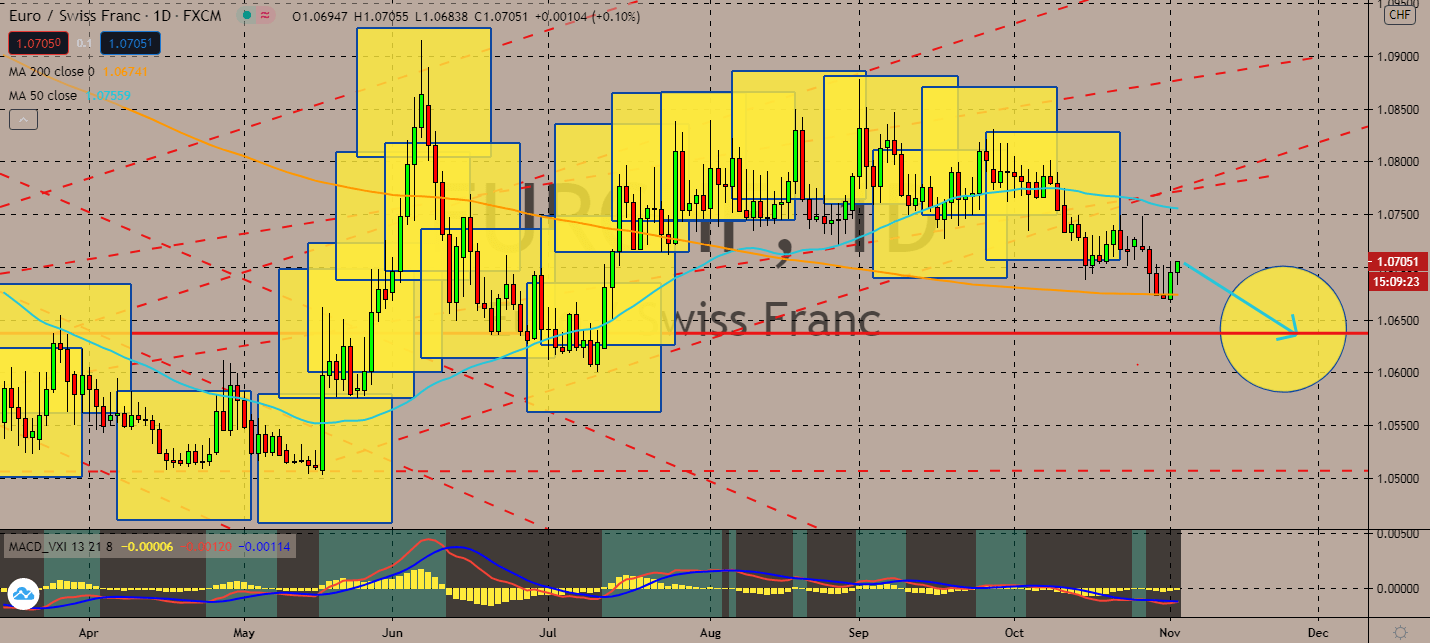

EURCHF

The eurozone economy hit record growth between July and September, having lifted 12.7 percent during the third quarter. Its largest economy, Germany, also announced record growth on Thursday. These turned the eurozone’s second-quarter fall of 11.8 percent around. However, economists are worried that this is a temporary relief. The European Central Bank said that it’s in discussion about upping monetary policy in December to counter further economic downturn. As prices begin to fall and unemployment figures fall into uncertainty, the eurozone’s currency is projected to fall. After all, the pair’s 50-day moving average had just curved down and is on the way to its slowly increasing 200-day moving average. Meanwhile, Switzerland’s manufacturing PMI had increased to 53.3 from 53.5 expectations from the market. The growth is projected to assist is projected to keep the franc up as the euro’s safe haven.

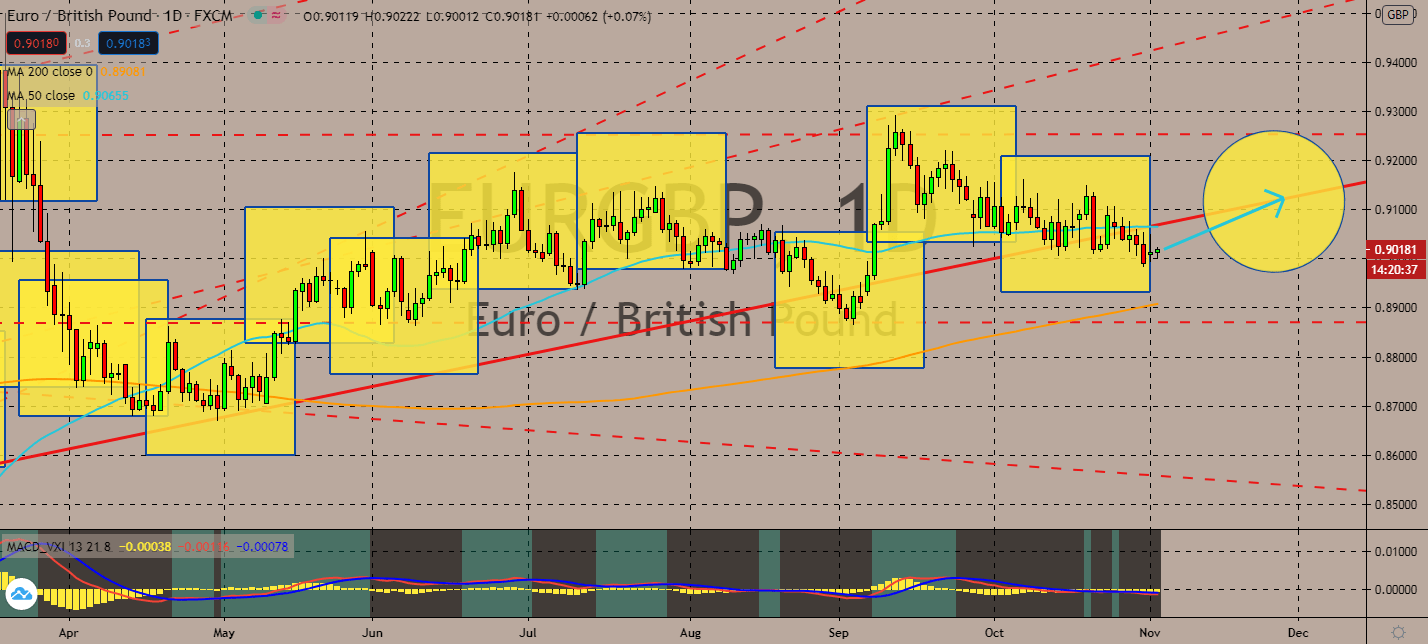

EURGBP

The pair is projected to experience a volatile two months to the end of 2020. Recent lockdowns initiated in both economies have been the causes of their bearish markets, now that the economies haven’t been sharing any updates regarding their Brexit agreement. But it looks like the UK has it worse in the near-term. Thousands of businesses are bracing for a devastating blow for the English economy over fears that the second lockdown will contract its economy by 12 percent this month alone. Director general of the Confederation of British Industry Dame Carolyn Fairbairn said that the recent lockdown was going to be devastating for public establishments. Meanwhile, improving manufacturing PMIs across bigger economies in the eurozone will help it lift in the near-term, especially as a safer currency in comparison to the Sterling. The eurozone’s GDP had also reversed Q2 losses in the third quarter, which is projected to be a temporary boost for EUR.

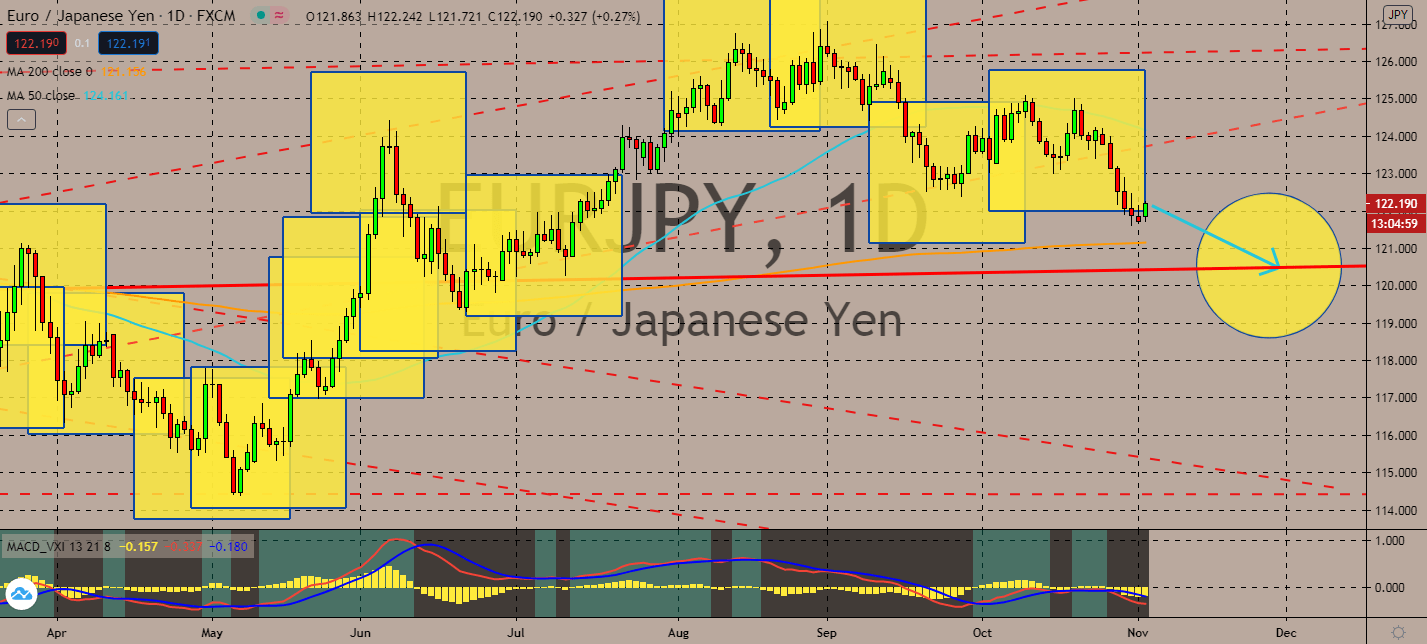

EURJPY

The Japanese economy is projected to rise from its coronavirus contraction better than the eurozone. The Bank of Japan confirmed last week that its economic growth will be slower than initially forecasted, and its massive monetary easing will be left untouched, but it looks like the growth is still gradually improving. Forecasts are now lower than what was given in July, mainly due to demand for its services, which will likely prevail for fiscal 2021 and 2022, as well. The pair’s 50-day moving average arched toward its 200-day moving average, showing signs that the bears are gaining momentum for the pair. As Brexit talks remain in hiding, the main driver for the euro pair will be its recently announced gross domestic product figure – in fact, the eurozone’s economy had recovered its second-quarter losses throughout the quarter ending September. However, economists claim that this record surge is going to plunge soon.

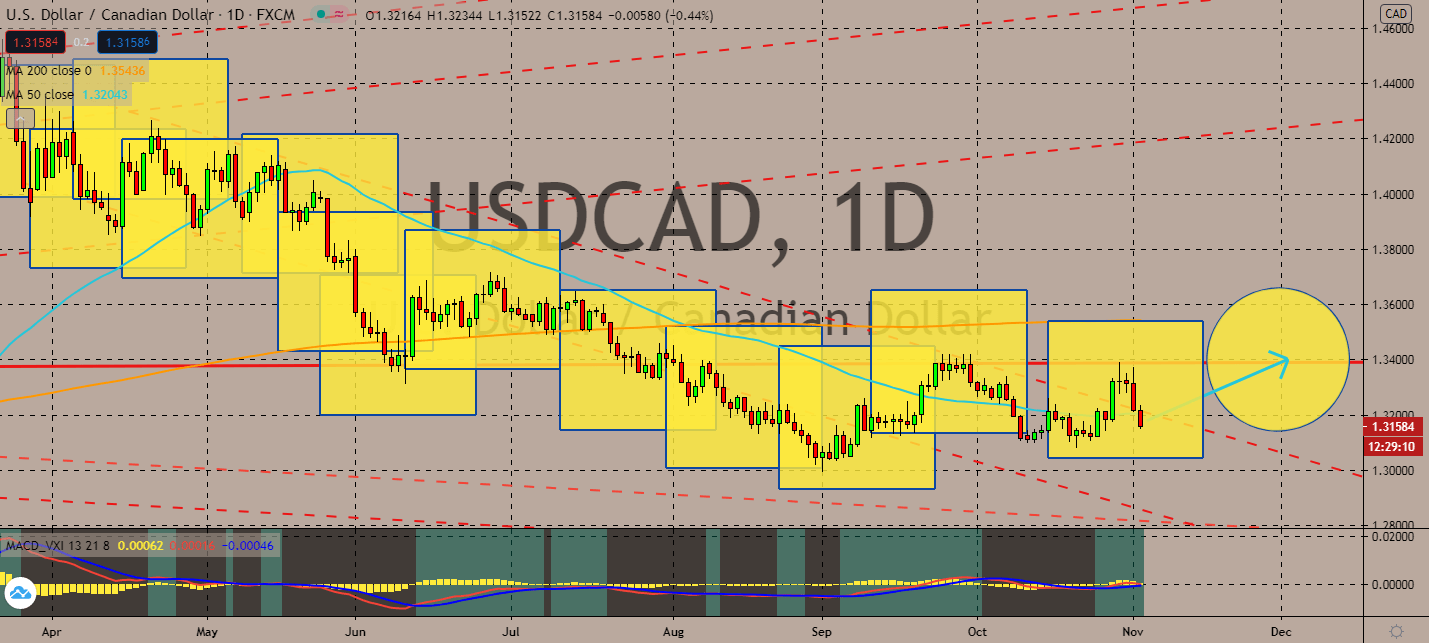

USDCAD

The Canadian economy is in a state of great uncertainty – at least, according to Canadian analysts, which are keeping a close eye on American politics this week. A Trump win could mean low taxes for pro-fossil fuels and prioritization of its economy over Covid-19 policies, which could help the Canadian loonie recover its losses from strength in oil prices. The recovery of its exports will also be dependent on the outcome of the presidential elections. Notably, markets are already claiming that Joe Biden is more likely to win, as his agenda remains as Trump’s polar opposite. The pair’s 50-day moving average has arched up towards its 200-day moving average, showing that near-term sentiment is more likely to be bullish. The Canadian recovery, after its gross domestic product rose by a timid 1.2 percent in August, is likely to slow down for the rest of the year if the oil market continues its plunge over stricter lockdowns across the globe.

COMMENTS