Here are the latest market charts and analysis for today. Check them out and know what’s happening in the market today.

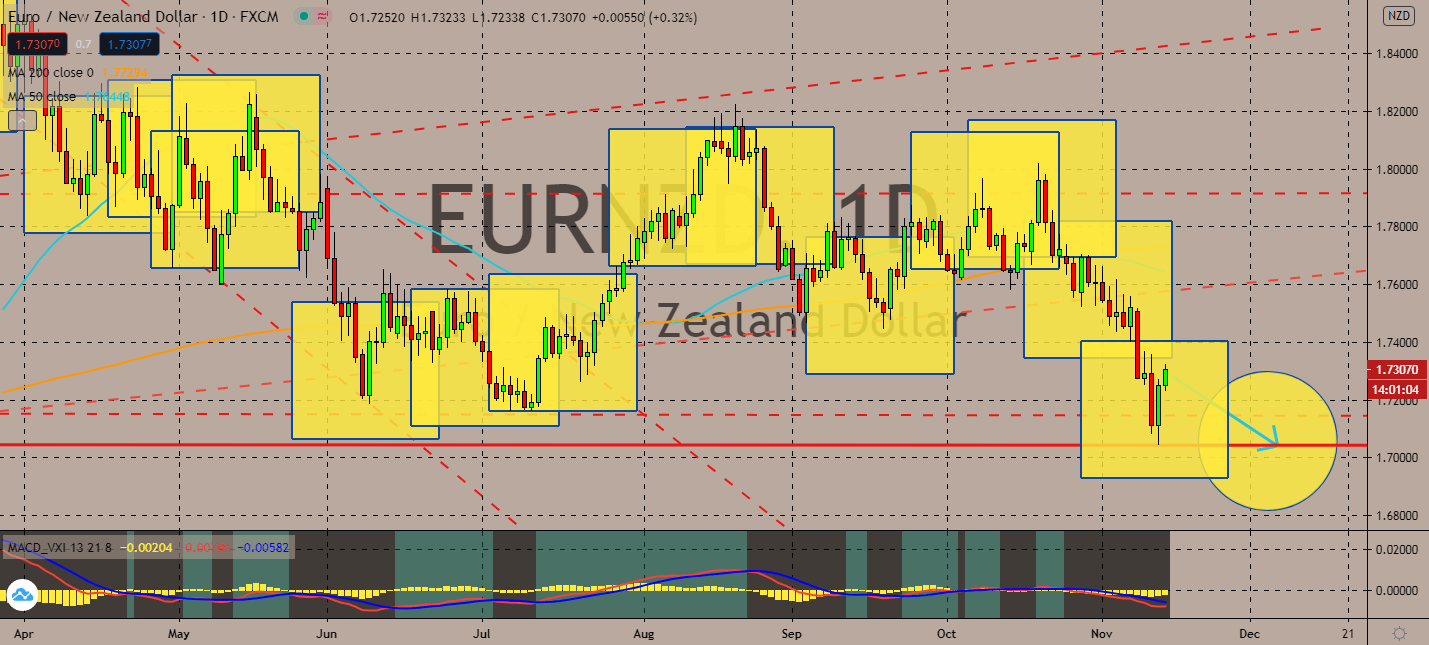

EURNZD

The kiwi dollar is expected to continue its outperformance for the week after the Reserve Bank of New Zealand hinted that it’s less driven to implement the initially planned negative interest rate policy, which had threatened the value of the dollar once before. Global sentiment will help the kiwi dollar lift in the near-term as its economy continues to outperform its peers during its Covid-19 recovery. The RBNZ MPS also recently delivered more easing within the week via an FLP scheme. The currency will benefit from having one of the lowest debt-to-GDP ratios among most of its surrounding developed economies. This sentiment is further proven by the pair’s 50-day moving average, which just crossed below its 200-day moving average in recent trading. Near-term sentiment is pointing to risk aversion. The Brexit deadline is fast approaching, and participating economies’ conflict will also be one of the pair’s biggest downfall.

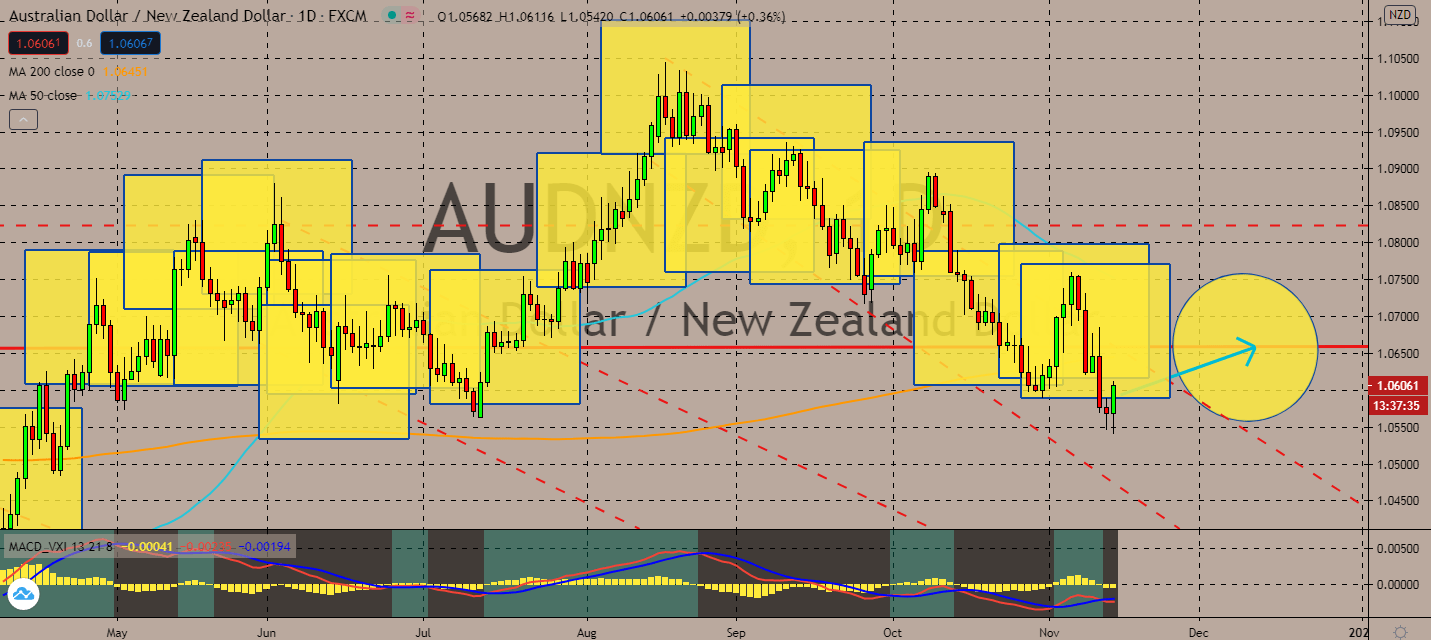

AUDNZD

China will deliver its Foreign Direct Investment report today. Hong Kong will also report its finalized data for its third quarter gross domestic product, as well. Both rates will determine the pair’s near-term track, and it will be bullish. Hong Kong is expected to report an increase for its GDP to 3 percent in comparison to the second quarter. The year-over-year comparison is less anticipated, largely because the rest of the world is already in an expected recession. The rate might remain around negative levels of 3.4 percent. The pair’s near-term track is projected to keep a cautious uptrend as its 50-day moving average remains above its 200-day moving average as the market keeps its eyes on the Reserve Bank of New Zealand. The kiwi dollar will recover its gains in the medium-term as long as the central bank remains optimistic about its current interest rate level, especially now that it has finally tamed its second Covid-19 wave.

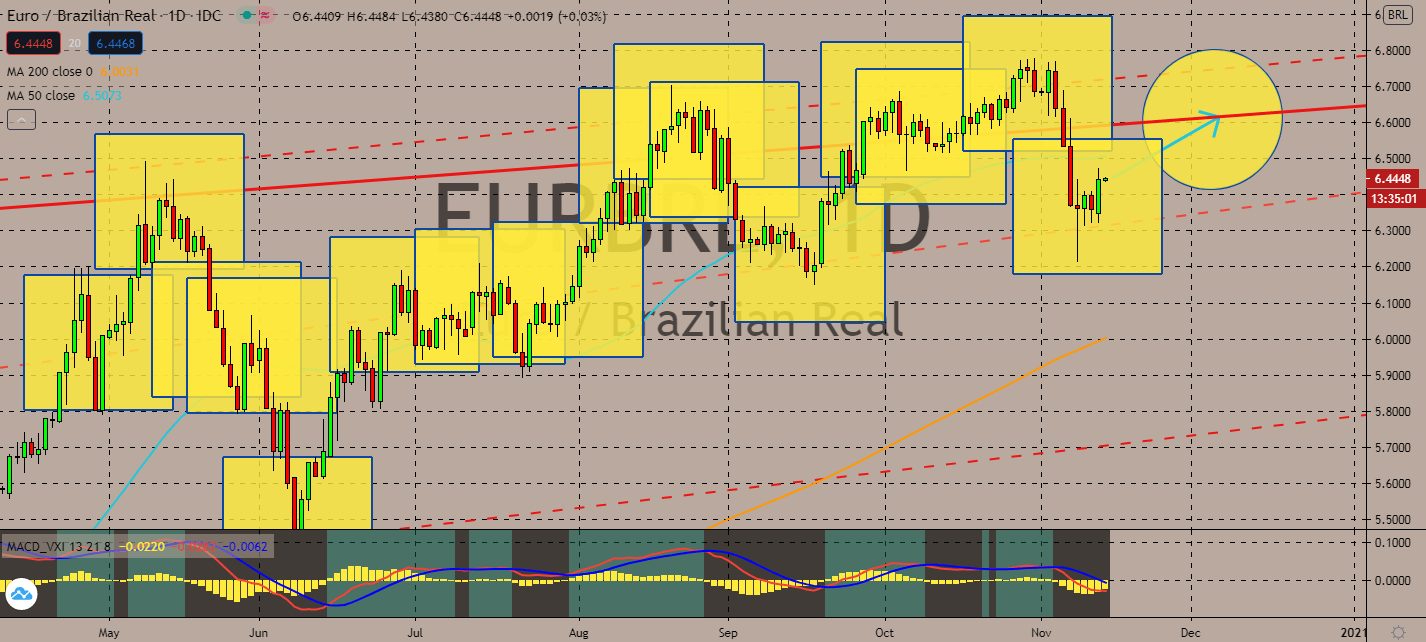

EURBRL

The Joe Biden administration is expected to put pressure on the Brazilian economy, driven by his promise to recommit the United States to the Paris climate agreement. Reluctant countries, such as Brazil, are pressured to halt policies that affect climate change. The largest economy in the world is projected to rally countries to come up with 20 billion US dollars for Brazil to protect the Amazon, warning that the country will suffer serious consequences if it doesn’t stop deforestation. Brazil has experienced record-setting wildfires for the past two years linked to massive legal deforestation under its President Jair Bolsonaro’s administration. The pair is projected to continue its bullish track as its 50-day moving average remains far above its 200-day moving average despite the fast-approaching deadline for the eurozone’s trade agreement with the UK, thanks to the possibility of a better geopolitical relationship between the US and the bloc.

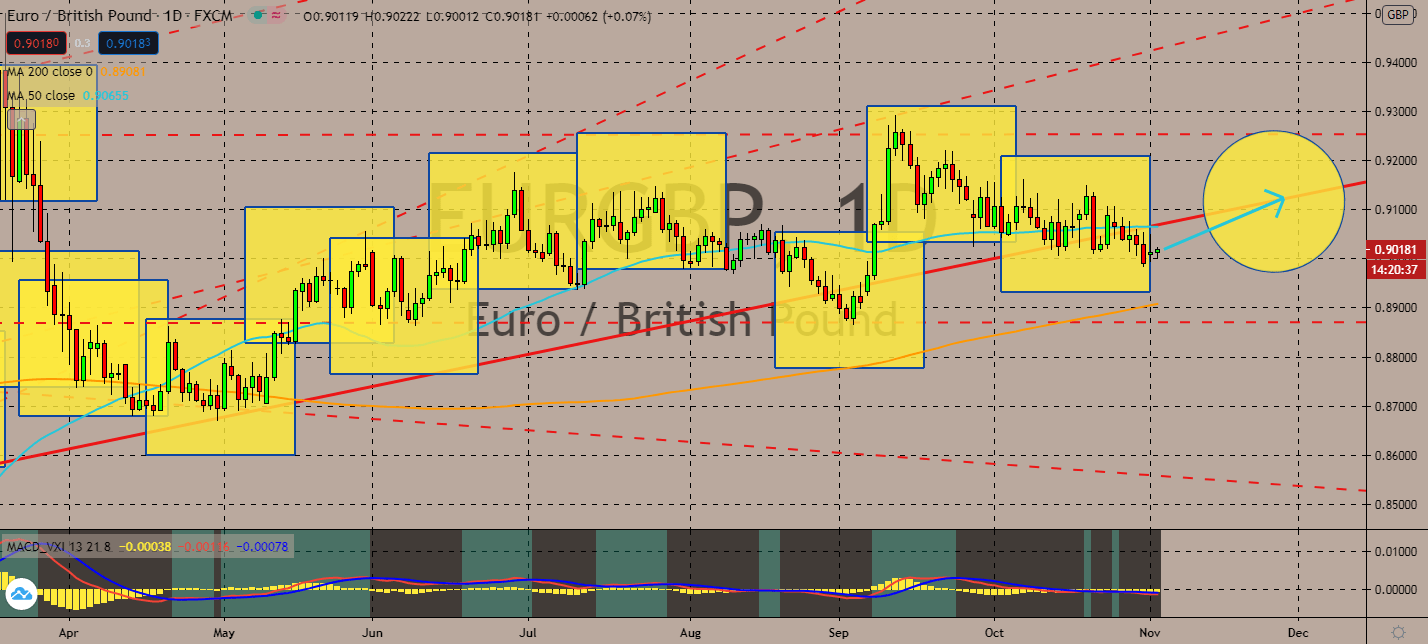

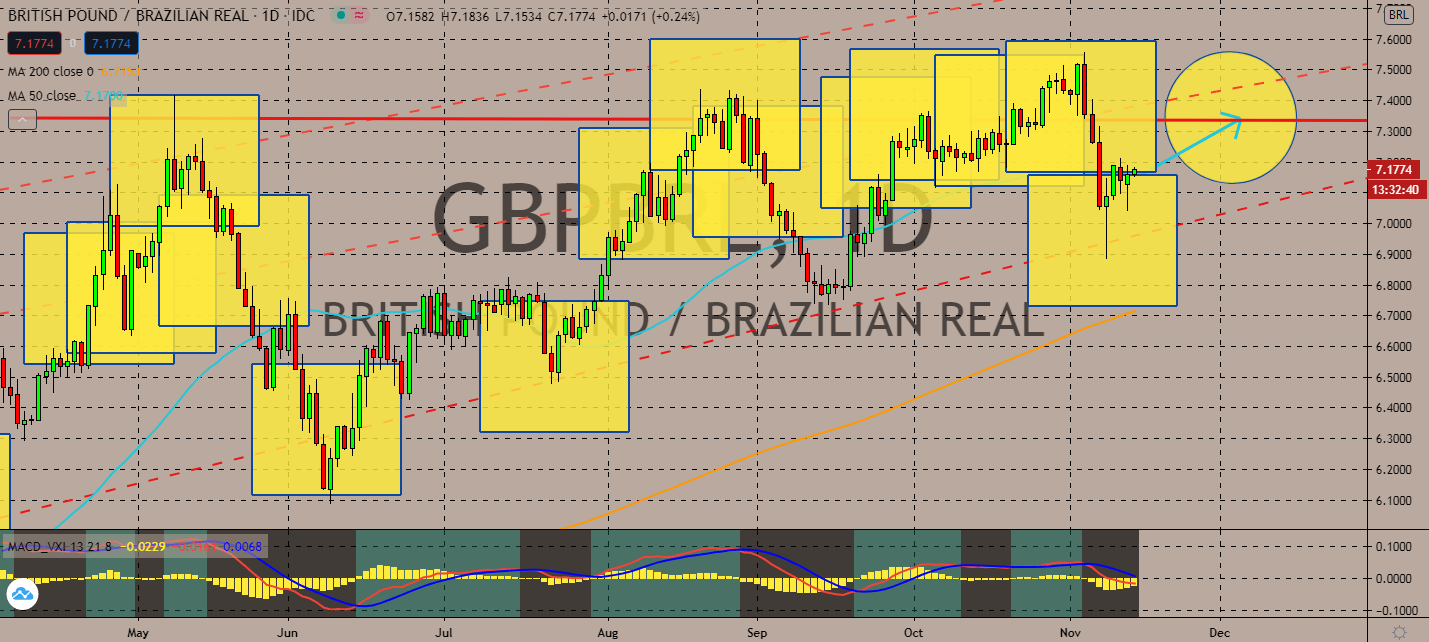

GBPBRL

The United Kingdom’s economy grew by 15.5 percent in the third quarter, according to preliminary figures published yesterday. Although the growth was timid in comparison to Main Street’s expectations of a 15.8 percent growth in three months ending in September, investor sentiment is more likely to uplift Sterling over emerging market counterparts. The bounce in the quarter was its sharpest in history. The pair’s 50-day moving average has been moving far above its 200-day moving average, and it’s going to continue this trend as Brazil’s public debt nears 100 percent of its GDP. The government and its central bank will likely spend much less if it experiences another wave of infections across the nation, hindering its economic growth in the near-term, as well. As the central bank urges its citizens to spend less for the rest of the year to keep up with inflation, the real is projected to fall because of it.

COMMENTS