Here are the latest market charts and analysis for today. Check them out and know what’s happening in the market today.

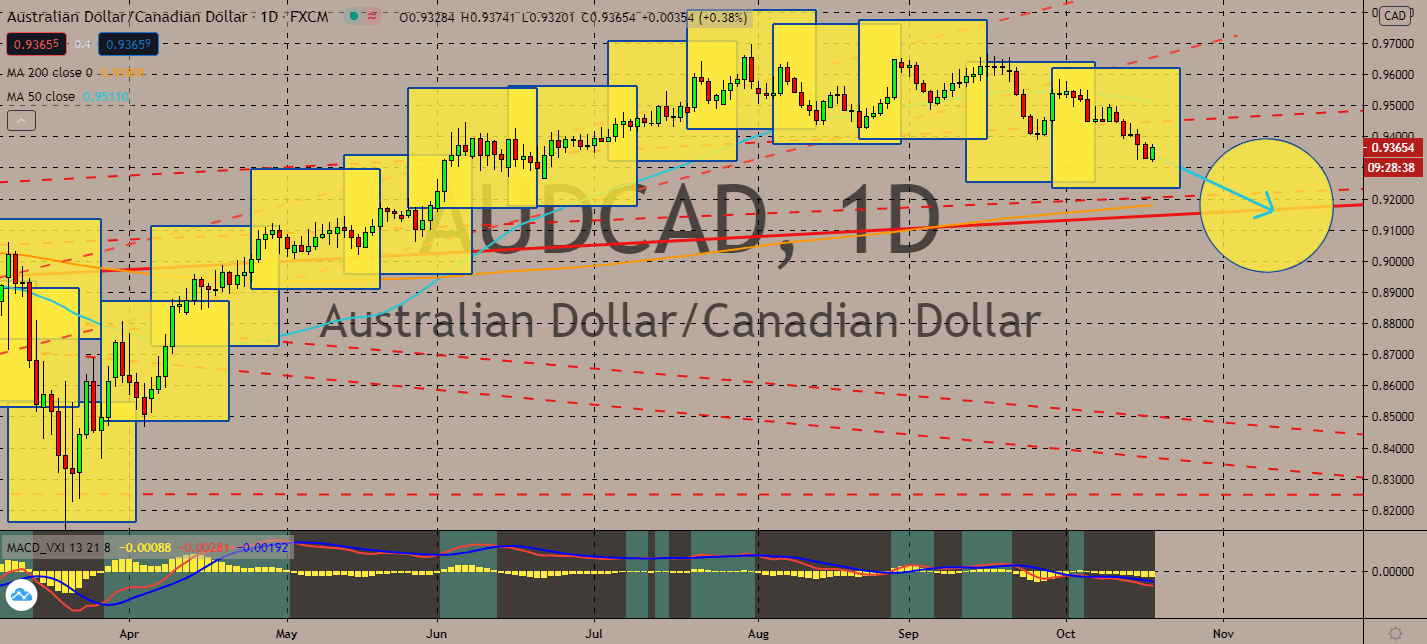

AUDCAD

The Reserve Bank of Australia is now expected to cut its interest rates to what could be a historic low of 0.1% from 0.25%. Economists also believe that it will have to initiate a quantitative easing program, which they claim is only a matter of time. These Australian government bonds would cost up to A$100 billion with maturities of five to ten years. This is projected to pull the Aussie lower than its peers, including the loonie dollar, as its 50-day moving average begins to fall down to its 200-day moving average. Notably, Canada isn’t looking so well, either – coronavirus cases have been inching towards the 200,000 mark, while CPI declined by 0.1% in August after a reading of 0 percent beforehand. It looks like the Aussie bank will likely suffer in the shorter term since Canada’s economy hasn’t been slowing as much as its peers have. Investors may want to look out for the long-term effects of the recent coronavirus surge.

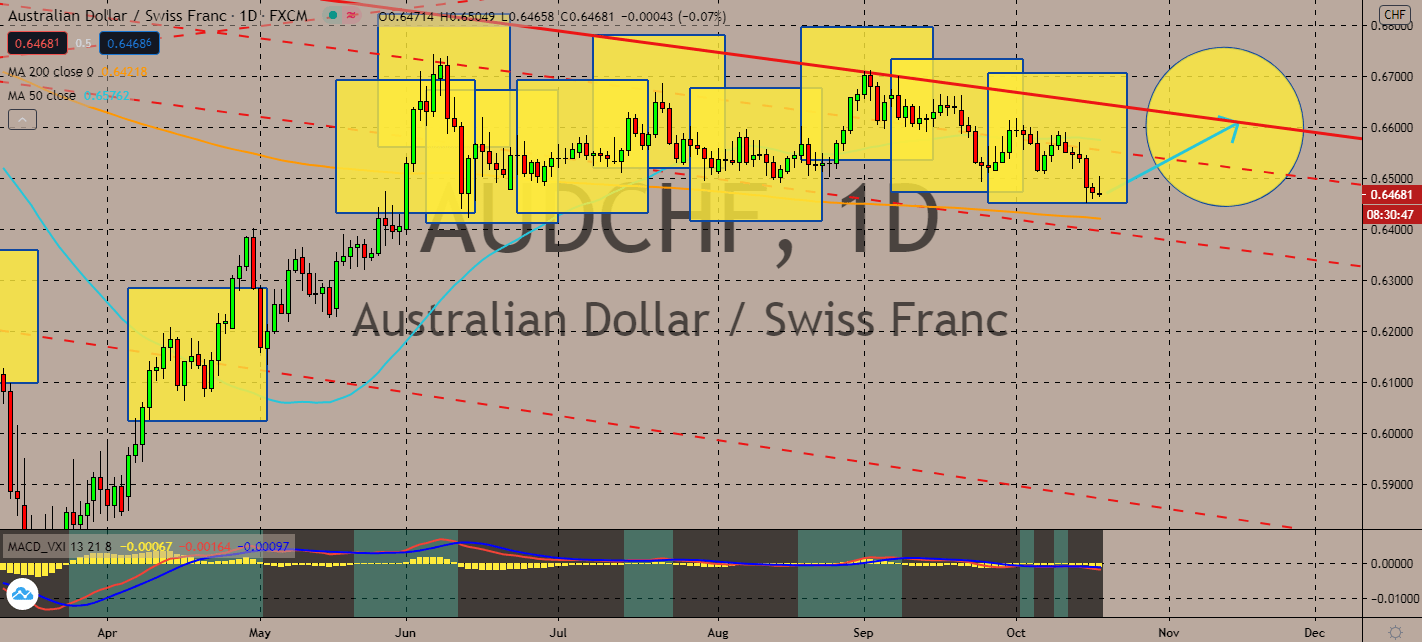

AUDCHF

Even though markets are expecting an interest rate cut to a record low of 0.1% from the Reserve Bank of Australia within the next few months, it looks like Switzerland’s predicament is more immediate. The Swiss government had announced a nationwide lockdown that will start today, which includes closing down most corporate and public establishments. It had reported a jump on Friday of more than 3,000 cases, which had turned out to be “double”, or as its president claims. The pair’s 50-day moving average is still above its 200-day moving average, indicating that the Aussie is still strong against its Swiss counterpart. Investors have also been optimistic about the recent reopening of the region’s most populous state, Victoria, after its cases began to decline. Investors are expected to keep the Australian dollar on a tentative uptrend at least until its central bank’s next monetary policy rate that will be held next month.

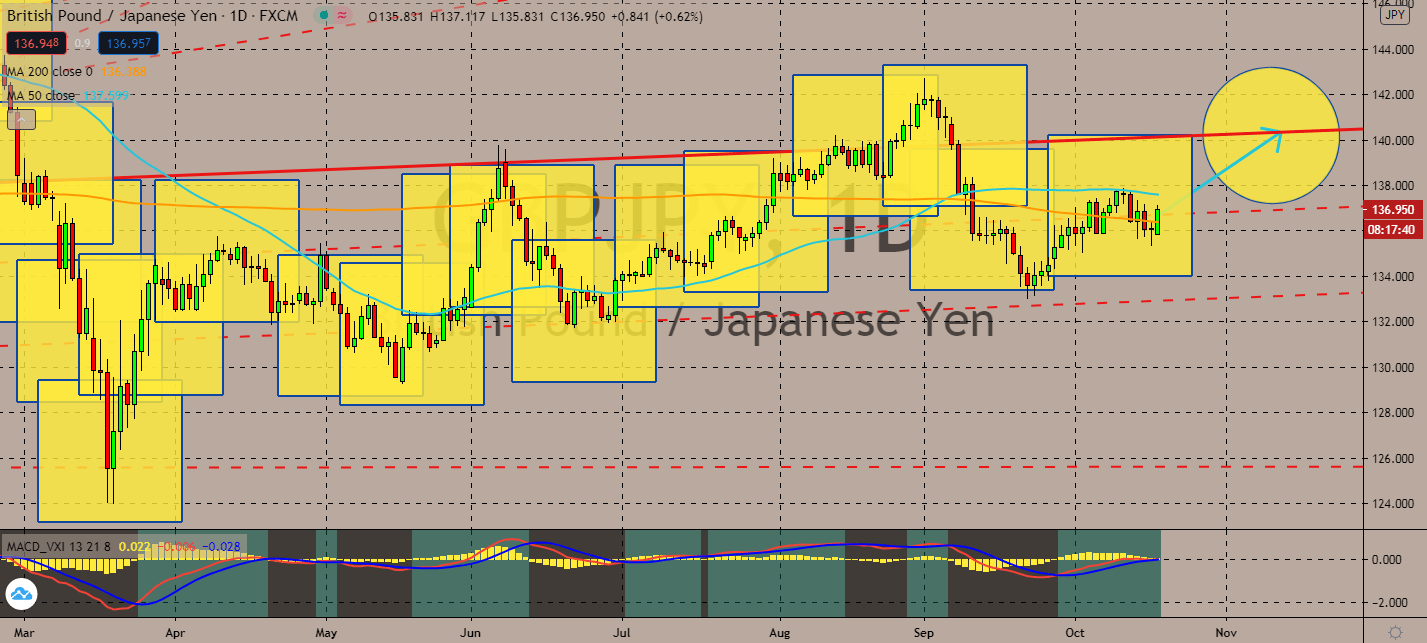

GBPJPY

The UK Prime Minister Boris Johnson may have undeniably claimed that he was willing to walk away from the European Union without a definite trade agreement, negotiations are still open for the taking. Two months before the deal’s deadliest deadline, UK negotiators confirmed that its government is willing to adjust its lawbreaking Northern Ireland bill as middle ground with its EU partners. This could push the Sterling Pound against its safer counterpart, the Japanese yen, as its economy struggles to recover from its 28% slump in the April to June quarter. The pair’s 50-day moving average just moved past its 200-day moving average, indicating that the bulls are fighting to take over its market in the near-term. The relatively stagnant Japanese economy has yet to deliver notable results after Yoshihide Suga began his reign as the country’s prime minister, but it looks like positivity will have to come in the form of potential stimulus packages.

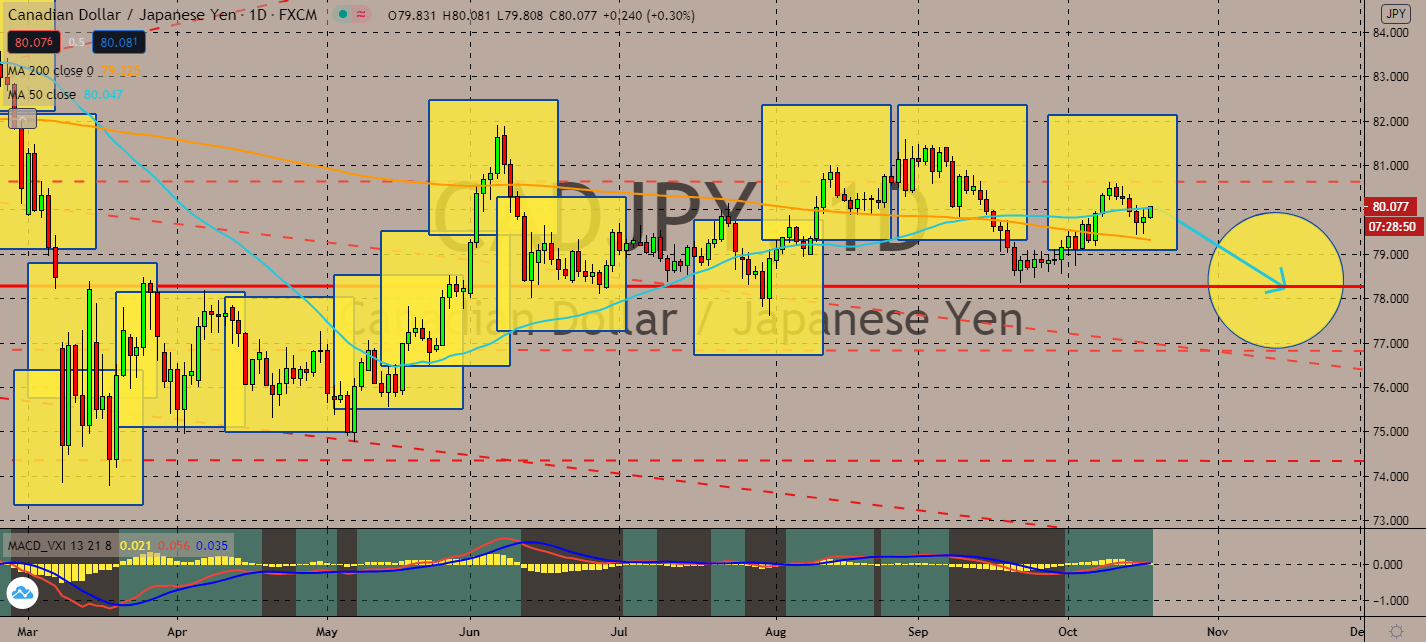

CADJPY

Albeit slowly, Japan’s economic recovery is underway. The Japanese yen is projected to meet with the bulls contrary to its loonie dollar counterpart thanks to a slow recovery in its exports in September. The country’s finance ministry confirmed that its overseas shipment had declined 4.9% on an annual basis, which was a narrow decline in comparison to its 14.8% decline the month before. The improved figure is expected to help lift the Japanese yen despite having its 50-day moving average above its 200-day moving average. After all, Canada has been failing to suppress coronavirus case surges in the country. In fact, it recently touched the 200,000 mark as its CPI declined notably in August. The second wave is projected to threaten the Canadian economy in the nearer term. This emphasized Canada’s already surging forecast deficit to C$343.2 billion, which is approximately 16% of its gross domestic product.

COMMENTS