Here are the latest market charts and analysis for today. Check them out and know what’s happening in the market today.

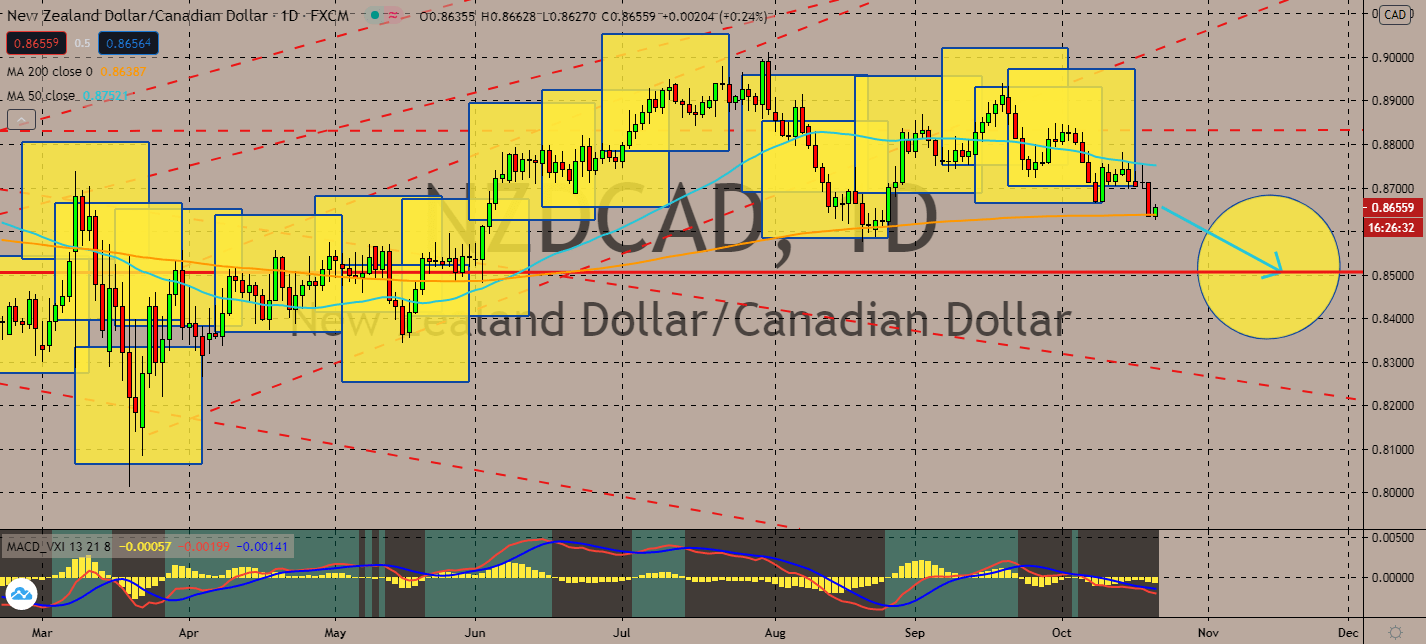

NZDCAD

Jacinda Arden kept her place as the Prime Minister of New Zealand last weekend. Traders are expected to bet their money on her commendable response against the coronavirus earlier this year as its economy continues to recover from the second wave of infections across the nation. Her position as a nation with the safe haven kiwi will help lift risk aversion. Notably, there’s rising political conflict in Canada – Prime Minister Justin Trudeau asked for a confidence vote on Ottawa’s response to the coronavirus on Tuesday, which could potentially put the country into another nationwide vote. The pair’s 50-day moving average is still above its 200-day moving average. Although the former is trading downward as of late, it looks like the pair won’t decline near-term brought by the need for safer assets only a few weeks before the presidential elections in the United States, which should keep the market close to the kiwi.

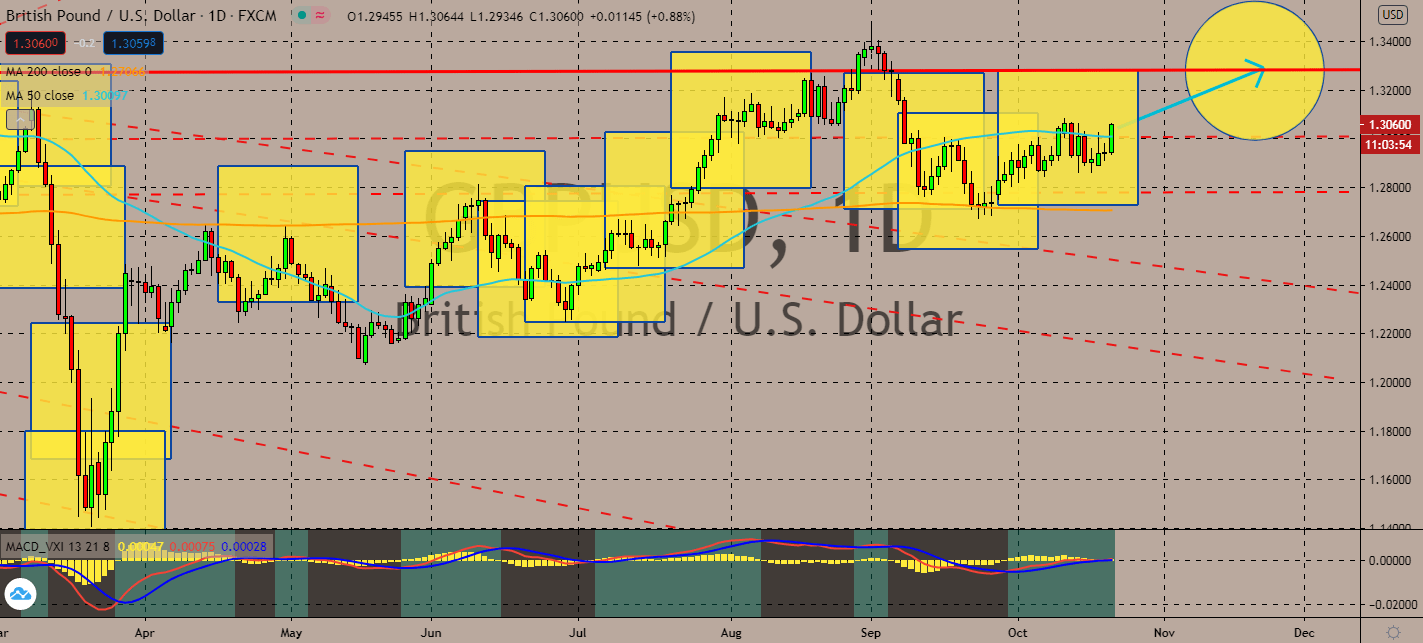

GBPUSD

The greenback is projected to keep declining from its one-month low as investors braced themselves for the outcome of a possible stimulus package in the US stimulus package before the presidential elections next month. As the pair’s 50-day moving average remains above its 200-day moving average, the pound is projected to lift even further over hopes that a trade deal between the European Union and the United Kingdom is still possible. The recent compromise from the UK showed that if both economies are willing to meet halfway, they will likely reach an agreement before the deadline on the last day of December. The comment provided optimism for traders across the globe, considering that economists believe that both economies will suffer greater than how they would from the slump caused by the coronavirus pandemic. It looks like the progress is likely going to oil the engines for the pound even in the longer term.

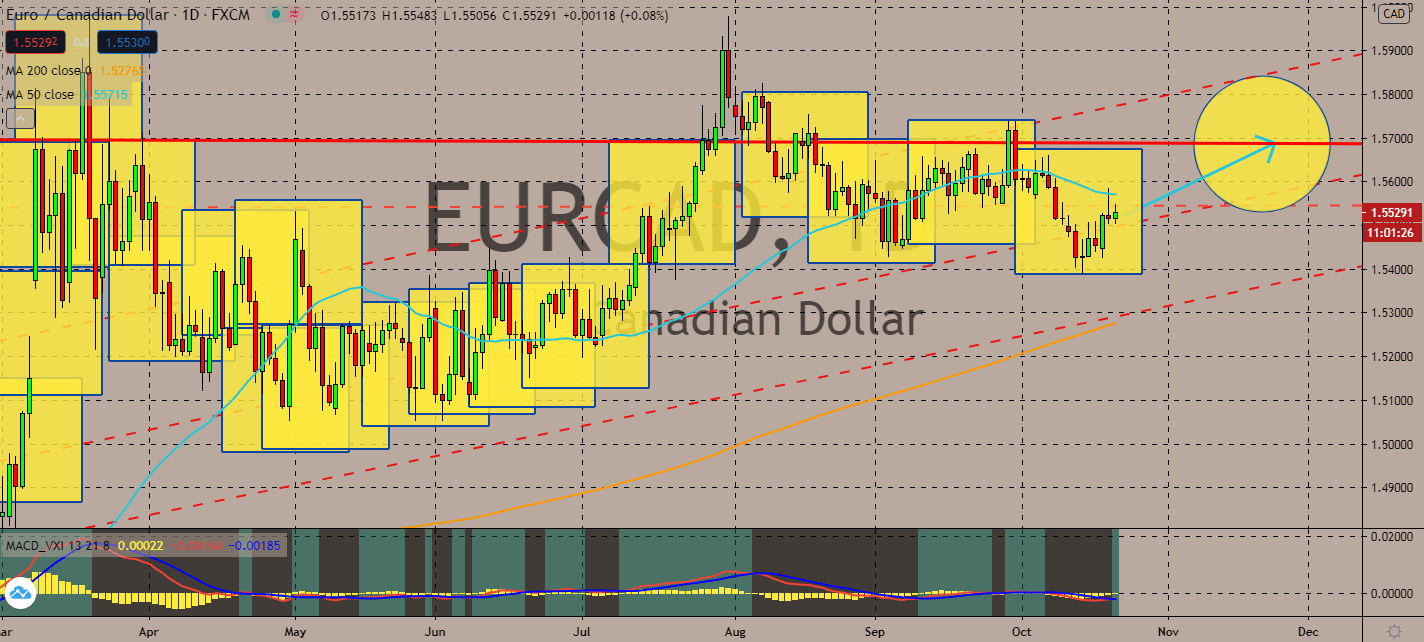

EURCAD

The euro currency is projected to lift thanks to the positivity around the Brexit trade agreement. Both the eurozone and the United Kingdom are projected to compromise with a goal to reach an agreement, despite the pressure struck on the UK when the eurozone filed a case against Brexit’s attempt to break international law. The EU’s chief negotiator Michel Barnier said that if both sides are able to work constructively and meet halfway, they could reach a definite agreement by the end of the year as planned. The pair’s volatile 50-day moving average is projected to curve further upwards, maintaining its place above its 200-day moving average counterpart as Canada struggles to reach a common ground for its economic response toward the coronavirus’ economic effect in the region. Ottowa leaders are in question, now that Canada’s Prime Minister has asked for a confidence vote on the state’s response. The tension is likely to pull the loonie low.

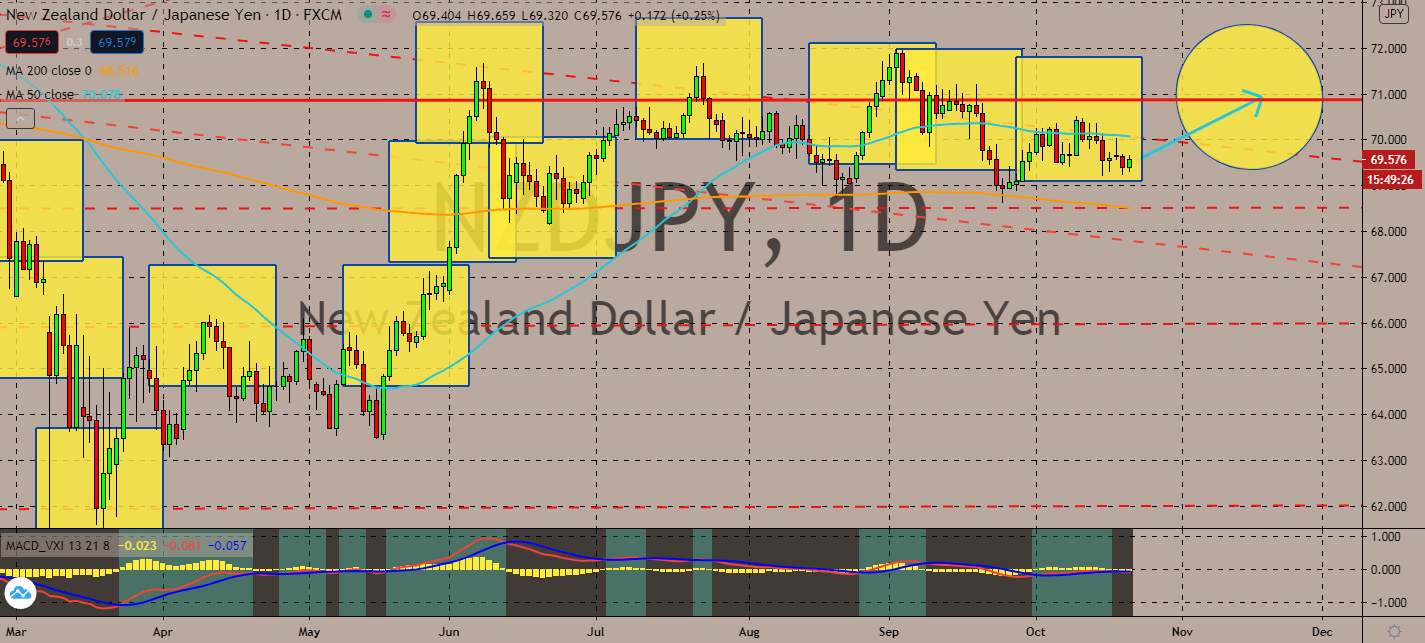

NZDJPY

The Bank of Japan is projected to grow more pessimistic toward its growth and budget forecasts for the end of the year. Economists found that its economy had slumped deeper than they had expected in the quarter from April to June, which also lead to soft consumption records in the summer. Although the central bank is unlikely to initiate another stimulus package within the year, the uncertainty is likely to drive the market toward the yen’s kiwi opposite. The pair’s 50-day moving average is, after all, still above its 200-day moving average counterpart. This indicates that the bullish market is unlikely to give up its investment in the bearish market anytime soon. New Zealand’s Prime Minister Jacinda Arden’s response to the economic effects of the coronavirus will keep the market excited for the kiwi dollar, especially after crisis management surveys found that her response was one of the best in the world.

COMMENTS