Here are the latest market charts and analysis for today. Check them out and know what’s happening in the market today.

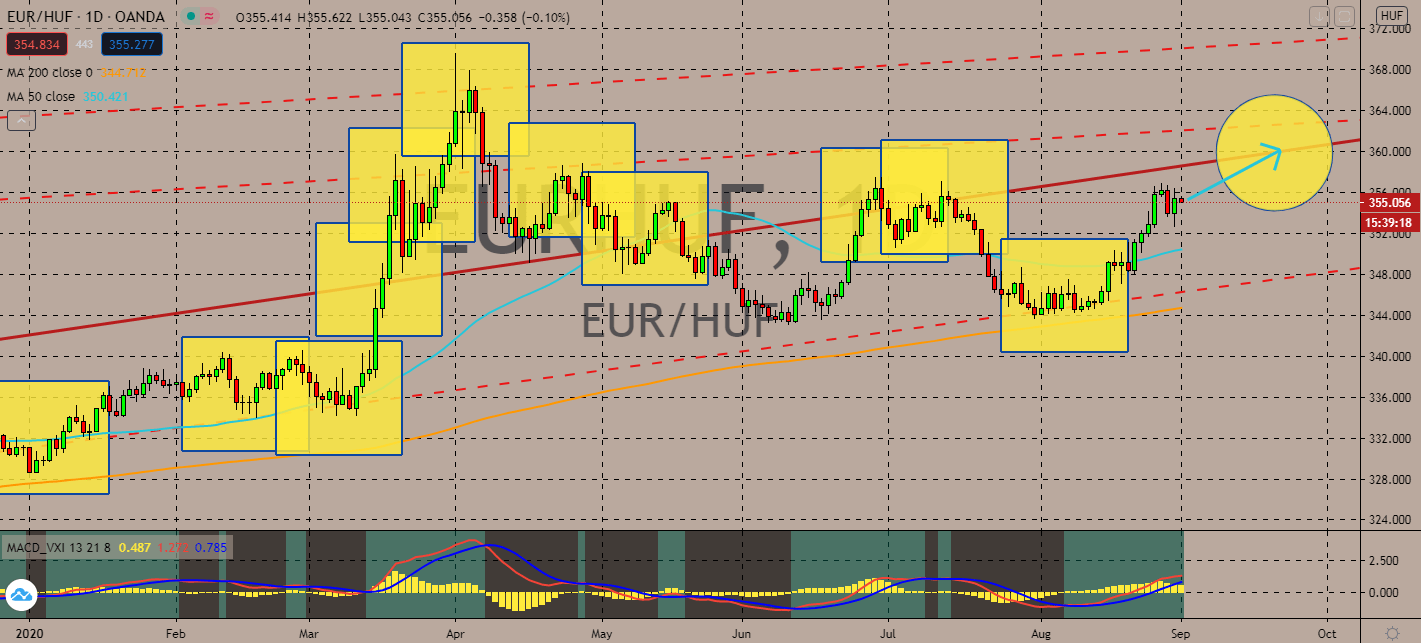

EURHUF

Hungary is about to close its international borders once again. The news is worrying forex investors even while its economy stays fully open and schools are going back to normal. But the lingering news that its GDP rate might not go back to pre-coronavirus levels are causing hesitance to buy its currency. The lira is still under selling pressure, as seen in its 50-day moving average going well below its 200-day moving average. The Central Bank of the Republic of Turkey is expected to implement another stimulus package in the near future. Meanwhile, many parts of the eurozone are still recovering from the coronavirus. The European Central Bank was confident in its implemented policies and said that the region doesn’t need another package to assist it. It currently aims for an inflation rate of below but close to 2%, which is considerably high given that other economies have a more pessimistic look toward their own year-end outlook.

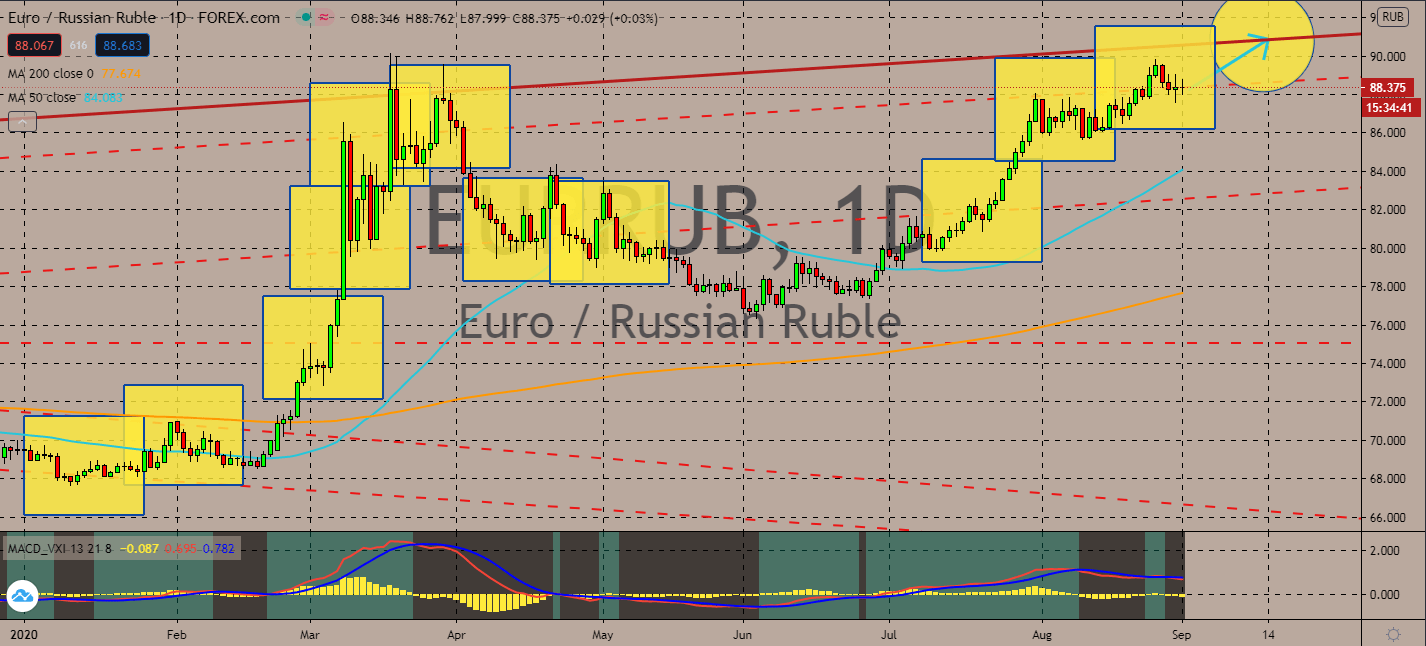

EURRUB

Russia’s economy has already been suffering, but the pandemic is likely to pressure it even further. The second quarter GDP growth dropped by 8.5% in the second quarter, and it’s likely to suffer even further no thanks to oil data and geopolitical risks. The ruble had tumbled after the Russian President Vladimir Putin said that the Kremlin had set up a defense for Belarusian leader Alexander Lukashenko, which could escalate their conflicts in the next few weeks. Economists believe that the Russian ruble will only be able to recover in a far, far trade, further proven by the pair’s 50-day moving average surging since August began. Its 200-day moving average is still in a sideways pattern, signaling that investors are still unsure of its track. Bullish traders are set to take control of the euro-ruble pair even with uncertainty revolving around the eurozone economy, largely thanks to the ECB’s confidence in its monetary policies.

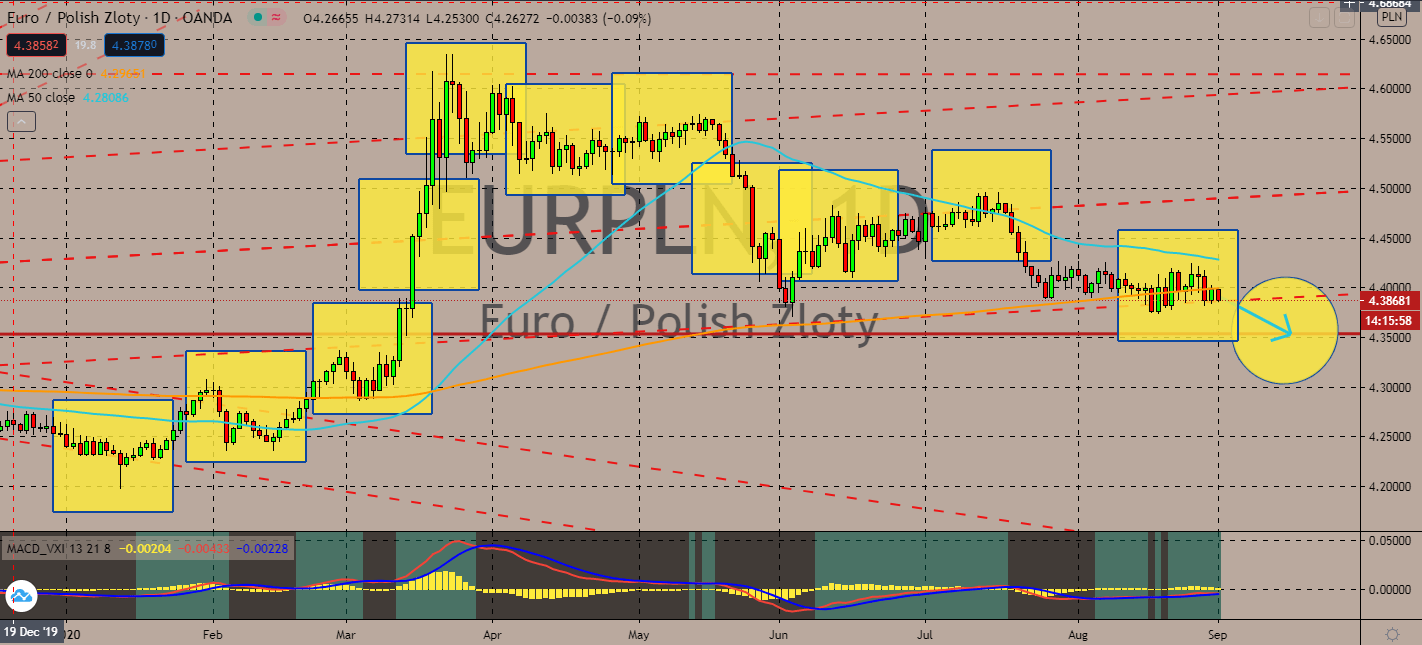

EURPLN

Italy’s GDP fell by 12 percent in the second quarter of 2020, which was a major contributor to the European Union’s 14.4 percent overall decline. Markets are bracing themselves for another series of reports from major economies’ manufacturing sectors, such as France and Germany, and as well as Italy later today. Investors are weary, since its last report had seen a slump and acitvity has stalled in August from resurging coronavirus cases in the bloc, halting some parts of its economy. Meanwhile, Poland’s recession is one of the mildest in the Central East European region, which is good news, knowing that the world is undergoing a simultaneous recession. The pair’s 50-day moving average has been rolling down since its peak in early May, and how the months go by. The pair is already approaching the bearish territory to cross the 200-day moving average soon, locking in the pair’s potential for selling pressure against the Polish zloty.

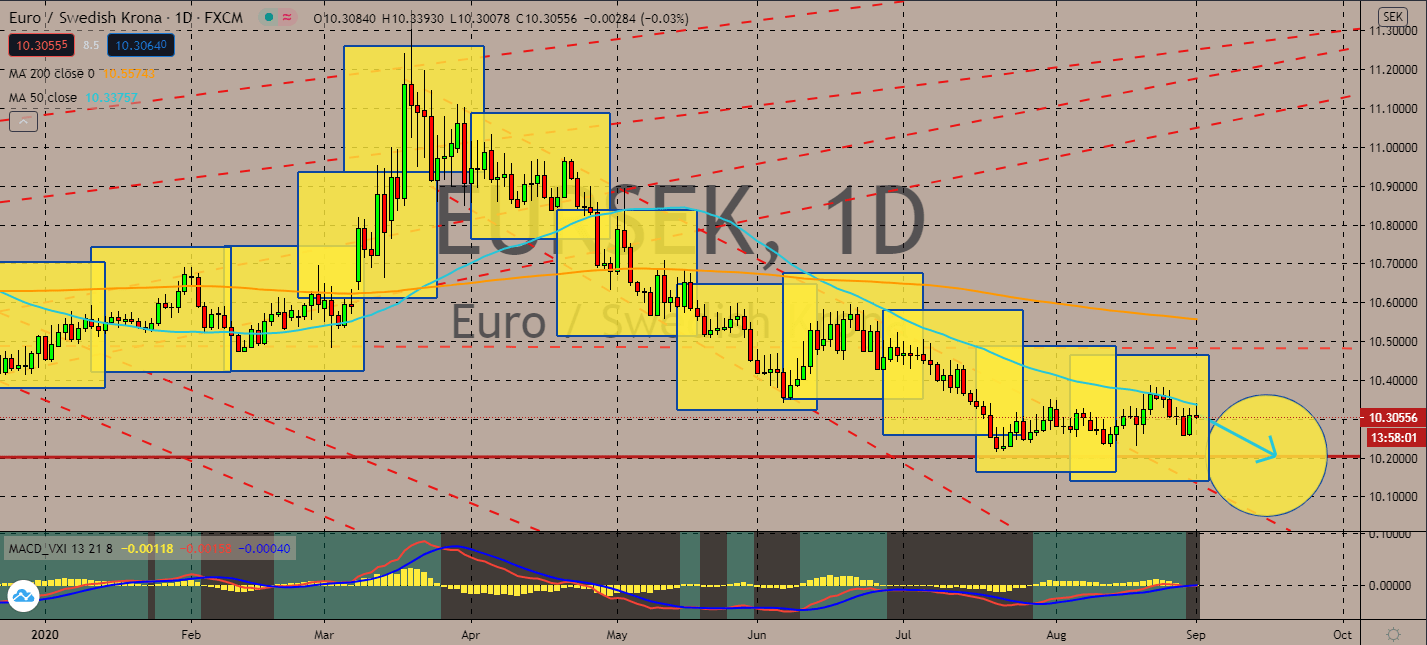

EURSEK

The euro’s moving averages have been the most volatile for the past year, but now it looks like its 50-day moving average can only go downhill from here. The World Health Organization’s Dr. David Nabarro complimented Sweden’s controversial approach to the coronavirus pandemic. He said that its strategy should be set as an example for other countries in the long-term. The surprising news led investors to keep trading for Swedish kronas. Recent forecasts also forecasted a relatively mild drop for its gross domestic product by the end of this year at 4.6 percent with confidence that it will grow back by 4.1 percent by 2021. Meanwhile, Europe is still looking for a way to keep up with the resurgence of coronavirus cases in its countries. Investors are either holding their euros or selling them with anticipation of the upcoming manufacturing data to be reported later today, which will determine the euro’s path within the next three months.

COMMENTS