Here are the latest market charts and analysis for today. Check them out and know what’s happening in the market today.

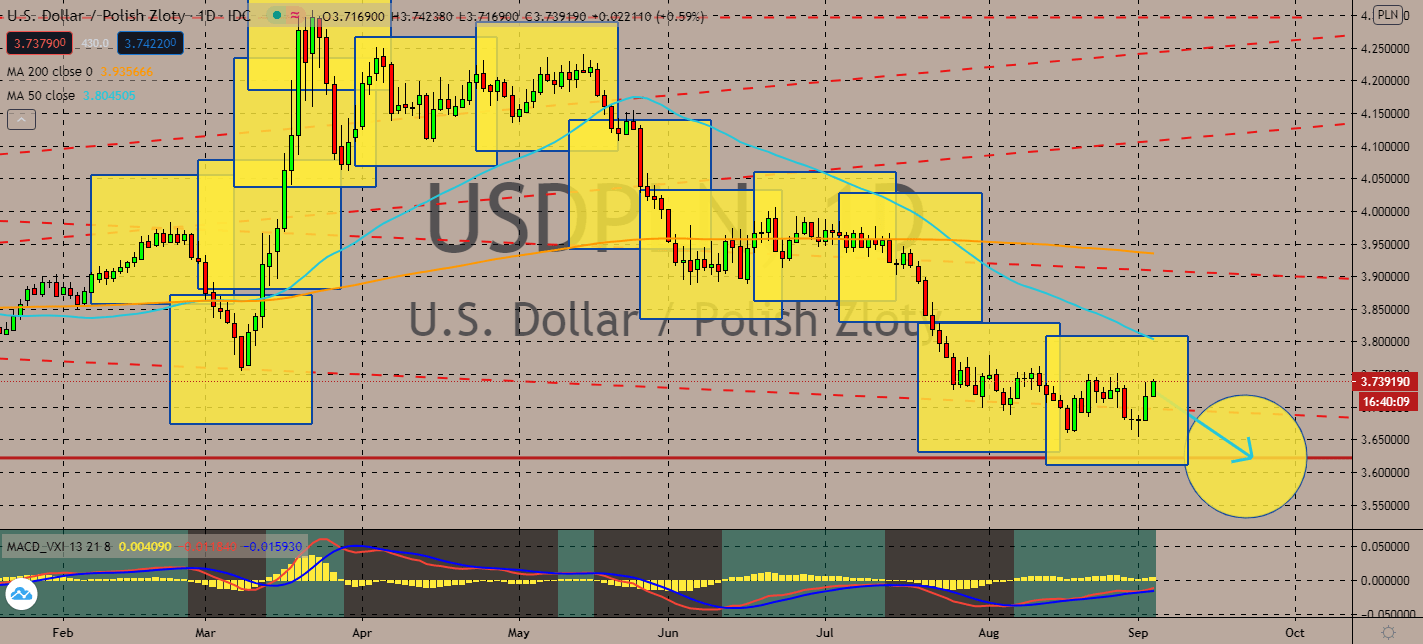

USDPLN

The US dollar has been declining against the Polish zloty for months now, but it looks like it won’t stop anytime soon. The pair’s 50-day moving average is still moving farther downward since it plummeted below its 200-day average in late July, and the bearish traders are seemingly still in control. This will be further proven by the president of the Polish Development Fund Pawel Borys’ claim that its economy’s fall is likely to be one of the shallowest for the third quarter of 2020. Its record high trade surplus, the rise in sales and production, and the second-lowest unemployment rate in the EU are all projected to keep the pair stabilized down low. Poland’s gross domestic product had shrunk by 8.2 percent in the second quarter, but it had grown by 2 percent in the quarter before that. As the greenback weakness triggers risk sentiment in the market near-term, it’s unlikely that the bigger currency is projected to recover.

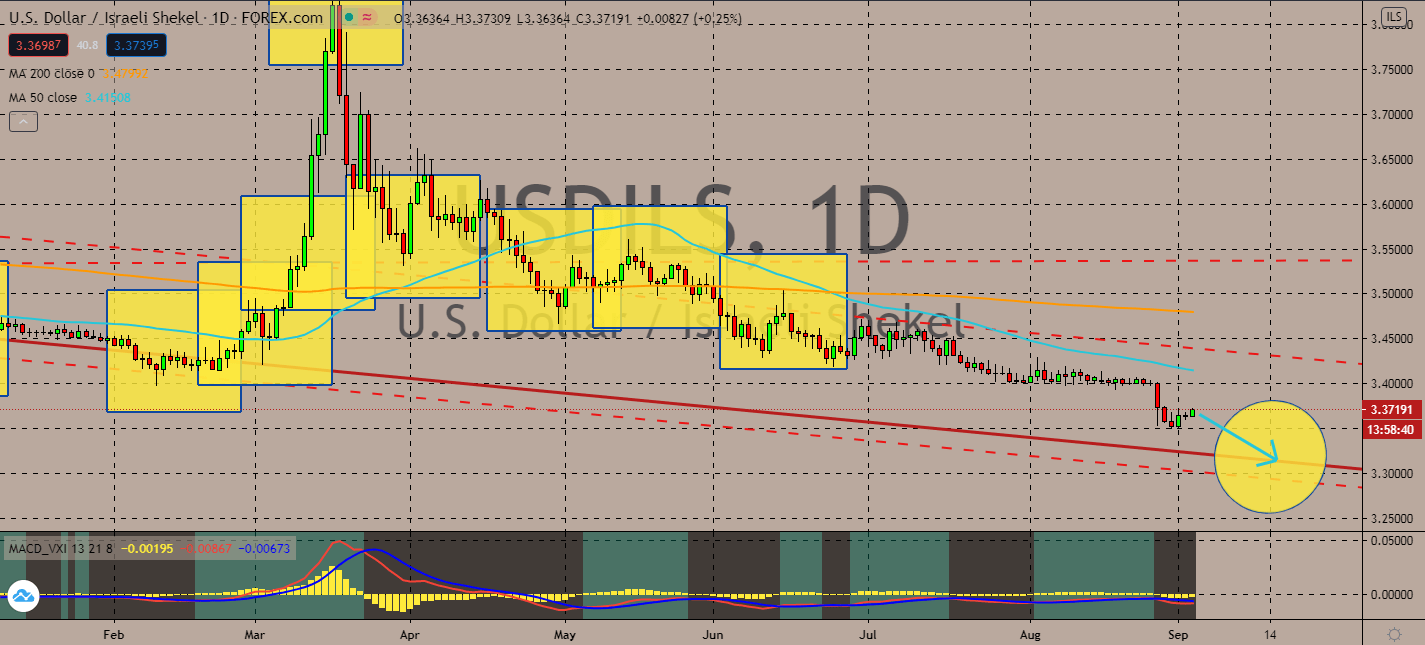

USDILS

After thirty years in conflict, the United Arab Emirates has formally ended its boycott of Israel, allowing many opportunities in trade and commerce. Both countries signed their first agreement with more deals on the horizon. The agreement paved a way for both countries to stimulate economic growth and promote technical innovation together. The good news kept investors engaged in the shekel near-term. The pair’s 200-day moving average is well above its 50-day moving average counterpart, which shows that the recent agreement could help keep the bearish market going. Risk sentiment is still high, and the US economy is about to report several figures today including its trade balance, which is projected to fall by about 8 billion dollars from the previous record. This shows that if the Federal Reserve doesn’t make a move soon, it could cause an even more aggressive economic decline in the long run.

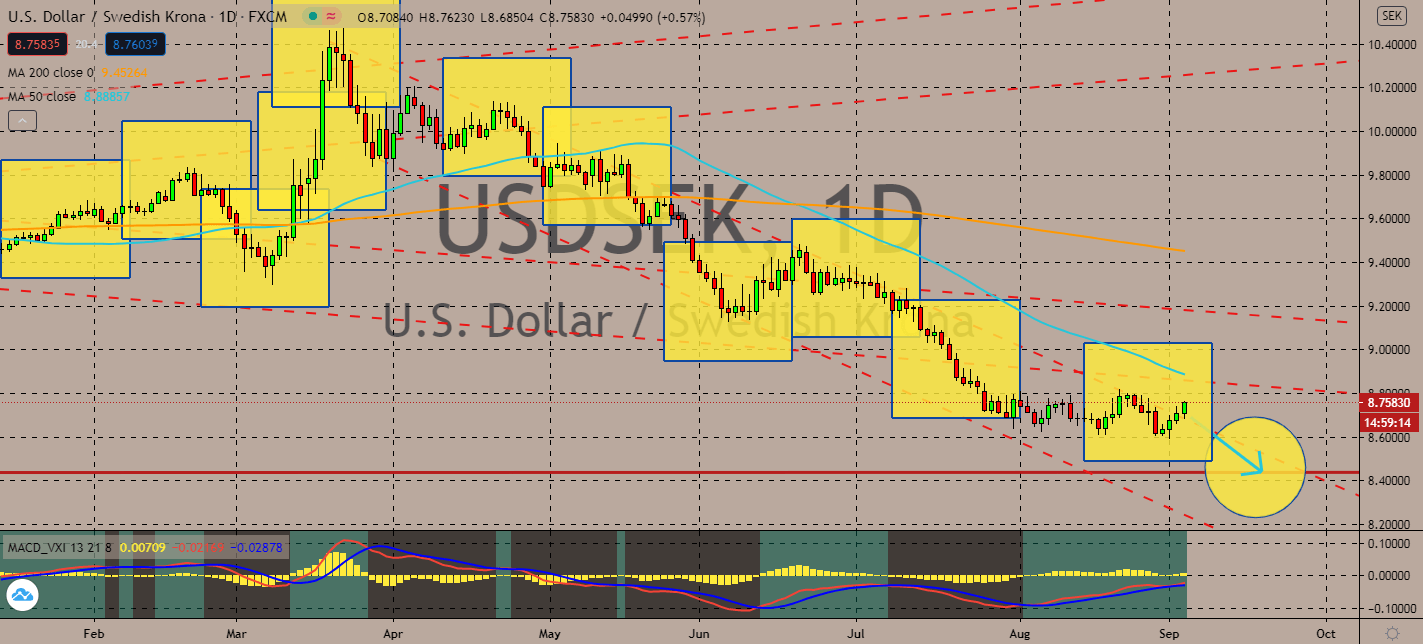

USDSEK

In a radio interview last week, a World Health Organization official commended Sweden for its response to the spread of the coronavirus pandemic. Its controversial move had surprised the market early on, since it implemented relaxed restrictions and continues to do so. The claim might have been misinterpreted among speculators, but Dr. David Nabarro’s claim rattled the forex market into investing krona for the near-term in the USDSEK pair. The pair’s 50-day moving average is rolling even further down its 200-day average, which has been trading sideways for the past months already, signaling that the bears are still in control. That said, the rattled market is expected to find more opportunities for the Swedish krone as the US dollar continues to struggle with risk sentiment and a struggle to formulate better fiscal efforts to help businesses, homes, and its unemployed throughout the rest of the decline led by the coronavirus.

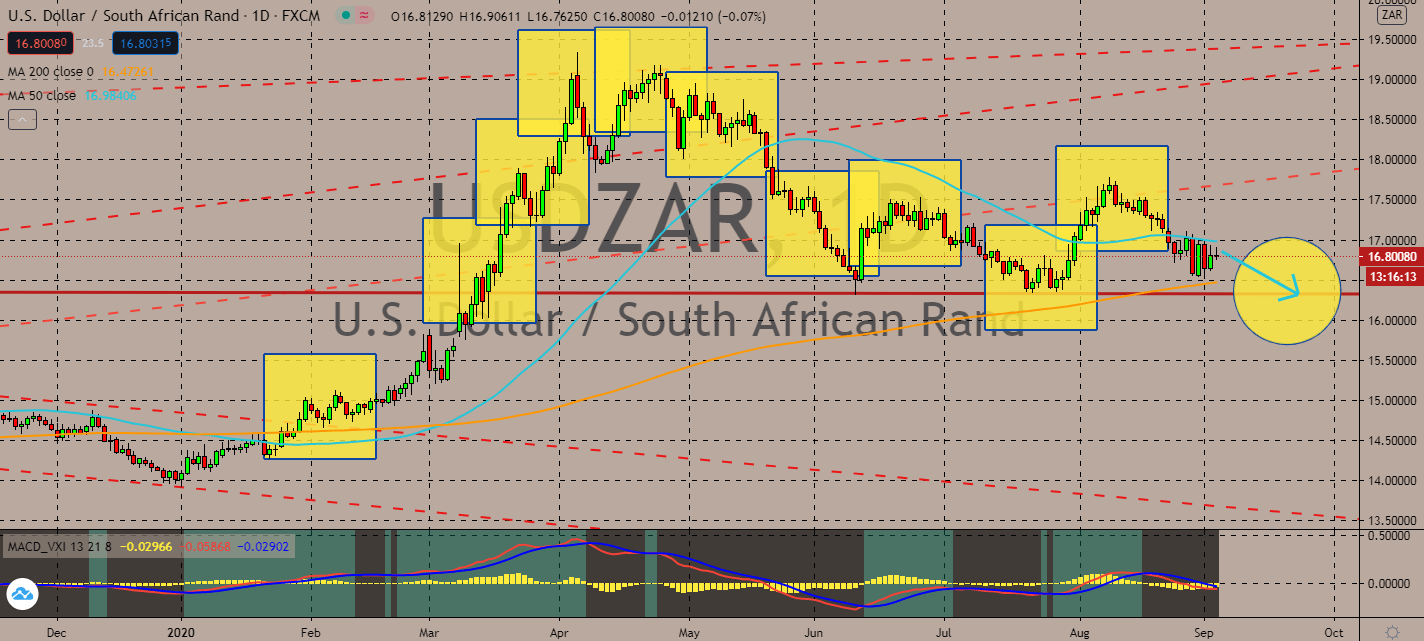

USDZAR

Gold’s record highs above $2,000 an ounce are helping the South African rand. Central banks have been stocking up on gold for the past year as a safe haven amid trade tensions, geopolitical issues, and sanction conflicts. Considering that South Africa is the home of the world’s largest gold resource, its currency is only bound to surge. The pair’s 50-day moving average is only hairs above its 200-day moving average and is already on its way to intersect it downward. The bears are ready to dominate while gold prices remain elevated with no signs of stopping even after the crisis is over. The pair is projected to test its recent support levels because of this. Meanwhile, the United States is still under pressure from its past fiscal policies and what it plans to do for the next three months of the year. In fact, investors are getting exceedingly worried that its national debt might even exceed the size of its economy by next year.

COMMENTS