Here are the latest market charts and analysis for today. Check them out and know what’s happening in the market today.

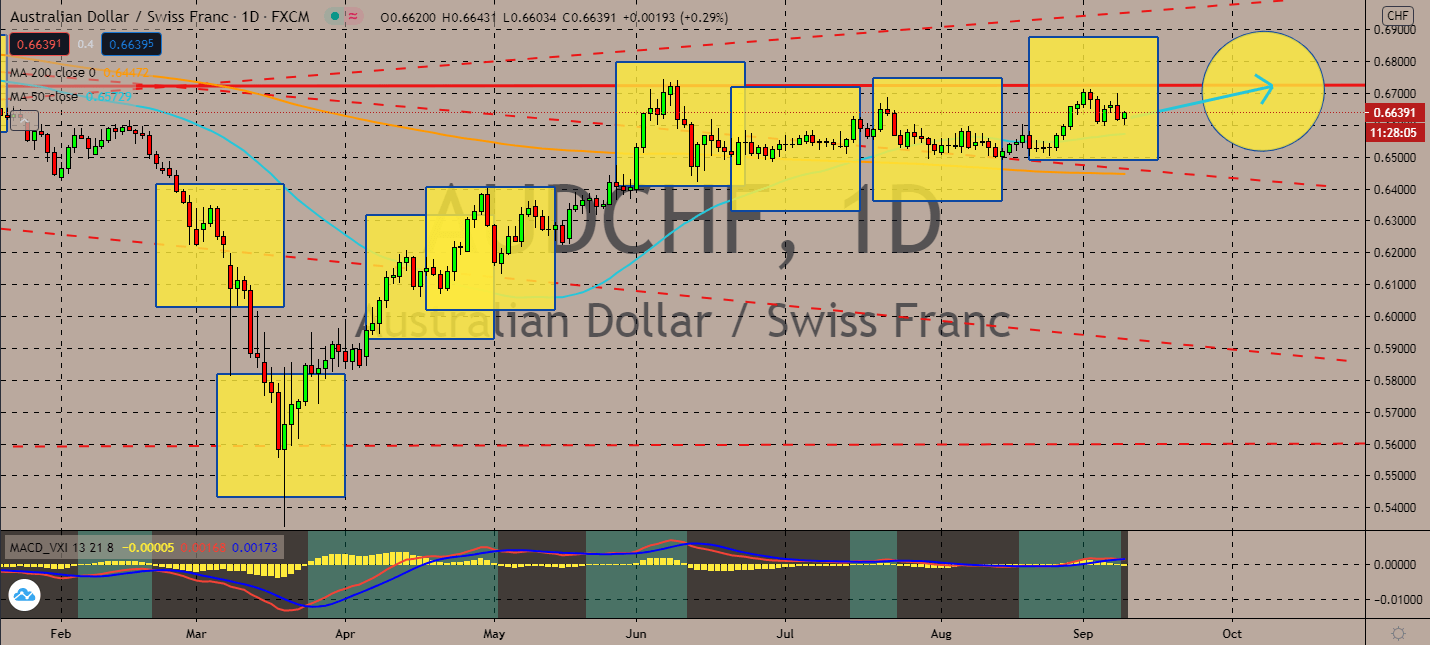

AUDCHF

Australian wheat demand was seen surging last week thanks to the need for smaller crops in the US, France, and the United Kingdom. High-protein Australian wheat is expected to benefit the region’s overall economy with improving business sentiment seen in August. The United States now has the smallest wheat crop in a century, while Australia’s recent east coast rains brought optimism for wheat output near-term. Global trade is projected to be drawn towards the commodity and therefore lift its currency. Now, the Aussie-franc pair’s 50-day moving average is trading only slightly above its 200-day moving average, which shows that if the bears want to take over, they should do it while it’s still trading relatively sideways. Investors are unsure of how Switzerland is going to fare throughout the rest of the year, which could begin by a possible incline in unemployment records seen in the month of August.

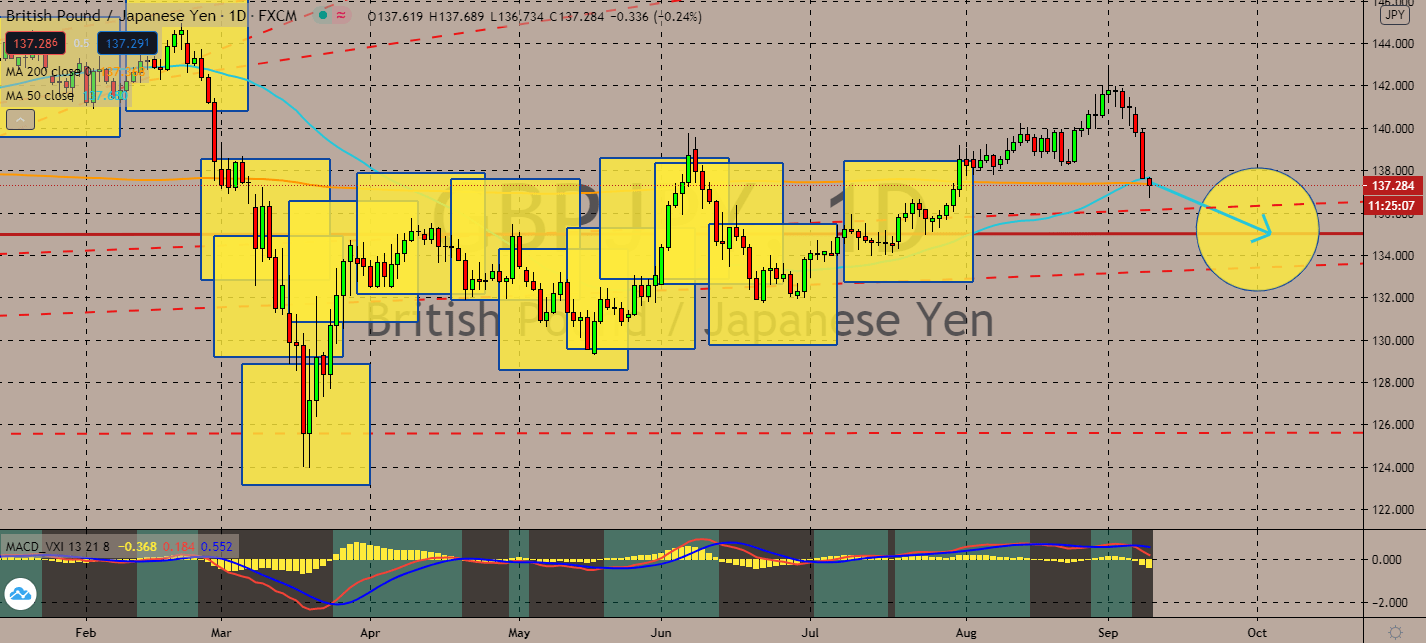

GBPJPY

Business sentiment in Japan recorded its highest levels in nearly one year in August as the country continues its efforts to recover its economic activities from the slump caused by the spread of the coronavirus. Economy watchers saw an increase of 2.8 points from July to 43.9, the fastest increase since September 2019 driven by a surge in private spending before a consumption tax hike seen the month after. The pair’s 50-day moving average might have just reached right above its 200-day average, but the news is projected to benefit the yen instead of the pound near-term. Bearish traders are expected to keep the forex pair’s prices low on almost all its forex pairs, including the JPY, due to fear of a no-deal Brexit. If pursued, it could cause its economy to contract even further, especially after it had reinstated its nationwide lockdown earlier this week.

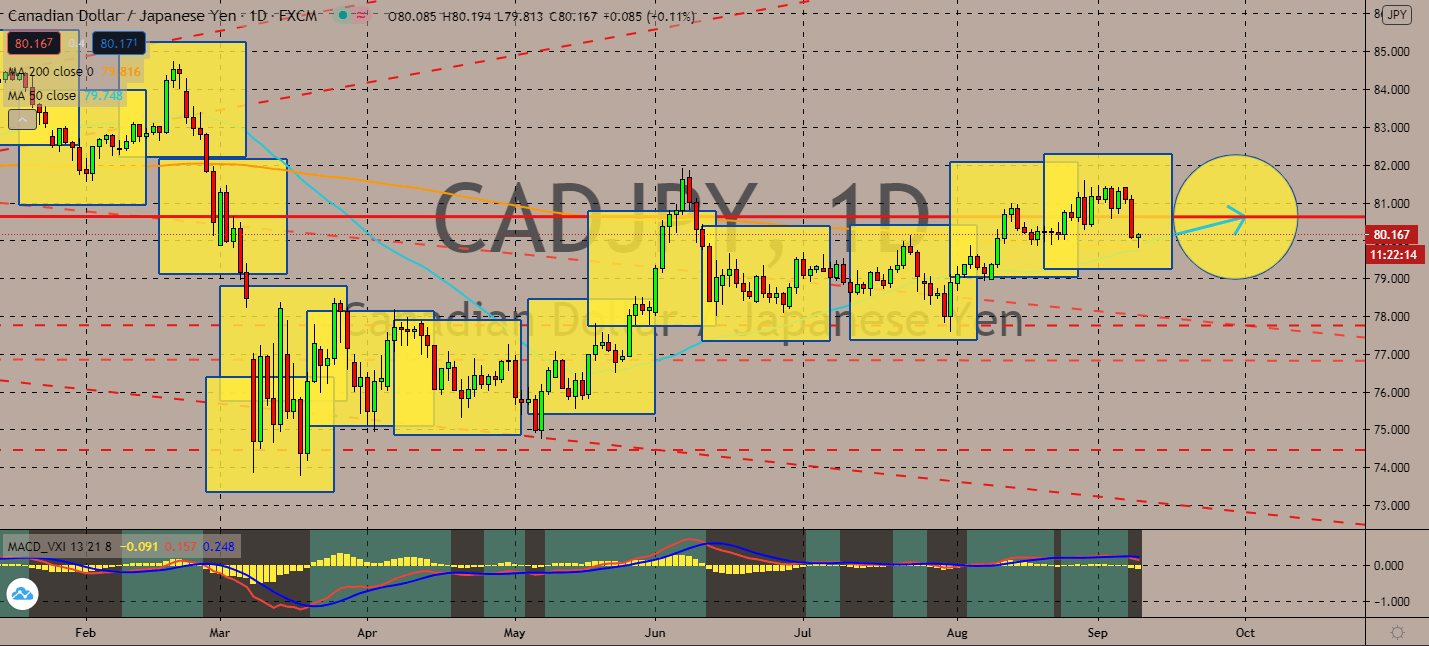

CADJPY

Japan’s tuna market, the largest in the world, is suffering amid economic uncertainty in the country. The news came in only days after it had reported its largest gross domestic product contraction postwar. In fact, the number’s annualized figure shrunk by 28.1% from April to June, which is also worse than the expected 27.8% contraction. It looks like businesses in the tuna market are being affected the most. Demand for fresh tuna dropped by 8.4% on an annualized basis compared to the anticipated 1.5% fall for overall prices. The news will bring the pair’s 50-day moving average further down its 200-day moving average after having crossed below it in recent trading. The upcoming proclamation of its new prime minister has also been benefitting the pair’s prices. In Canada, economists are already keeping an eye on a post-Covid economy involving immigration figures, which had significantly fallen throughout the pandemic.

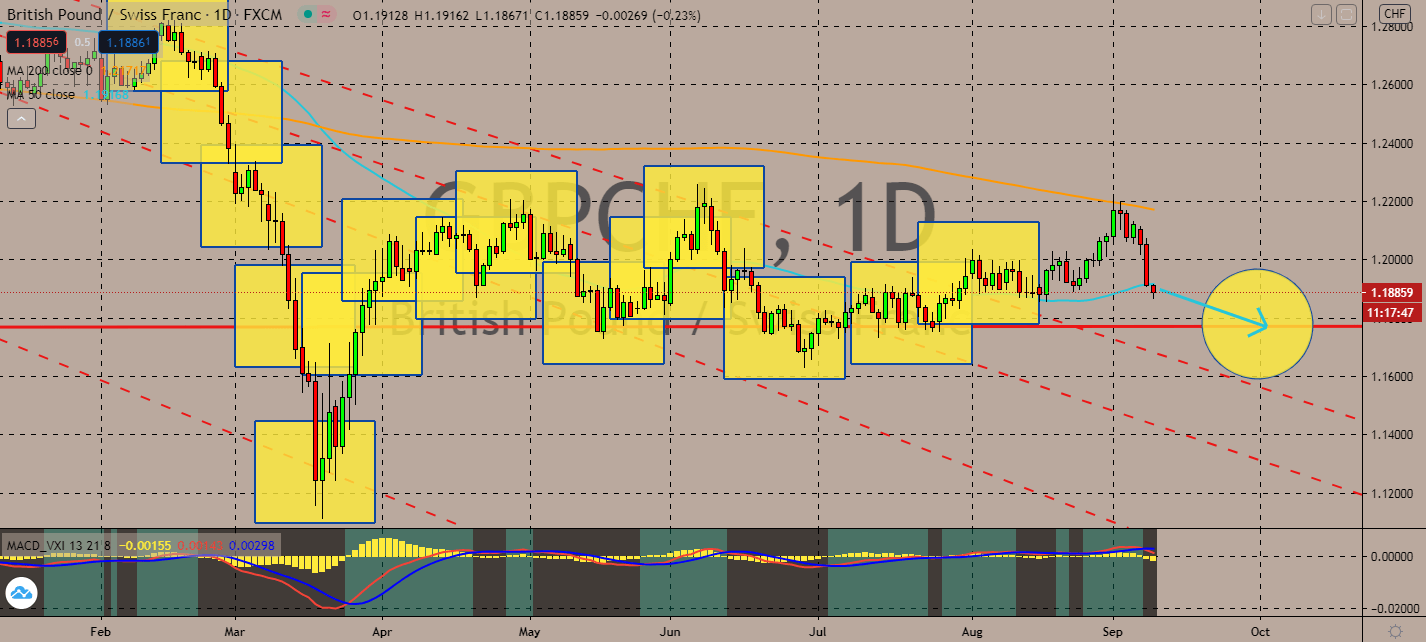

GBPCHF

Geopolitical relations are in focus for the GBPCHF pair as its shaky 50-day moving average continues its track below its 200-day moving average. Swiss Foreign Minister Ignazio Cassis said that he had “fruitful” talks with his Iranian counterpart on Monday involving peace, economic development, and human rights. Their talks marked the partners’ 100 years of diplomatic presence in Iran. Meanwhile, Brexit is in conflict with the European Union after a cabinet minister in the House of Commons declared that the UK is preparing legislation that will break international law. Pound weakness is projected to take place across most of its market because of it. The Good Friday Agreement between the US and the UK are in question if Brexit chooses to alter its trade deal proposal. Moreover, the City had just closed its doors earlier this week, raising investors’ worries that it could recover much slower from May’s estimates.

COMMENTS