Here are the latest market charts and analysis for today. Check them out and know what’s happening in the market today.

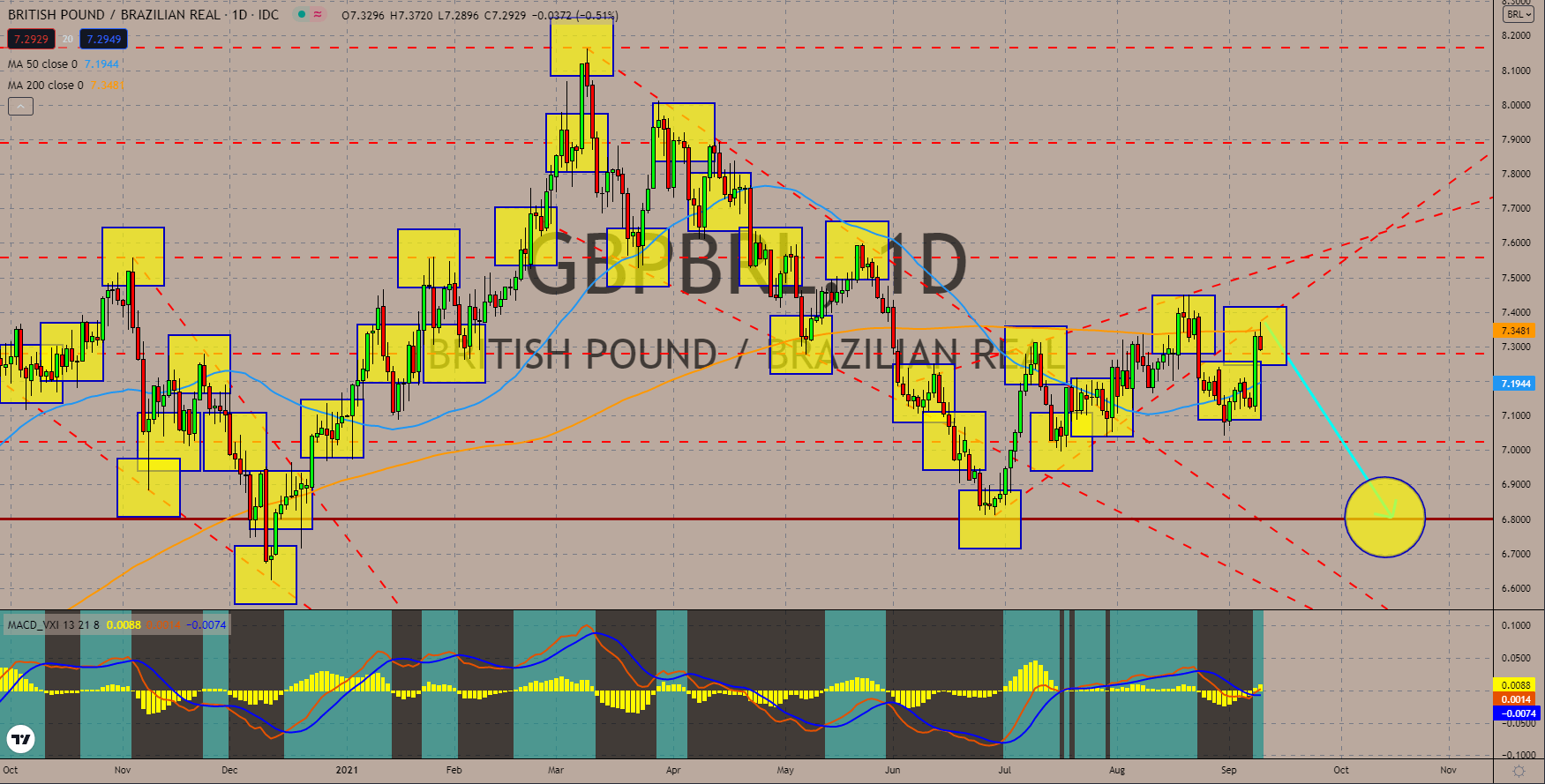

GBPBRL

Before the 2020 pandemic, international students generated 28.8 billion for the British economy. However, Brexit limits free movement between the other EU countries. According to Universities UK International and Higher Education Policy Institute, only 5% of the 272,000 students are non-EU residents. The numbers are relevant as the country moves towards a post-pandemic economy. Meanwhile, the Bank of England warned of slowing economic activity. The third wave of the pandemic could delay the country’s recovery. In addition, the central bank said the plan to increase income tax would have major repercussions. In the first year of coronavirus, the UK government spent nearly 300 billion pounds. PM Boris Johnson is under pressure to raise revenue. The most likely source of the money is the income tax. The BoE said the action would create high inflation. The pair currently trades at 7.2929 after falling from 200-MA at 7.3481 on its Thursday attempt.

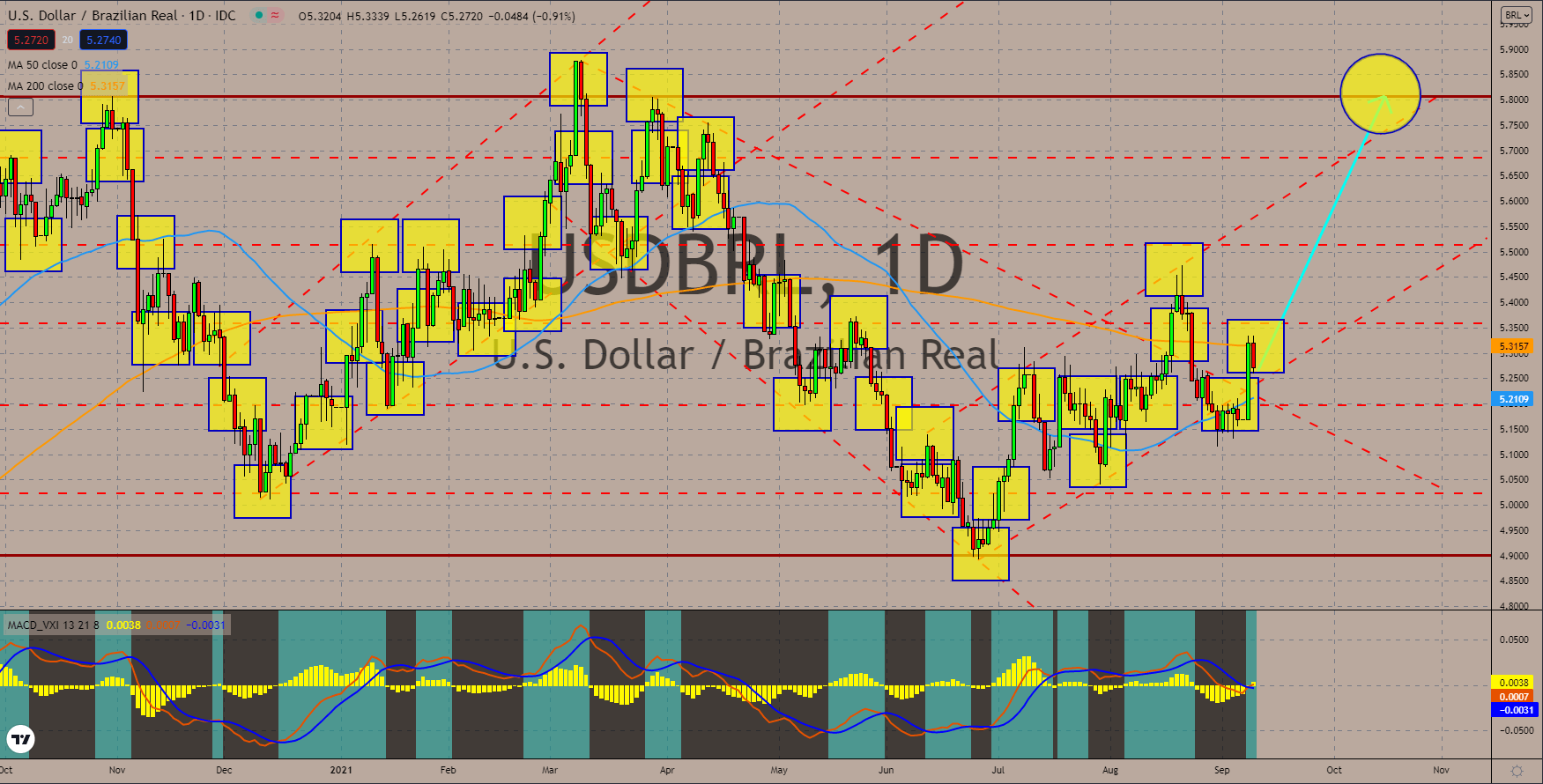

USDBRL

The US employment data this week are higher than analysts’ estimates. The JOLTs (Job Openings and Labor Turnover Survey) report rose to 10.934 million in July 2021, the highest in two decades. Meanwhile, the initial jobless claims on September 09 reached a pandemic low of 310,000. The forecasts for the reports are 10.000 million and 335,000. Meanwhile, crude inventories continue to record negative figures that suggest high demand for the commodity. The American Petroleum Institute (API) has a deficit of -2.882 million barrels based on the report. The Energy Information Administration (EIA) sees -4.612 million barrels result for the report. The recent comment from the Federal Reserve also serves as a bullish catalyst for the US dollar. The central bank sees the economy slowing down in July and August. The USDBRL pair will trade between the 50 and 200 moving averages at 5.2109 and 5.3157 in the short term. The MACD also gives a bullish signal.

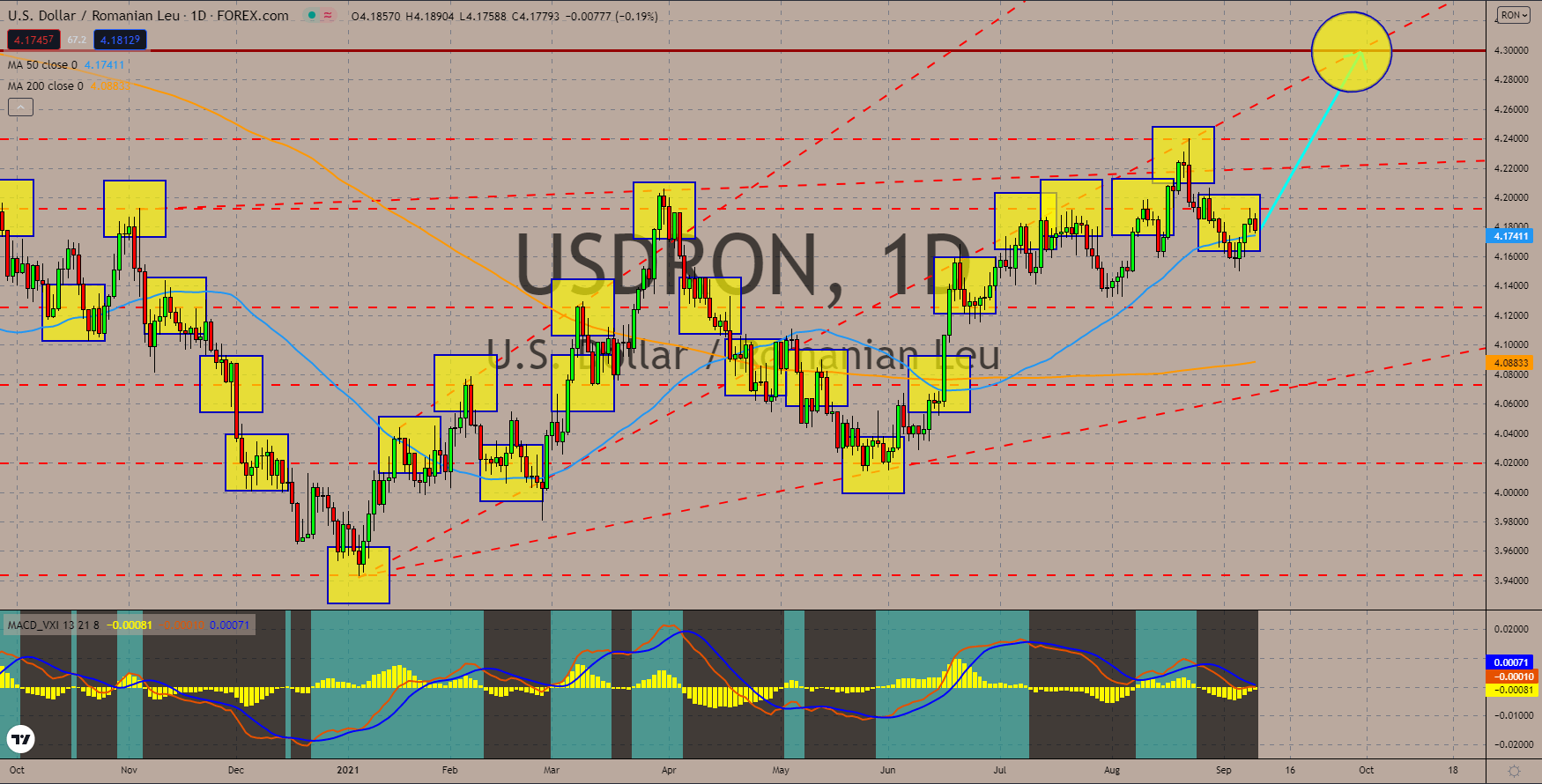

USDRON

Romania’s gross domestic product for the second quarter of the year advanced by 13.0% year-on-year. The annualized data is an all-time high record. During the same period in fiscal 2020, the Q2 GDP fell 10%. On a quarterly basis, the economy is up 1.8%. The industrial sector led the gains with 18.8% improvement, while construction lags at 1.0%. The consumption is also up with 8.1% in the quarter. The increase is in contrast to the decline in the agricultural sector of -3.4%. Despite the upbeat data, analysts remain skeptical about the future of Romania’s economy. Fitch Ratings also put its investment grade on hold. The reason for the bearish outlook is the political turmoil in the country. A political party resigned from the coalition government, which paved the way for a vote of no confidence for Prime Minister Florin Citu. The concern roots from the possibility of increasing Romania’s budget deficit. The MACD shows a formation of a “bullish crossover.”

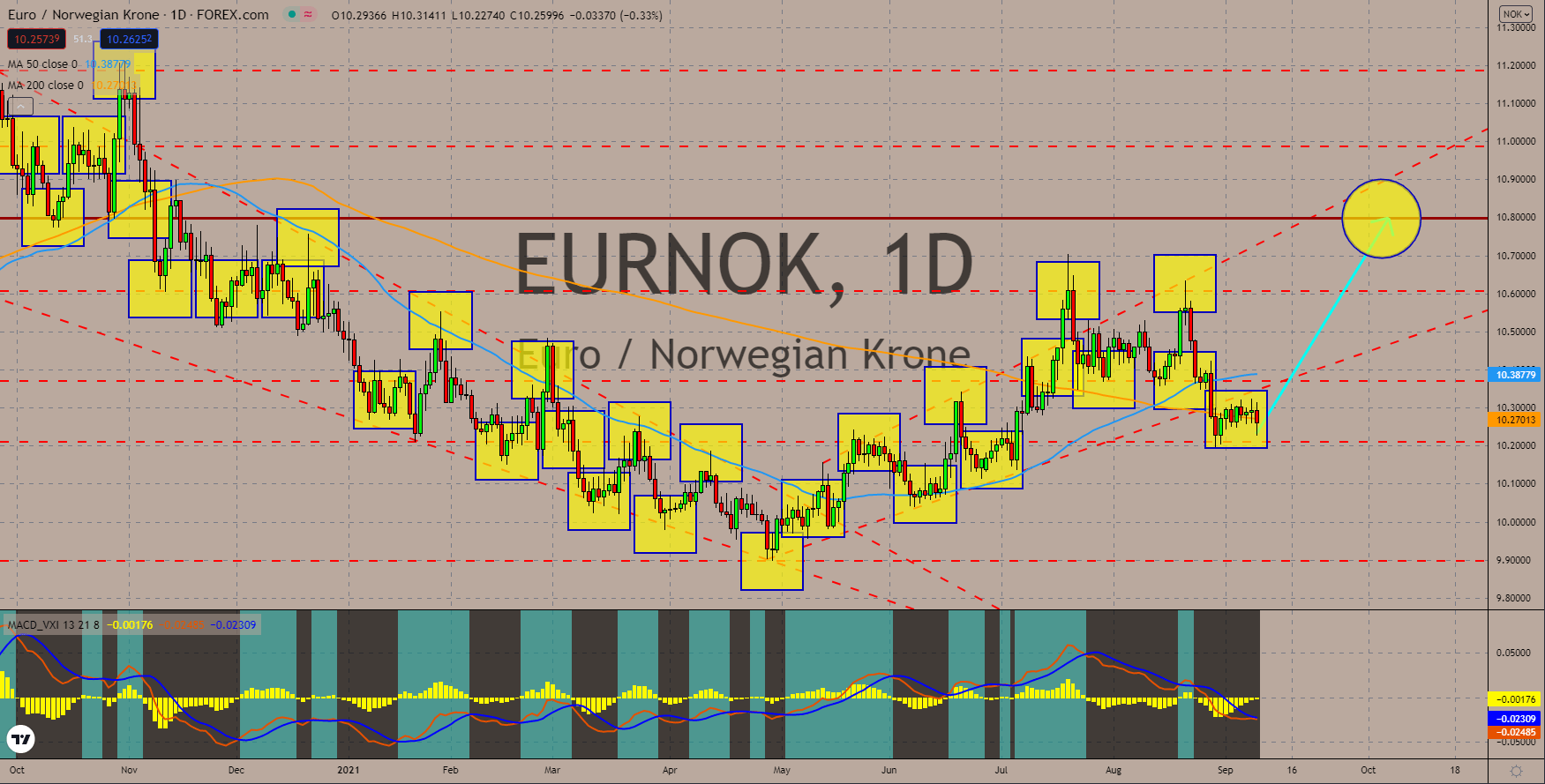

EURNOK

Policymakers in the European Central Bank maintained the currency bloc’s key rates. The interest is at zero 0%, the deposit rate at -0.50%, and the Eurozone’s lending rate at 0.25%. One of the monetary readjustments made at Thursday’s meeting is a slowdown in bond purchases. The central bank allotted 1.8 trillion euros for the Pandemic Emergency Purchases Programme. The decision came after the annualized inflation soared by 3.0%. The economic figure represents a decade high. Other reports for the day are Germany’s trade activities. The July net surplus was 17.9 billion. The increase in the trade balance is despite the slowdown in exports to 0.5%. On the other hand, imports fell by -3.8%. The negative data supports the strength of the euro currency. Meanwhile, the current account is at 17.6 billion. Analysts expect the 10.20000 level to hold as MACD nears to recover and form a “bullish crossover.” For prices, the pair will rebound from the 200-bar MA at 10.27013.

COMMENTS