Here are the latest market charts and analysis for today. Check them out and know what’s happening in the market today.

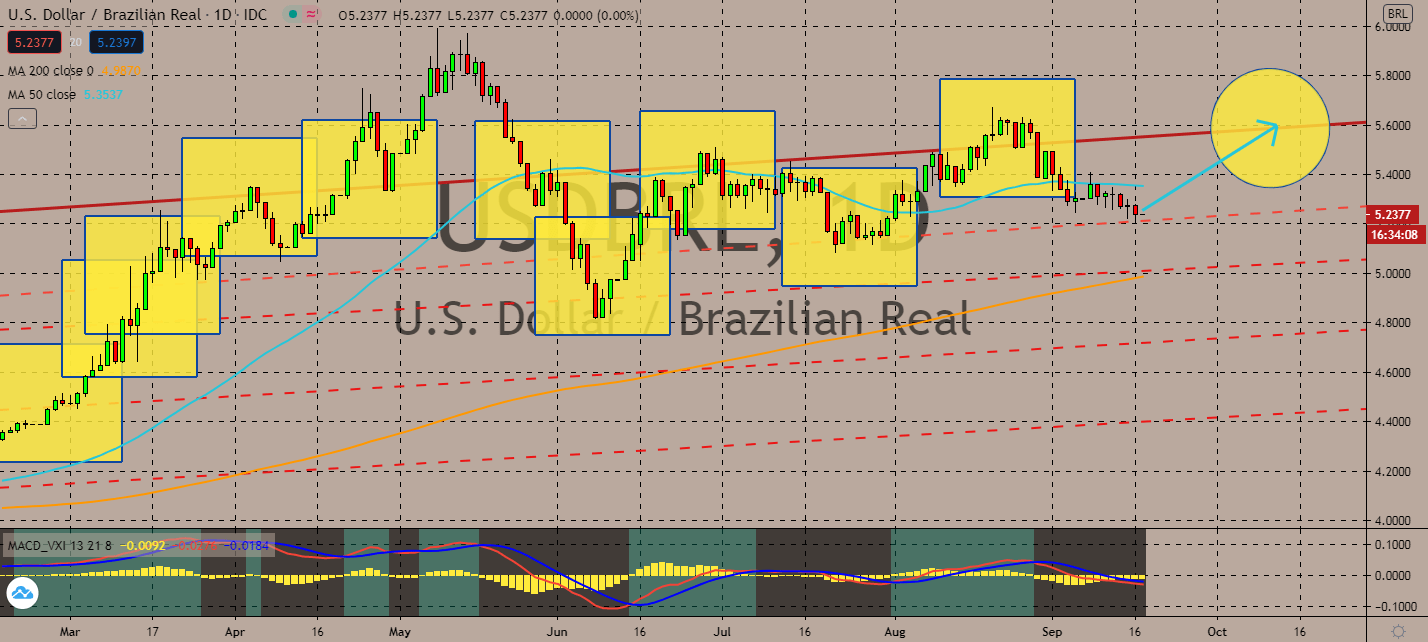

USDBRL

The Federal Reserve said it plans to keep its benchmark interest rate near zero for at least two years. Investors seem unsure about the news, but it’s more likely that sentiment will help the dollar against the real near-term. Judging by the pair’s 50-day moving average for the past few months, the pair could still push through its sideways pattern, or until the rising 200-day moving average crosses familiar support levels last seen in early June. For now, the bulls will lift the dollar. Moreover, now that Brazil’s central bank is unsure of how it could change its interest rates due to the spread of the coronavirus, investors are projected to be hesitant to trade for the Brazilian real. This year brought extra spending in Brazil past the national debt up to 86.5% of its GDP, up from 75.8% seen last year. Its economic recovery is also taking a toll on local prices as its inflation forecast remains below its initial target of 4% expected in January.

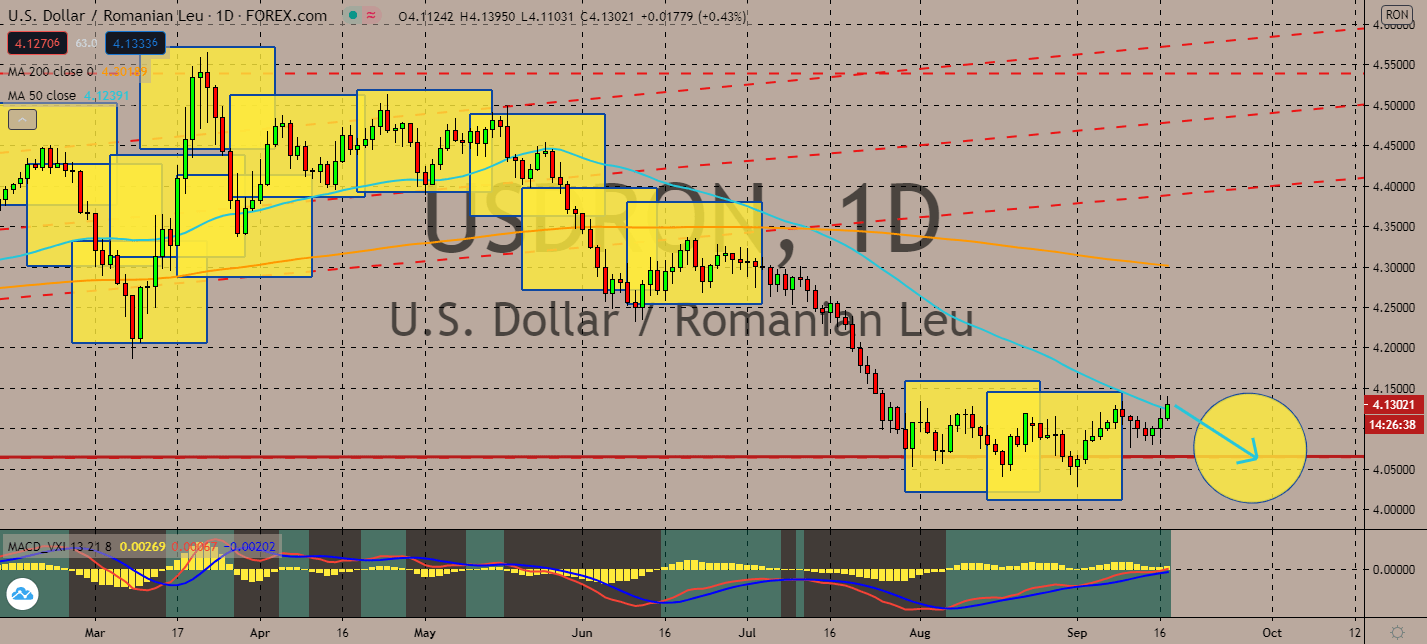

USDRON

The ratio between Romania’s national debt and its gross domestic product is expanding. In fact, after it decreased its nominal GDP over the past four quarters, the gap reached up to 2% in favor of its debt. But it looks like that’s not the main problem of the pair – the Federal Open Market Committee’s announcement that it plans to keep its interest rates near zero isn’t sitting well with USDRON investors. Risk sentiment is expected to help the leu, proven by the pair’s falling 50-day moving average, which is already far below its 200-day moving average. The Fed’s new guidance on rising rates and falling economic projections will bring the US dollar further down at least until the national elections that will be held in November, which will also be around the time that it could forecast more positive economic stimulus in the country with progress in coronavirus cases and results seen from rising employment counts.

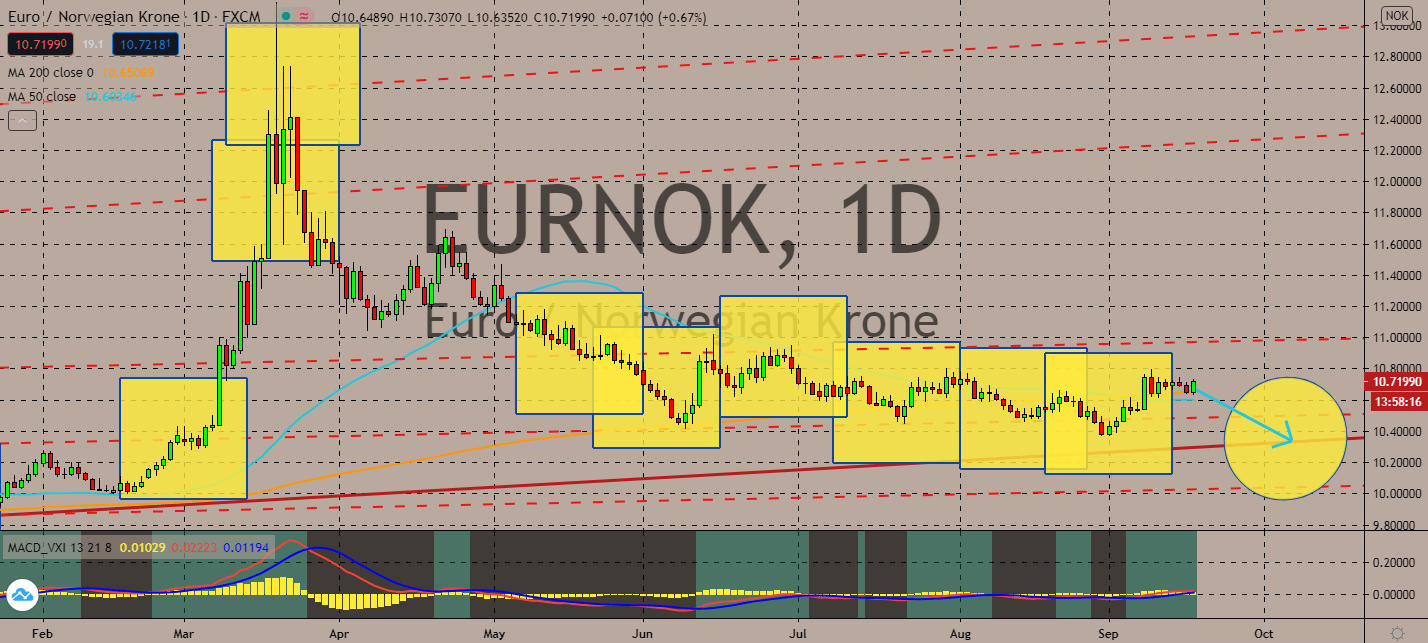

EURNOK

The European Union has yet to agree on a trade deal with the recently departed United Kingdom, which is supposedly due at the end of this year. If the City does push through without any agreements with key economies in the EU, such as France, the Netherlands, and Spain, it will be detrimental to both economies even if they manage to surpass the coronavirus recession. Moreover, risk sentiment is alive and well, bringing the euro into a disadvantage against the Norwegian krone. The exchange’s 50-day moving average recently fell below its 200-day moving average, which means that the bears are getting ready to take the wheel for the relatively stagnant pair near-term. Meanwhile, the surging prices in oil and energy commodities brought by the unprecedented supply cut will help the oil-dependent Norwegian economy, and consequently, its currency alongside it. The pair should test its current support levels soon.

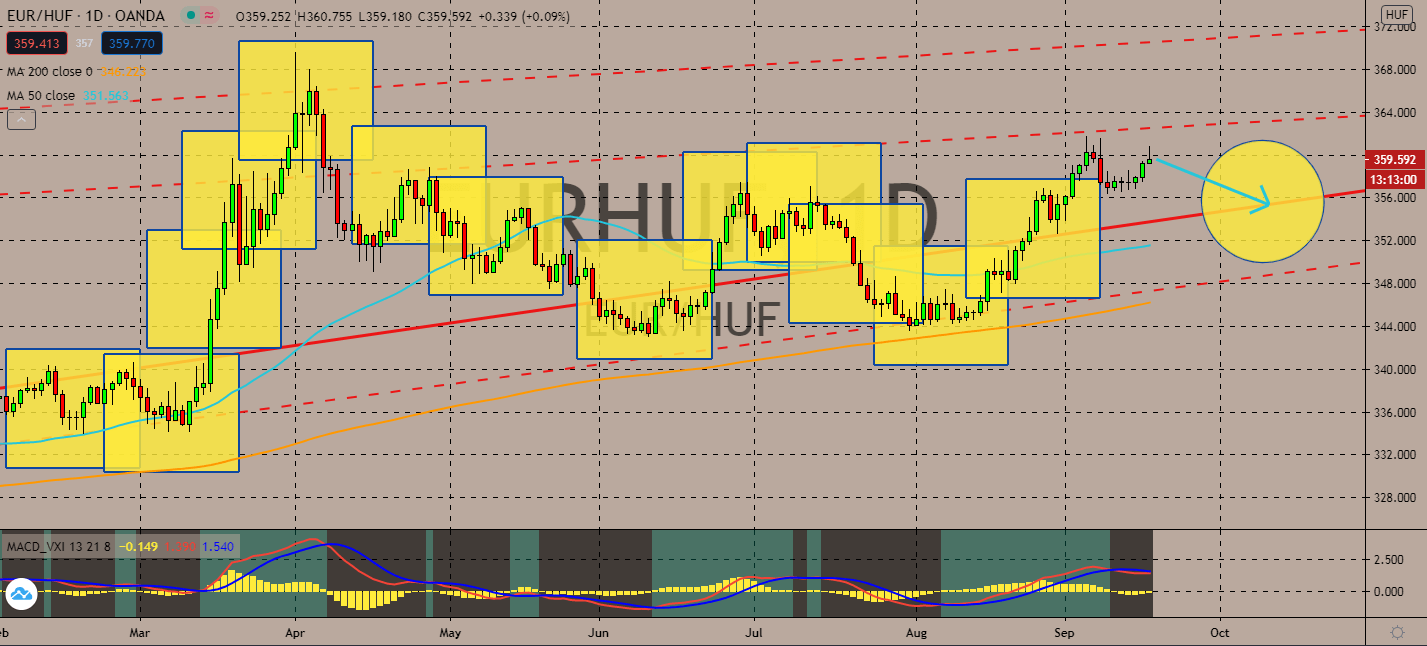

EURHUF

Economists believe that the National Bank of Hungary is likely to leave its benchmark interest rates unchanged during its monetary policy meeting next Tuesday. Central bank sources believe that the country’s stimulus package is running out of steam, and that its recovery will be much slower than initially anticipated. Its gross domestic product shrank by nearly 14% in the last quarter. But even then, the euro is projected to fall against the forint. Long term-oriented investors are concerned that the European Union’s series of disagreements with the United Kingdom, which is getting more and more uncertain on the daily. If the respective economies don’t manage to reach common ground, a no-deal Brexit could cost almost triple as much as the coronavirus slump can bring. The pair’s 50-day moving average might still be hovering above its 200-day moving average, but it looks like the latter is about to catch up soon.

COMMENTS