Here are the latest market charts and analysis for today. Check them out and know what’s happening in the market today.

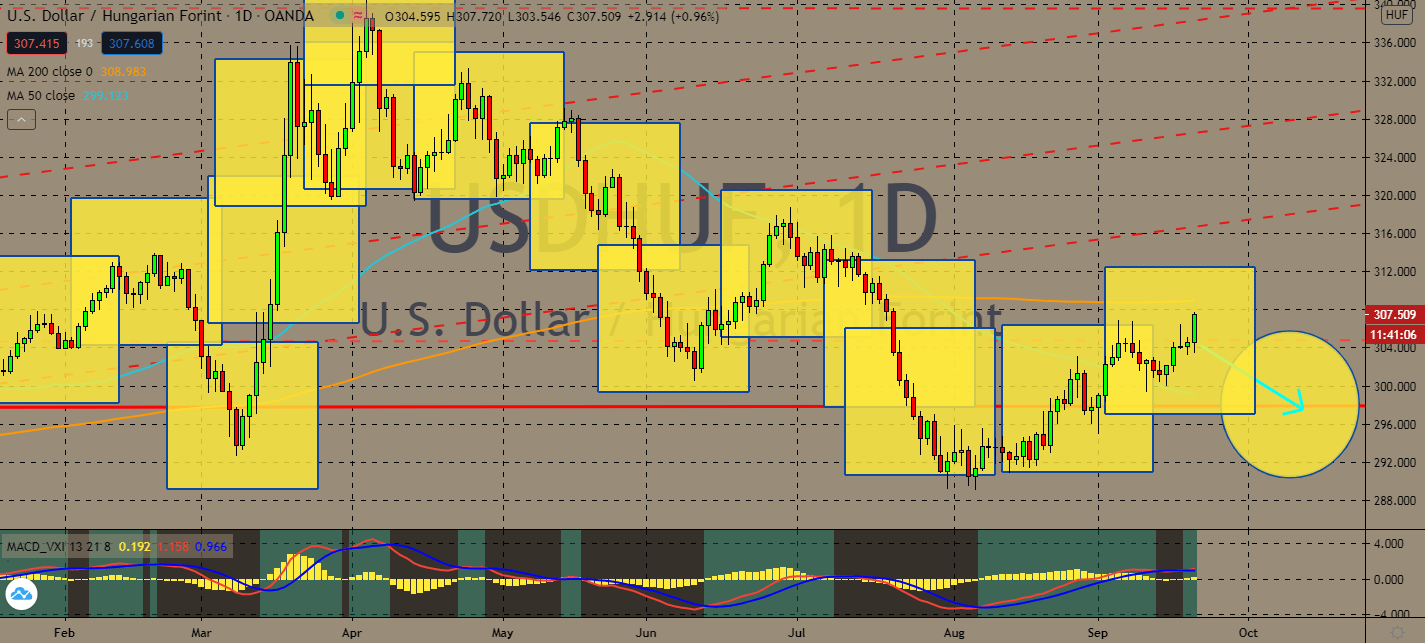

USDHUF

Risk sentiment is keeping the dollar lower than its emerging counterparts in near trade. Although the Hungarian economy projected a slower economic recovery than previously expected, its currency might find itself in the bullish market in comparison to the greenback. The pair’s 50-day moving average is still below its 200-day moving average, which means that it could still meet a decline in nearer terms. But the pair could witness a change when its price manages to intersect the indicator. Policymakers in Hungary are projected to keep its interest rates as it is as its inflation hovers at the top of its tolerance. Although, Fed chair Jerome Powell has the chance to turn things around after the pair’s slight decline. He is set to appear before Congress to assess his leadership in helping the economy throughout the pandemic in three separate meetings this week, which could be the start of another wave of fiscal stimulus that could cripple its economy in the long run.

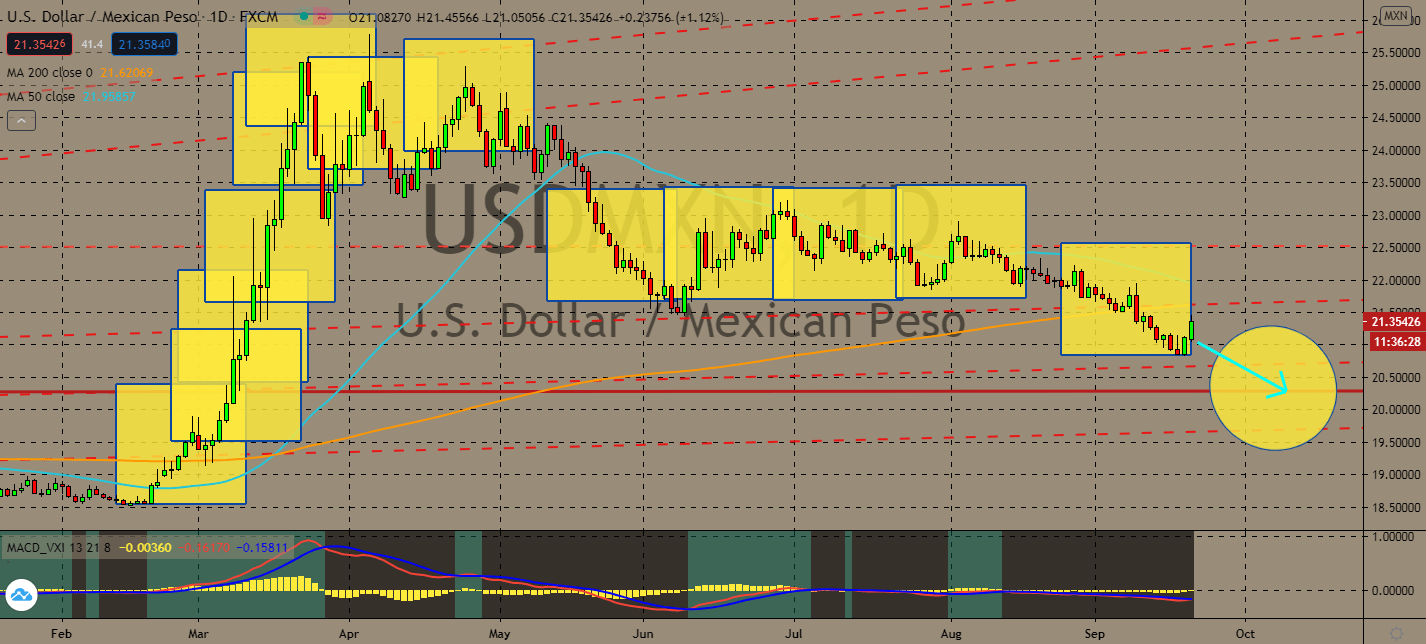

USDMXN

It’s going to be a quiet day in the US economy, but it’s going to be an eventful week, nonetheless. Fed chair Jerome Powell is projected to meet Congress in three separate hearings in regard to his leadership throughout the Treasury and Federal Reserve’s response against the economic effects of the coronavirus pandemic. Although Powell has been one of the leaders most praised for his response, the meeting also brings up what could be the need to launch more fiscal policies that could support a robust economic recovery for the rest of the year. Last week’s announcements and views on the US’ three-year economic outlook is projected to drive away support for the dollar. As Mexico’s central bank prepares to report its monetary policy changes, including a cut for its benchmark interest rate, the pair’s 50-day moving average is projected to stoop lower than its 200-day moving average and test its support levels soon.

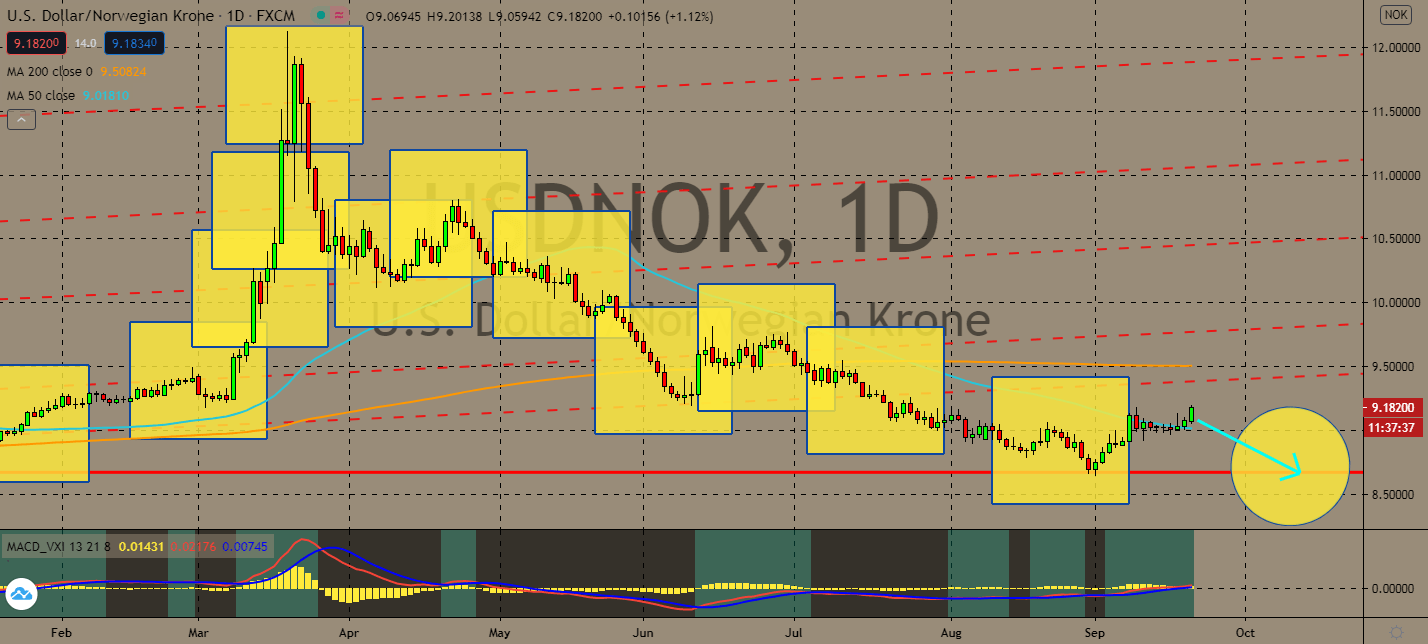

USDNOK

Norway’s government extended its loan guarantees for its airline industry to the end of the year, which was previously set to run until the end of June, and then the end of October. Despite the government’s advice against non-essential travel, it hopes that the extension could still attract more passengers that could boost the economy along with it. This could lead to a tight increase against the worrying greenback as the pair’s 50-day moving average moves further below its current resistance levels, which is also below its 200-day moving average. Meanwhile, markets are worried that the US might need another stimulus package to buoy its economy. Employment figures are projected to increase slower the Feral Reserve’s initial forecasts, and the stock market is hesitant to trade with fear of financial losses. Risk sentiment will drive investors away from the greenback until Powell turns things around later this week.

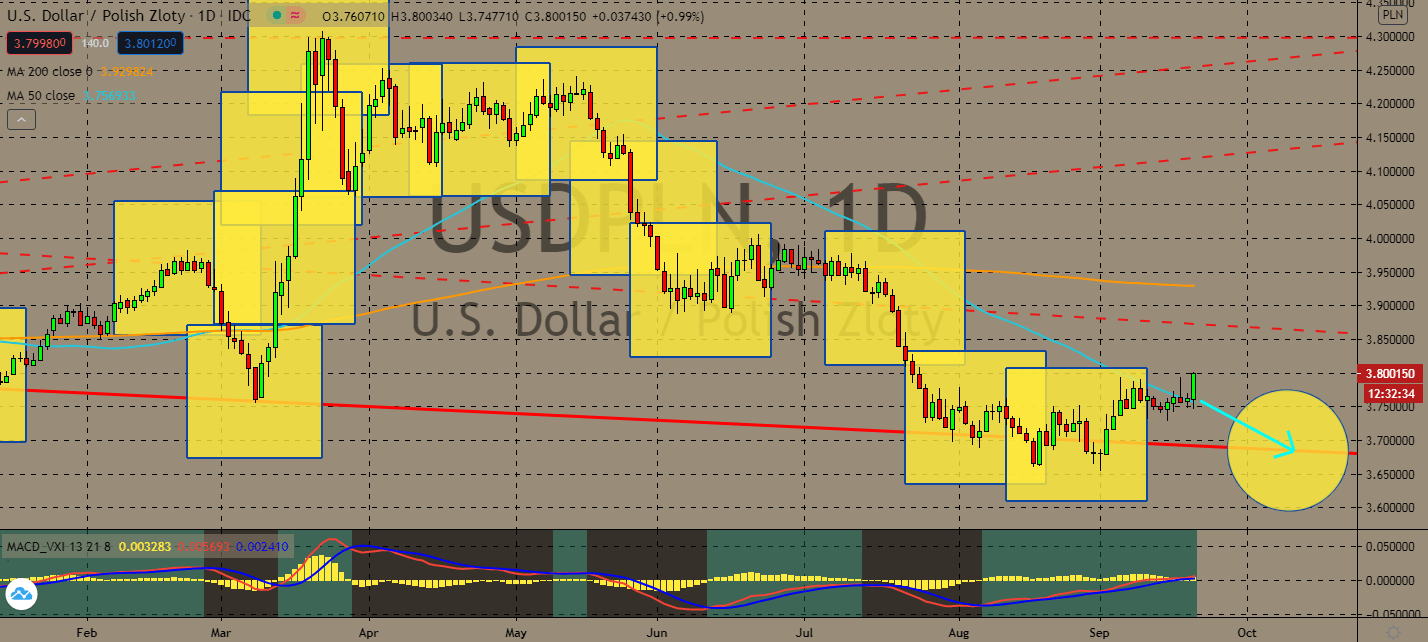

USDPLN

Poland’s industrial production increased by 1.5% on a yearly basis in August, showing investors that its recovery from the coronavirus might be better than they initially thought. Although the increase was below market consensus, the figure was still faster than in July. The figure is projected to continue its normal growth thanks to its manufacturing sector, which was better than last year, as well. The improvement could help the Polish zloty recover from its stagnant relationship with the US dollar. The pair’s 50-day moving average, which is currently far below its 200-day moving average, just touched its current levels. This means that the pair could test its support levels soon. Markets are also worried about the US economy and the possibility that it will have to implement another fiscal policy for the rest of the year to buoy it, which will be announced by a series of meetings with the Federal Reserve and the US Congress later this week.

COMMENTS