Here are the latest market charts and analysis for today. Check them out and know what’s happening in the market today.

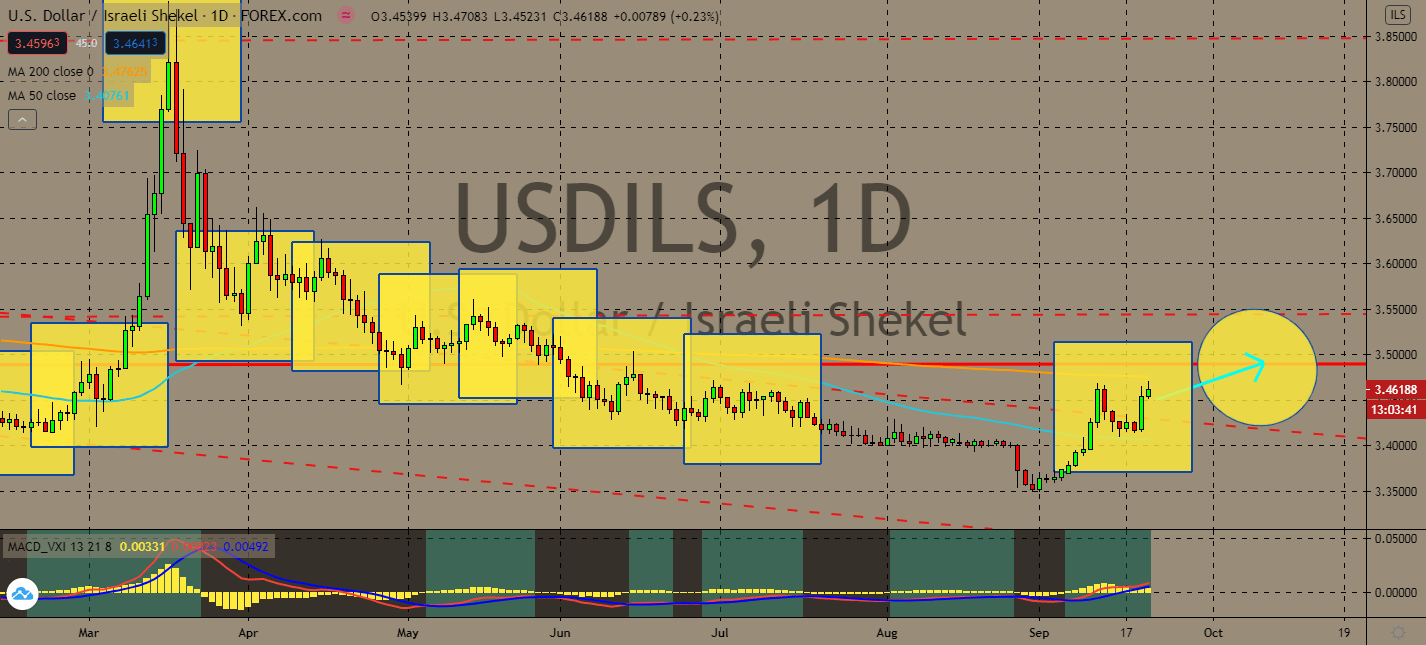

USDILS

The Federal Reserve’s chair Jerome Powell claims that the economy is showing signs of improvement. Although his notion was highly uncertain, he confirmed that there might have been an increase in economic activity in household spending and the housing market after it bottomed out in the second quarter. Meanwhile, Israeli businesses aren’t doing so well after its TA 35 index closed lower by 1.30% points yesterday. Financial, oil & gas, and communication sectors are projected to witness lower engagement in Israel this week. Moreover, the pair’s 200-day moving average looks like it’s nearing its 50-day moving average, although the latter remains lower. The greenback’s unforeseen high against the shekel in recent trading could promote more positivity for the greenback despite its overall weakness in the market, giving the exchange’s bulls another chance to take over and breach the levels last seen in May.

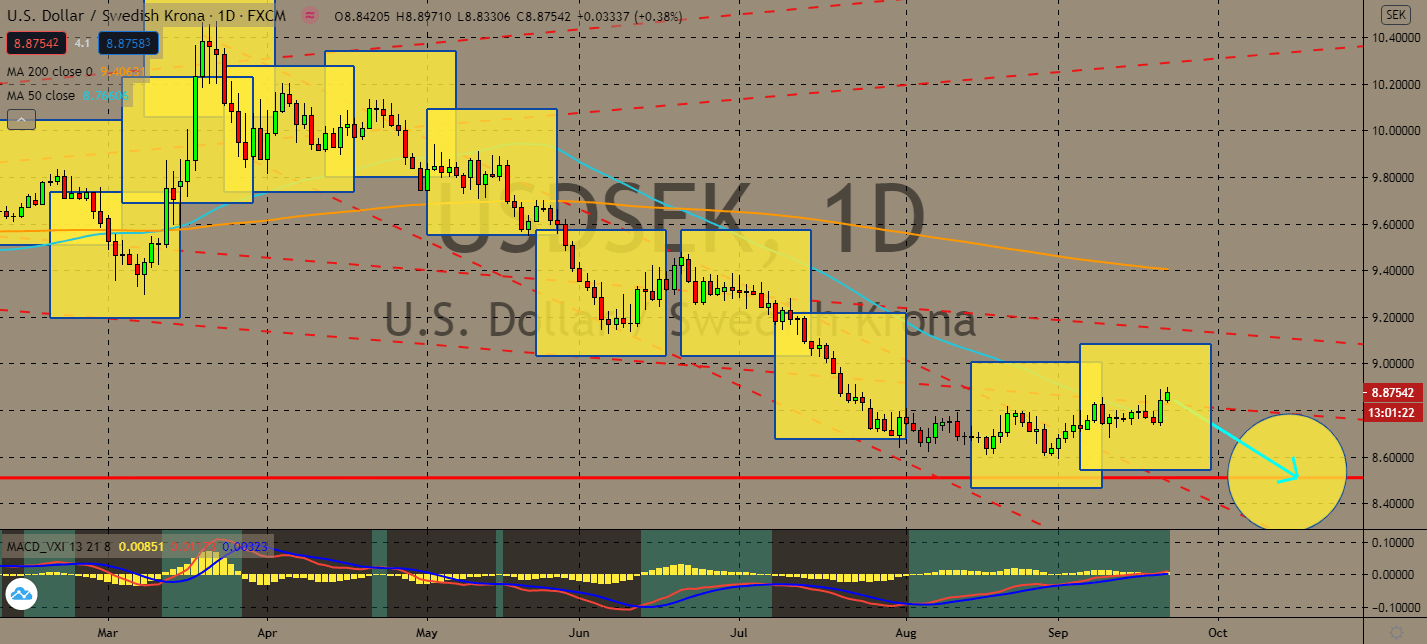

USDSEK

The Swedish government promised to spend about 105 billion crowns by next year, with the help of cutting taxes and spending money on record giveaways, to kickstart its economy from the downfall caused by the coronavirus pandemic. Although its gross domestic product is projected to sink around 4.6% by the end of 2020, Sweden claimed that its fall was still relatively mild in comparison to other European countries. As the pair’s 200-day moving average stays high above its 50-day moving average, it’s projected that its currency will be one of the winners against the greenback in nearer terms. The pair has been stagnant for the past month or so, but it looks like the next move could make or break its resistance levels this week with a bearish market with greater certainty and high volatility. Bullish investors are also hesitating to exchange for the dollar as Fed chair Jerome Powell spends the week announcing how the US is faring in the outbreak.

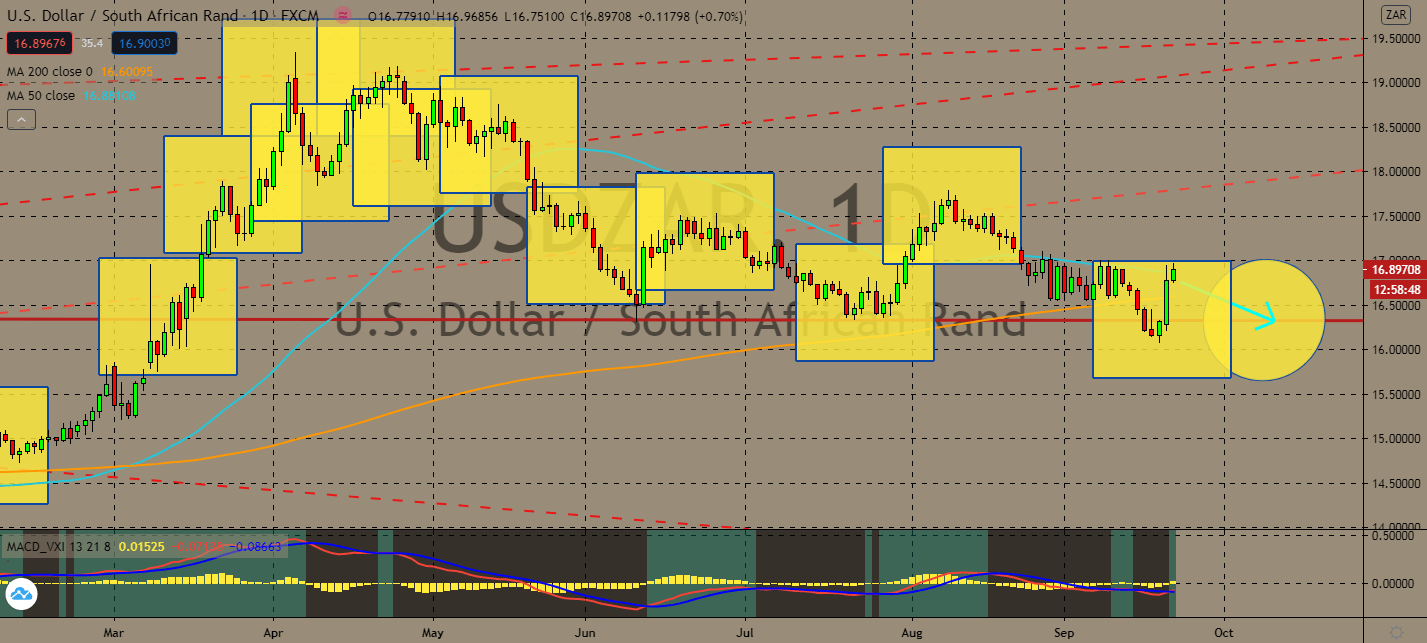

USDZAR

The worst has come to an end in South Africa, or so its government claims. After President Cyril Ramaphosa implemented one of the strictest economic lockdowns in the world, he now managed to cautiously say that there’s now a threshold of one case out of 100,000 people per day in the country purely by fact. Almost all economic activity has resumed, and its borders are slowly opening. The urgency and efficiency of which it responded to the pandemic in communication and testing bid well. Now that the world’s earliest lockdown has ended, the significant feat is celebrated by the markets. The pair’s 50-day moving average is tumbling down as its 200-day moving average leaps up, indicating what could be a volatile upcoming market in favor of the bears near-term. This is also led by the series of updates from the Federal government due this week, which is showing uncertainties revolving around the greenback and its economy as well.

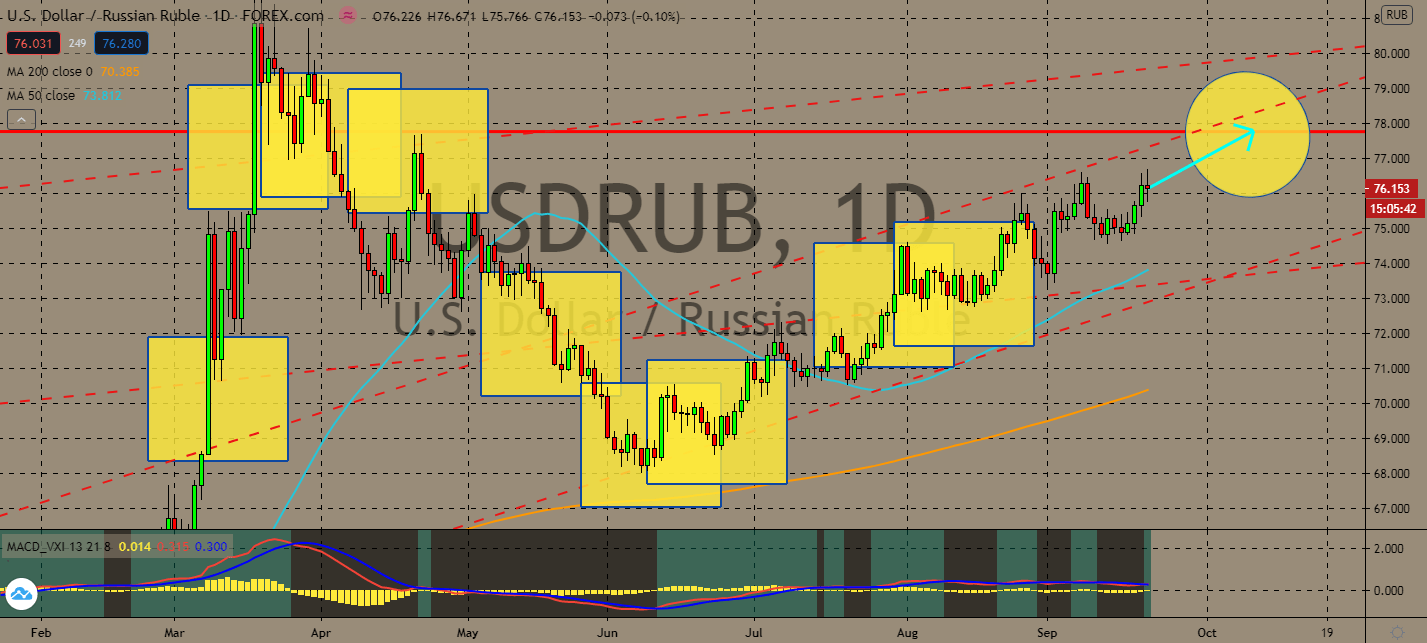

USDRUB

Russia is still in a rocky conflict with Germany after the Novichok poisoning. Russian opposition politician Alexei Navalny is asking for his clothes back on Monday to investigate the details of his incident. Neither Russian authorities nor the Kremlin has spoken up on the matter, inevitably sparking worries about the alleged crime. The tension will push the greenback higher near-term as its 50-day moving average skirts above its 200-day moving average. The United States, according to its Federal chair Jerome Powell, has been improving in housing markets both in spending and in existing household sales lately. This means that although the traction is relatively slow, the US economy could be in better recovery than the markets initially thought. The bulls are expected to continue its track upwards until Russia is able to react to the accusations, or if the Federal Reserve wraps up this week with unforeseen outlooks for its economy.

COMMENTS