Here are the latest market charts and analysis for today. Check them out and know what’s happening in the market today.

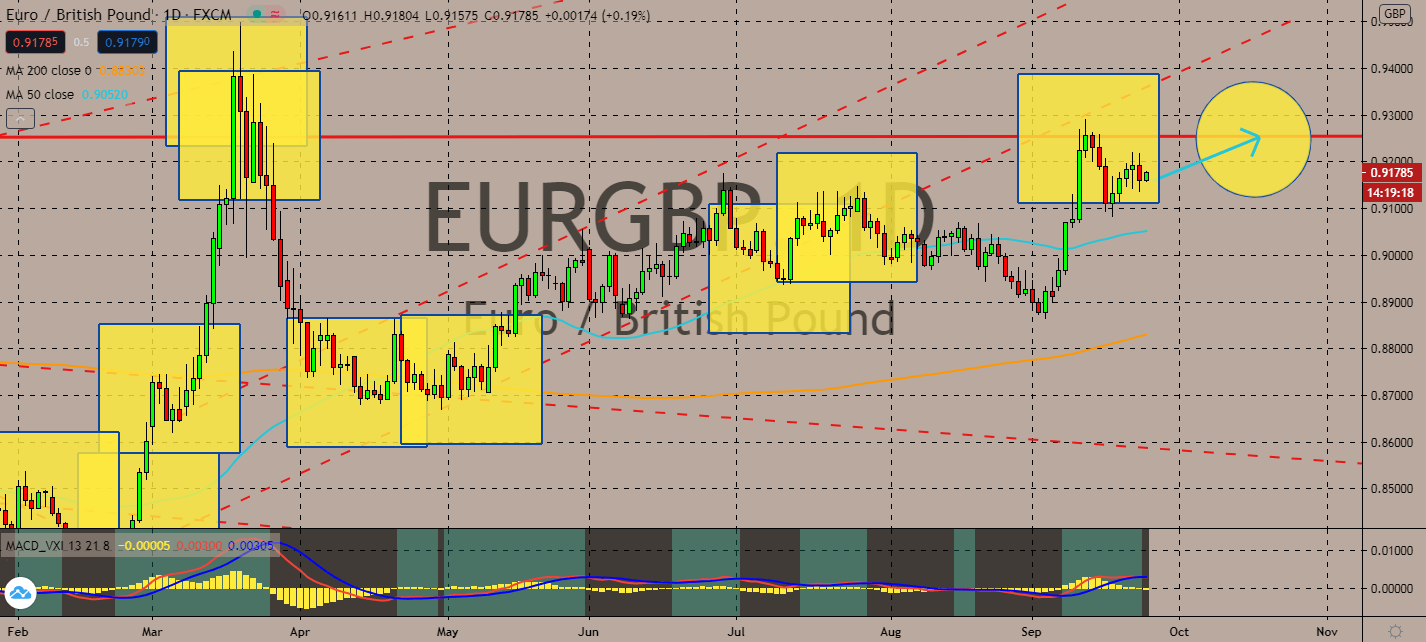

EURGBP

Markets found that the UK’s economic recovery from the coronavirus lost momentum long before it announced new restrictions to muffle a recent spike. Monthly IHS Markit estimates went to its lowest in September to its lowest since June as outlooks for its businesses fell to its weakest since May. The UK has also been shedding its employment rate throughout September. After the pair’s price intersected with its 50-day moving average earlier this month, its pair has been projected to increase and meet its previous pattern’s high from early March. Although, its 200-day moving average is catching up, seemingly driven by the economies’ comparable improvements. Fresh lockdowns in the eurozone led economists to conclude that it could meet a two-digit decline in gross domestic product by the end of the year. The euro currency is projected to boost near-term as no-deal Brexit appears to have been more detrimental to the UK than the European Union.

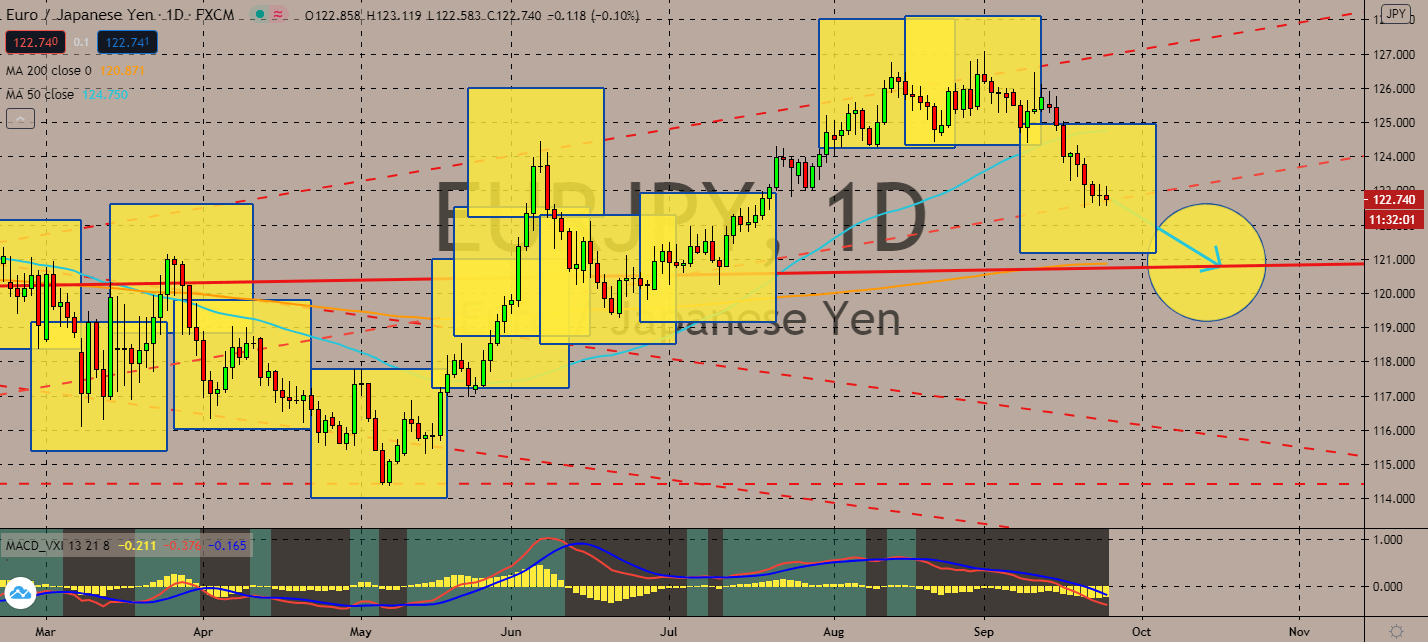

EURJPY

Bearish traders took over the euro-yen pair after its 50-day moving average touched its already declining price in recent trading. Now that the exchange is testing its current support levels, investors will attempt to bring its pattern back to what was last seen in June. This was led by recent reports that the eurozone’s economic activity stagnated in September based on the IHS Markit’s Purchasing Managers’ Index. Against 51.9 in August, the figure stood still at 50.1, only hairs above the above 50-point basis for growth. The uncertainty around how its biggest economy, Germany, can pull the bloc’s output this year will push its currency’s investors away from its currency. Although, the pair’s 200-day moving average is slowly creeping upwards. Japanese Prime Minister Yoshihida Suga’s succession has yet to deliver results in its economic figures, but optimism for his leadership is expected to help ensure the yen’s safety in upcoming sessions.

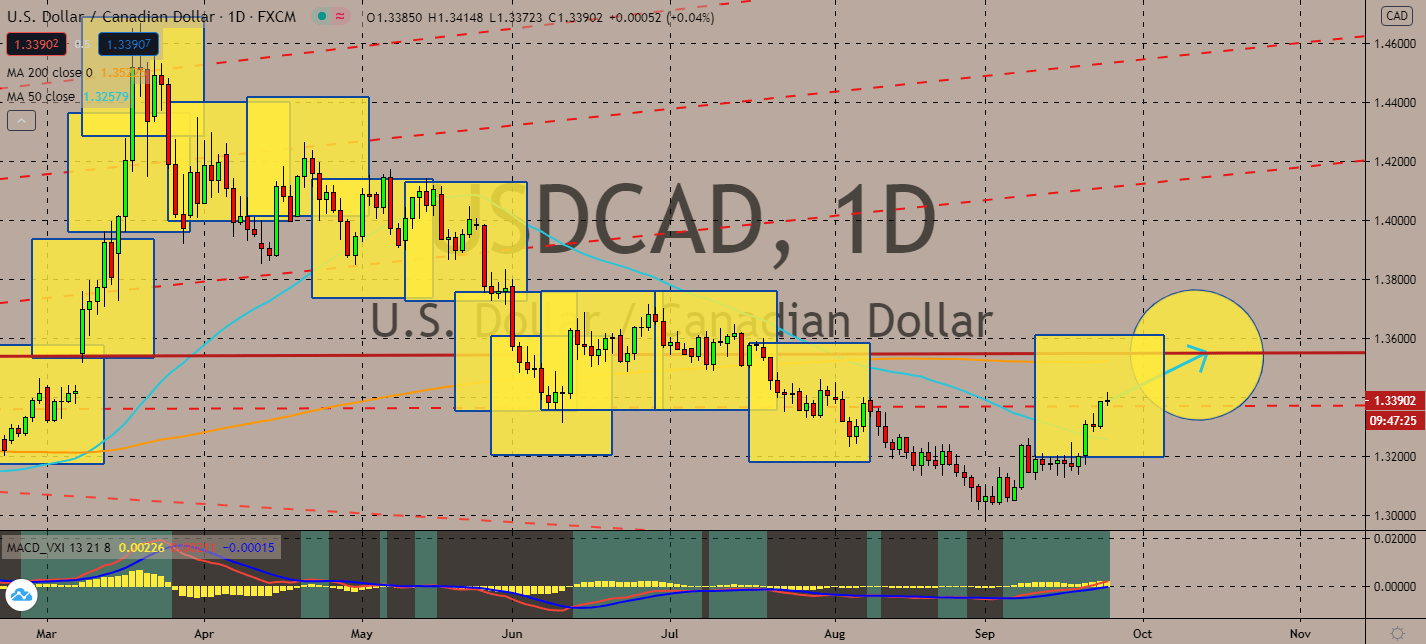

USDCAD

The recent surge in coronavirus cases and the implementation of stricter lockdowns in the European Union triggered demand for safer assets worldwide. Risk-oriented currencies like the loonie are projected to fall against the cushion that is the greenback as investors grow more concerned about how the winter season will affect global economies. This month’s series of negativity in economic drivers is projected to continue the greenback’s track upward, even as the pair’s 50-day moving average remains below its 200-day moving average. The pair could further test its current resistance level of about 1.337 as the United States nears its presidential elections, which will be held in November. Moreover, Canadian prime minister Justin Trudeau confirmed that the country just experienced it second infection wave. The spark of worry towards its economy in particular could drive the market away from trading for its currency.

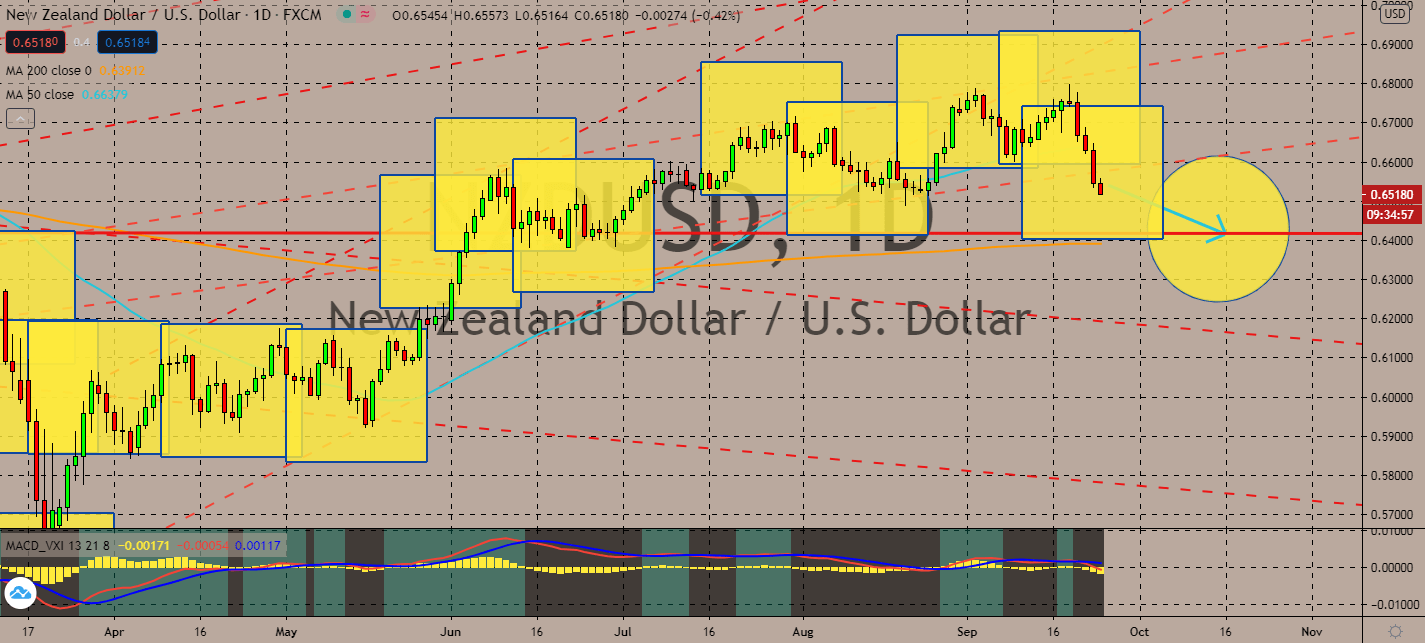

NZDUSD

The New Zealand dollar is projected to continue its downwards track as investor risk aversion takes over with worries of the globe’s overall economic contraction come end-2020. The United States Federal Reserve plans to keep its inflation goal of 2%. The central bank also appears to be disinterested in altering its current monetary policy, which is bullish for the greenback. The pair’s 50-day moving average is still surging above its 200-day moving average, keeping investor sentiment close to safety nets near-term. This is also because the Reserve Bank of New Zealand brought up the possibility of another cut to negative for its official cash rate, in addition to additional purchases of foreign assets and pumping gas for a Funding for Lending Program. The RBNZ is expected to meet on November 11 to confirm the speculations. Notably, Governor Adrian Orr and his associates are currently moving away from quantitative easing.

COMMENTS