[table “” not found /]

CONTENT:

- General information

- Regulation

- Finantiko trading platform

- Spread and leverage

- Trading instruments

- Trading accounts

- Demo account

- Educational materials

- Deposits and Withdrawal policy

- Customer support

- Conclusion

Finantiko.net Review: Can We Trust this Broker?

The financial market is today’s colossal trend. Everyone wants to make big money in a shorter time. However, it requires particular experience, patience, and knowledge. The financial market has a vast possibility to help you gain big profits. There are thousands of tools to trade, so you don’t have to worry about running out of opportunities soon because more will be added. In addition, you do not need to go anywhere to start online transactions.

There are hundreds of different brokerage firms which assist beginner or even advanced clients in achieving their goals. However, some brokers are considered scam companies, and they try to steal from their clients. Our honest Finantiko review will guide you to analyze the company’s features, underline key factors, and ensure that this is the place where you can feel safe.

About Finantiko

Finantiko, a forex trader, has a good reputation in the market. The company is based in Saint Vincent and the Grenadines and quickly gained a status. How? This is because of the company’s significant features. Now let’s discuss critical aspects of their firm before you decide to sign up.

Regulations and Actors

Before you entrust your funds or information to them, it is essential to determine the broker’s legitimacy. Speaking of Finantiko, the company hasn’t gained international regulation yet due to the difficulty of obtaining trust internationally. However, Finantiko.net is regulated by the MIFID II (Market Directive for Financial Instruments), which is designed to protect customers and safety. This means that the platform will not exploit its customers, and all its policies and activities are open and transparent.

Finantiko Review: Trading Platform

The trading platform provided by Finantiko is the Sirix trading platform. Sirix is an all-in-one social trading platform for foreign exchange. Sirix is developed by Leverate, a professional IT solution and service provider for foreign exchange brokers.

Leverate was founded in 2008 and launched the Sirix platform to customers in 2014.

Sirix Broker provides you with flexibility and transparency to group your traders and adjust their trading conditions according to your needs.

Social trading involves traders reflecting on the transactions of another trader who they believe is more experienced and successful in foreign exchange trading. However, when conducting social trading, you should keep in mind that the trader’s rating or past performance does not guarantee future success, and traders should exercise caution.

Spreads and Leverage

Based on the buying/selling price of the EUR/USD currency pair, we calculate that the big difference is only 0.2 pips. Such a low spread means that transaction costs will not be too high.

Leverage also seems to be very low-1:10. Such low leverage is good because it will not expose the client’s funds to too much risk of a financial loss if the transaction is unsuccessful.

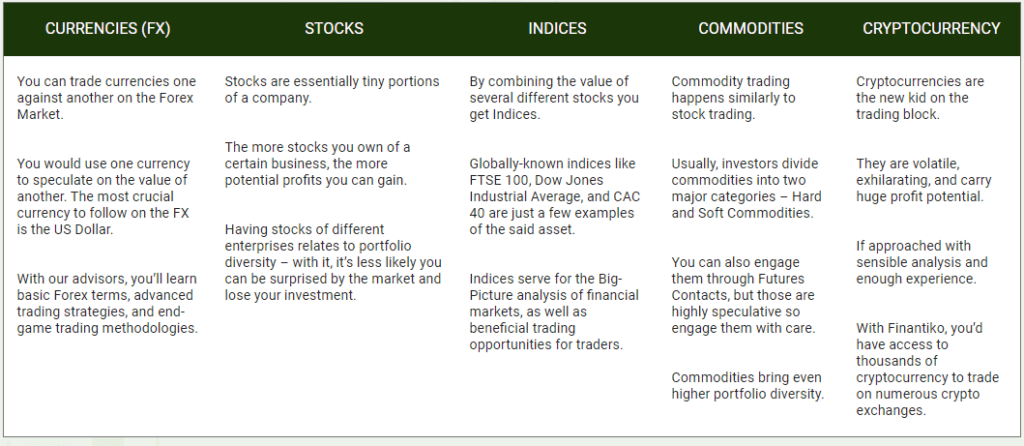

Trading Instruments with Finantiko

The assets provided by the broker are also important. Clients need to ensure that the brokerage’s trading instruments can help them get the most profit.

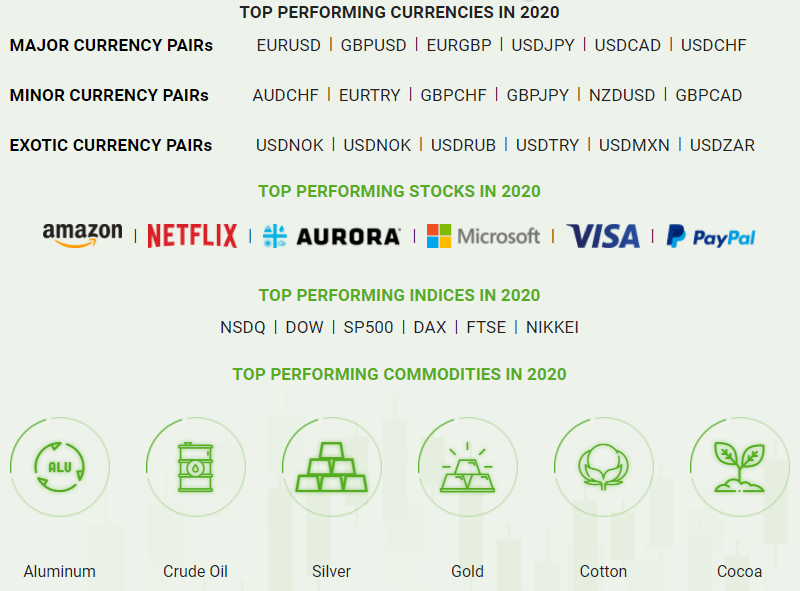

Finantiko is a CFD broker, so it provides clients with a large number of assets for trading. You can trade commodities, including soft and hard commodities, such as cotton, coffee, gold, silver, and even oil. In addition, you can trade shares of companies such as Microsoft, Apple, Facebook, Netflix, and Amazon. Indices such as Nasdaq, FTSE 100, Nikkei 225, and Dow Jones are also available.

If you are looking for some volatility, the currency market can provide you with sufficient fluctuations, and you can trade different currency pairs according to your preferences. These include EUR/USD, GBP/USD, USD/Ruble, USD/Mexican Peso, and GBP/Canadian dollar. In addition, there are also cryptocurrencies available, such as Bitcoin, Bitcoin Cash, Litecoin, and Dow Jones. This gives you enough space to diversify your portfolio without any problems.

Finantiko and All its Trading Accounts

Online trading means that you have to give your hard-earned money to the broker, which is a considerable risk. How do you ensure that your funds are safe and will not be used for any activities other than transactions? Finantiko maintains separate accounts for its customers to reassure them. It means that all traders’ deposits are kept in individual accounts in reliable and safe banks. The company’s funds are kept separately to ensure that there is no confusion. Even if bankruptcy, traders’ funds will remain safe and returned to them.

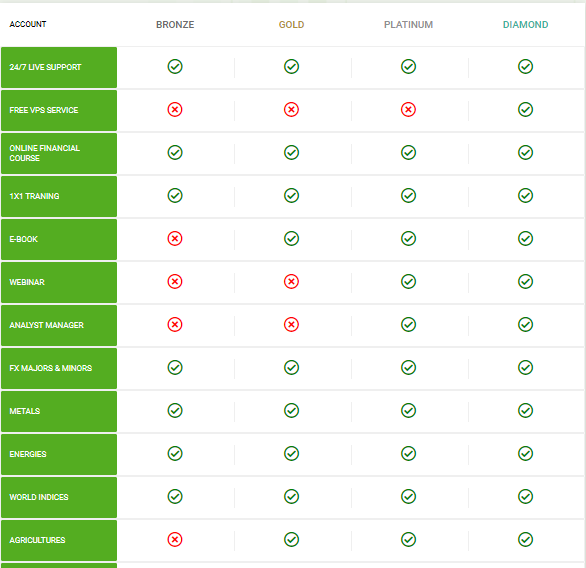

Finantiko broker offers four general kinds of accounts: Bronze, Gold, Platinum, and Diamond.

Each account comes with loads of features and Assets. But, even with the most basic one, you can enjoy a flexible trading experience.

Bronze account:

- 24/7 live support: YES

- Free VPS Service: NO

- Online Financial course: YES

- 1×1 training: YES

- E-book: NO

- Webinar: NO

- Analyst Manager: NO

- FX majors & minors: YES

- Metals: YES

- Energies: YES

- World Indices: YES

- Agricultures: NO

Gold Account:

- 24/7 live support: YES

- Free VPS Service: NO

- Online Financial course: YES

- 1×1 training: YES

- E-book: YES

- Webinar: NO

- Analyst Manager: NO

- FX majors & minors: YES

- Metals: YES

- Energies: YES

- World Indices: YES

- Agricultures: YES

Platinum Account:

- 24/7 live support: YES

- Free VPS Service: NO

- Online Financial course: YES

- 1×1 training: YES

- E-book: YES

- Webinar: YES

- Analyst Manager: YES

- FX majors & minors: YES

- Metals: YES

- Energies: YES

- World Indices: YES

- Agricultures: YES

Diamond Account:

- 24/7 live support: YES

- Free VPS Service: YES

- Online Financial course: YES

- 1×1 training: YES

- E-book: YES

- Webinar: YES

- Analyst Manager: YES

- FX majors & minors: YES

- Metals: YES

- Energies: YES

- World Indices: YES

- Agricultures: YES

Demo Account

When you are new to the trading world, you want to practice before entering the market. A wrong transaction will cost you all your investment, and you hope to avoid this situation at all costs. Finantiko provides traders with solutions in the form of demo accounts. These basic practice accounts come with virtual currencies, which can be used to try various strategies and help eliminate mistakes. In addition, these are also very useful for traders who want to test the company’s trading platform and trading conditions before registering.

Finantiko Review: Educational Material

Traders’ knowledge of financial markets can have a significant impact on their success. If you don’t know how they work, it will cause you many problems and lead you to make the wrong decision. Knowing this, Finantiko.net has added comprehensive and detailed learning materials to its platform, covering a wide range of topics related to the world of trading. You can find e-books, webinars, trading courses, and tutorials to help you understand the market.

Deposits and Withdrawal Fees

You must deposit funds to start trading, and you also need to withdraw profits. For this, you need to ensure that the broker provides a fast and straightforward method. In the Finantiko review, we want to confirm that this broker adds modern and traditional options to meet the needs of traders. You can choose standard options, such as bank wire transfers, or you can choose more modern debit and credit cards. The platform supports Visa and Mastercard, allowing you to make deposits and withdrawals easily. The withdrawal policy is not free. However, in the refund and withdrawal policy, the company makes the pricing pretty straightforward: the deposit and withdrawal fees charged by the company may be between 25 and 50 euros.

Besides, the time required to process the withdrawal request is up to 7 working days. So it is better to consider the timing in advance.

The company charges inactive accounts a fee of 5% or 25 EUR/USD. However, the terms under which the account is considered dormant will be determined by the broker.

Finantiko.net also offers a bonus system. However, traders should note that they must execute a transaction volume equivalent to 1 lot for every $5 bonus amount before they are eligible to withdraw the bonus amount if they accept the bonus.

Customer Service

When you use the broker’s platform and functions, you may encounter some questions or problems and need help. If sufficient customer support is not provided, many issues will arise. Finantiko offers strong customer support to avoid such issues. They provide multiple channels, such as online contact forms, email addresses, and phone numbers, to contact their team. They respond quickly and are very friendly.

Besides, Finantiko.net operates in multiple languages, including English, German, French, Czech, Polish, Slovak. It means that the brokerage is dedicated to giving its clients sufficient information in their language and lower language barriers.

Do We Recommend this Broker?

Overall, in the Finantiko review, we wanted to demonstrate the broker’s significant features.

Finantiko a good choice for traders of different backgrounds. The broker can quickly meet their needs and guarantee their safety.

Worth keeping

Excellent spreads offered, minimal slippage and good trading profit. I will surely keep them as my forex broker.

Did you find this review helpful? Yes No

Quick support

Very quick and understanding trading support and professional brokers. recommended.

Did you find this review helpful? Yes No

Great trading software

Updated trading software. It made my trading career easier and more successful. It has so many useful features.

Did you find this review helpful? Yes No

Good customer ssrvice

Good customer service. They are very helpful and professional. I am getting the support I need promptly.

Did you find this review helpful? Yes No

Good profit

I was able to withdraw about 15 percent on average monthly. I get good services, too.

Did you find this review helpful? Yes No

Quick support

Very quick and understanding trading support and professional brokers. recommended.

Did you find this review helpful? Yes No