| General Information | |

|---|---|

| Broker Name: | Mixfinancing |

| Broker Type: | Forex & CFDs |

| Country: | UK |

| Operating since year: | N/A |

| Regulation: | N/A |

| Address: | 22 Bishopsgate, London, England, EC2N 4BQ |

| Broker status: | Active |

| Customer Service | |

| Phone: | N/A |

| Email: | [email protected] |

| Languages: | English |

| Availability: | 24/7 |

| Trading | |

| The Trading platforms: | Web |

| Trading platform Time zone: | N/A |

| Demo account: | No |

| Mobile trading: | No |

| Web-based trading: | Yes |

| Bonuses: | Yes |

| Other trading instruments: | Yes |

| Account | |

| Minimum deposit: | $250 |

| Maximal leverage: | 1:50 |

| Spread: | Floating From 1 Pip |

| Scalping allowed: | Yes |

BROKER REVIEW CONTENT

- General Information & First Impressions

- Fund and Account Security

- Account info at mixfinancing.com

- Mixfinancing’s Trading Platform

- Conclusion

Broker Review: Mixfinancing

General Information & First Impressions

Mixfinancing is a high-quality brokerage that has recently caught the public’s eye. It’s primarily Europe-oriented, as it operates from the UK and has the website in German by default. However, that doesn’t prevent the broker from operating globally and serving clients more or less anywhere. Besides a few areas that forbid CFD trading or can’t make legal contracts with UK companies, you should be fine. Our Mixfinancing review will explore the broker’s service and explain its advantages.

And we have one advantage prepared already, in that it’s a CFD broker. Some traders would disagree here because of a false notion imparted to them by people who have gotten scammed by fake brokerages. Yes, a lot of scams pose as CFD brokers, but not every CFD broker is a scam. As many experienced traders know, CFD trading has numerous advantages for everyone but the top fraction of a percent of traders.

The advantages include ease of asset acces, pricing, liquidity, and much more. If you find a CFD broker that isn’t a scam, it’s much more likely to offer a pleasant experience than a regular brokerage.

We’ll cover the broker’s safety score later in our mixfinancing.com review, but let’s look at the user experience for now. The broker organized its site excellently, with sensible sections and information that’s easy to read and explore. That eliminates the frustrating feeling of brokers flooding you with an overbearing amount of information.

The site runs smoothly, which adds on to the already solid baseline. That way, the customer experience is smooth and streamlined without any bugs or overlapping elements. Altogether, that creates a positive atmosphere for the start of our Mixfinancing review, as it’s clear the broker has an effortful approach.

Fund and Account Security

You can’t call a broker good if they don’t know how to treat their customers safety-wise. A lot of brokerages either get too big and start ingoring smaller customer complaints or are scams outright. The former is less horrible than the latter, but both provide a horrible experience for customers.

The risk with scams is that you lose all your money and your data. Of course, you don’t need us to tell you why that’s a horrible feeling. However, even with the brokerages that are real companies but simply ignore smaller clients, the experience isn’t much better. You can get shut out from your account and miss important trades, or prevented from getting your money when you need it.

That’s why it’s wise to choose brokerages that are both safe and know how to communicate with customers. However, that’s not always the easiest to figure out. There are a lot of paid reviews in online spaces, and you can’t always tell who’s being genuine. And exploring a broker for yourself is tedious and confusing if you don’t know what you’re doing.

That’s why we’ve devoted this part of our Mixfinancing review to elaborate on its security. We’ve looked into its trustworthiness, customer treatment, and technical security, letting us form a full picture.

Luckily, the broker does well on all three fronts we mentioned. It has numerous trust features, such as its UK location and history of treating customers well. Furthermore, it has encryption and other technical features that improve safety. Altogether, we believe it’s highly doubtful anyone will run into significant security issues while using Mixfinancing.

Account Info at mixfinancing.com

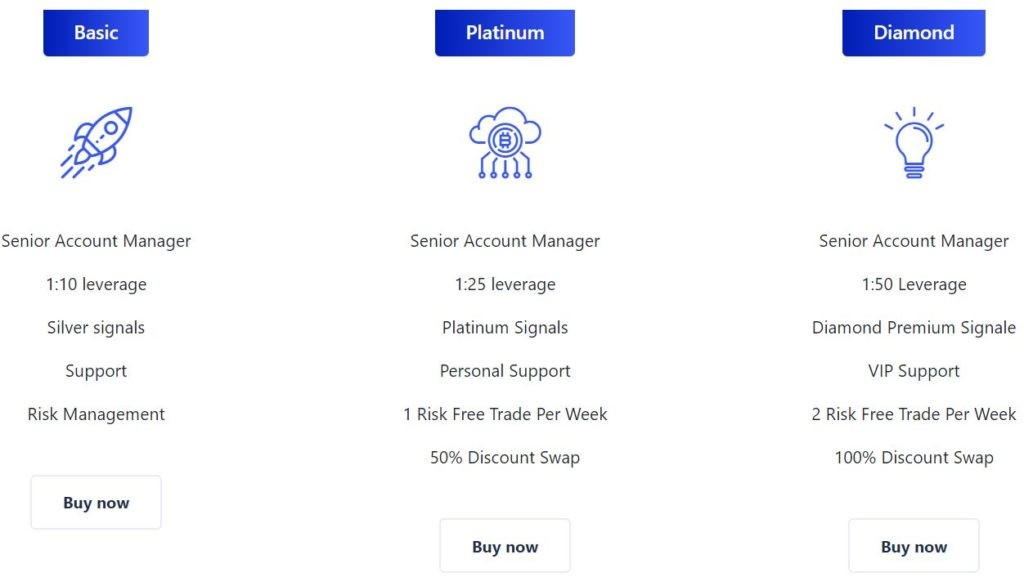

A large part of the broker’s versatility and openness comes from its ability to satisfy different groups with different accounts. That way, instead of having a baseline experience that only really suits one group, it can remain flexible.

Even though it maintains a similar structure to most brokers, Mixfinancing doesn’t fall into the same trap. As we just said in our Mixfinancing review, many brokers only have a single account. That means there’s only one group the account fits perfectly.

However, even if brokers do segment their customers, they often hold on to the notion of their primary target group. That way, even though the accounts are divided, the influence of the first group lingers through them all. In other words, if the broker had budget users in mind first, it won’t do enough to attract high-end clients.

It comes down to keeping an open mind, and Mixfinancing did just that. Instead of tying the accounts too closely to either kind of investor, it divided them clearly. As such, there’s a little bit for everyone, and each account outperforms competitors with similar prices.

For example, the baseline account only requires a deposit of $250 to get going. And even with that low of an investment, you get access to features that are usually reserved for high-end customers. Among other things, you get trading signals and risk management assistance to smoothen your trading experience.

And when you move on, the broker piles on additional services that improve your odds of profiting. There are risk-free trades and even a bonus which we’ll elaborate on later in our Mixfinancing review.

Here are some of the properties you can expect from the mixfinancing.com accounts:

Basic

- Senior Account Manager

- 1:10 leverage

- Silver signals

- Support

- Risk Management

Platinum

- Senior Account Manager

- 1:25 leverage

- Platinum Signals

- Personal Support

- 1 Risk Free Trade Per Week

- 50% Discount Swap

Diamond

- Senior Account Manager

- 1:50 Leverage

- Diamond Premium Signale

- VIP Support

- 2 Risk Free Trade Per Week

- 100% Discount Swap

Mixfinancing’s Trading Platform

Mixfinancing’s trading platform contains a lot of the broker’s power and completes the service. As we’ve already mentioned in our mixfinancing.com review, one of its major goals is to remain open. That means its platform needs to support both sophisticated traders and those using it for the first time.

If you open up a platform and see that there aren’t any complex features, you’ll likely close it if you’re an advanced trader. Or if it looks like a piece of alien technology and you’re a beginner trader, you won’t feel welcome. We feel like Mixfinancing strikes a great balance between the two.

The experience opens with an intuitive UI that even most first-timers should get. And if they don’t, even the baseline account includes an account manager that can help you. So there’s no possibility of you being locked out of the service because you can’t figure it out.

However, that doesn’t mean the platform loses out on power. It has just about all the features traders are used to, including take wins, stop losses, and analytical tools. It supports the use of numerous indicators simultaneously, thus helping analysis significantly.

And one thing we also mentioned earlier in our Mixfinancing review is the broker’s bonus. Once you sign up and deposit the appropriate amount, you get a 30% deposit match through the platform. That way, you have some extra money, which can be quite a large sum depending on your initial investment. It allows you to better use your capital or take some riskier positions and come out unscathed.

We feel like the platform complements the rest of the service excellently and adds to an already great customer experience.

Conclusion

Mixfinancing is an honest and upfront company that cares about its customer experience. That’s why it ends up feeling comfortable on top of the excellent trading service it provides. There are numerous assistance features and other qualities that give traders an edge over those that use other brokerages.

If you’ve followed our Mixfinancing review until now, you won’t be surprised by us giving the broker a top rating. And if you’re searching for a trading service provider, the broker should be on your radar.

Good brokers

Based on my trading results, I can say that these are good brokers. I can see their efforts and dedication to help me attain successful trades. I gain profit and was able to withdraw swiftly.

Did you find this review helpful? Yes No

Good source of income

I am fully satisfied with what I get from this broker. It is a good source of income.

Did you find this review helpful? Yes No

Good trading broker

They are enthusiastic and attentive. They assist me gain good profit and they deliver updated market news.

Did you find this review helpful? Yes No

Amazing platform

Amazing forex trading platform.It made trading so much easier for me.There are so many good features, too.

Did you find this review helpful? Yes No

Good trading deals

Offers really good trading deals. I have been trading current currencies and the results are favorable.

Did you find this review helpful? Yes No

Good broker

Good broker. They respond promptly even on messages.

Did you find this review helpful? Yes No

Good trading company

This is a good trading company. They are skilled in forex and they never fail to pay profit on time.

Did you find this review helpful? Yes No

Happy and sarisfied

Services are consistemtly good.It’s a been a year since I’ve joined them but services are just keeps getting better.Happy and satisfied.

Did you find this review helpful? Yes No

Impressive trading brokers

Impressive broker services. Withdrawal is fast and easy. I have been trading with this broker for almost a year and so far I am pleased with the services.

Did you find this review helpful? Yes No

Good trading broker

Processed withdrawals swiftly and attend to my trading needs promptly. One of the best broker I hve traded with.

Did you find this review helpful? Yes No