Quick Look

- S&P 500 slightly down after surpassing 5000 last week.

- Dow Jones hits a new record with a 0.3% gain.

- Nvidia outperforms, reaching $1.83 billion in market cap, outpacing Amazon and Alphabet.

- Lowe’s shares jump 3% on JPMorgan’s upgrade, setting a new price target of $265.

- Market buoyed by strong corporate earnings, with eyes on upcoming financial reports and Fed’s rate decisions.

- Nvidia’s year-to-date performance surges over 50%, entering the race to a $2 trillion valuation.

The stock market displayed a mixed performance on Monday, with major indices following divergent paths. The S&P 500, having recently surpassed the 5000 mark, closed slightly lower, indicating a temporary halt in its upward momentum. In contrast, the Dow Jones Industrial Average (DJI) achieved a new high, gaining approximately 0.3%. In comparison, the Nasdaq Composite faced a 0.3% decline, reflecting diverse investor responses to current market developments and future expectations.

Company Highlights: Nvidia and Lowe’s in the Limelight

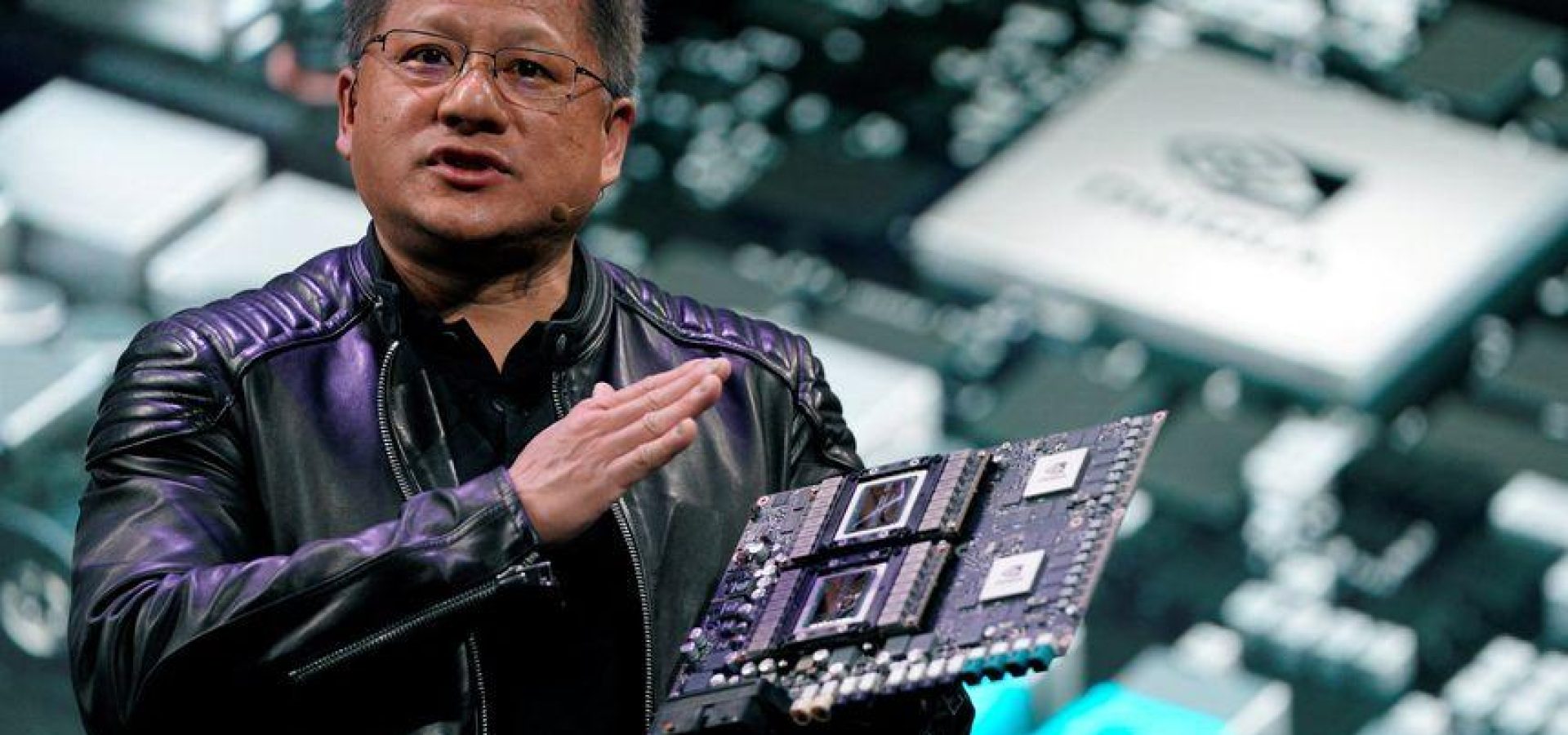

Nvidia (NVDA) saw its shares ascend by 2%, reaching a new peak before trimming some of the gains. This movement highlights Nvidia’s commanding presence in the market, now exceeding tech giants Amazon and Alphabet in market capitalization, with a remarkable figure of $1.83 trillion. Nvidia’s year-to-date stock increase of over 50% positions it as a central figure in the race towards a $2 trillion valuation.

Lowe’s Companies, Inc. (LOW) also captured attention in Monday’s trading, benefiting from a JPMorgan upgrade to a new price target of $265, up from $210. The stock rose by 3%, reflecting increased optimism in the home improvement sector, driven by falling mortgage rates and expected demand growth.

Market Trends and Analyst Insights Offer a Positive View

The overall market sentiment remains positive, supported by stronger-than-anticipated corporate earnings, notably within the tech sector. Analysts regard JPMorgan’s positive outlook on Lowe’s as reflective of wider market trends, where lower mortgage rates are predicted to stimulate home improvement projects. Additionally, the market is keenly observing the Federal Reserve’s actions, with potential interest rate cuts in 2024 likely to impact both the housing market and retail sectors further.

Key financial disclosures and updates, such as the Consumer Price Index (CPI) and earnings reports from major companies like John Deere, Coca-Cola, Airbnb, and Kraft Heinz, are eagerly anticipated. These reports will be crucial in assessing the economic landscape and shaping investment decisions.

Nvidia’s Leading Role in Market Capitalization

Nvidia’s standout performance not only demonstrates its industry leadership but also signifies a change in market capitalization dynamics. With its valuation now surpassing that of Amazon and Alphabet, Nvidia solidifies its status as a significant force in the technology sector. This development is part of the larger race to reach a $2 trillion market cap, a feat currently achieved only by Microsoft and Apple, underscoring the competitive and innovative nature of the tech industry.

As investors navigate through economic indicators, corporate earnings, and Federal Reserve policies, they remain alert to opportunities amid market fluctuations. The focus on companies like Nvidia and Lowe’s showcases the dynamic aspect of stock market investments, where industry trends and company performance significantly influence investment strategies.

COMMENTS