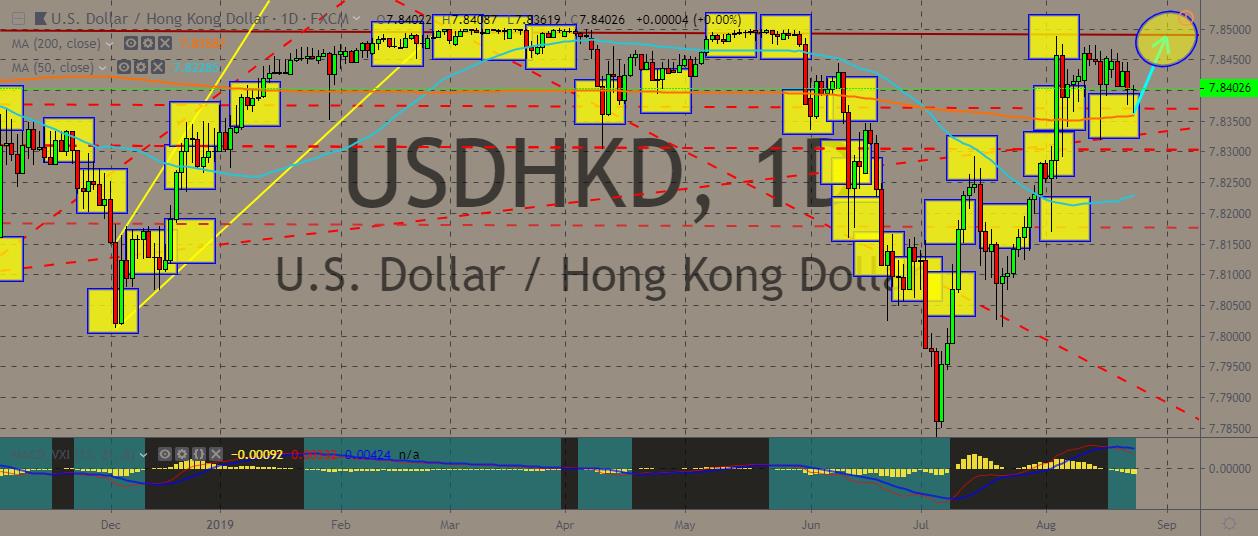

USDHKD

The pair has recently climbed up the charts from record lows in recent weeks, with the price going above the 200-day and 50-day moving averages on the daily charts. It’s now headed downward again with the 200-day MA acting as its solid support. Hong Kong is now preparing for another wave of protest as the pro-democracy protesters continue the fight to its 12th week. Over the weekend, the city will be seeing further demonstrations and a “street test” of the its international airport. Multiple protests are also set to happen on Friday. The peg between the greenback and the Hong Kong currency could prove to be a weakness of the city if the financial markets start to turn sour. That would mean a double-damage blow for the city’s economy. The Hong Kong dollar peg system has been in effect for 36 years, and it has supported the economy during several major economic crises, even during the SARS epidemic in 2003.

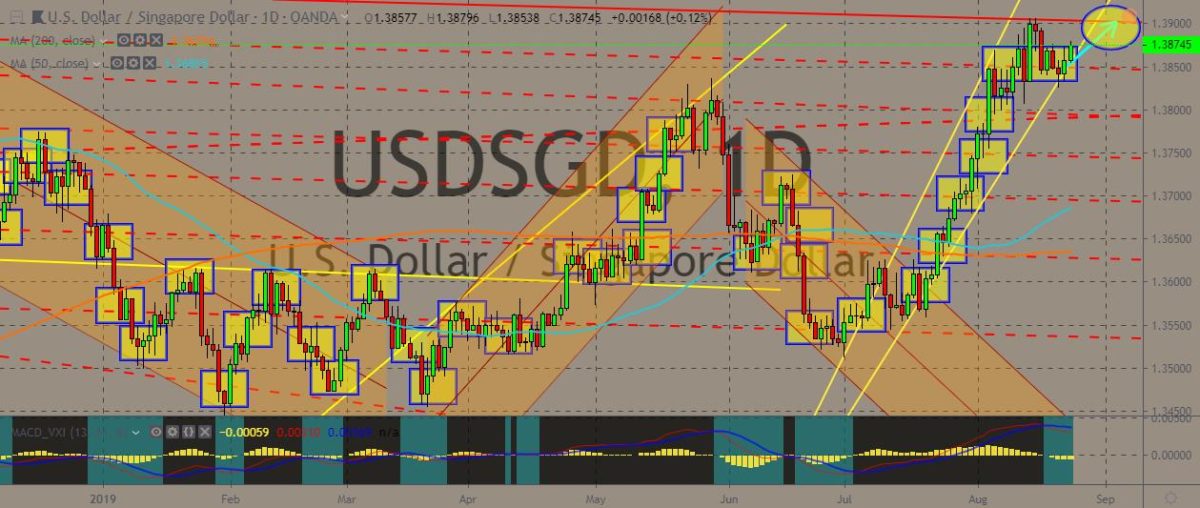

USDSGD

The USDSGD pair has traded upward the daily charts in the past two months, posting record highs. However, recently the Singaporean dollar managed to cut the US dollar’s rally against it, whipsawing in the last trading sessions. In Singapore, the economy has surprising attracted large amounts of investment commitments. During the first half of 2019, the country got $8.1 billion in investment commitments in manufacturing and services. For the same period last year, it only attracted $5.3 billion worth of commitments. It indicates that the near-term growth concerns and higher operating costs and manpower issues did not discourage companies with money to spare. The top investors in the city continue to be from the United States and Europe. Among such companies are Micron, Facebook, and Dyson. On the other hand, actual spending may still be much lower. It’s also not clear weather Singapore is benefitting from the US-China trade war.

EURDKK

The EURDKK has already confirmed the death cross in the past week, and, from there, the pair appears to be in a freefall, with prices diving into record lows in months and breaking a solid support level not touched for months. That comes despite the surprise upside in various European PMIs amid talks of recession incoming. The European Purchasing Manager’s Index (PMI), especially that from Germany, came better than expected. The German PMI clocked in at 43.6 for August, and that’s higher from 43.2 in July. Even so, that figure is still way inside the contraction territory. On the DKK side, US President Donald Trump recently cancelled a planned visit to Denmark after Danish Prime Minister Mette Frederiksen rejected Trump’s idea that Denmark could sell Greenland to the United States. Officials from Copenhagen and Nuuk, capital of Greenland, had been firm in their refusal to consider the sale of the place.

EURTRY

The pair is trending down within a channel. On the daily charts, the 50-day MA is appeared ready to cross the 200-day MA below it. And should a death cross become confirmed, prices will probably continue going downwards. The lira has weakened, however, in recent weeks as investors become concerned for the potential impact of speedy loan growth after a central bank decision to lower the required reserves limits and boost returns for lenders with more than 10% loan growth. Additionally, concerns about the developments in Syria also dragged down market sentiment after Ankara said that an air strike on a Turkish military convoy in northwest Syria happened and caused three fatalities in civilians. The Syrian attack is a continuation of the Syrian violations of last year’s ceasefire agreement. Last September, Turkey and Russia agreed to turn an area into a de-escalation zone where acts of aggression are prohibited.

COMMENTS