Here are the latest market charts and analysis for today. Check them out and know what’s happening in the market today.

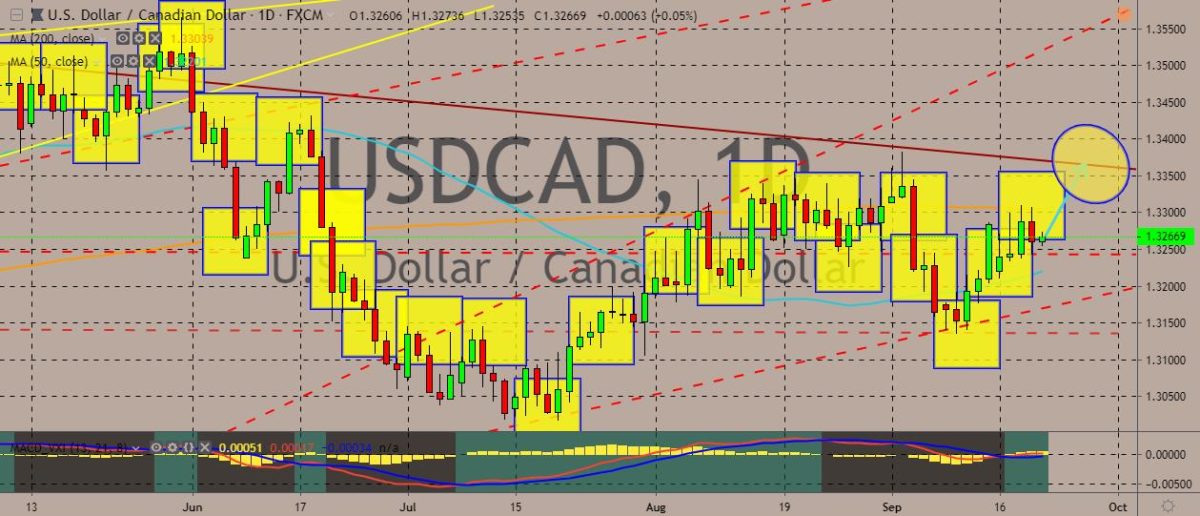

USDCAD

The pair is back from recent lows in recent weeks, with the short-term trajectory overall bullish. It has also recently slipped down the 50-day moving average to almost reach recent record lows. Now it appears testing to breaking the 200-day moving average. The greenback was largely robust against the Canadian dollar. This is in spite of the trade pessimism weighing commodity-linked currencies. The pair apparently offers less important to oil price pessimisms. On the buck side, White House economic adviser Larry Kudlow and Michael Pillsbury, who is President Donald Trump’s adviser on China, provided less than upbeat sentiment over the US-China trade negotiations. Over in Canada, the country’s July month retail sales will be in the focus. Markets are expecting sales to be higher for the month. Two main drivers would be higher gasoline prices and higher auto sales.

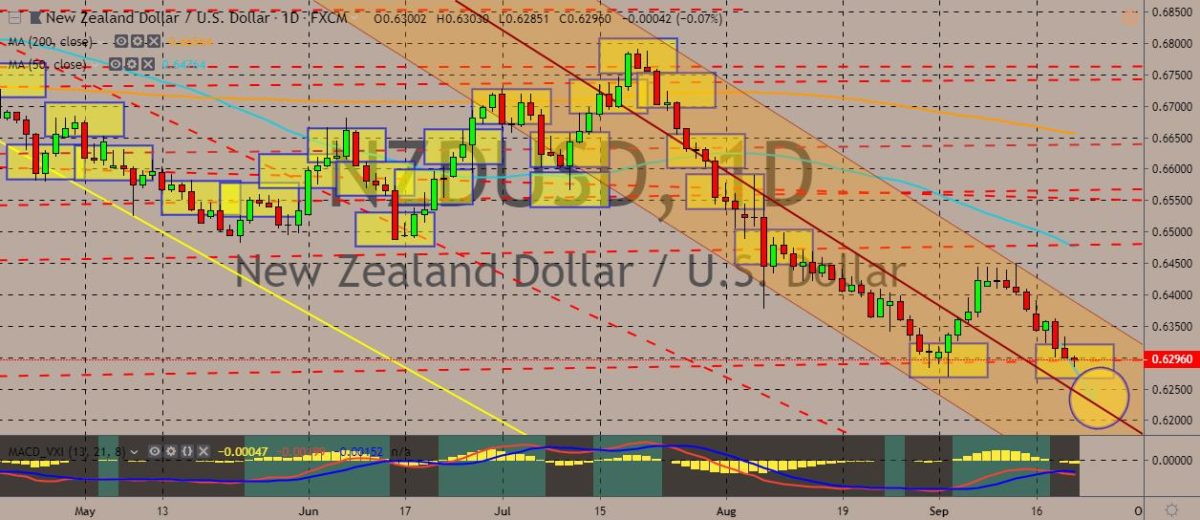

NZDUSD

The NZDUSD is suffering from weakness this week, with continued decline to recent lows after previously attempting to climb up, effectively forming a retracement direction. The pair is largely weighed down by the headlines over the US-China trade deal. Over in New Zealand, the gross domestic product (GDP) perked up by 0.5% over the June quarter. Over the same quarter last year, it rose 2.1%, although this still falls in line with the general economic activity slowdown. In the March quarter, there was 0.6% rise, marking a quarter-on-quarter rise of 2.5%. The figures fell in line with the Reserve Bank’s forecast for the GDP. Last month, the RBNZ recognized slower growth over the last year and bigger headwinds. It cut the official cash rate by a 0.5 of a point to 1.0%–larger than what the markets and analysts expected. With the figures for economic data and the actions of the central, the cuts are probably warranted.

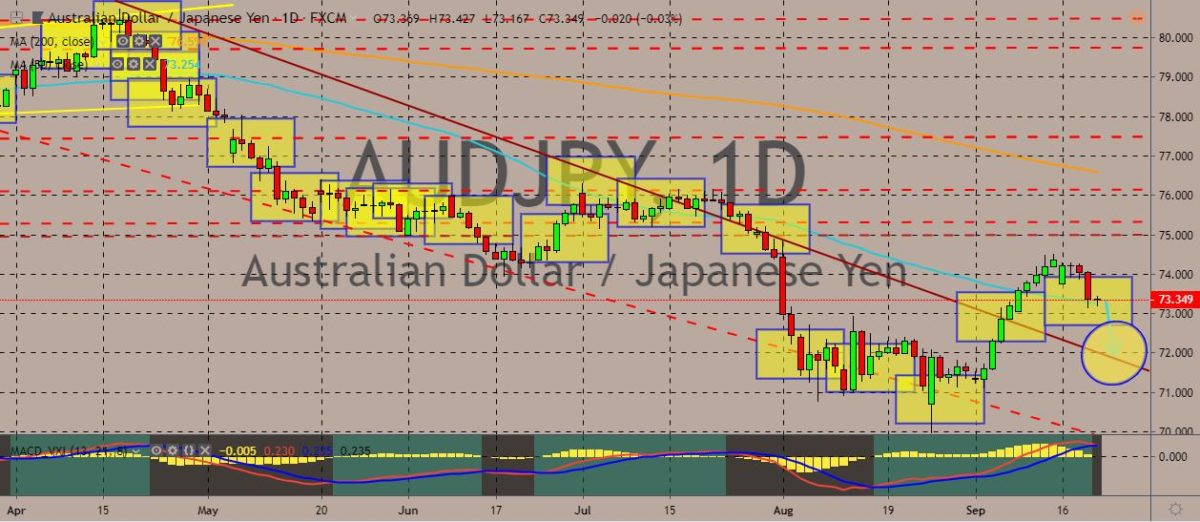

AUDJPY

The pair jumped up the charts in recent weeks but now appears to be retracing that jump towards the 50-day moving average. Should the pair close a session below the 50-day MA, the pair could back to recent low. Australia’s central bank held its key interest rates at record lows recently, a decision that the markets largely expected. Next month, expectations of a rate cut to a record-low of 0.75% have mounted. Major banks are predicting that, saying that the RBA stated that the unemployment rate will need to fall to 4.5% in order for wages growth to increases sufficiently for consumer inflation to return to the 2% to 3% target. If that happens in October, it would be the third time this year that the bank reduced the borrowing costs, after the back-to-back rate cuts in June and July. The government has repeatedly said that it’s not ready to significantly boost spending to revive growth and inflation.

AUDUSD

The pair slipped into the negative zone in the previous trading session, with the markets speculating whether it could quickly bounce back. The recent sentiment around the US-China trade deal has been mixed as the US visit of a delegation of 30 Chinese officials led by Vice Finance Minister Liao Min kicks off. Although Kudlow and Pillsbury aren’t very much optimistic, the US Agriculture Secretary Sonny Perdue betted on optimism as he spotted Chinese officials’ willingness to visit US farms. Over in the China, media said firmly that the Asian country wasn’t anxious to hammer out a deal with the US. Overall, the pair would be driven by the lack of positive drivers in Australia in its next move. No major data are set to be released on the economic calendar. Traders will scour trade and political headlines to spot fresh clues over the possible trajectory of the trading pair.

COMMENTS