Here are the latest market charts and analysis for today. Check them out and know what’s happening in the market today.

EURCAD

The pair is expected to break down from a major support line, sending the pair lower toward its 30-month low. The relationship between the European Union and Canada is sitting on uncertainty following the looming Canadian Federal Election on October 21, 10 days before the United Kingdom is set to leave the European Union. Canada extend its ratification of the EU-Canada free trade agreement (FTA) to pave way for the United Kingdom to draft its temporary tariff rates in line with the World Trade Organization (WTO). This is expected to benefit Canada as it will be able to weigh down which agreement will benefit the country the most. The United Kingdom reassured the Canadian government that the country will avoid a no-deal Brexit as much as possible as worries among investors looms that the messy Brexit will affect trade agreements. Histogram and EMAs 13 and 21 will continue to go lower.

CADCHF

The pair will fail to breakout from 200 MA, sending the pair lower towards 50 MA. In 2018, Switzerland was named the most resilient economy, followed by Canada. However, 2019 had tested emerging economies as the trade war between the United States and China escalates. Trump had also waged a trade war with its neighbors, Canada and Mexico, and its allies in Europe, particularly with the European Union. Recently, Canada cut its benchmark interest rate in response to the slowing global growth. Analysts foresee a possibility that Canada might enter a negative interest rate territory to keep its economy afloat. Switzerland on the other hand, has been in negative rates for years, making it easy for the economy to weight uncertainty in the global market. Aside from this, Switzerland has diversified trading deals, including one from China. Histogram and EMAs 13 and 21 will fail to crossover.

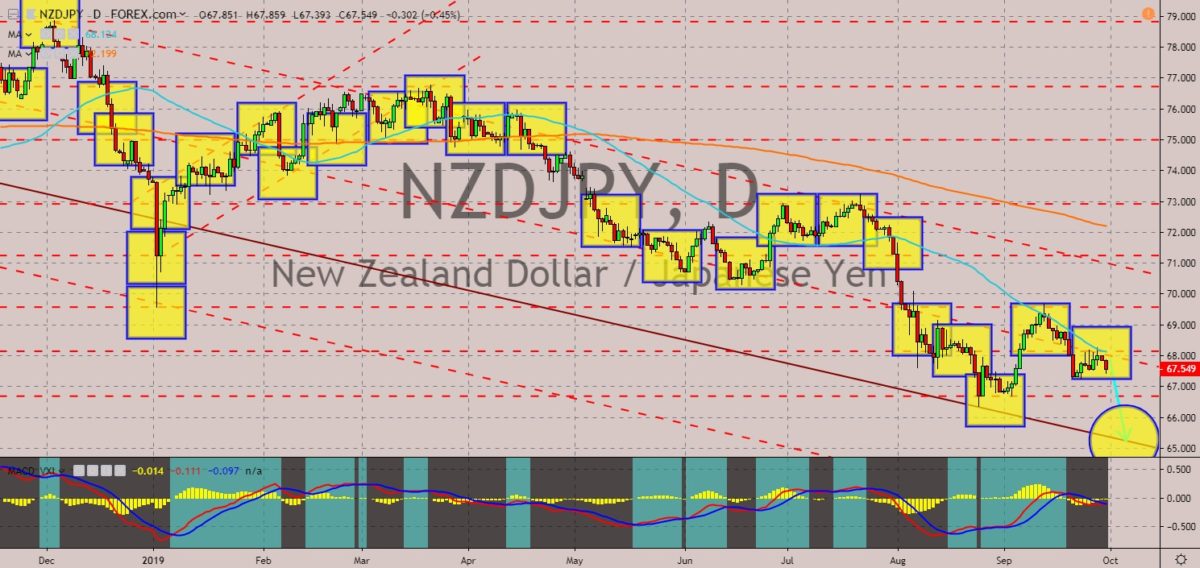

NZDJPY

The pair failed to breakout from 50 MA, sending the pair lower towards a downtrend channel support line. New Zealand Prime Minister Jacinda Ardern met with Japanese Prime Minister Shinzo Abe to strengthen the relationship between the two (2) countries amid the slowing Australian economic growth. In the past few months, New Zealand has been the headlines of different news channels and websites as the country plans to move away from the influence of Australia. In line with this, PM Ardern’s move against the Christchurch bombing attacked was praised by different leaders. On her recent meeting with U.S. President Donald Trump, he tweeted that the meeting was “wonderful”. Australia on the other hand, is an economic rival of Australia in the region and strengthening its alliance with New Zealand is expected to benefit the country. Histogram and EMAs 13 and 21 will continue to move lower.

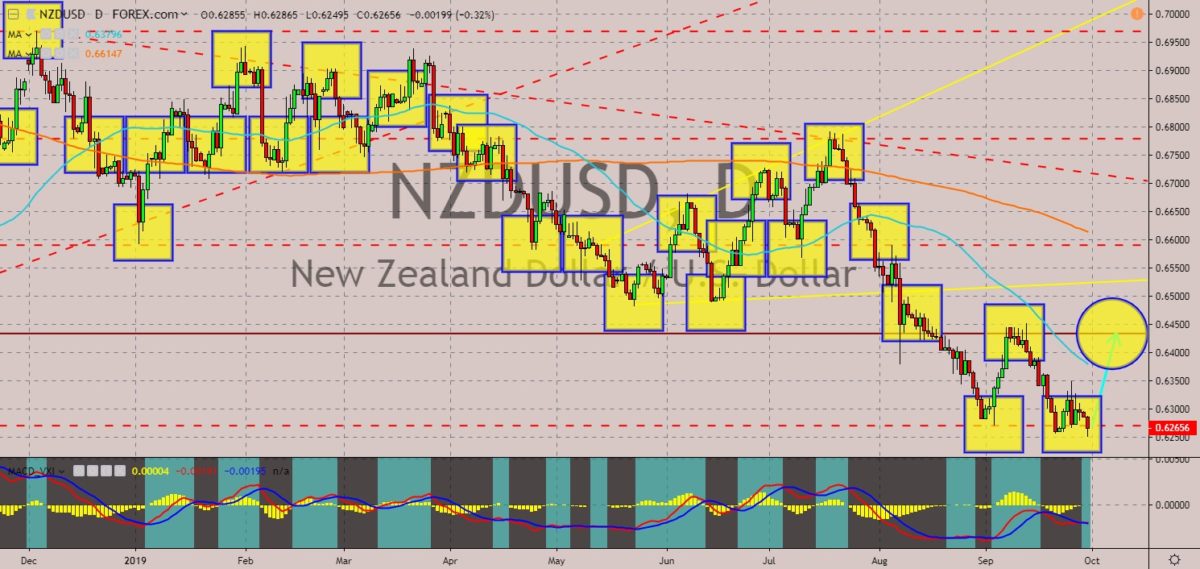

NZDUSD

The pair is expected to bounce back from a major support line, sending the pair higher toward its previous high. Worries were shunned with the successful meeting between U.S. President Donald Trump and New Zealand Prime Minister Jacinda Ardern. Trump tweeted and described the two (2) world leader’s meeting as successful. The meeting has been long anticipated after PM Ardern showed what analysts described as a solution for U.S. gun control. Despite this, the relationship between the two (2) countries remained strong. This has been New Zealand’s latest push to diversify its allies and trade agreements. New Zealand is a signatory of the post-Brexit trade agreement. It has also a standing trade agreement with the European Union. Aside from that, PM Ardern recently visited China to renew the country’s relationship with them. She also met her Japanese counterpart, Prime Minister Shinzo Abe, in Japan.

COMMENTS