Here are the latest market charts and analysis for today. Check them out and know what’s happening in the market today.

GBPNZD

The pair has jumped back to the trading channel it’s established before, although it doesn’t appear that it would follow the same trajectory as the fundamentals for the British pound threat more volatility for the currency. In recent trading sessions, the pair traded in the red. Still, the 50-day moving average lies above the 200-day moving average, indicating bullish sentiment among traders. For the Brexit saga, Prime Minister Boris Johnson will encourage the Parliament to support his Brexit proposal as he is on the final bid to get the United Kingdom to leave the European Union by the end of the month. If the MPs choose to support the deal, they will then have to approve an intensive three-day schedule that will be used to consider the legislation. According to the opposition MPs, this will not be enough time to scrutinize the bill. On the flipside, ministers have insisted that they have the numbers to fetch an approval for the Withdrawal Bill.

USDCNH

The pair is trading on an uptrend just below the 50-day moving average, with the prices on top of a solid support line. It has been having difficulty gaining a solid volume in the recent previous trading sessions. The Chinese yuan is largely expected to trade higher than 7-per-dollar even if the US and China managed to hammer out an official partial deal. Earlier in the month, the two economic superpowers have appeared to agree on some kind of deal after the high-level trade negotiations in Washington. At present, a partial trade deal is being ironed out between the two sides. Meanwhile, US commerce secretary said that an initial US-China trade deal doesn’t need to be finalized in November. This comes despite US President Donald Trump’s comments that he would like to sign a deal when he meets with Chinese President Xi Jinping during next month’s APEC summit. According to Wilbur Ross, it’s more important that it’s a proper deal.

USDTRY

The pair is still trading sideways, with no clear bias for either the upside or the downside. Prices have fluctuated along with the escalation and de-escalation of tensions over the Turkish invasion on the Kurdish-led forces in Syria after Trump decided to withdraw US troops from the place. Recently, top US foreign affairs lawmakers and multiple European allies condemned both Trump’s decision to withdraw American troops from Syria and the Turkish invasion in a joint statement. The signers said that they “deeply regret” the recent events, saying that the abandonment of the Syrian Kurds to be wrong. Two weeks ago, Trump suddenly decided to withdraw US troops out of border areas, even though Turkey has warned that it would invade and attack the US’s allied Kurdish-backed fighters. In the joint statement, the lawmakers called on the European Union and its member states to take responsibility and intervene for an immediate and sustained joint action.

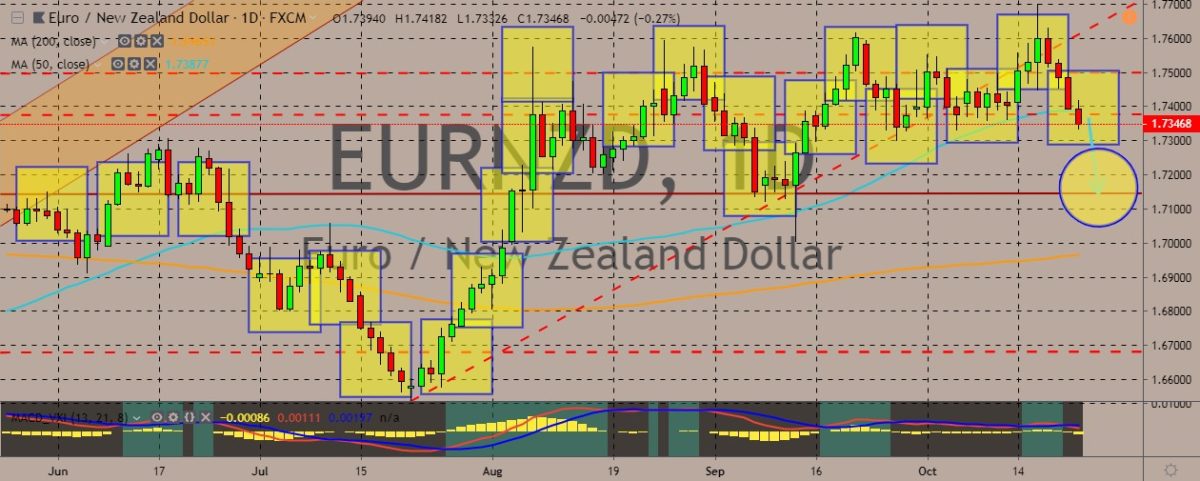

EURNZD

The pair has traded in the negative territory for the last week, with prices weakening to below the 50-day moving average, indicating a prevailing bearish sentiment among the pair’s traders. Over in the European Union, the next EU economic affair commissioner, Paolo Gentiloni, said in a published article that the EU is in need of less restrictive budget policies. Gentiloni said the EU’s deficit and debt rules needed to be reviewed and updated. According to him, the economy was faltering and slowing down, and it cannot be left to monetary policy alone to stimulate the economy. According to him, it’s time for countries which have fiscal policy capabilities to use it, “in an overall context of less restrictive budgetary policies.” Gentiloni, who is former Italian prime minister, warned that officials shouldn’t overlook the prolonged period of low growth. Gentiloni is set to replace Pierre Moscovici as economic and financial affairs commissioner on November 1.

COMMENTS