Here are the latest market charts and analysis for today. Check them out and know what’s happening in the market today.

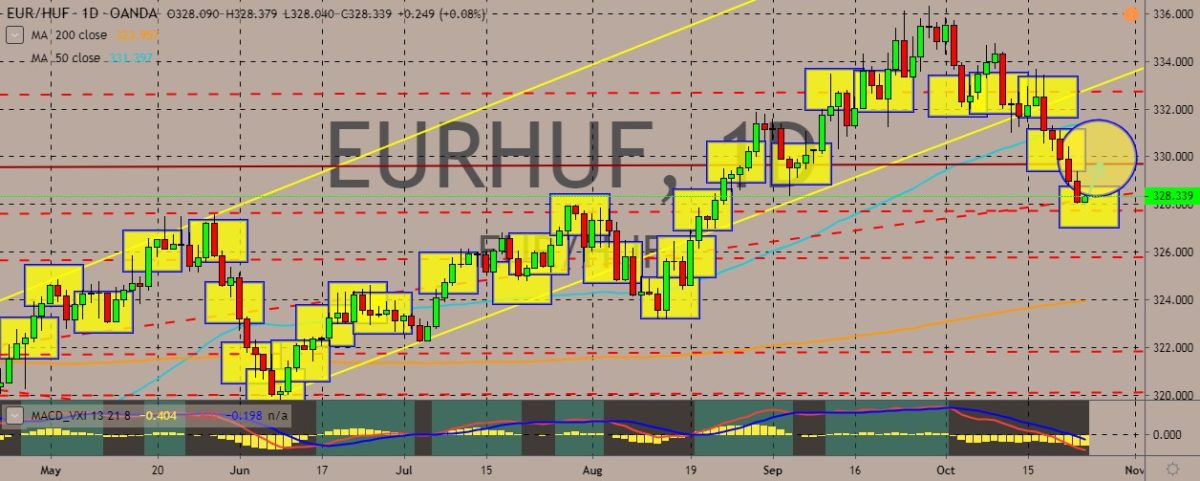

EURHUF

The pair is trading in the green in the current session after days of slumping. During the previous sessions, the exchange rate of the pair crossed below the 50-day moving average. It has since hit a solid support. European Council President Donald Tusk said that the Turkish military campaign in northwest Syria should be withdrawn, and that “any other course means unacceptable human suffering…and a serious threat to European security.” This was taken as an indirect criticism to Hungarian authoritarian prime minister Viktor Orban, who was the only European leader to openly support the Turkish military attack on Syria. After the US military pulled out from Syria, Turkish President Recep Tayyip Erdogan rolled out a military campaign to purportedly eradicate terrorism. However, the Turkish force has also been targeting Kurdish fighters, who fought alongside the US side against the Islamic State, the terror organization destabilizing the country.

EURSEK

The pair is trading in the red, but it set to clock in a higher low as it continues to traverse the upward-trending trading channel, although it has broken below the 50-day moving average. Over in Sweden, the central bank is seen to be holding its benchmark rep rate unchanged at its meeting later in the week. The rates are likely to remain at the current level of -0.25% through the year 2020 and beyond. The Riksbank’s latest forecast was made in September, and it has guided spectators for a rate hike late this year or early next year. However, due to slowing domestic economy and uncertainty over developments in international trade, the bank will probably postpone its plans. Meanwhile, others in the market expect that the Riksbank may have to wait until December before it lowers the rate path. After years of robust growth, the economy has hit a hitch, hurt by a trade war between the US and China, Brexit worries, and a slowdown in eurozone.

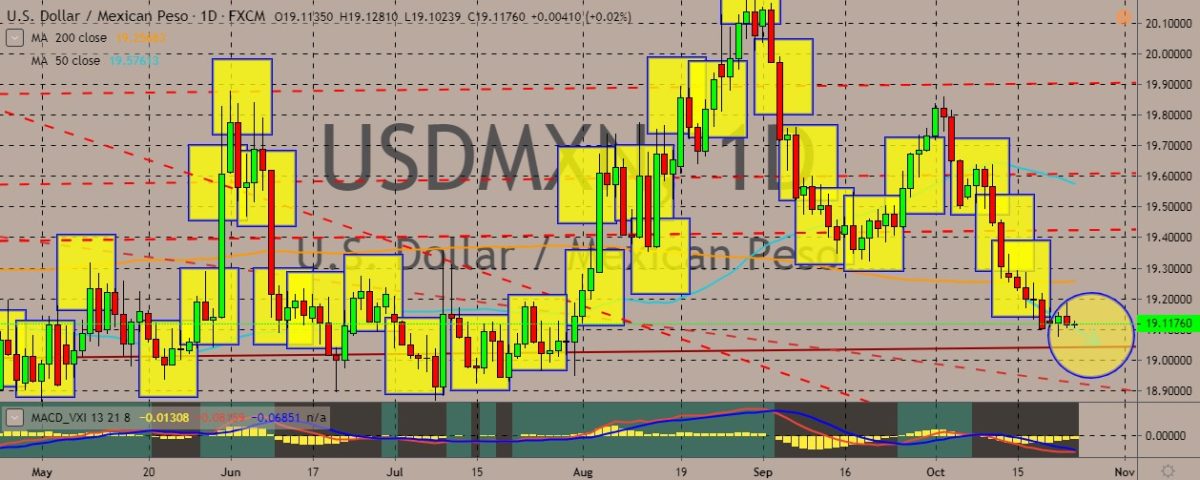

USDMXN

The pair is trading lower on the daily charts, with the price now trading sideways after plummeting and breaking below both the 50-day and 200-day moving averages. US Trade Representative Robert Lighthizer met this week with Democratic lawmakers with a view to resolve the concerns about the US-Mexico-Canada trade agreement (USMCA), with Republicans increasing pressure to get the deal hammered out by the end of 2019. Democrats said that they have been making some progress despite the criticism from US President Donald Trump and some Republicans who accused them of stalling a vote on the deal. The agreement is set to replace the North American Free Trade Agreement (NAFTA), which goes way back to the ‘90s era. On Wednesday, Lighthizer and other US trade officials met with a working group of Democrats in the House of Representatives, according to three sources with direct knowledge of the matter.

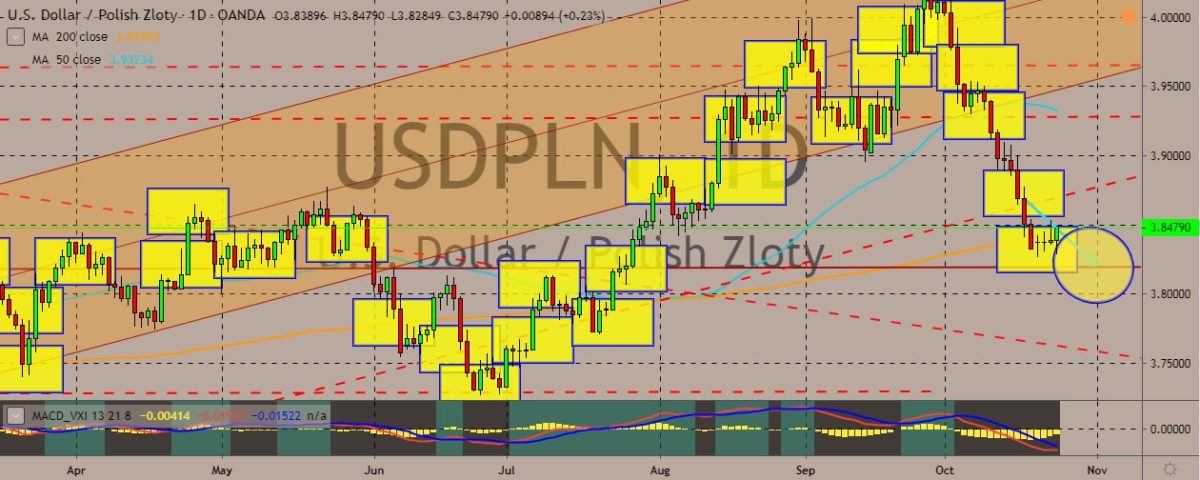

USDPLN

the pair is currently trading sideways with low trading volume after plummeting to two month lows, slipping below the 200-day moving average after previously diving below the 50-day counterpart. Poland’s general government deficit in the second quarter of the year is seen to be at 48.1% of the gross domestic product, according to Eurostat, an EU statistical office. In the first quarter, Eurostat determined the country’s deficit reached 49.1% of GDP. Meanwhile, according the Polish Economic Institute (PIE), a hard Brexit may decrease the country’s GDP by 0.24% because of the slump in exports. In case the Brexit ends with a deal, GBP will slump by 0.14%. As for other economic figures, headline CPI slumped but the services prices jump in September, indicating that the core inflation remains on the upside. CPI decelerated in September to 2.6% year-on-year from 2.9% in August. Core inflation grew 2.3% year-on-year in September.

COMMENTS