Here are the latest market charts and analysis for today. Check them out and know what’s happening in the market today.

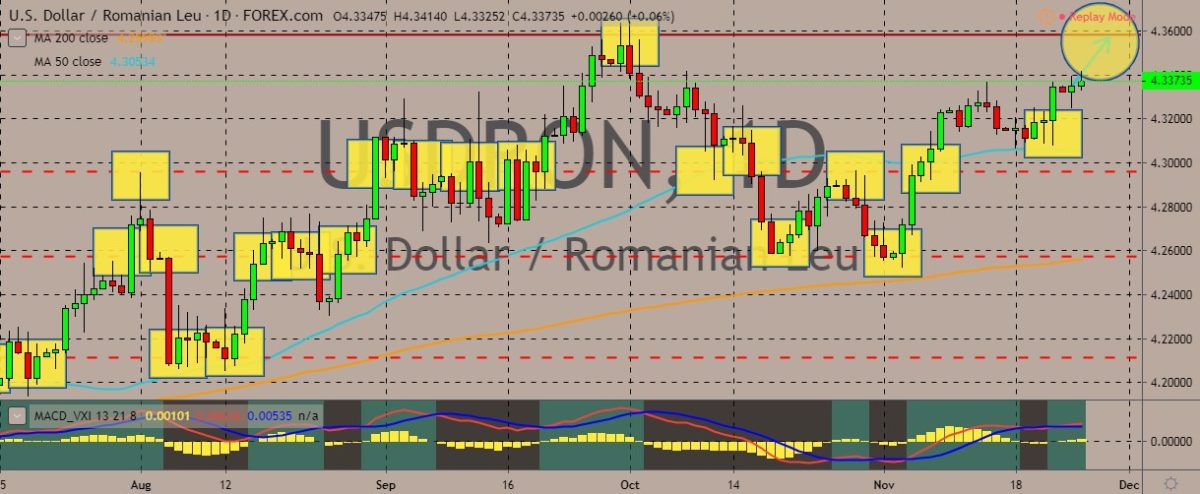

USDRON

The pair is trading in the green, with prices trading above the 50-day moving average, indicating bullish sentiment among traders. Over in Romania, banks’ outstanding loans to the non-government sector grew 7.5% year-over-year to 268.3 billion leu in October. This compares to the 7.7% growth recorded in September, according to the central bank. Private lending in the leu increased by 9.7% to 179.3 billion leu in October on a year-on-year basis. Meanwhile, the country’s M3, which is the broadest metric of the country’s money supply, rose by a nominal 9.8% year-over-year to 404.4 billion leu in October. CFA Romania, which is an association of investment professionals, said that the economic activity in the country is expected to improve in the next 12 months. The index regarding the economic situation in the country in the next 12 months was 49.2 points in October, higher than the figure recorded in September.

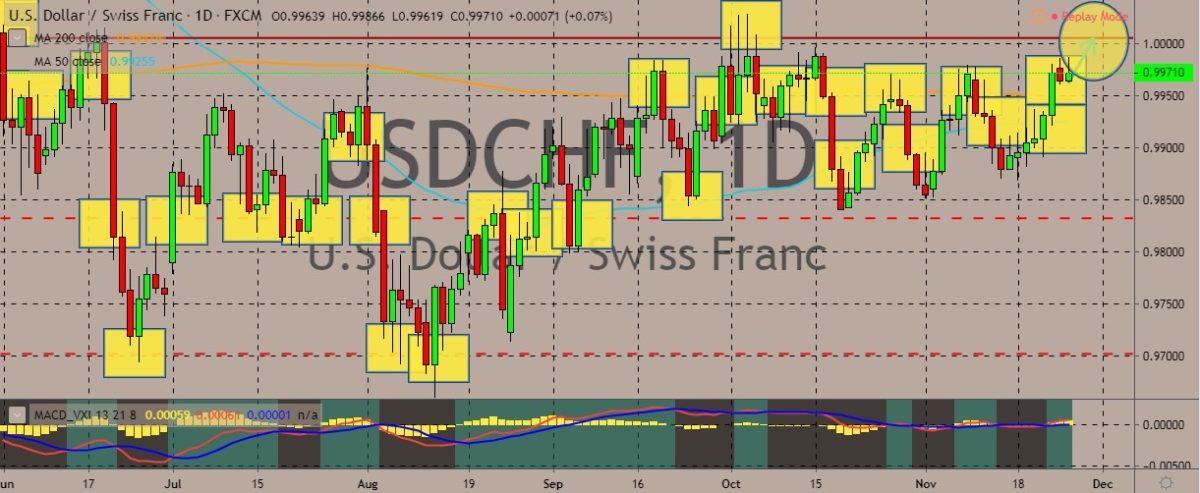

USDCHF

The pair is trading in the green after slumping in the previous session, which ended the rally it was pursuing in the week. It has crossed over the two moving averages, both 50-day and 200-day, and now it is attempting to rally above those levels. Over in Switzerland, traders are awaiting economic figures. There has been a notable drop in investor expectations as sentiment continues to be softer in recent months during the ongoing slowdown in the European region. Meanwhile, the country’s government said it was revamping its system to report suspected money laundering or terrorism financing. As for the US dollar, performance has been tepid as traders weren’t too eager to make moves while the US-China trade talks continue. The Chinese Ministry of Commerce said in a statement that the two countries had “reached consensus on properly resolving relevant issues,” although it did not add any further details.

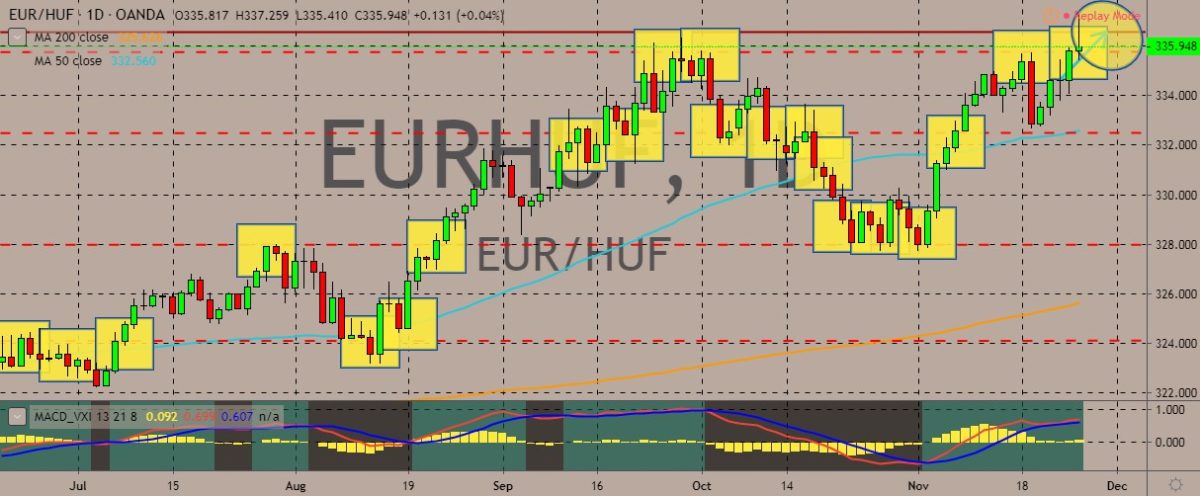

EURHUF

The pair has pared its recent losses and now trades in the green, rallying above the 50-day moving average, although moves are pretty limited. The Hungarian forint has been weak, hitting new historical low. According to the local news, the weakening of the forint can be attributed to the weakening economy of western Europe, which is Hungary’s first trading partner, compounded by the risks caused by Brexit uncertainty. The Hungarian National Bank is keeping the central bank base rate of the forint at an all-time low of 0.9%, and this is also cited as a contributing factor. So far in the year, the currency has already lost 4.6% of its value. The central bank still sticks to its accommodative stance as economic growth is widely anticipated to slow in the country next year from nearly 5% this year. Although no immediate comments from the central bank were available, it has previously announced that it had no exchange rate target.

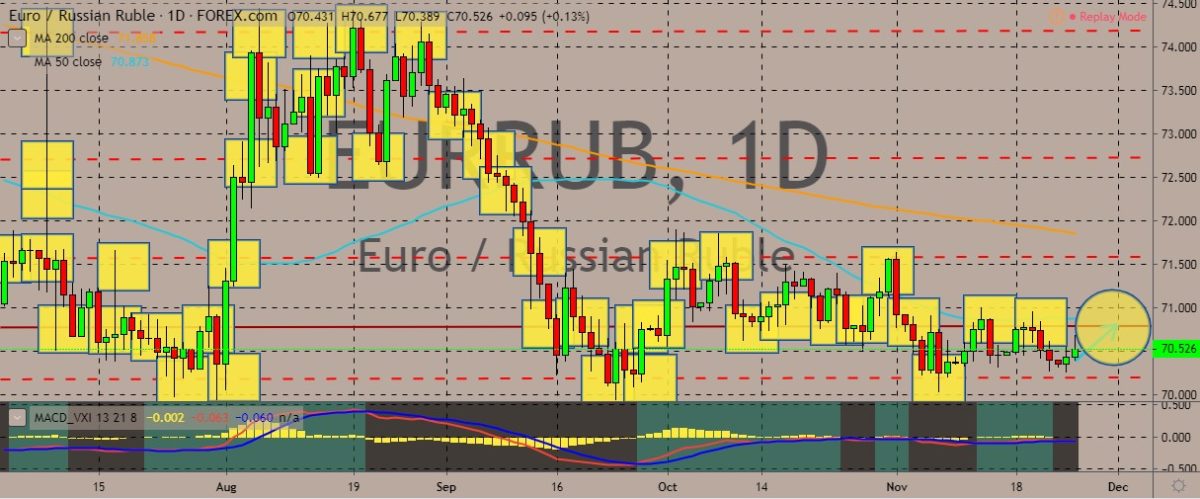

EURRUB

The pair still trades at the lower levels of the charts, with limited movements below the 50-day moving average. The price has attempted to break above that aforementioned level but failed to move significantly and fell back within tight ranges. Over in Russia, the central bank is warning Russian lenders against making operations in euros, as per governor Elvira Nabiullina. Nabiullina said that doing business in euros brings no profits to Russian banks because of the negative interest environment in the eurozone. At the same time, the Russian central bank is pushing financial institutions not to have “excessive” foreign currencies on their balance sheet. Despite the bank’s preference for Russian banks and households to save in rubles, the growth in deposits denominated in foreign currencies has growth by more than twice the rate of ruble savings this year. At present, Russians hold $96 billion in foreign currencies with local banks.

COMMENTS