Here are the latest market charts and analysis for today. Check them out and know what’s happening in the market today.

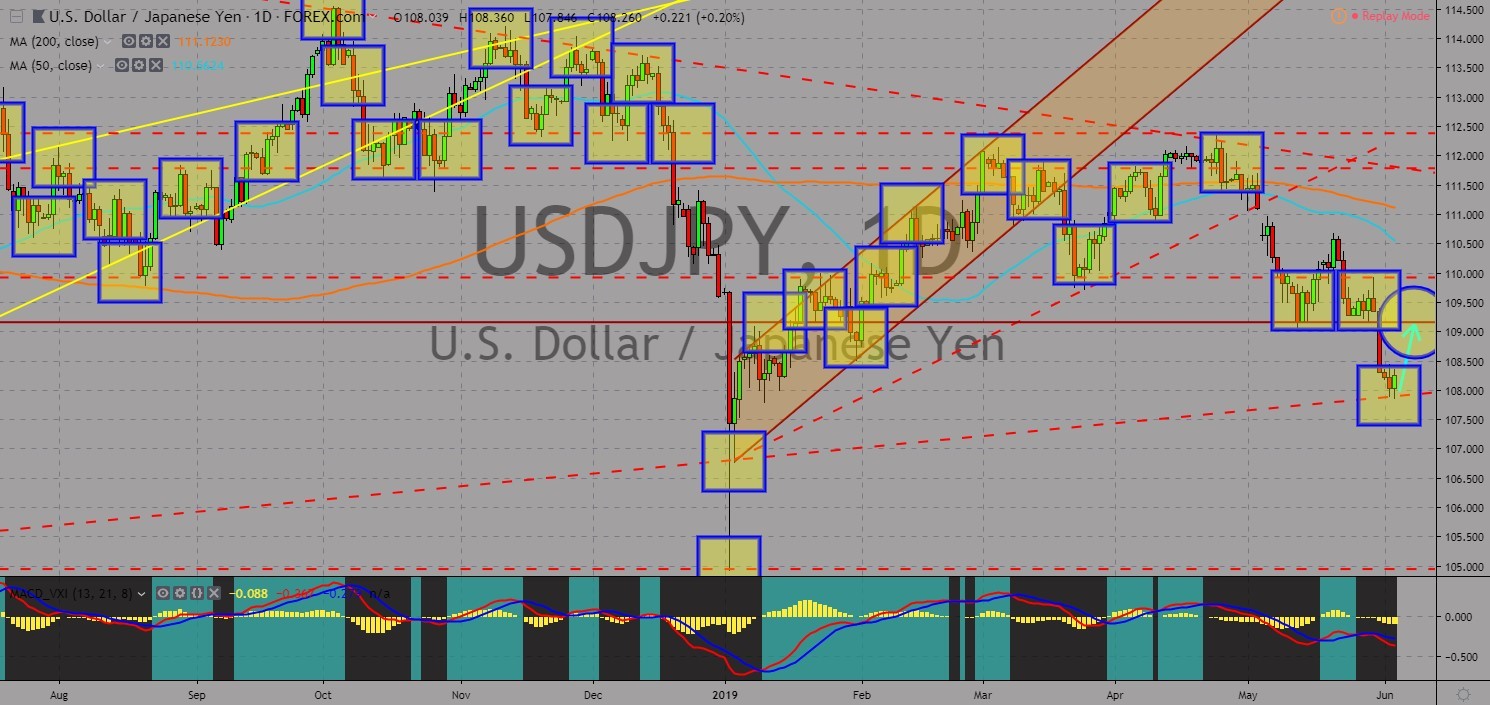

USDJPY

The pair was expected to bounce back after it found a strong support line, sending the pair higher towards its nearest resistance line. The United States and Japan were in a renewed relationship following the visit of U.S. President Donald Trump in Japan to meet the new Japanese Emperor Nahurito and to held talks regarding a bilateral trade agreement between the two (2) powerful economies. President Trump will be back once again in Japan for the G20 Leaders Summit by the end of June. Despite the positive momentum on the two (2) countries relationship, Trump had threatened that he will impose tariffs on Japan and EU’s auto manufacturing industry but agreed to delay it for another 180 days. However, the failure by the United States and China to end their trade war threatened to repeat the same scenario with the U.S. and Japan. Histogram and EMAs 13 and 21 will reverse in the following days.

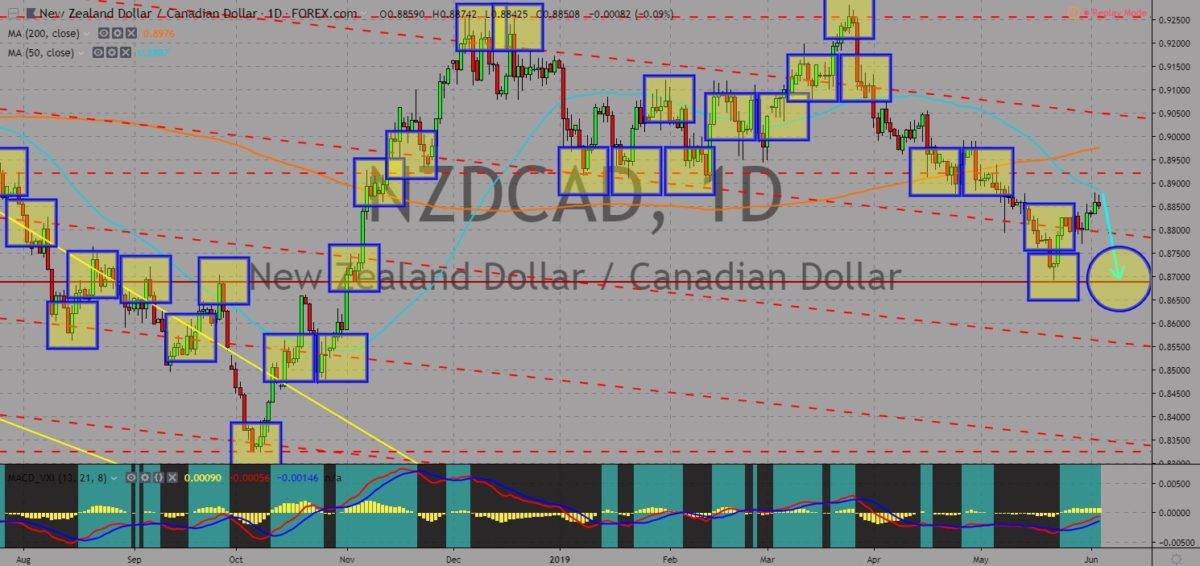

NZDCAD

The pair was expected to fail to break out from 50 MA, which will send the pair lower towards its previous low. New Zealand and Canada were the next in line with Australia and Japan on leading the pacific rim trade pact, the CPTPP (Comprehensive and Progressive Trans-Pacific Partnership). Just like Japan and Australia, the two (2) countries were in different position when it comes to global issues. However, the recent partnership of Japan and Canada to the Germano-Franco Alliance led “alliance of multilateralism”, gave the two (2) countries an unprecedented influence in Europe. New Zealand on the other hand, had stayed neutral, with the country signing a post-Brexit trade agreement, while maintaining its existing trade relation with the European Union. Investors are wary of investing in the region after Australia entered a recession (based on GDP per capita). Histogram and EMAs 13 and 21 will fall lower in the following days.

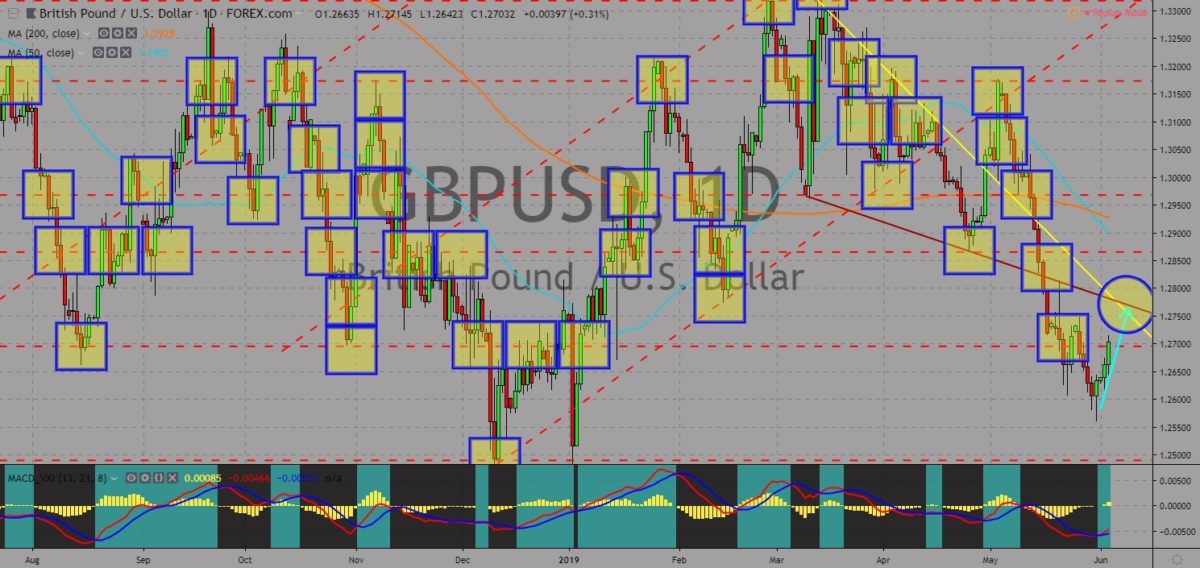

GBPUSD

The pair was seen to recover after it was sold heavily in the past few days, which will send the pair to a rally. The United Kingdom was in an uncertain position after the Brexit extension until October 31, the country’s participation during the recently hold European Parliamentary Election, and the resignation of UK Prime Minister Theresa May. However, the prospect of a new PM was giving a little hope for the United Kingdom that it will have an orderly Brexit. U.S. President Donald Trump had recently visited the UK to hold talks with PM May and the Brexit ministers to discuss the planned bilateral trade agreement between the two (2) countries, which was supposed to take effect after the UK officially withdraw from the European Union. PM May will be leaving the office on June 07, Friday. Histogram and EMAs 13 and 21 was now poised for an upward movement.

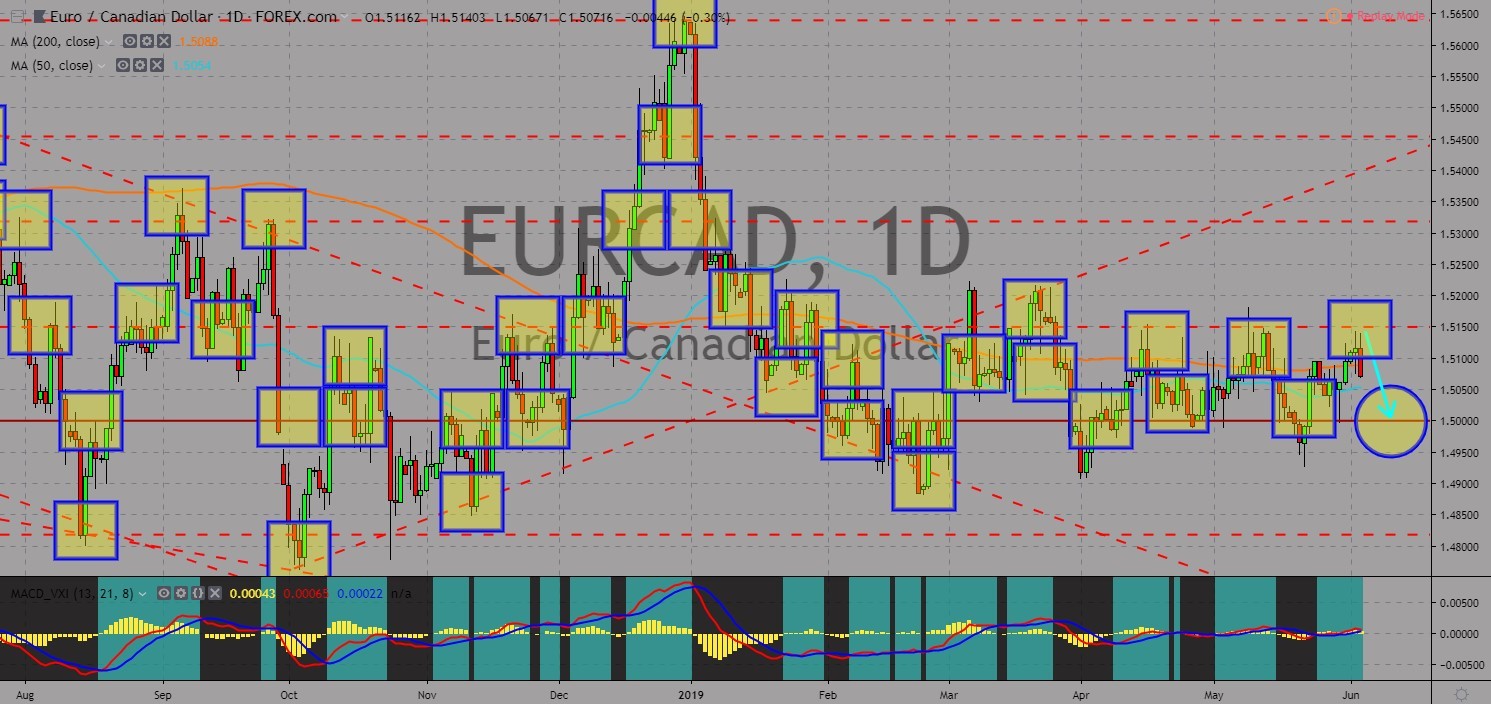

EURCAD

The pair failed to breakout from the channel’s resistance line, sending the pair lower towards its support line. Canada and Japan had recently joined the Germano-Franco led “alliance of multilateralism”. Canada had also recently given a green light by the European Parliament to conduct a bilateral trade agreement with the country, while Japan had ratified the EU-Japan free trade deal, which became the larges trading zone in the world. However, Canada was seen to be more reliant of the pacific rim trade pact, the CPTPP (Comprehensive and Progressive Trans-Pacific Partnership), on which Japan and Australia is leading. Japan was also a key influence for the revival of Canadian economy following its rift with the Kingdom of Saudi Arabia after a peace advocate was jailed and China’s retaliation with Canada’s arresting of Huawei’s CFO. Histogram and EMAs 13 and 21 will move lower in the following days.

COMMENTS