Here are the latest market charts and analysis for today. Check them out and know what’s happening in the market today.

USDSEK

Many traders are selling the pair in recent trading sessions, with price moving lower and toward the 200-day moving average. For this pair, the 50-day and 200-day moving average often act as solid resistance and support lines. At present, the 50-day MA services as resistance, while the 200-day MA serves as support. If this pattern is followed, the next move of the pair may be north of the long-term MA. But if it breaks below that level, it may plummet towards July lows. Over in Sweden, the central bank is expected not to go with the flow of global monetary policies by increasing rates even as the economy starts to soften. Surveys showed that manufacturing sentiment skidded to its slowest since 2012 and the third-quarter growth was weaker that Riksbank expected. However, the bank is scheduled to end its love affair with negative interest rates during the pre-Christmas meeting.

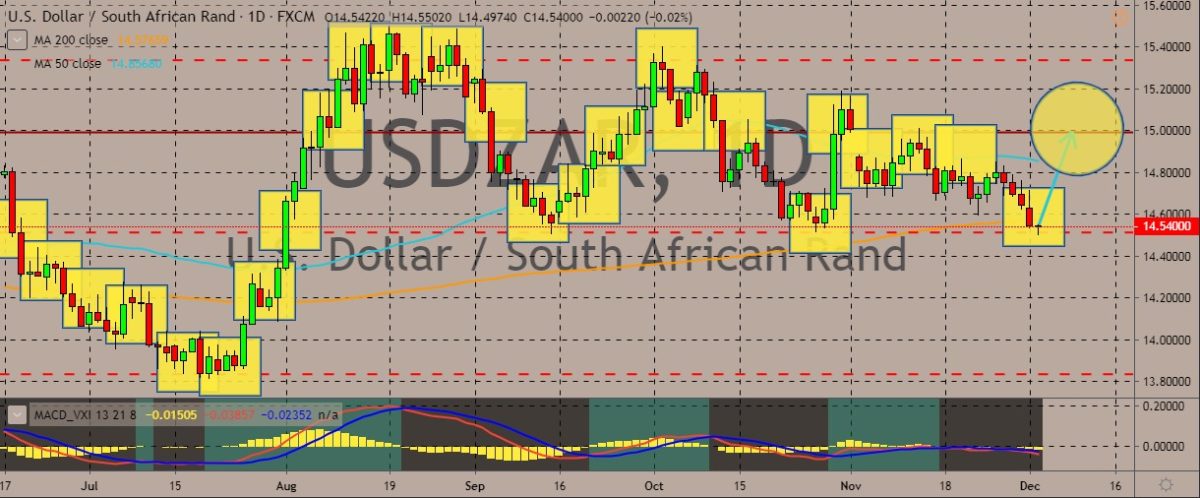

USDZAR

The pair is still trading within ranges, which have been getting tighter in the previous month. The 50-day MA and the 200-day counterpart are also serving as support and resistance levels, both getting closer to each other. In the medium-term bearish moves could be expected from the pair, but short-term patterns suggest that a move upward is also very likely. Over in South Africa, economic growth data for the rest of the year could be disappointing, according to professional services company PwC. Only two of the indicators used to measure the health of the economy showed some improvements during the third quarter. In the second quarter, the economy grew by 3.1% on a quarter-on-quarter basis, which helped South Africa sidestep a technical recession after a contraction in the first quarter. However, PwC said that the recent quarter-on-quarter and year-on-year data pointed to a bleak outlook for the economy.

USDRUB

With the tight space between the 50-day and 200-day moving averages in recent sessions on the daily chart, prices have moved with little volume on either direction. At present, traders are selling the pair, pushing prices toward the 50-day MA that’s serving as a support line. For sentiment, traders are getting bearish on the pair. For fundamentals, a head of the International Monetary Fund mission said that further interest rate cuts by the Russian central bank would be appropriate given that inflation has been falling. Structural reforms are also being advised to speed up the growth of the economy. So far this year, the central bank has slashed its key rates four times. Most recently, it cut 50 basis point off of the rate, pushing it down to 6.5%. Despite the cuts, economy growth has so far been tepid. IMF mission leader James Roaf said that weak domestic demand and an unfavorable foreign environment have held back growth.

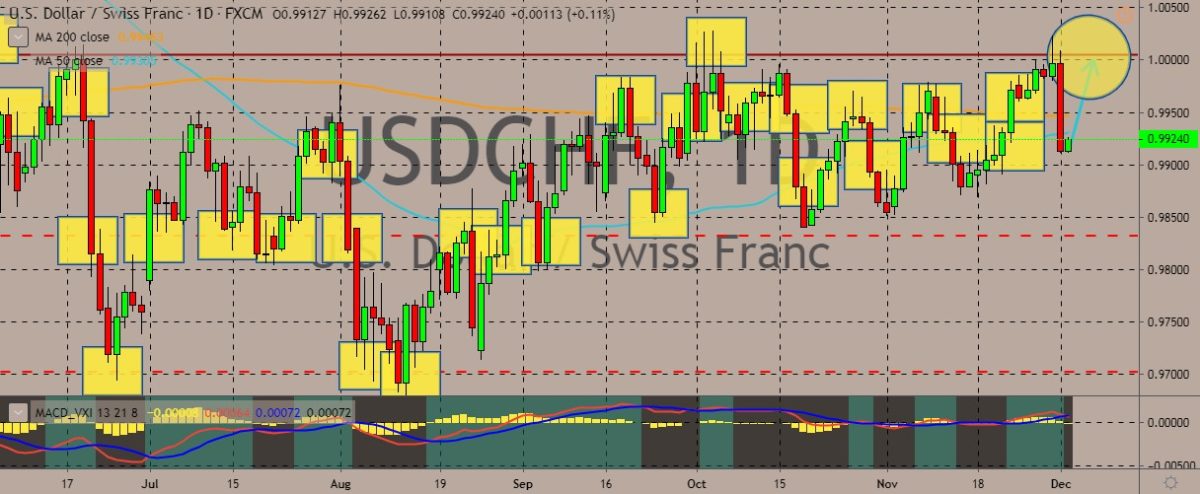

USDCHF

Plunging from weekly highs, the pair is trading just below the 50-day and 200-day MA now. The pair continues its zigzag, sideways pattern on the daily charts, although indicators show that the sideways trend may be set to change soon. At present, the US dollar is trying to pare back its losses to the Swiss franc. The greenback gets some boost from US President Donald Trump’s announcement of plans to reinstate steel and aluminum tariffs on Brazil and Argentina. This announcement comes after the release on Monday of new data from the Institute of Supply Management. The data noted that the manufacturing activity in the US contracted in November, falling to 48.1 and failing to meet expectations. Traders still remained focused on the US-China trade talks, with uncertainty still looming large after Trump said that the signing of two legislations to support Hong Kong protesters wouldn’t help negotiations, but China still wants the deal.

COMMENTS