Here are the latest market charts and analysis for today. Check them out and know what’s happening in the market today.

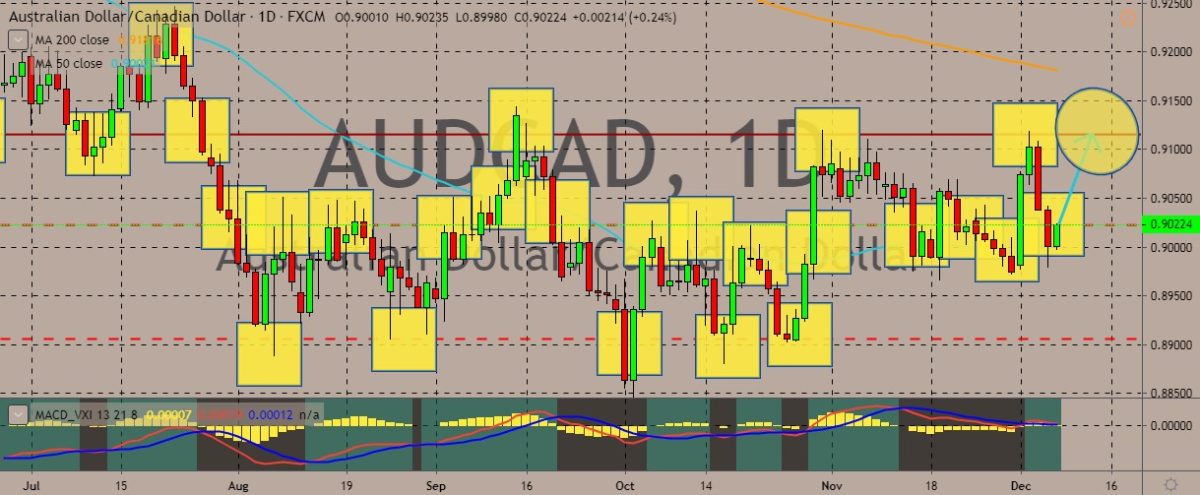

AUDCAD

The pair is trading in the green today, attempting to pare back its losses in the previous session after it slipped from weekly highs to the 50-day moving average. Overall, the trend is sideways, with bias on the upside. The moves for each currency in the pair were driven largely by the decisions of their respective central banks. Both the Reserve Bank of Australia and the Bank of Canada decided to hold rates steady. The RBA held the cash rate at a record low of 0.75%, which is widely expected by economists. The decision came amid the release of lackluster set of GDP figures. Meanwhile, the Bank of Canada’s October estimates for global economic growth appears to be solid, while there is nascent evidence that the global economy is stabilizing with growth, which slowed down in the third quarter of 2019 to 1.3%, as widely expected. Consumer spending improved slightly, thanks to stronger wage growth.

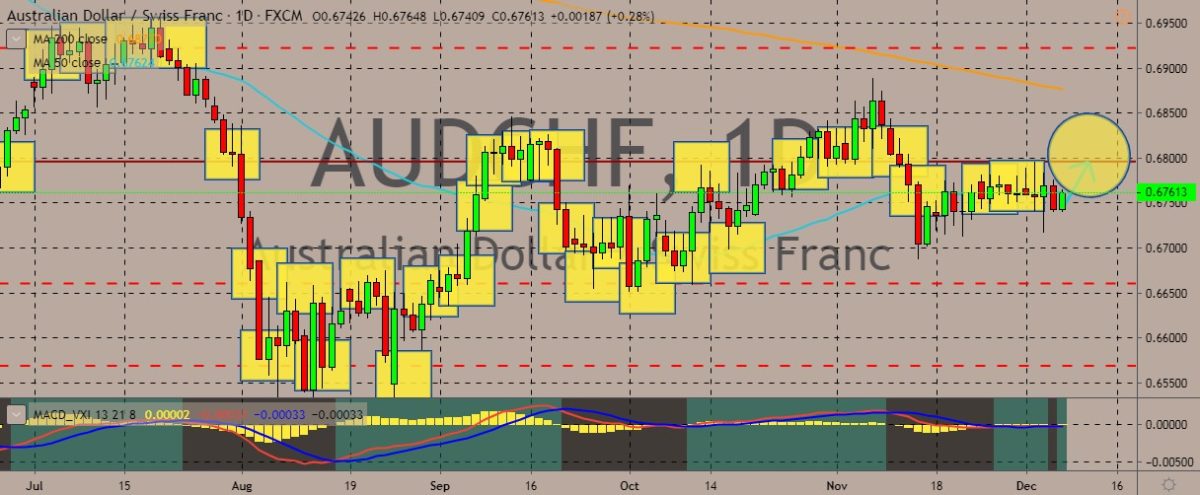

AUDCHF

The pair is trading within tight ranges, with the prices using the 50-day moving average as support line, although recent moves have been below this level. The Swiss franc, which is perceived as a safe-haven asset, weakened due to the ongoing optimism over the US-China trade negotiations. However, markets still tiptoe on the mixed messages coming from US President Donald Trump, who has said that a trade deal might have to wait until after the 2020 US Presidential elections but also said that trade talks have been going very well. Back in Australia, data showed that the economy expanded by an underwhelming 0.4% in the September quarter. Annual growth trend sits at 1.7% in spite of rising from the previous quarter’s 10-year low. The quarterly increase undershot market estimates of 0.5% growth as domestic final demand stayed subdued and the household sector underperformed.

GBPJPY

The pair has perked up in recent sessions, reaching multi-month highs. However, the pair traded weakly in the most recent session. This could be an opportunity for traders to lock in profits and then buy for lower prices; a buying opportunity, overall. Another indication that the price could be set for a stronger uptrend is the confirmation of the golden cross by the 50-day and 200-day moving averages. The outlook for the British pound remains semi-bullish as it continues to grind higher against major rivals. Traders, meanwhile, could expect a bit of volatility because of the upcoming UK elections. However, it appears that the Conservatives will continue to run the Parliament. If that happens, markets will have some semblance of certainty, which is something that the British pound needs. The election will be on December 12, and it is expected to be a decisive moment in the history of the Brexit debate.

CADJPY

The pair is trading near weekly highs, with the price pulling back from recent gains to head to the 50-day moving average. Moves depended on the updates coming from the Canadian central bank and the government. Despite the risks and uncertainties spurred by the US-China trade war, Bank of Canada deputy governor Timothy Lane says that the Canadian economy is resilient. His wording was also careful. He said that while Canada was resilient, it was also not immune to the turmoil. The Bank of Canada has stood out from many of its global peers, which have mostly opted to cut rates and adopt a looser monetary policy to combat the weakness in the global economy. In the US, the Federal Reserve Bank has cut its key interest rates three times this year. Meanwhile, Lane suggests there is no reason for the BoC to follow the US Federal Reserve’s moves. According to him, decades show that the US and Canada have followed different paths.

COMMENTS