Here are the latest market charts and analysis for today. Check them out and know what’s happening in the market today.

USDPLN

The pair has been largely trading in the green, rising above both the 50-day and 200-day moving averages and climbing to a one-month high. The momentum appears solid for the US dollar, with the Polish zloty bulls losing to bears. Over in Poland, legal chaos with the European Union ensued, deepening dramatically after the Polish government and the high court judges clashed over who administered justice. According to experts, such rift could adversely affect the young democracy the country has and eventually lead to a breakup with the EU. The right-wing populist governing party has attempted to take control of Poland’s court system since it took power in 2015, reportedly eroding the courts’ independence from politics. Last week, the party took two huge steps toward assuming full control of the legal system: passing legislation that enables government firing of judges with rulings it didn’t like and expressing explicit defiance of a Supreme Court resolution.

USDILS

The pair appears to be struggling to break above a key resistance line on the lower levels of the chart, with bears and bulls reluctant to take the lead as they weigh the simmering tensions between the US and Israel and Palestine. Palestinian President Mahmoud Abbas has warned Israel and the US not to cross “red lines,” as tensions simmer over the release of US President Donald Trump’s peace plan, which is expected to be heavily tilted in Israel’s favour. Trump previously said he would probably release the details of the plan this week after inviting Israeli Prime Minister Benjamin Natenhayu and opposition leader Benny Gantz for talks in Washington. There will be back-to-back meeting with the two as Trump prepares to release the long-delayed Middle East peace plan. The Palestinian leaders, however, have warned that no deal could work without them being on board. Trump has made some decisions that Israel liked while Palestine disliked.

USDSEK

The pair is drifting up the daily charts, climbing above the 50-day and 200-day moving averages and gaining momentum. Last week, Sweden’s government warned the country against slowing growth and rising unemployment. The country’s finance ministry said it expected the country’s economy to grow by 1.1% in 2020, lower than 1.4% it predicted last September. According to Finance Minister Magdalena Anderson, the slowdown was due to trade wars and the growing barriers for business, which have spurred uncertainty over trade in the future and could lead to reduced investments. She added that the dull economic growth in Germany had been a particularly nagging problem from the Swedish exporters. Also, the prognosis said unemployment would hit 7% this and next year, compared to the 6.4% it estimated in September. However, Anderson remarked that the country’s healthy government finance would allow the country to survive.

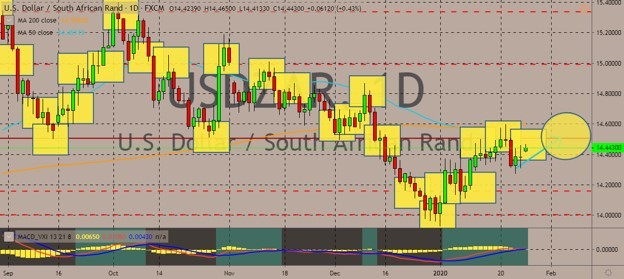

USDZAR

The pair is trading in the green although the momentum is a bit week, recovering from a previous decline. The South African rand previously strengthened against the dollar after the consumer price index picked up as expected in December. Headline inflation rose from 3.6% to 4% on the year. Price pressures continued to be within the South African Reserve Bank’s (SARB) target for inflation. This encouraged bets for more interest rate cuts in the next month, enabling policymakers to have more room to support the domestic economy. The South African rand is still vulnerable, however, if the US continues an aggressive attitude on trade and follows through with its threats of tariffs on EU exports, weakening market risk appetite. Also, the rand is also under pressure from fears over the coronavirus that’s spreading in China. As of press time, 2000 cases have been confirmed in mainland China while more than 50 people have died, all in China.

COMMENTS