Here are the latest market charts and analysis for today. Check them out and know what’s happening in the market today.

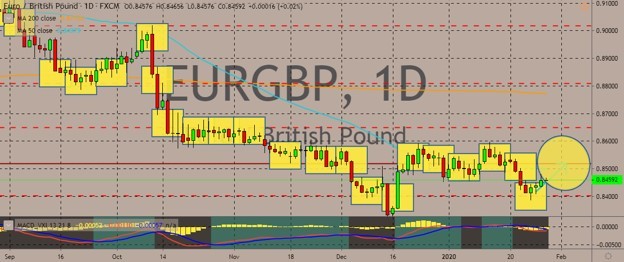

EURGBP

The pair appears to be gaining momentum to the upside now, with the euro trading in the green against the British pound and recovering from the two-month low it hit last week. Overall, the outlook is bullish for the pair as the British pound is facing some selling pressure ahead of the rate decision that will come from the Bank of England. That is true even if the rates turn out to be the same. Overnight index swaps are betting on a 50% chance that the officials will choose to cut the key rates by 25 basis points. The meeting will be on January 30, and it will also be Governor Mark Carney’s last time to chair as the leader of the BoE. Traders can expect that his farewell speech would have a particularly impactful effect on the markets. Ahead of the decision, Carney and other officials have debated about the merits of “near-term stimulus” amid the UK’s growth-sapping political fiasco. Currently, the UK is preparing to leave the European Union on January 31.

EURJPY

The pair is facing some selling pressure as traders now favour safe-have currencies, like the yen, over riskier ones amid the concerns surrounding the Novel coronavirus. Still, experts suggested that risk-off positioning has cooled off, although the world still remains wary of a dramatic escalation in the epidemic. Meanwhile in Japan, the government nominated Seiji Adachi to join the Bank of Japan’s nine-member board. Adachi is an economist known to be a staunch supporter of aggressive monetary easing. Adachi would replace Yutaka Harada, whose term expires on March 25. Effectively, Prime Minister Shinzo Abe kept the number of stimulus advocates the same. Abe’s selection has been under tight scrutiny by BOJ watchers searching for clues over his current stand on monetary policy amid the signals that achieving the inflation target may not be his top priority.

USDCAD

The pair is recovering from a recent slump that saw the Canadian dollar pare back most of its losses to the dollar in the last two sessions, slipping back to the 50-day moving average. The Canadian dollar rallied after investors became less fearful of the economic damage from China’s spreading coronavirus. However, today appears to be another weak day for the loonie, as investors couldn’t resist the appeal of the dollar’s safe-haven status amid the concerns of a global pandemic. The descent of the Canadian dollar started after the Bank of Canada’s January 22 interest rate decision, which saw the central bank keeping rates steady at 1.75% and trimming the 2020 economic forecast. Last December, the BOC warned that the rising trade tensions were the primary risk to the economy. But after the phase one trade deal was signed on January 15, Governor Stephen Poloz still issued a surprisingly dovish policy statement, catching the market off-guard.

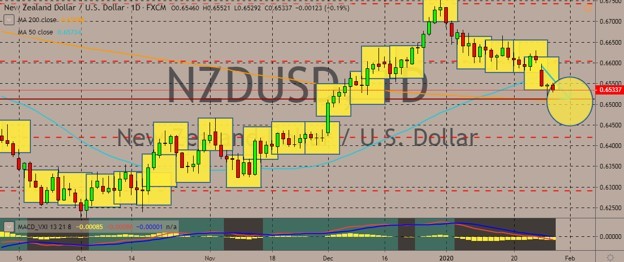

NZDUSD

The pair is still drifting to the downside, with the price slipping between the 50-day moving average (higher) and 200-day moving average (lower). Pressure appears to be on the kiwi as the dollar continues to benefit from the market’s fears of further coronavirus outbreak. Over in New Zealand, Reserve Bank of New Zealand’s Assistant Governor Christian Hawkesby said that lower NZD is helping to insulate the country’s economy, although a number of short-to-medium-term risks exist to both the upside and downside. Meanwhile, the RBNZ has endorsed a decision to select the central bank’s policy rate as a fallback option for the benchmark rate. Also, new figures confirmed that mortgage lending soared in December, with the amount of borrowed higher to almost $1.2 billion when compared with the same month a year earlier. The figures follow on from November, when almost $6.8 billion was borrowed.

COMMENTS