Here are the latest market charts and analysis for today. Check them out and know what’s happening in the market today.

EURCAD

The pair is struggling to break above the 50-day moving average on the daily charts, with the previous sessions ending in the negative even though prices have surged to multi-week highs during the sessions. The sentiment is still overall bearish. The euro is suffering from high downward pressure after recent data releases that showed the German economy, which has served as the powerhouse of the European economy for years, further contracted, according to IHS Markit data. Similar things have also been observed in the French economy. Meanwhile, Canadian dollar trades are focusing on the ongoing election campaigns in the country as well as the court hearing involving Huawei’s Chief Financial Officer Meng Wanzhou and the Canadian government. Recently, lawyers for Wanzhou argued that the Canadian authorities abused their powers and violated her rights, which the government rejected.

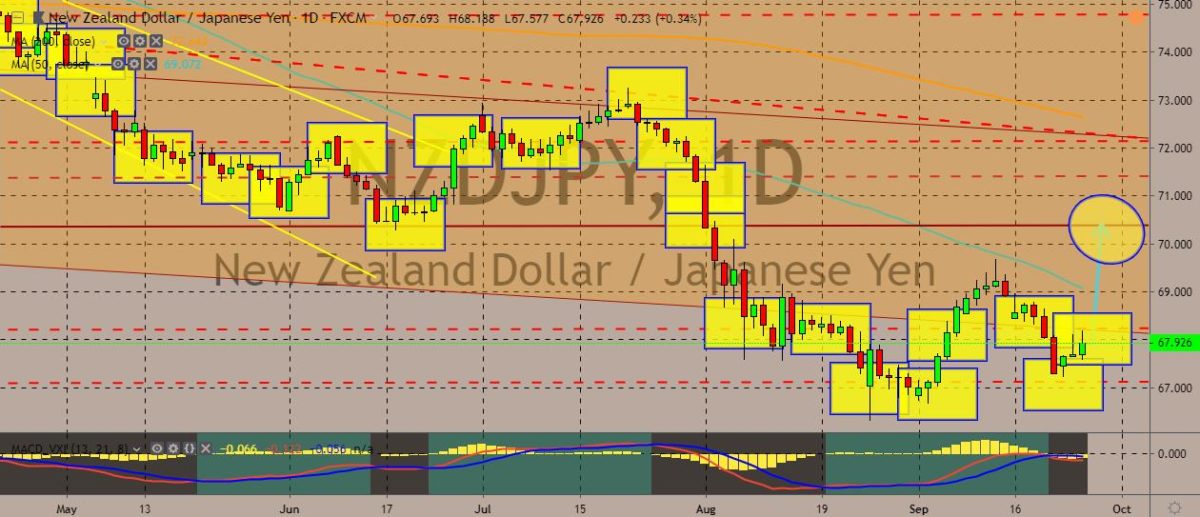

NZDJPY

The pair is back from recent lows, after falling to multi-month lows in the previous sessions. It’s still trading below both 50-day and 200-day moving averages on the daily charts, indicating largely bearish sentiment over the short-term. Over in New Zealand, the central bank said that there was scope to ease the monetary policy if needed on the back of the slowing economic growth and weak inflation. Last Wednesday, the Reserve Bank of New Zealand kept its official cash rate on hold. The Monetary Policy Committee said that the new information analyzed after the August decision “did not warrant a significant change” to the monetary policy. The OCR is still now at a record-low of 1%. This year, the RBNZ already cut borrowing costs by 75 basis points. That includes an unexpected 50-point cut in August. RBNZ Governor Adrian Orr said that the bank would watch, wait, and observe the domestic economy.

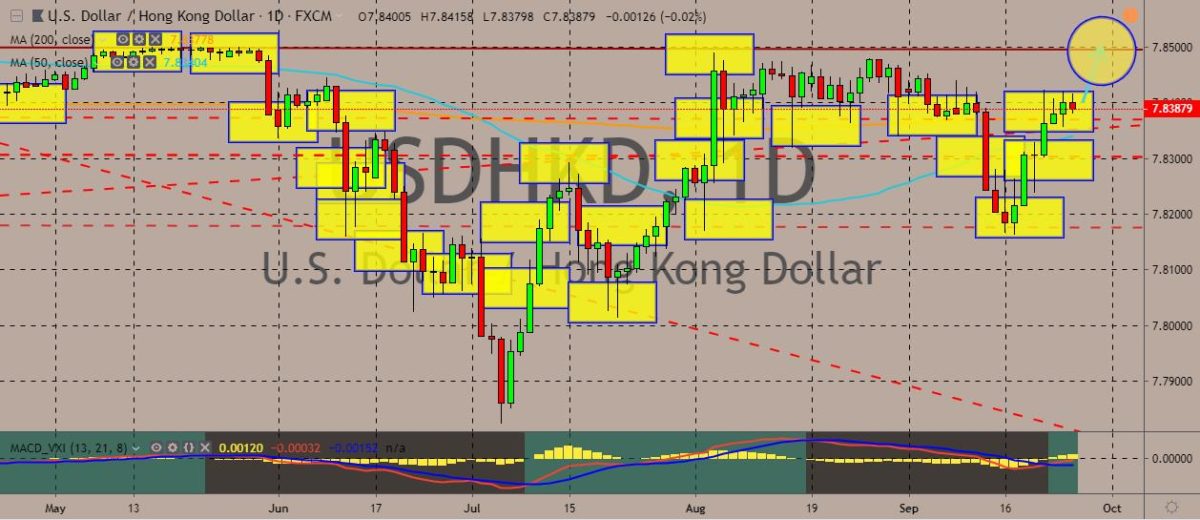

USDHKD

The pair recently traded in the red after consecutive sessions of trading in the green. The 50-day moving average appears poised to cross the 200-day moving average, indicating a sentiment over the pair that’s starting to get bullish. For the Hong Kong side, the Asian Development Bank has revised down its growth forecast for the region. The ADB said that the escalating tensions are dampening the economy. The lender said that it expects regional growth of 5.4% this year, and 5.5% in the coming year. These figures are slightly below their previous forecasts. In 2018, the Asian economies recorded 5.9% growth, but the weakening exports and investments have shrunk the region’s dynamics. The report also said that the trade conflict has damaged exports from industrializing countries that are suppliers to China of manufacturing materials. Then, the bank said that other developing countries, the growth will remain at 6%.

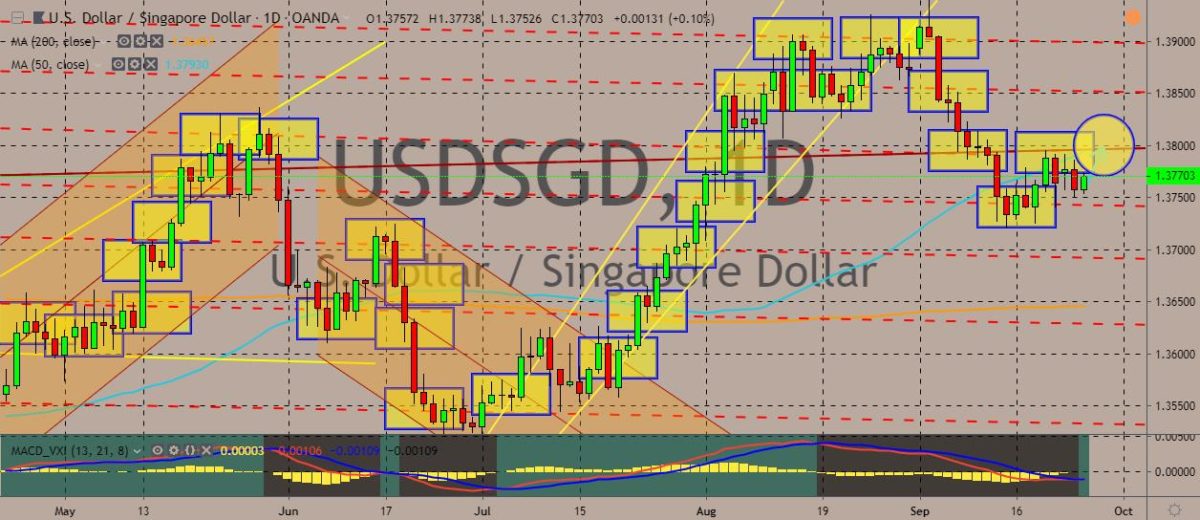

USDSGD

The pair has fallen to multi-month lows previously and then attempted to recover in recent sessions, although it appears to have some difficulty breaking about the 1.3800 level. Price is trading just below the 50-day moving average line, which still lies above the 200-day moving average. This indicates a largely bullish sentiment for the pair. Over in Singapore, the economy is expected to sidestep a technical recession on the third quarter this year. That’s because of the improvement in the manufacturing sector. Analysts expect the city state’s economy to register a growth of 0.4% on a year-on-year basis, and a growth of 2.1% on a quarter-on-quarter basis in the third quarter of this year. Further, inflation has continued to fall in recent months, but it will soon bottom out and rise steadily in the next months. The slip in inflation in the previous months was likely caused by lower electricity tariffs.

COMMENTS