Here are the latest market charts and analysis for today. Check them out and know what’s happening in the market today.

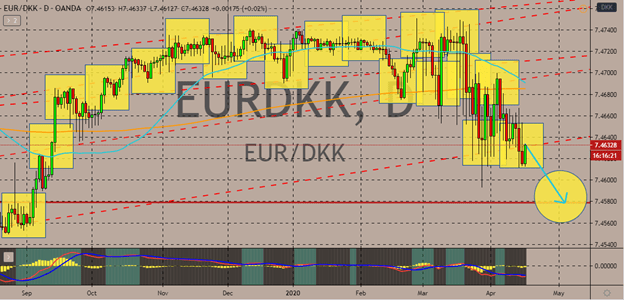

EURDKK

The EURDKK bulls are expected to remain on their backfoot. Bearish traders are looking to force the pair to its support levels as they take advantage of the high volatility of the euro. The single currency is on the defensive. The number of confirmed coronavirus cases in Europe, unfortunately, reaches the 1 million mark this week.

Looking at the chart, bears are close to their goals of shifting the momentum in their favor; technically speaking, the pair is still slightly bullish. This is because the 50-day moving average is still hovering near the 200-day moving average. However, as said, bears are looking to push the 50-day MA lower. Moreover, the Danish authorities are looking to issue securities in foreign currencies. The gov’t debt office has thus moved to finance the programs to support the economy. This could somehow work out for the kroner as Denmark is one of the few countries with a high credit rating. It is in a favorable position to do so.

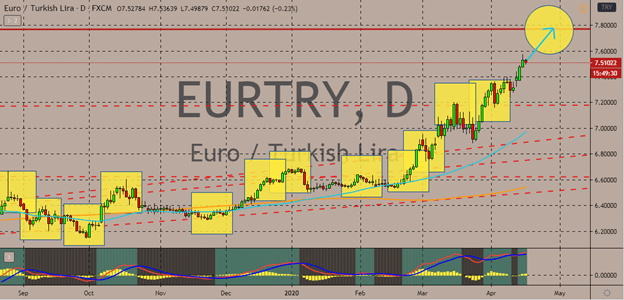

EURTRY

The Turkish lira hits its two-year lows against the euro and has also crumbled against other currencies. Bearish EURTRY traders have faced levels last seen on the height of the 2018 currency crisis in trading sessions.

The main weakness of the lira can be traced to the concerns about the impact of the virus in Turkey. The pandemic has taken a deep chunk out of the Turkish government budget. Recent data has shown that corporate deals in the country have faltered last month. In just a span of less than two years, the Turkish economy has faced two recessions. This situation has placed the Turkish lira in a very tough predicament. The pair has a highly bullish tone considering that the 50-day moving average has left the 200-day moving average in the dust. Bullish investors are expected to hold on to the momentum despite the vulnerability of the single currency. Over the past week, news about the virus in Europe has started to show improvements, mainly in Italy and Spain.

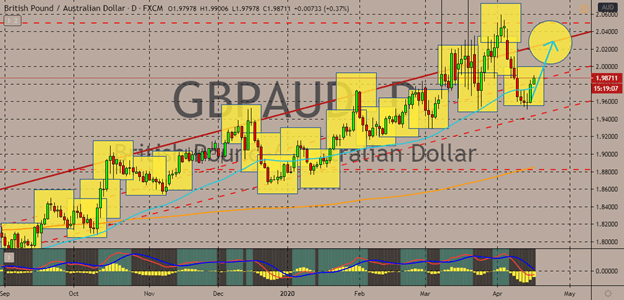

GBPAUD

Bulls are able to regain their composure after a slip up in the previous sessions. The confidence of bearish investors deteriorated following the alarming fall of Australia’s Westpac consumer confidence report for April. The gauge dived to its lowest reading in about 30 years from 17.7% to a devastating -3.8% due to the rising risk of a recession.

Economists say that the result of the report is very alarming and that it would most likely affect the performance of the Australian dollar in the foreign exchange market. Therefore, predictions that the GBPAUD pair would rally to its resistance level have heightened. Looking at the pair, it is widely bullish based on the distance established by the 50-day moving average away from the 200-day moving average. As for the British pound, investors are eager for further guidance as the British government starts to lay out plans to end or ease the restrictions on the nationwide lockdown.

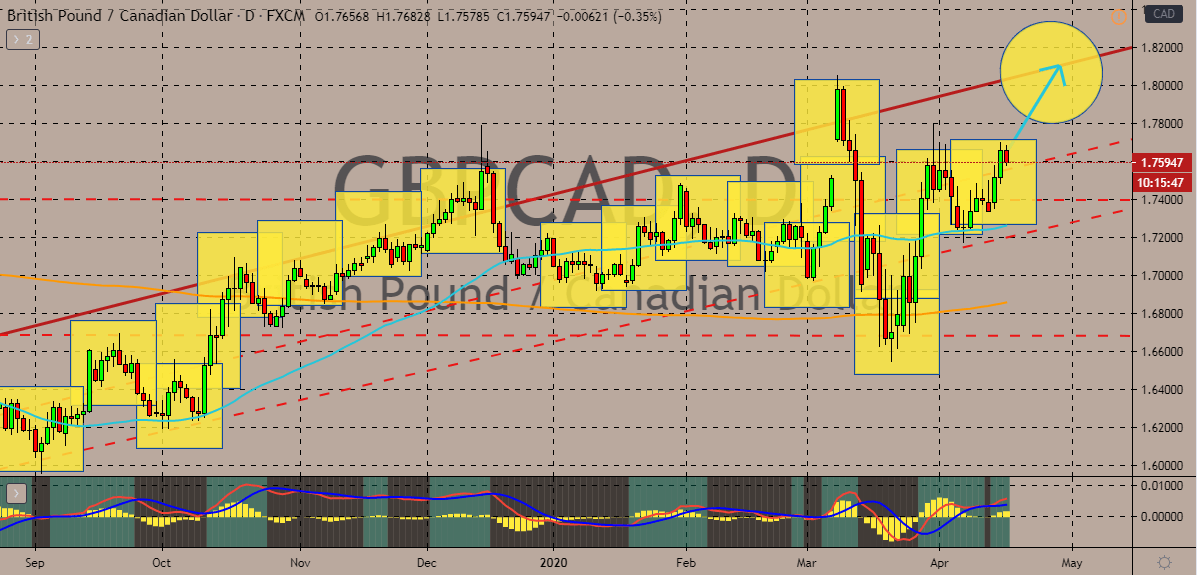

GBPCAD

The British pound should climb higher against the Canadian dollar, pushing the GBPCAD pair higher to its resistance level. Both currencies have struggled to gain strong momentum this Thursday as both the British pound and Canadian dollar receive support from their fundamentals. The Canadian dollar is backed by the revived hope in the commodity market following the massive supply cut from the OPEC on Sunday.

Meanwhile, the pound sterling has also strengthened. This is in thanks to the news that the UK government is working on plans to ease the lockdown restrictions. This could mean that the economy could recover sooner than expected or at least remain afloat. Aside from that, Bullish investors were delighted to know that the UK Prime Minister Boris Johnson has finally been discharged from the hospital. The news sent a wave of relief as the UK’s head recovers. However, it’s understood that he can’t work immediately as he’s advised to focus on his recovery.

COMMENTS