Here are the latest market charts and analysis for today. Check them out and know what’s happening in the market today.

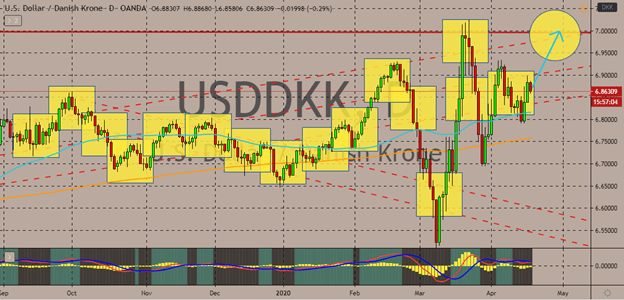

USDDKK

Bullish investors of USDDKK should hold the momentum in the coming sessions. This is in thanks to the safe-haven appeal of the US dollar. It’s believed that the pair will once again climb to its resistance as the concerns about the deepening global economic slump raise the appeal of the greenback. Looking at the chart, bears have also fought back. This has caused the 50-day moving average to not faced jolts. However, it clearly remained above the 200-day moving average.

Then yesterday, bullish investors felt a slight sigh of relief as the number of jobless Americans ease. The results from the US Department of Labor’s initial jobless claims report didn’t meet its projections. However, it’s still a notable improvement in comparison to its previous results in the past weeks. If the jobless counts continue to improve, it eases the possibility of another massive stimulus package from the US authorities that could be detrimental to the health of the greenback in the forex market.

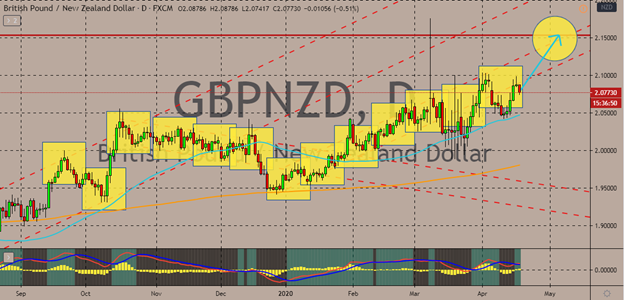

GBPNZD

The New Zealand dollar may have gained against the British pound in today’s sessions. However, it isn’t expected to hold on to the momentum for long. Bullish investors remain determined to force the pair upward to its resistance level as the British pound receives support from COVID-19 related news. The pair has retained a bullish momentum for a long time now. The 200-day moving average remains marginally lower than the 50-day moving average. Moreover, the comments about the possibility of negative rates from the Reserve Bank of New Zealand has not been good to the kiwi in the foreign exchange market.

According to the head of RBNZ, negative rates are still on the table as the country battles the impact of the pandemic. The reserve bank has already slashed its interest rates at an all-time low of 0.25% because of the coronavirus. This is a significantly intense drop. Just a year ago, New Zealand held the highest rates among the G10 countries.

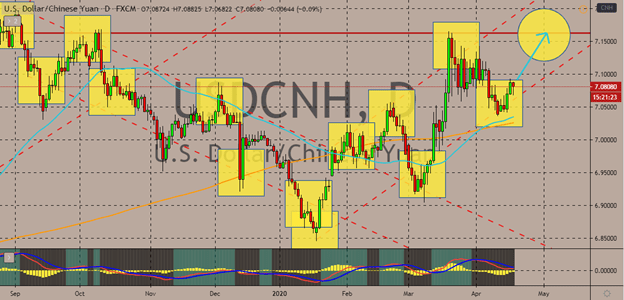

USDCNH

The Chinese yuan rises against the US dollar this Friday ahead of the Chinese GDP data. However, it’s widely expected that the pair will eventually gain bullish momentum in the coming sessions. Looking at the chart, it’s seen that ever since the coronavirus outbreak, bearish investors managed to take back some of the gains from the trade war period. However, bulls have now turned things around, forcing the 50-day moving average to pivot and rise back up against the 200-day moving average.

Technically speaking, the pair has maintained a bullish momentum this April as the 50-day MA looms slightly above the 200-day MA. Moreover, the Chinese gross domestic product is widely believed to contract by 6.5% in the first quarter of the year due to the paralyzing virus that originated there. However, some are even predicting a massive contraction that is as deep as 16%. This is because of the sheer damage of the virus to the second-largest economy.

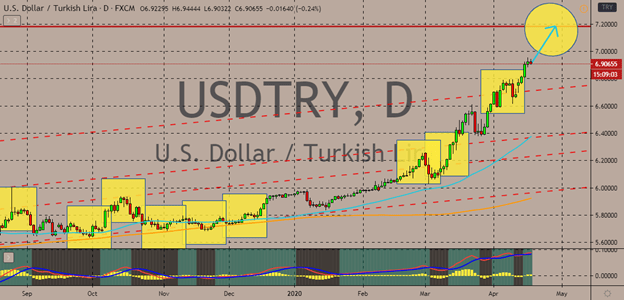

USDTRY

The Turkish lira has hit its lowest levels since the currency crisis two years ago. Unfortunately, the US dollar is poised to continue its upward trajectory against the Turkish lira. This is in thanks to the notable improvement from the jobless claims yesterday. Not to mention that the safe-haven appeal of the beloved buck has also shined through to concerned investors as the pandemic also hurts Turkey’s economy. Optimists note the improvement compared from the previous readings. This is despite the outcome of the initial jobless claims report yesterday still not matching projections.

This suggests that if the figures actually improve, it could ease the possibility of another massive stimulus package from the US authorities. As for the lira, some experts say that the currency is now the new rand. It appears to continue to collapse against the US dollar. And unfortunately for the Turkish lira, some experts say that Turkey may soon run out of ammunition to protect it.

COMMENTS