Here are the latest market charts and analysis for today. Check them out and know what’s happening in the market today.

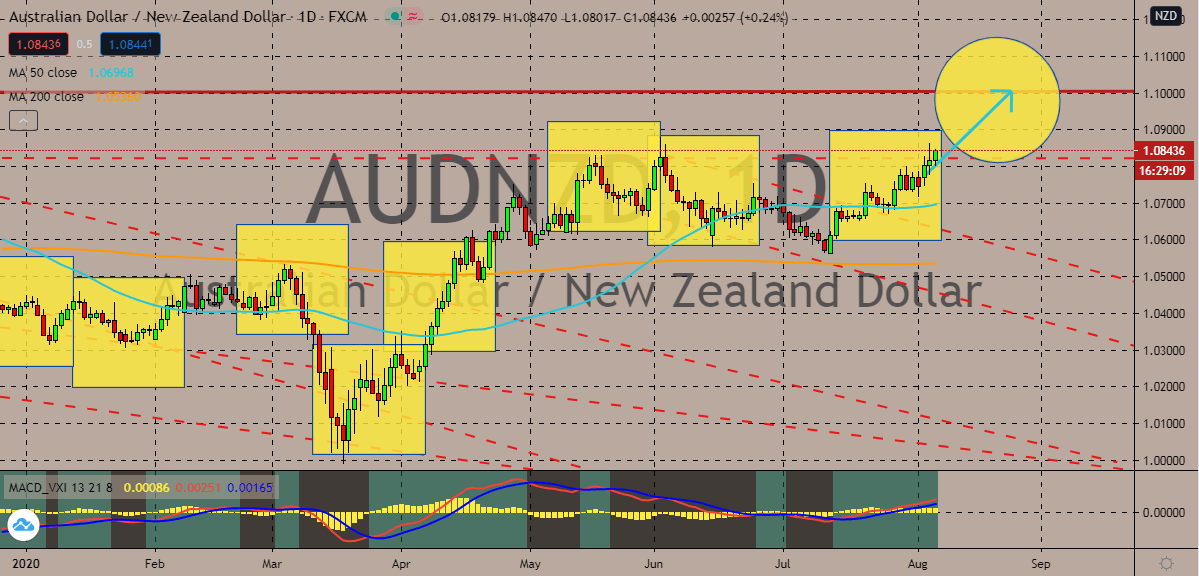

AUDNZD

The Australian dollar continues to drag the New Zealand dollar and prices are widely projected to surge to its resistance level. The trading pair has been very bullish in recent months despite the polarities faced by the two antipodean nations amidst the ongoing coronavirus pandemic. The Australian dollar’s strength is impressive considering that the odds appear to be against it at first glance. The bullish market isn’t expected to die down anytime soon which means that the 50-day moving average will continue to advance against the 200-day moving average. New Zealand has been recording mixed results in its economic performance, but even with the strong jobs figures from the second quarter, it’s still not enough to force a reversal for the trading pair. Meanwhile, traders of the Aussie felt a sigh of relief when the Reserve Bank of Australia didn’t deliver an unexpected rate cut, leaving its rates unmoved at around 0.25% as expected.

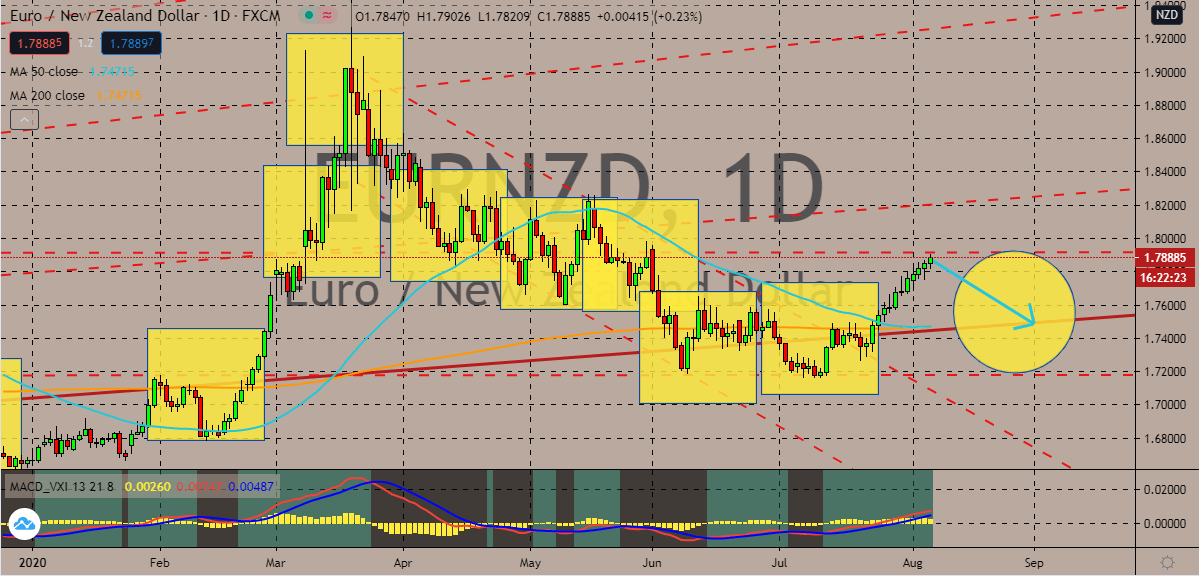

EURNZD

The euro to New Zealand dollar exchange rate has been rallying the recent days bulls continue to thrive from the latest news. However, base on its strength, it’s believed that the pair will see a correction in the coming that’s. That means that prices would go down and possibly hit their support level soon. That should help bearish investors pull the 500-day moving average and prevent it from climbing back against the 200-day moving average. Looking at it, the euro has been greatly benefiting from the global dynamics and the weakening of the US dollar. Since the European Union agreed on a consensus stimulus program, bulls have been able to pull away against most major currencies in the market including the New Zealand dollar. And aside from that, the strong recovery of the bloc’s manufacturing PMI helped it get back on track. As for the kiwi, traders are now cautious as New Zealand sees new Covid-19 cases who were from the Philippines.

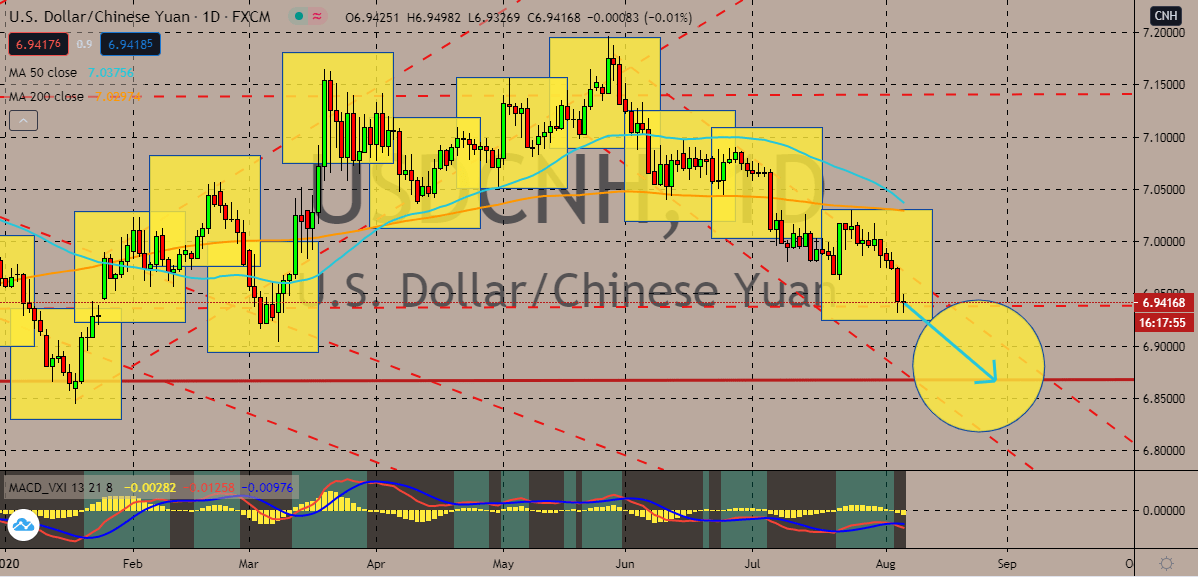

USDCNH

Bearish investors reached an initial support level this Thursday and the pair finally steadies. Unfortunately for bulls, the pair is still expected to go down to its lower support level soon, hitting ranges last seen in January. Looking at the chart, its clear that the Chinese yuan has been on a winning streak against the US dollar. Perhaps the recovery of mainland China’s economy, the continued capital flows, and the troubles faced by the United States is helping the cause of bearish investors of the pair. China’s economy has expanded by 3.2% on a year-over-year basis in the second quarter. The comeback is strong considering that it followed a 6.8% contraction in the quarter prior according to the National Bureau of Statistics. The recent NBS record shows that the Chinese purchasing managers; index for the country’s manufacturing sector grew by 51.1% in July, also a great comeback from 5.9% in the previous month.

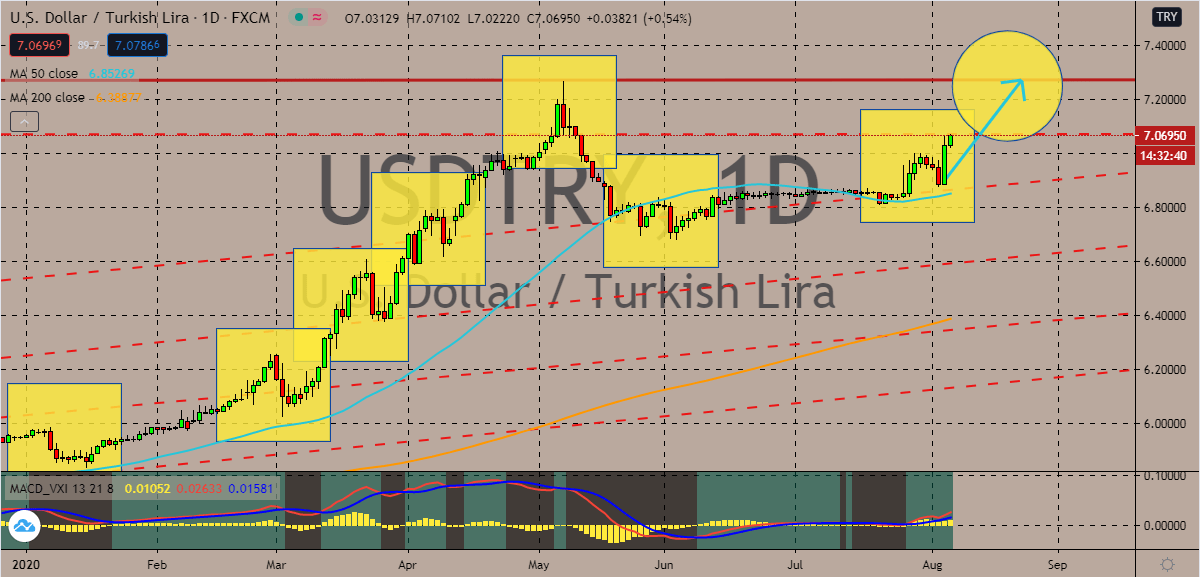

USDTRY

The Turkish lira continues to weaken against the US dollar despite the extremely rough sees faced by the United States. The exchange rate’s prices are projected to continue climbing up towards their resistance level this month, hitting record highs for the trading pair. That should help bullish investors keep the strong momentum and further buoy the 50-day moving average higher against the 200-day moving average. Just recently, it was reported that several foreign banks unsuccessfully closed their lira positions with Turkish counterparts earlier this week. This is said to be an outcome of the policies that are keeping the lid on local-currency liquidity offshore. International lenders failed to meet their obligations as the cost of borrowing in the Turkish lira jumped as high as 1,050% for offshore investors. Reports say that regulators are unlikely to enforce fines or any fees over the settlement failures earlier this Tuesday.

COMMENTS