Here are the latest market charts and analysis for today. Check them out and know what’s happening in the market today.

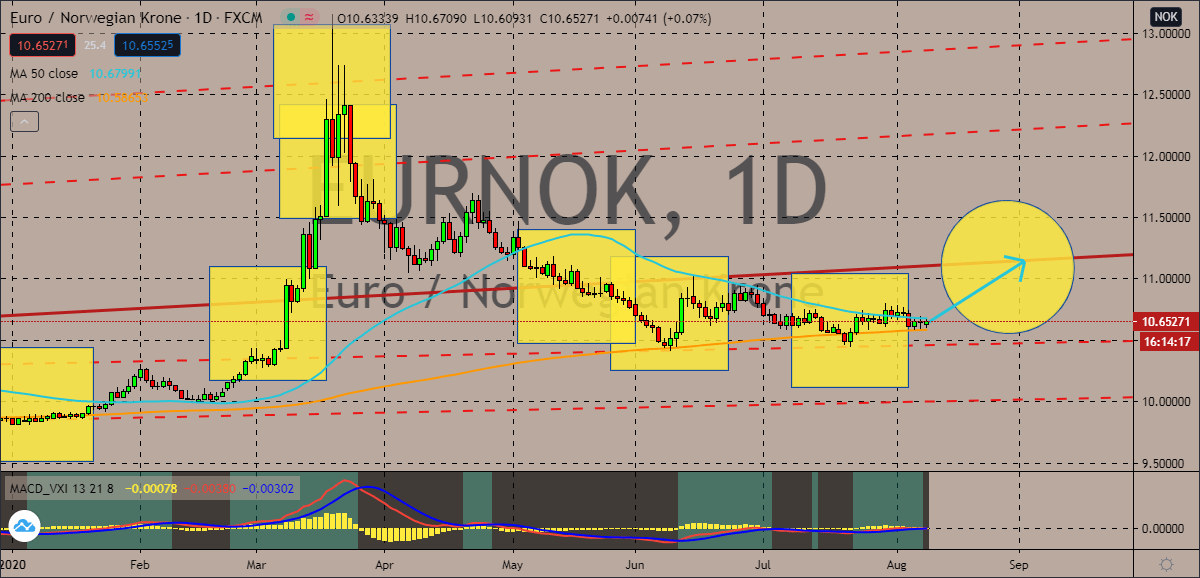

EURNOK

The euro to Norwegian krone exchange rate is about to climb up towards its resistance as bulls prepare to secure more gains. Prices should hit their highest level since May by the start of September as bullish investors gradually advance in the sessions. The climb should help the euro by buoying the 50-day moving average and preventing it from sliding past lower against the 200-day moving average. Looking at it, the Norwegian krone is also strengthening amidst the coronavirus pandemic. Its’s connection to crude oil, however, could be its main downfall against the euro again. Some experts believe that the crude market is about to see slightly bearish markets in the coming days as the number of infections around the world continues to rise. This means that the Norwegian krone will feel the pressure from it. Also, according to some experts, the bloc’s single currency is getting much better as the coronavirus crisis continues.

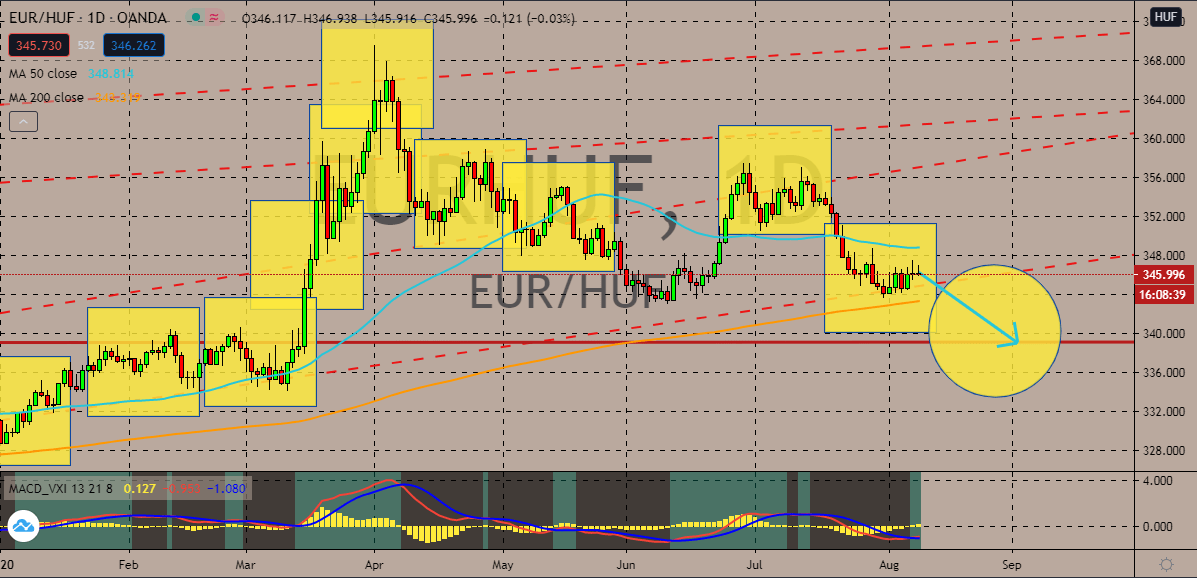

EURHUF

As of writing, the pair is seen trading flat as both bears and bulls struggle to break the current levels. However, despite the euro doing better day by day, the Hungarian forint is projected to power through in the trading sessions. The pair’s prices are bound to climb down towards its support level by the first part of September. Bearish investors are hoping to force the 50-day moving average closer to the 200-day moving average. The main fundamental that’s moving the Hungarian forint right now is the positive results produced by the country’s economy. Just recently, it was reported that the budget balance of Hungary for July slightly improved. According to the Hungarian Ministry of Finance, the budget balance declined from -785.5 billion Hungarian forints to -785.5 billion Hungarian forints. Aside from that, Hungary’s trade balance for June also climbed up from around 102.0 million euros to about 697.0 million euros.

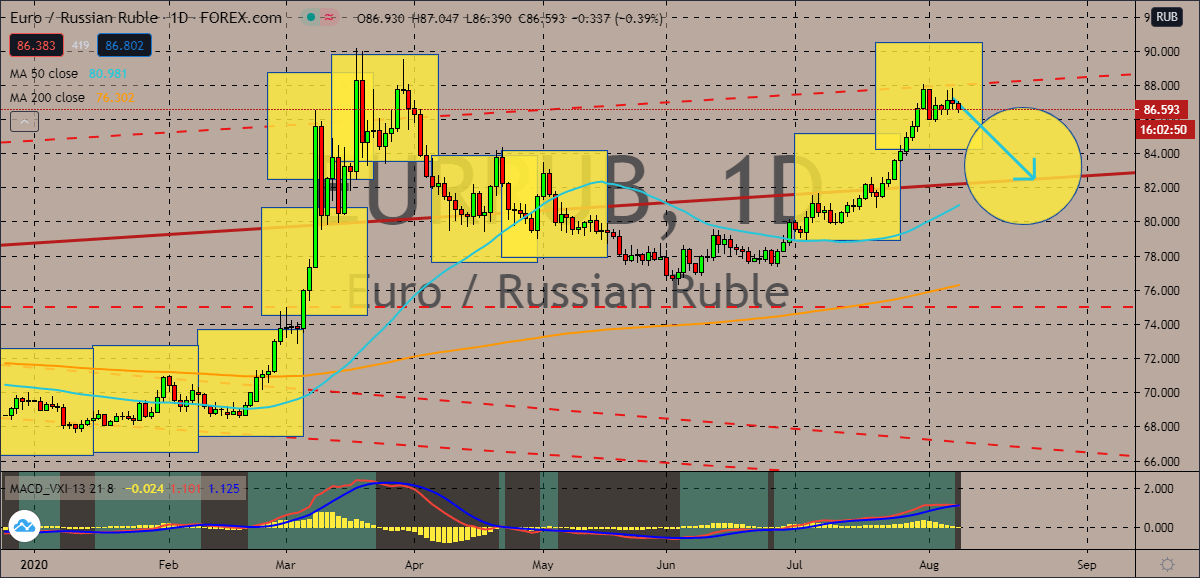

EURRUB

The past couple of weeks has been rough for bearish investors of the euro to Russian ruble exchange rate. Now, as it has trouble break past its resistance level, it’s believed that prices could turn around and go down to its support, facing a reversal. Prices should climb down soon, helping bears ease the pressure by preventing the 50-day moving average from advancing against the 200-day moving average. Despite concerns of investors over projections of a massive economic contraction for the Russian economy, bears are determined to push the tides towards their favor. Tomorrow, the country’s second quarter GDP is scheduled to come out, and experts believe that it will drop from 1.6% to -9.0%. Perhaps the main source of strength of bearish investors is the fact that the second quarter is over and in the first month of the third quarter, the Russian economy is starting to show signs of improvement such as the CPI and central bank reserves.

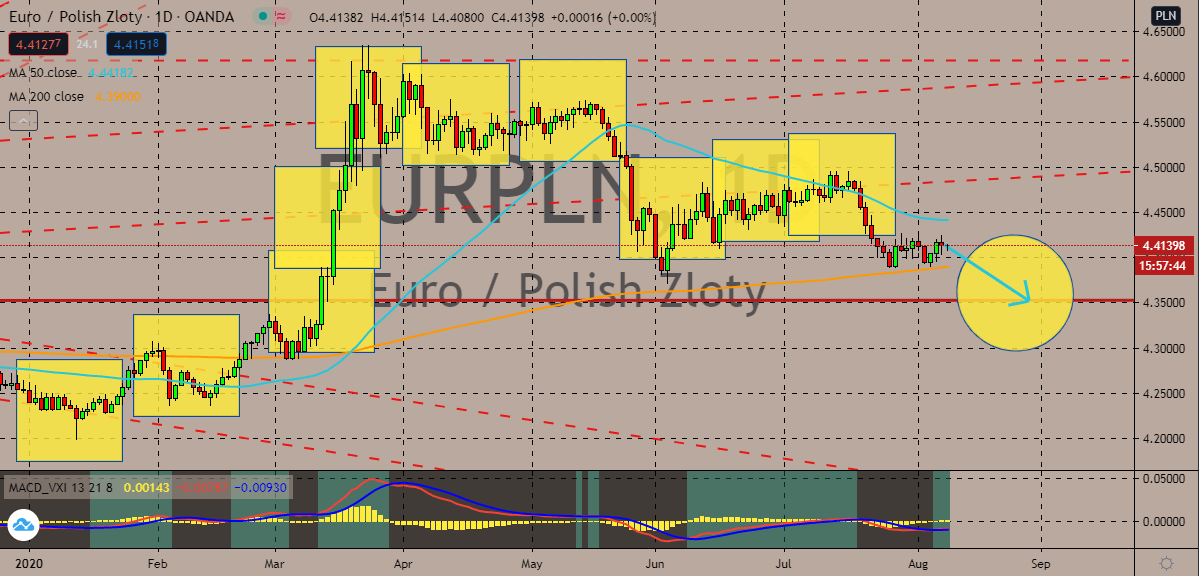

EURPLN

The trading pair’s prices are on track to go down towards their support level despite moving neutrally this Monday. Perhaps investors are still waiting for further guidance from the pair that’s why it’s having trouble gaining any sort of momentum this today. However, prices are projected to gradually slide as the greenback starts to bounce back finally. Looking at it, in the past few weeks, one of the factors that are affecting the strength of the euro is the US dollar’s weakness. Now that bullish buck investors are picking up their pace, the euro could see losses. This would benefit the Polish zloty. Also, it was just reported that Polish rate-setter Eugeniusz Gatnar said that the central bank’s current interest rates are too low, urging the Monetary Policy Council to adjust them higher. Thanks to the pandemic, the central bank has eased its rates to record lows of 0.1% and launched a large-scale bond purchasing program which initially weakened the Polish zloty.

COMMENTS