Here are the latest market charts and analysis for today. Check them out and know what’s happening in the market today.

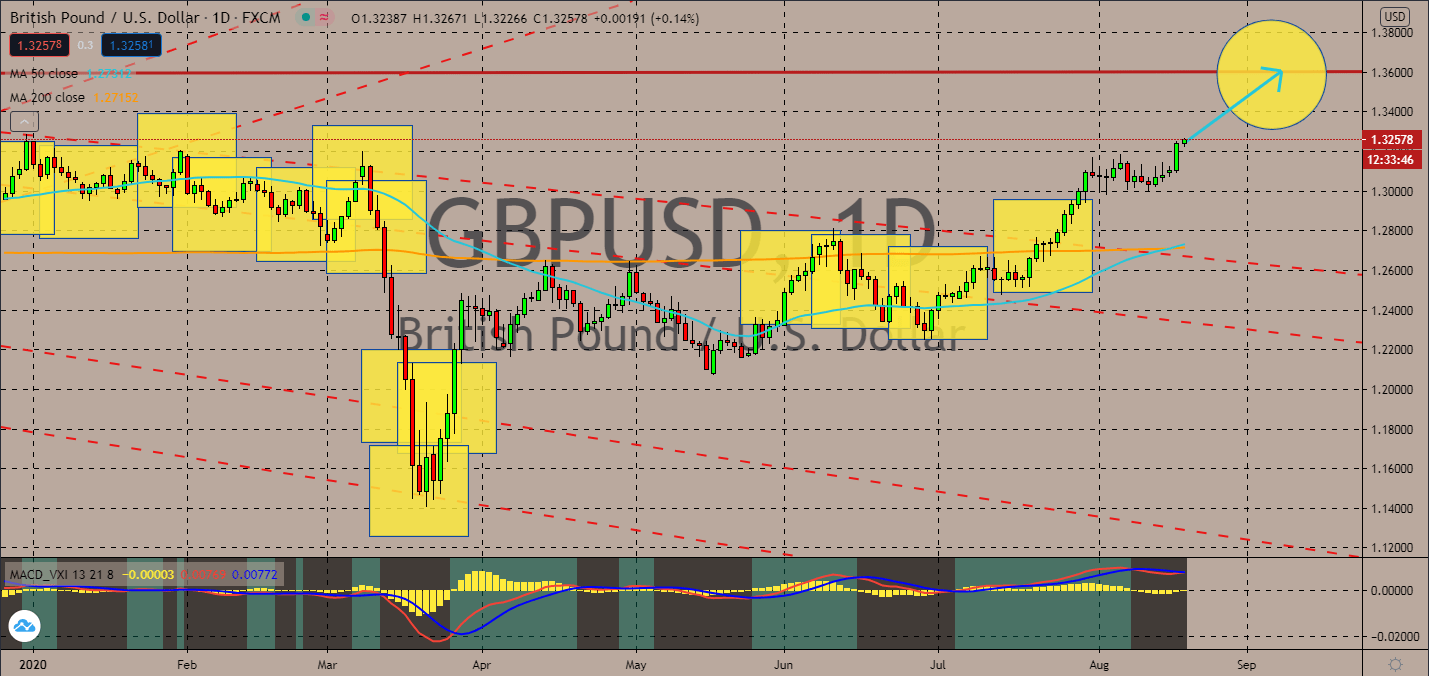

GBPUSD

Sterling pound is projected to lift against the American dollar with an expected 0.6% figure for its Consumer Price Index for the month of July on a yearly basis, surprising investors as the percentage came equal to what was seen in 2019. The pair’s 50-day moving average touched 200-day moving averages in recent trading, proving that its status is bound to improve near-term. Risk sentiment is helping sterling push upwards against the greenback following BoE’s Chief Economist Andy Haldane’s announcement that the British economy was on its path to rapid recovery with an expectation to see its GDP rise by over 20% by the second half of the year. In fact, Haldane also claimed that its economy has been rising by an average of about 1% per week. The anticipated crude oil inventory announcement from the United States or the weakening household finances in the UK will dampen a surge, but sterling is still bound to rise.

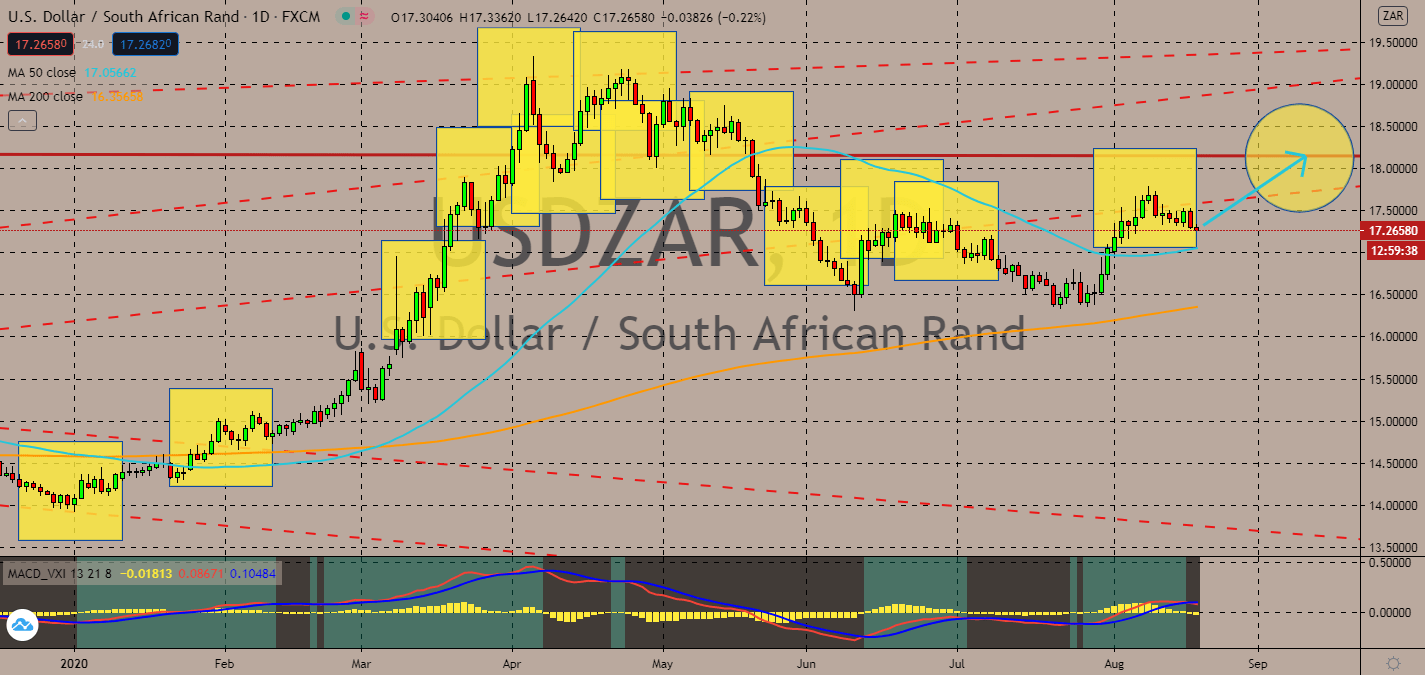

USDZAR

Economic analysts are worried about South Africa’s manufacturing and mining sectors, which have been suffering from the implemented lockdowns in earlier months. The South African Reserve Bank expects its economy to drop by 32.6% in the second quarter, way up against the 2% decline in the first. That will be the third consecutive quarterly decline for the country, which is also a deeper low than what was expected prior. That said, USDZAR’s 50-day moving average is still well above its 200-day moving average equivalent, showing that the greenback will most likely rise near-term against the rand. Investors are projected to move in favor of the rand with uncertainty for the country’s recovery led by closed businesses and scaled-down operations leading to an increase in job losses. National Treasury also announced that it sees its economy contracting by 7.2% for the full year, the most in almost 90 years.

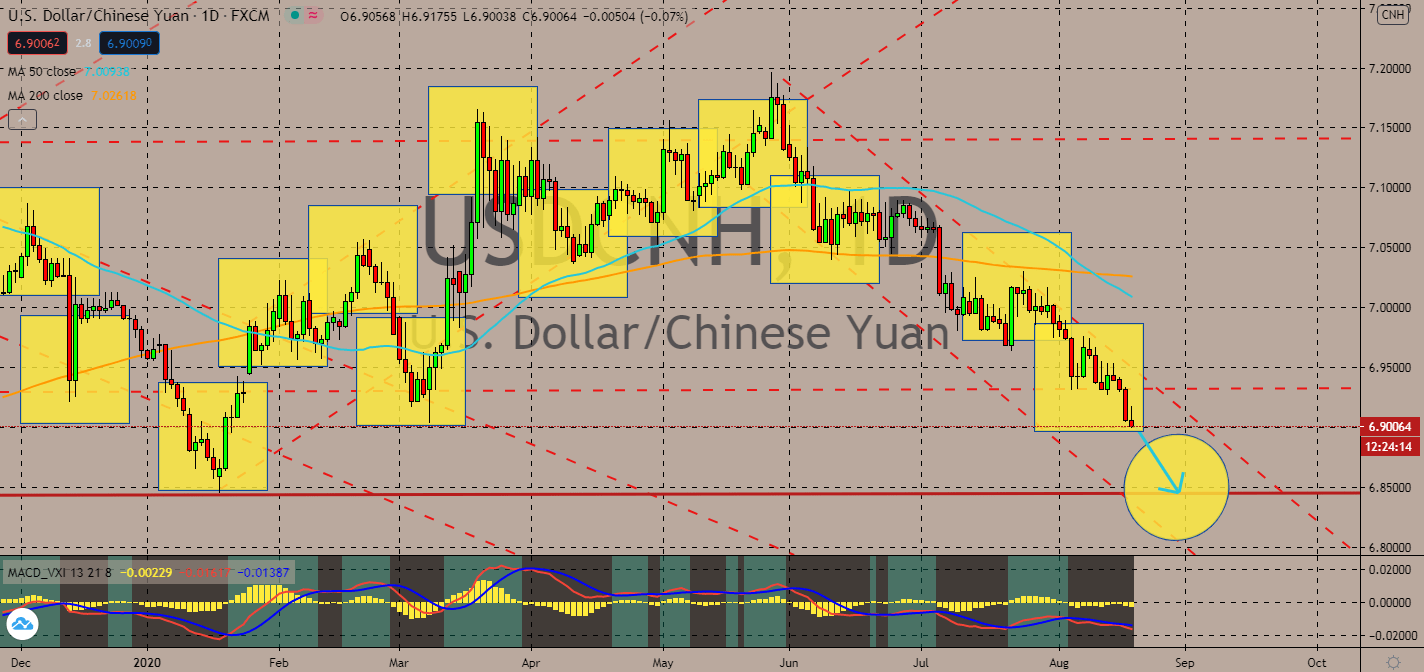

USDCNH

Since the beginning of the COVID-19 pandemic, the People’s Bank of China had pushed its loan prime rate down by 0.3% to 3.85%. But good news came for Beijing when economists claimed they expected no change for the country’s benchmark rate this week. This lead the greenback-yuan pair’s 50-day moving average to fall against the 200-day moving average and showed rising sentiment for the latter currency over the former. The greenback is best for longer-term investors, because its crude oil inventories report is expected to increase in today’s trading from -4.512 million to -2.679 million. State exports have dropped dramatically since the beginning of the pandemic both the from first-to-second quarter of this year and year-over-year 2019 and 2020. From $395.69 billion in Q1, the figure dropped to $291.47 billion Q2 2020. From $414.95 billion in Q2 2019, it went down to $291.47 billion by Q2 2020.

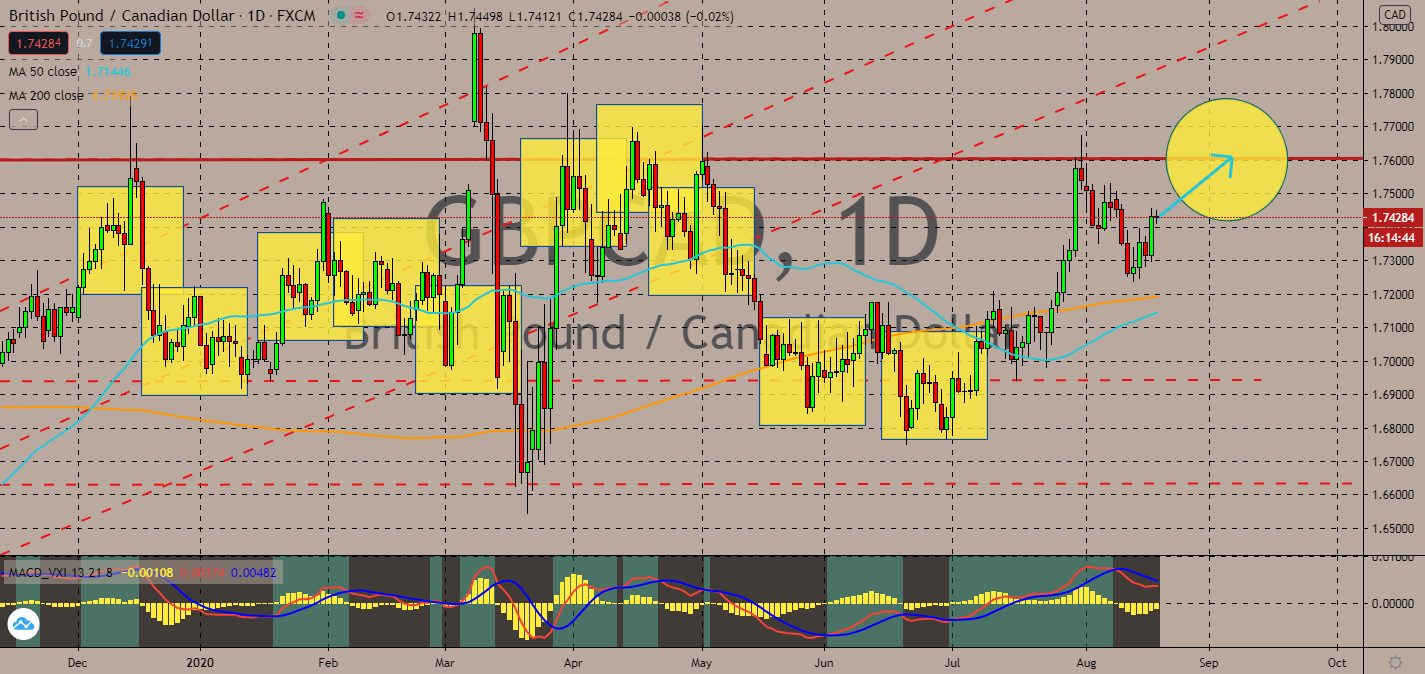

GBPCAD

Sterling pound has been performing well over the past several weeks despite having much lower GDP numbers than expected for the second quarter as well as another threat of a coronavirus wave. The GBPCAD pair went over a bearish connection for a few sessions, but the 50-day moving average is now gradually pulling through against the 200-day moving average. Improved Manufacturing and Services PMI data in the UK are expected by Friday of this week, which will set the pair’s ongoing trend near-term. Its yearly CPI index is expected to retain its 2019 levels for July at 0.6%. The UK is also firm in its belief that it can reach a post-Brexit deal with the EU next month, which is projected to raise sentiment for the Pound sterling in a few weeks. Core retail sales in Canada will also be announced later this week, which investors should look out for.

COMMENTS