Here are the latest market charts and analysis for today. Check them out and know what’s happening in the market today.

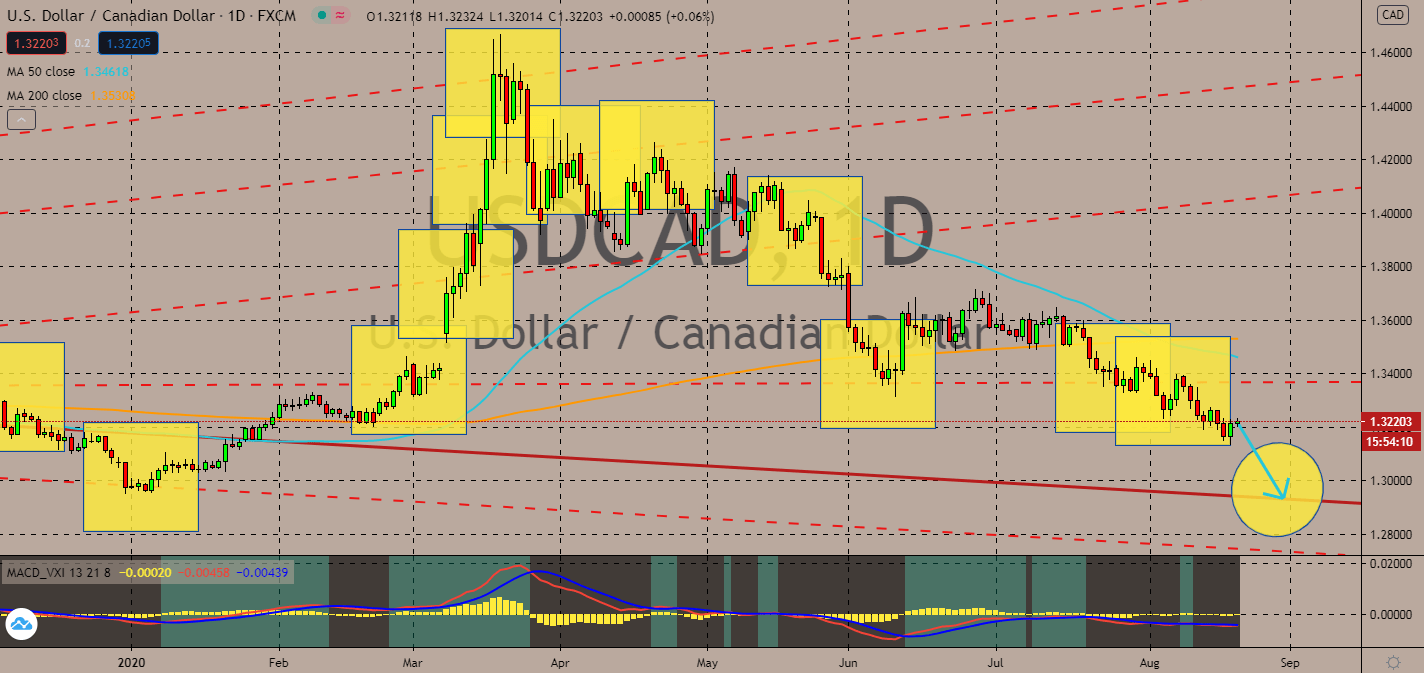

USDCAD

Finance Minister Bill Morneau’s retirement did nothing to offset the recent gains for the Canadian dollar, consequently bringing the USDCAD exchange further into the bearish market. The 50-day moving average is experiencing a downhill slope and had recently reached below 200-day moving average, and markets are worried that it would continue this track near-term. Meeting minutes from the Federal Open Market Committee proved that the coronavirus will continue to hinder the US economic growth and potentially pose dangers to its financial system. Fed leaders claimed that it will mostly affect inflation and employment medium-term. Canada’s employment surged soon after new daily coronavirus cases fell from 1,800 to 400. Economic activity such as the surge in house sales and credit card sales will also help the Canadian dollar gain against most of its currency counterparts with its much faster growth pace compared to the US.

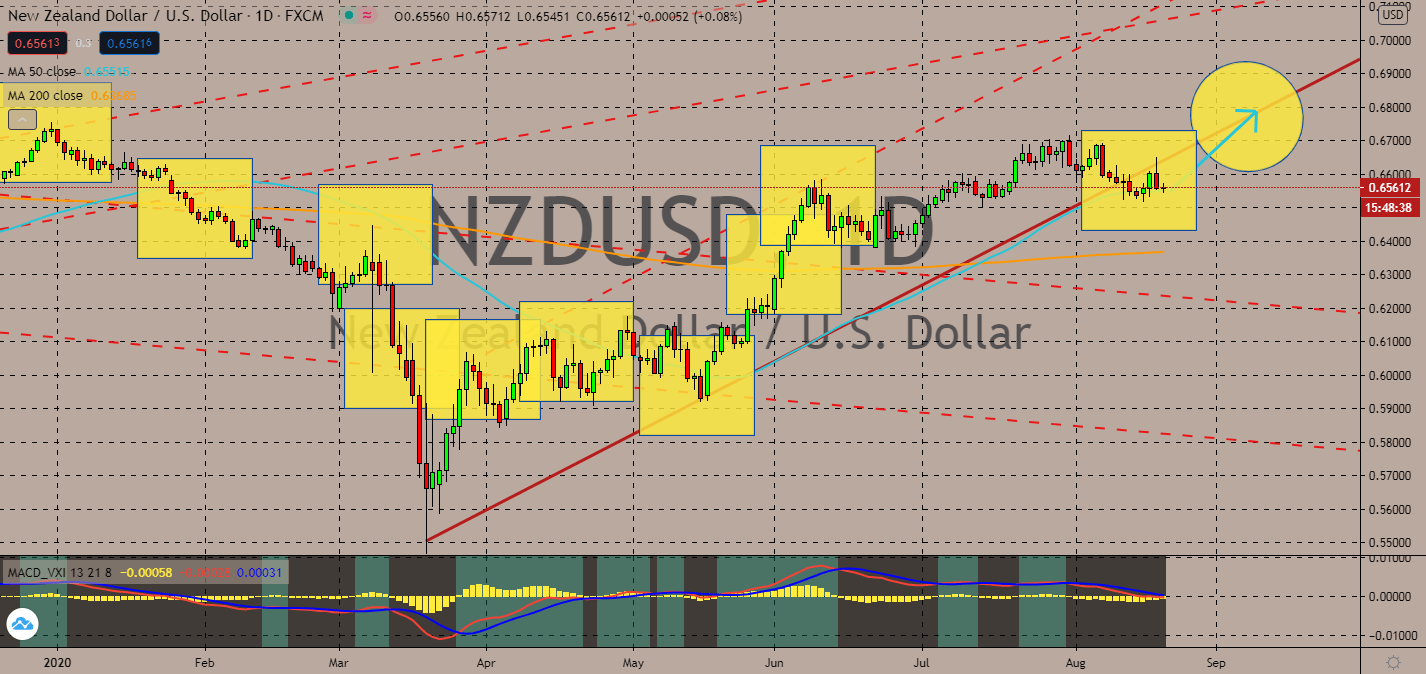

NZDUSD

Economists are relatively optimistic about the economic effects brought by the coronavirus pandemic. The country’s economic powerhouse, Auckland, is left at level 3 as the rest of the country remains at level 2. This would theoretically cause its gross domestic product to drop by 6 percent. However, as other economies have proven, holding lockdowns off will push its economy deeper down in the long term. Moreover, the pair’s 50-day moving average had just recovered past its 200-day moving average, showing that the market is more inclined to buy NZD near-term. That said, the US economy is barely doing better after its more than 30 percent decline in the previous quarter. Meeting minutes from the Federal Reserve Open Market meeting earlier this week proved that the US economy is in danger of harming its unemployment and inflation rates in the long run as the coronavirus continues to affect most business activity in the country.

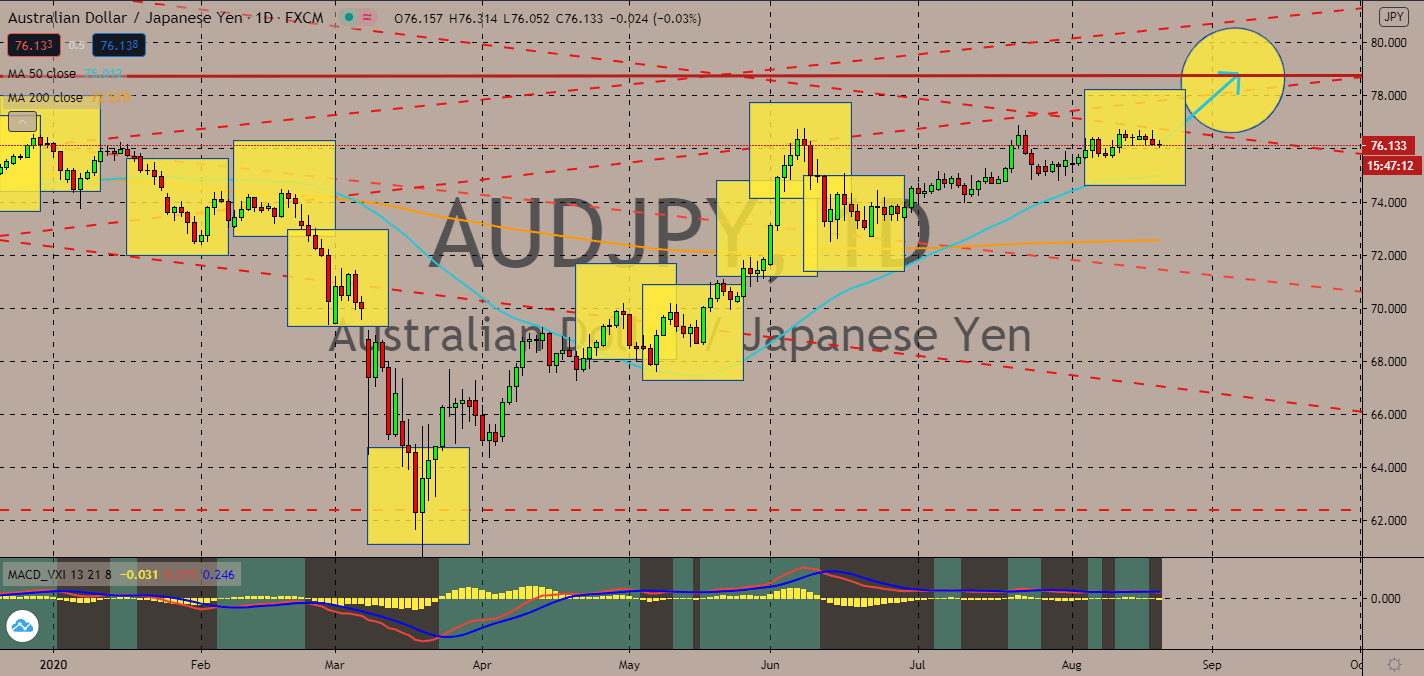

AUDJPY

Japan recorded its biggest economic decline in 40 years by a record of -7.8% from April to June 2020, showing a 27.8% annualized decline in GDP. It turns out that this was the deepest since 1980. Inevitably, this wouldn’t help Japanese investors recover its level against the Australian dollar as its 50-day moving average continues to fly past its 200-day moving average counterpart. The Reserve Bank of Australia minutes released overnight confirmed that the central bank doesn’t see the need to ease its policy rates further down, helping the Australian dollar boost against the typically safer currency. Risk sentiment is bound to boost the AUDJPY near-term. The pressure is now on Japanese policymakers to take more aggressive actions to counter its domestic coronavirus crisis after realizing that this decline was its third straight quarter of contraction and an even bigger decline than the market consensus of 27.2% drop.

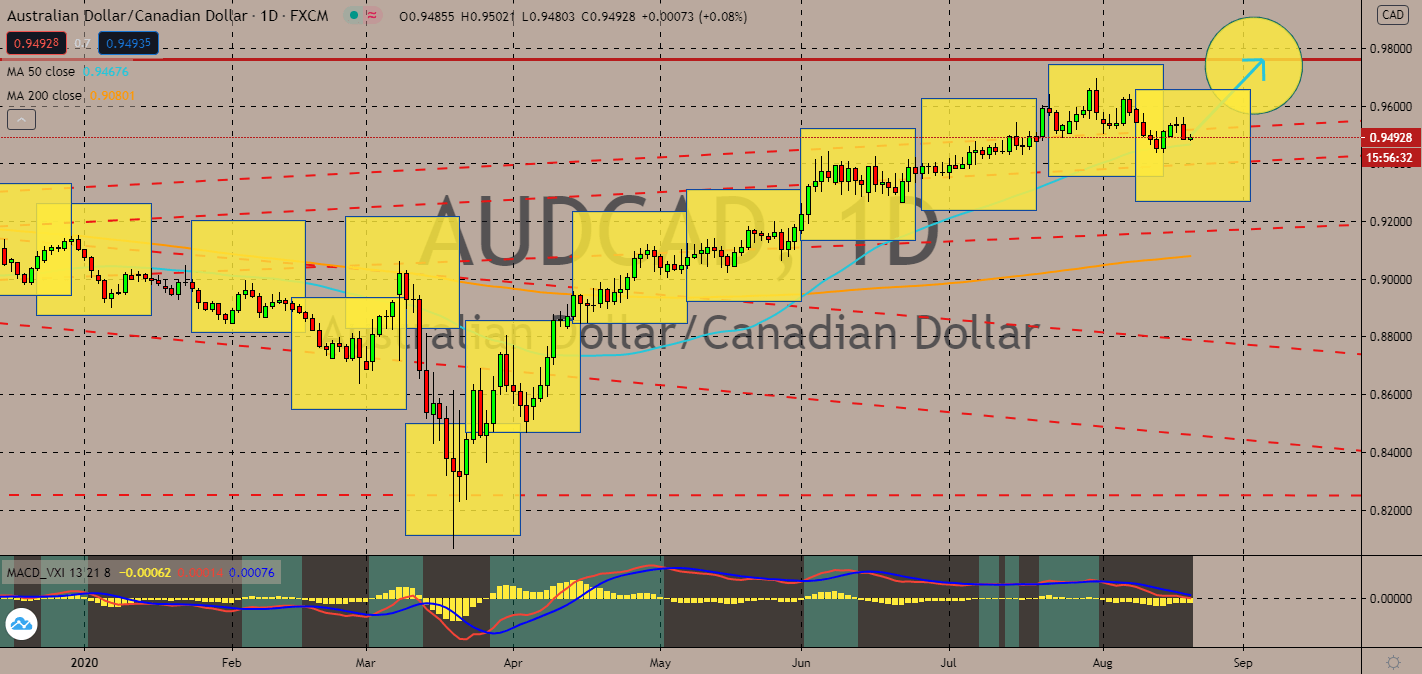

AUDCAD

Australia recently witnessed its deadliest day since the beginning of the coronavirus pandemic, reporting 25 deaths and 290 more infection cases in 24 hours. About 282 cases were detected in one of its most successful states, Victoria. Meanwhile, Canada’s economy looks like it’s growing faster than most markets. However, the annual Canadian inflation rate cooled down to 0.1% in the second quarter, and showed signs of slowing further down in July. Investor brows raised when they saw lower prices for gasoline and air travel, one of the country’s biggest markets. In fact, the commodity’s prices plummeted on an annualized basis by 14.9% in July. While its recovery is projected to be “modest,” investors are more inclined to help the AUDCAD pair to rise near-term. Its 50-day moving average is still gradually climbing well above its 200-day average, as well, which eases hesitance to buy the Aussie dollar instead of the loonie.

COMMENTS