Here are the latest market charts and analysis for today. Check them out and know what’s happening in the market today.

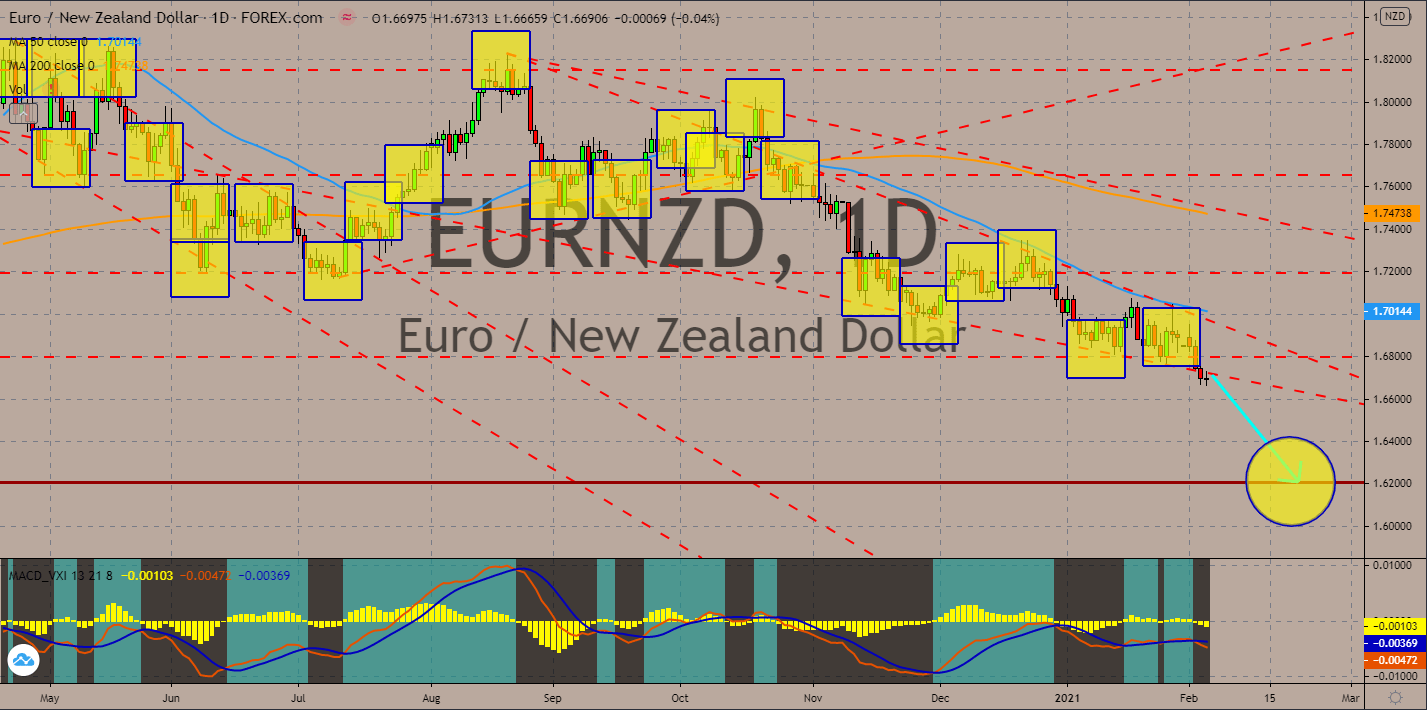

EURNZD

While the EU and its member states posted better-than-expected results, these PMI figures were still below the 50.0 points benchmark. Meanwhile, New Zealand’s recent reports showed upbeat economic data. In Q4, Wellington’s unemployment rate shrunk to 4.9% despite the resurgence of COVID-19 worldwide. In Q3, NZ’s reports were bleak as the country took the hard approach in containing the virus. In fact, the previous quarterly unemployment data of 5.3% was the highest in the past 48 months or four (4) years. The low unemployment number translates to a higher participation rate of 70.20%. Meanwhile, employment change for the reported quarter was 0.6% against -0.8% expectations. Also, despite the upbeat labor data, the cost for hiring new employees is stable at 0.5% QoQ. The MACD line and Signal line skewed to the downside, which suggest further downward movement for the EURNZD pair in coming sessions.

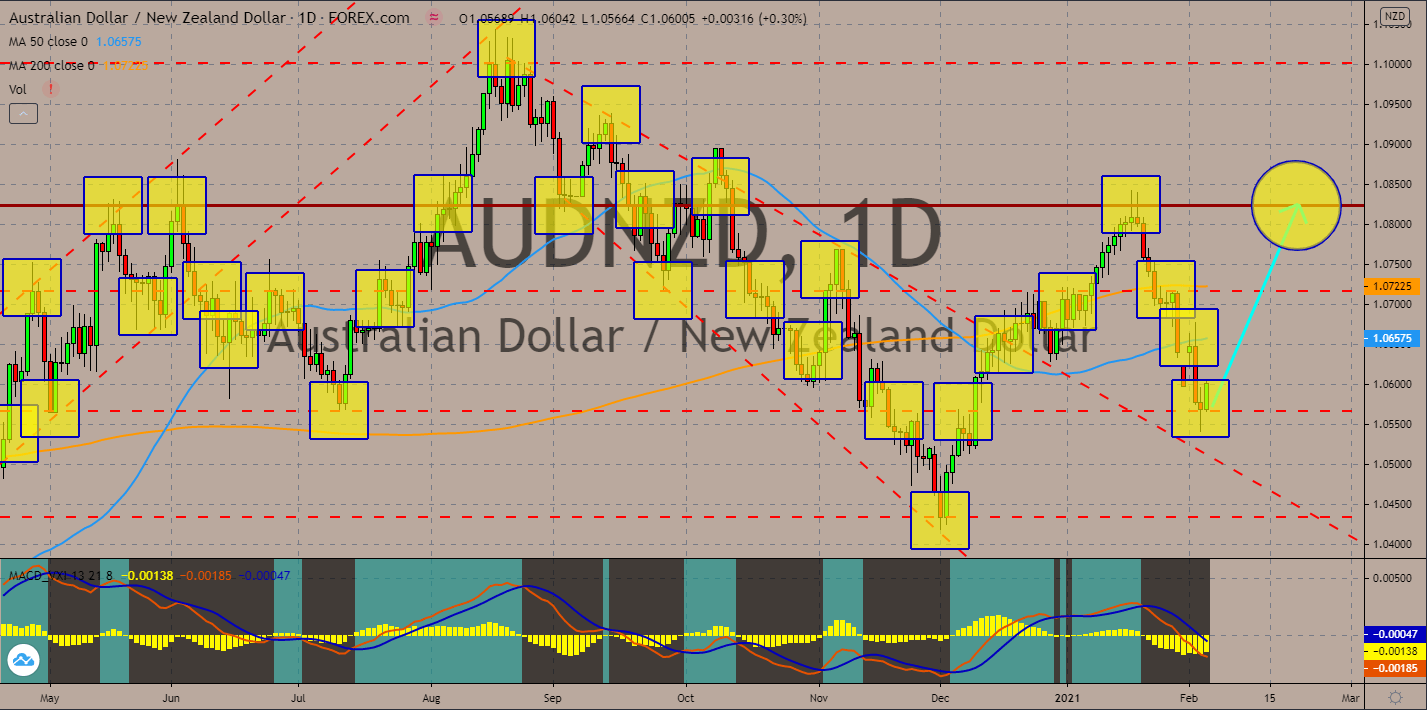

AUDNZD

New Zealand had an impressive report for the labor market from the fourth quarter. However, Australia’s data were more inclusive. The services sector slowed down to 55.6 points, but still above 50.0 points, which suggests a continued expansion for the purchasing managers index (PMI) report. Meanwhile, the AIG Construction Index rose to 57.6 for the month of December from 55.3 points prior. The advance in the index was due to higher buildings for the reported month. Figure came in at 10.9% compared to the 3.3% growth in November. The strong exports data is also pushing the Australian dollar higher against the kiwi currency. Exports grew by 3% in December against the decline in imports by 2%. This resulted in a higher trade surplus in December by 6.785 billion. And most importantly, business confidence is up by 22 points to 14 points. Histogram is showing a possible reversal in the trend. The MACD and Signal lines are expected to follow.

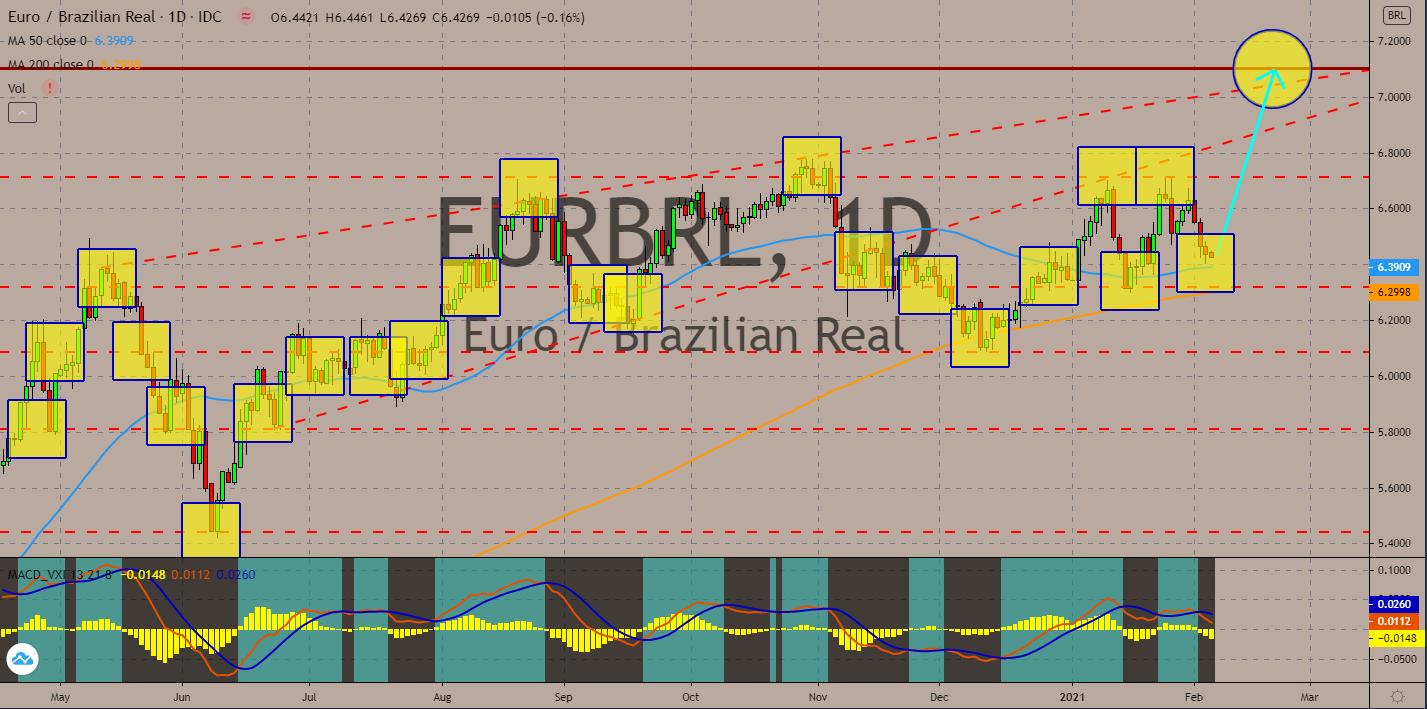

EURBRL

Six (6) out of nine (9) PMI reports from the EU and its member states posted better-than-expected results for Composite and Services. Germany’s Composite PMI for January remains at 50.8 points while its Services PMI along with Spain posted worse-than-expected results. On the other hand, Brazil’s Markit Composite and Services PMIs fell below 50.0-point benchmark since August and September, respectively. The World Bank has already given a warning sign for investors when it said that the 3.0% GDP growth expectations will not be enough to cover the anticipated 4.5% drop for fiscal 2020. The global financial institution added that 2022 growth will be stagnant compared to 2021. Meanwhile, Brazil said that the delay in vaccination roll out could derail the expected recovery this year. The Histogram, MACD line, and Signal line are expected to reverse back as 50-day and 20-day moving averages are seen supporting the EURBRL prices from falling.

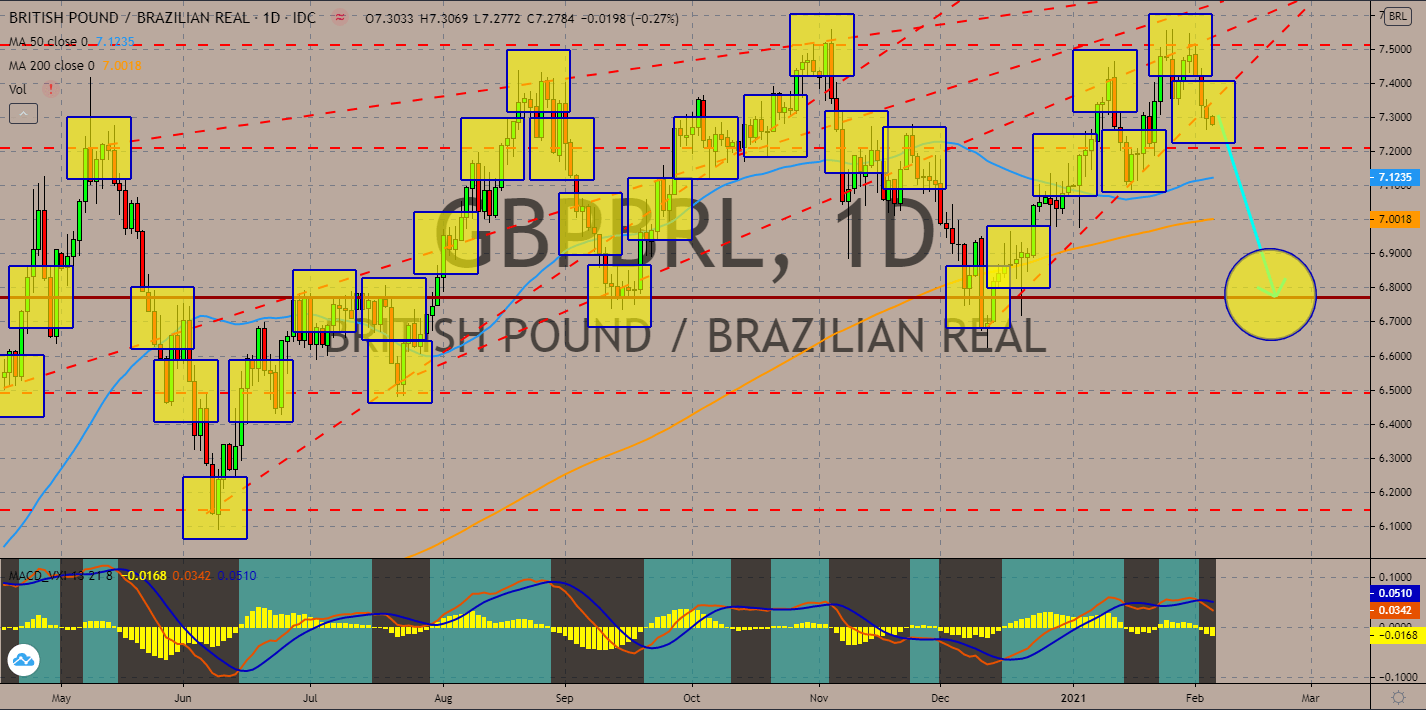

GBPBRL

The UK had the worst PMI results for Composite and Services in Europe despite the upbeat data. Figures came in at 41.2 points and 39.5 points. Another key report that led to a decline in the GBPBRL pair by -1.14% was the House Price Index (HPI) report. For the first time in six (6) months, the monthly report posted negative growth at -0.3% in January as Brexit and new COVID-19 variant bite investor’s confidence in the real estate market. On a year-over-year basis, this translated to a drop of 6.4%, its first growth slowdown in the past six (6) months. The International Monetary Fund has also downgraded the British economy’s GDP growth to 4.5% in fiscal 2021, down from October’s 5.9% forecast. The UK is expected to post a -10% contraction for 2020, which is higher than the European Union average of 7%. The largest economy in Europe, Germany, shrank by -5% in fiscal 2020. MACD and Signal lines formed a bearish crossover.

COMMENTS