Here are the latest market charts and analysis for today. Check them out and know what’s happening in the market today.

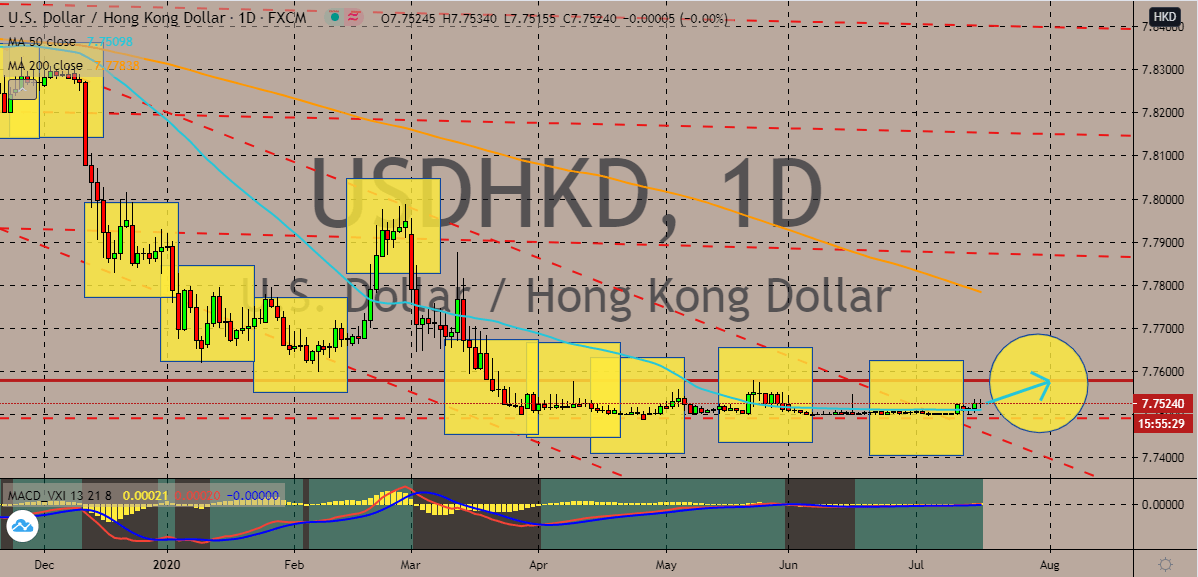

USDHKD

It appears as if Washington’s attempt to move the pegged exchange rate is starting to work. The US dollar to Hong Kong dollar exchange rate is gradually advancing against the strong gravitational pull of the Hong Kong Monetary Authority. Prices are projected to climb to their resistance level, which isn’t too far, and reach ranges last seen in the latter half of May. The move won’t drastically change the course of the 50-day moving average and the 200-day moving average is widely predicted to remain dominant. Washington isn’t happy with Beijing’s decision to enforce a new national security law in Hong Kong. And just recently, it was reported that State Secretary Mike Pompeo suggested taking measures that could undermine the Hong Kong dollar’s pegged stance against the US dollar. Although it’s believed that this threat won’t totally budget the Hong Kong dollar as most experts say that it has a strong support from the HKMA.

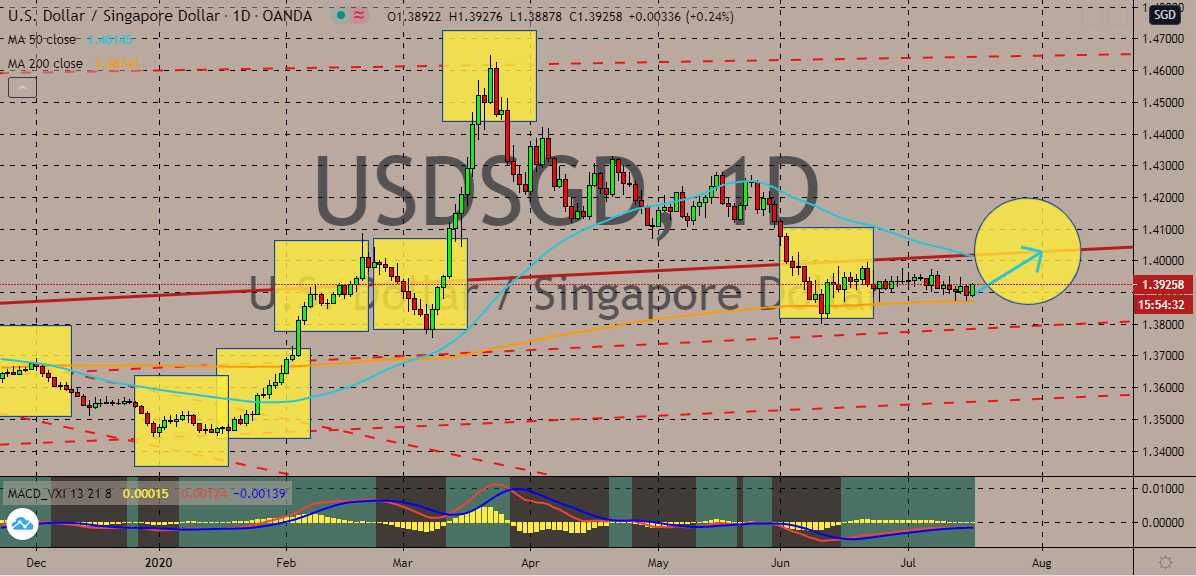

USDSGD

The poor gross domestic product data recorded by Singapore has caused bearish investors to lose their steady grip on the USDSGD. Since the report was released earlier this week, the Singaporean dollar has buckled against the buck. And now, the trading pair’s prices are seen advancing, and it’s predicted that prices would eventually reach its resistance. That should help bullish traders maintain the bull market, preventing the 50-day moving average from gradually falling against the 200-day moving average. Moreover, it was reported earlier this week that Singapore’s quarterly gross domestic product plunged from about -3.3% to a devastating -41.2% in the second quarter of the year. And for its annual GDP, official figures show that it fell from -0.3% to -12.6%, causing Singapore to enter a technical recession. This could perhaps help increase the domestic demand for safe-haven currencies like the greenback, causing the USDSGD to climb once again.

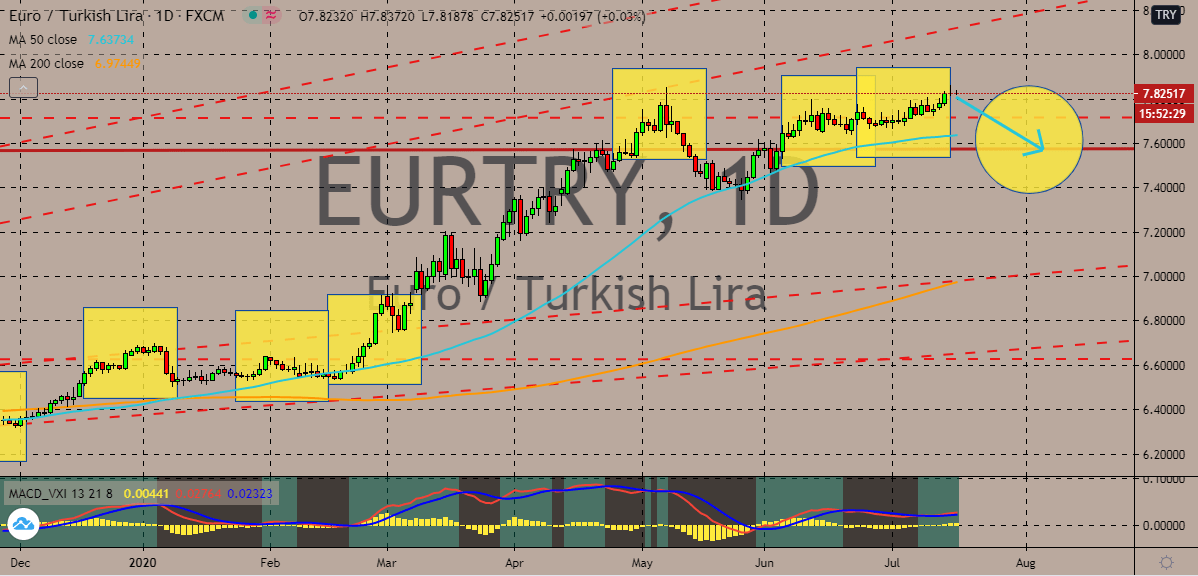

EURTRY

The euro to Turkish lira is seen very bullish in the foreign exchange market but headwinds along the way could force prices downwards. Looking at the charts, it’s clear that the euro is starting to slow down. And according to recent reports, analysts believe that the euro is rallying as the European Central Bank takes a breather. This suggests that if the bank once again makes another move in its monetary policy, the Turkish lira could see an opening for redemption. Although if prices do go down, the 50-day moving average isn’t expected to plummet towards the 200-day moving average. Just recently, it was reported that Turkish state banks are offering short forex support to the Turkish lira. Sources close to the matter say that Turkish state banks have doubled down on their short foreign currency positions in about six weeks to around 8.3 billion US dollars to help prevent the Turkish lira from depreciating against other currencies.

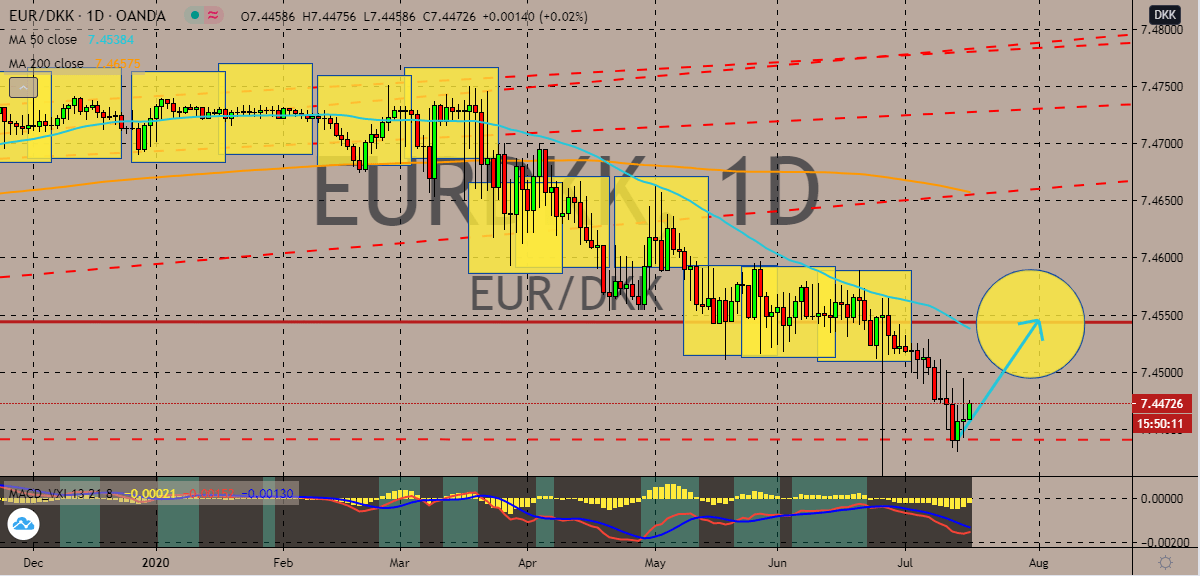

EURDKK

The bearish momentum of the euro to Danish krone exchange rate halted this week and bulls are seizing the opportunity to propel themselves in the trading sessions. The pair formed new support around the ranges before it ricocheted and is now predicted to climb its resistance level in the coming sessions. That climb should help ease some pressure off of bulls and help the 50-day moving average to take a U-turn against the 200-day moving average. Looking at the charts, it’s evident that in the recent days, despite falling against the krone, the euro still tried to rally but unfortunately, it wasn’t able to hold on. And as of writing, investors are closely tuning in on the virtual meeting of European Central Bank policymakers scheduled later today. Experts believe that the bank would agree to wait and see the impact of their moves from earlier this year. That news is helping the euro to rally against other currencies and against the Danish krone.

COMMENTS