Here are the latest market charts and analysis for today. Check them out and know what’s happening in the market today.

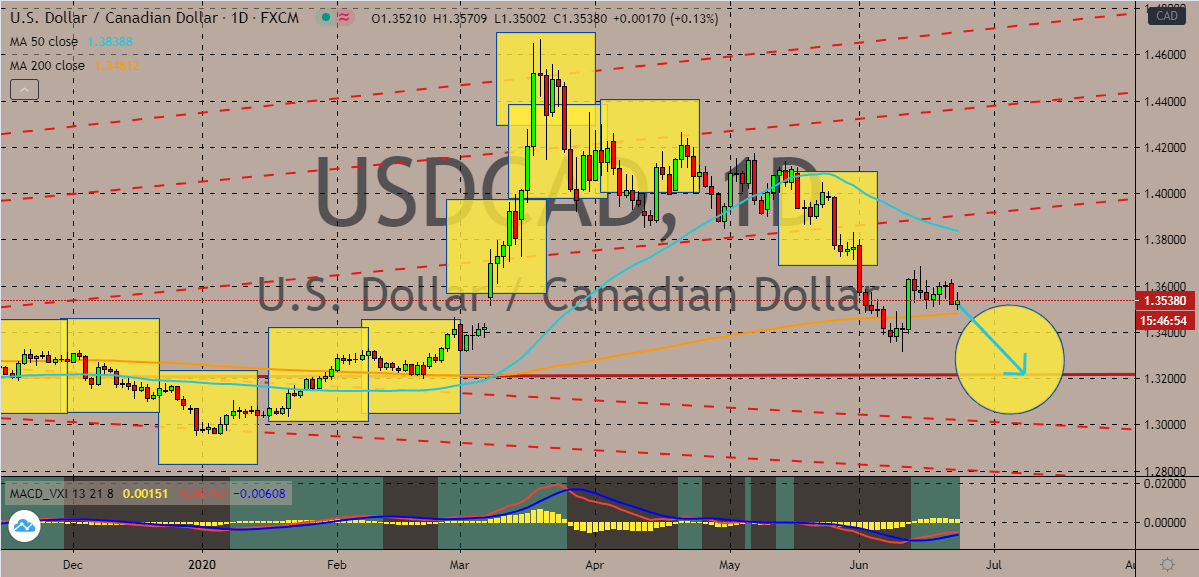

USDCAD

The US dollar tries to run away against the Canadian dollar and makes a few gains earlier this Tuesday. Unfortunately for bulls, the earlier rally didn’t hold up and now the pair is seen trading steadily. Prices should continue its downward trajectory in the coming sessions as the Canadian dollar gets reinforcement from the resiliency projected by the crude market amidst second wave concerns. As of writing, the pair is still considered bullish because the 50-day moving average is still trading significantly above the 200-day moving average. If the Canadian dollar successfully pushes the prices lower, the 50-day MA should plummet and would open an opportunity for bears. Another factor that supports the Canadian dollar is the great performance of Wall Street. In the past couple of weeks, commodity-linked currencies such as the loonie benefit from the rally of major indices as it sends signals about a speedy recovery for the struggling economies.

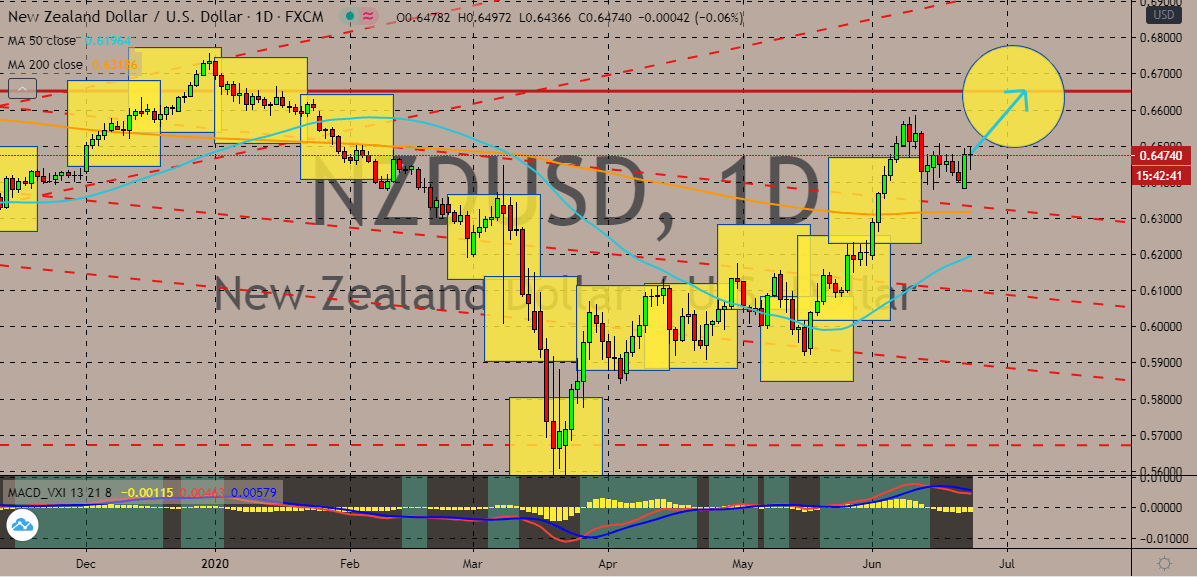

NZDUSD

As of writing, the pair is seen steady. Although looking at the chart, it appears that bearish investors tried to make a run and attempted to push the pair lower in today’s sessions. However, their luck ran out and the pair is seen almost neutral this Tuesday. But the New Zealand dollar’s gains are also limited as investors worry about negative rates from the Reserve Bank of New Zealand. Later this Tuesday, the kiwi central bank is due to release its interest rate decision, which is widely expected to be left unmoved at 0.25%. Experts aren’t expecting the bank to cut its rate to negative levels just yet despite the references and willingness expressed by the bank. But the fact that the bank is willing to cut it prevents the New Zealand dollar from securing big gains in trading sessions. Last week the Antipodean country recorded alarmingly bad economic data. New Zealand’s gross domestic product dropped by 1.6% in the first quarter of the year.

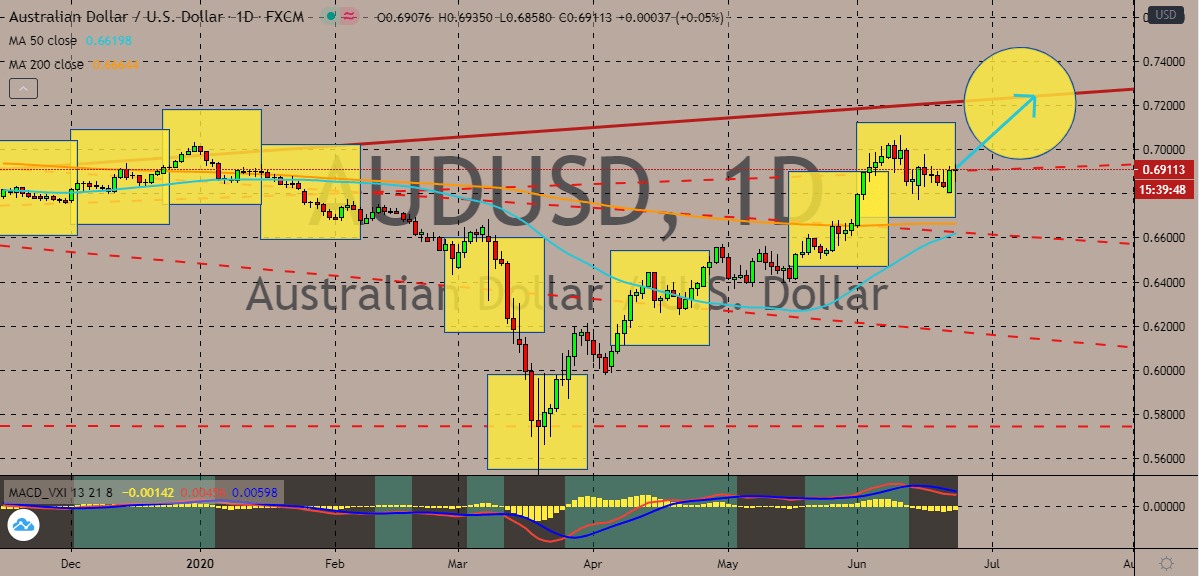

AUDUSD

The Australian dollar manages to defend itself against the US dollar despite the numerous odds against it. It appears that the Aussie is still looking to appreciate against the US dollar in spite of the earlier acknowledgment of the Reserve Bank of Australia to the strength of the Australian dollar. The Australian dollar took a harsh after White House trade adviser Peter Navarro said that the trade deal with Beijing is finally “over”. Navarro’s words were immediately taken out of context and the US President Donald Trump commented, relating that the Phase 1 deal was already struck earlier this year. The market was initially concerned that Washington might be ditching the agreement with Beijing. And now that it’s all cleared, the Aussie manages to get a grip on the pair’s direction again. The Australian dollar takes advantage of the US dollar which is seen struggling to gain momentum against a number of currencies this Tuesday.

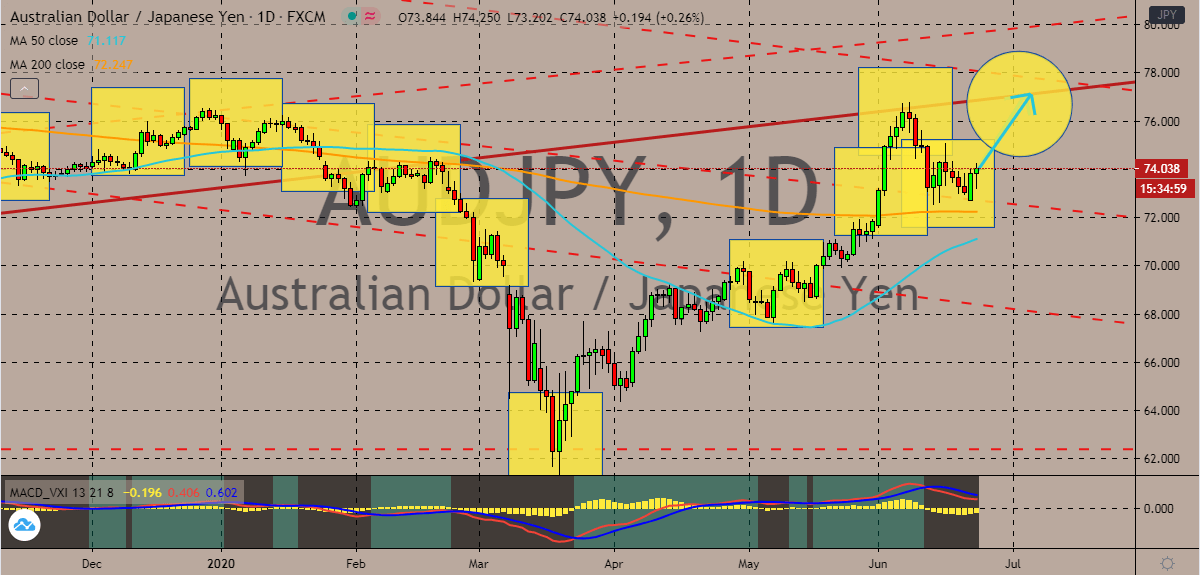

AUDJPY

The Japanese yen fails to bring the prices lower in sessions. Loong at the chart, it’s evident that in every attempt that bearish investors make, they bounce off from the support level. And as of today, it appears that the Japanese yen is losing its steam as it failed to hold on to its earlier gains. Bullish investors of the Australian dollar are looking to propel the pair’s prices higher toward their resistance level despite the comment of the Reserve Bank of Australia regarding its strength. Also, the earlier comments of the Reserve Bank of Australia governor have given the Australian dollar a boost against the Japanese yen. According to RBA Governor Phillip Lowe, he would like to see a lower Australian dollar in the future, and that isn’t helping out AUD bears as it suggests that there is still plenty of room for appreciation for the currency. Meanwhile, the poor workforce data that was released last week failed to prevent the Aussie from rallying against the yen.

COMMENTS