Here are the latest market charts and analysis for today. Check them out and know what’s happening in the market today.

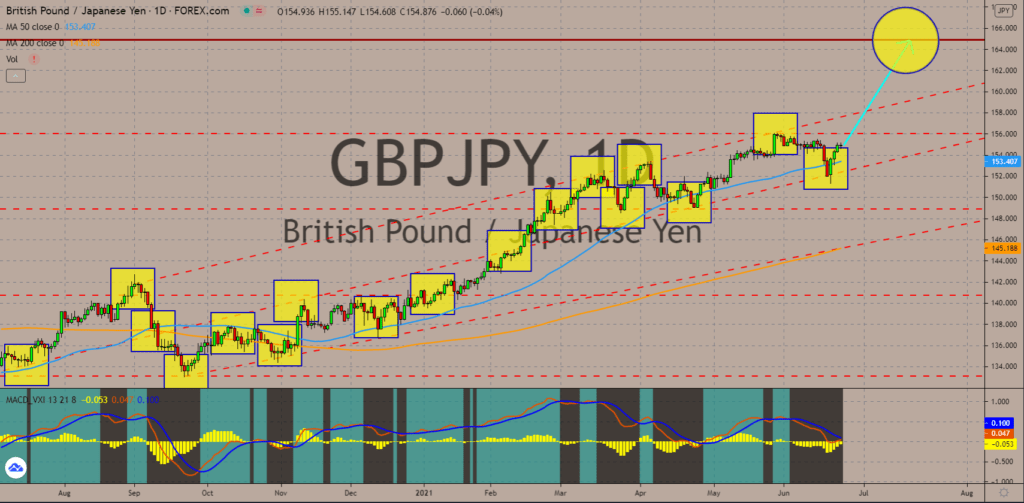

GBPJPY

Recent economic reports from Japan show a continued slow down in the world’s third-largest economy. On Thursday last week, the Bank of Japan (BOJ) reaffirmed its commitment to ultra-loose monetary policy after keeping the interest rate at -10%. In theory, the negative rates should encourage business activity in Tokyo. However, the inflation data is yet to reach the central bank’s annual inflation target of 2.0%. In May, the price of basic goods advanced only by 0.3% from deflation of -0.3% prior as per the government’s record. But for the BOJ, the consumer price index (CPI) was flat at zero percent. The bleak data were reflected on the Purchasing Manager Index’s (PMI) report on Tuesday, June 22. The manufacturing sector slid to 51.5 points while the services sector advanced to 47.2 points but below the expansionary level above 50.0 points. The MACD indicator is showing signs of a short-term rally with prices rebounding from the 50 MA at 153.407.

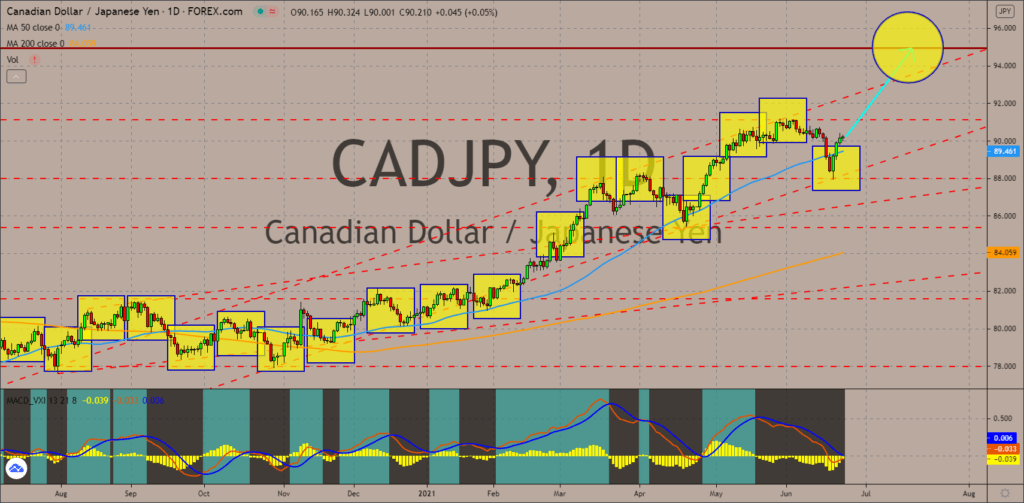

CADJPY

As countries began to reopen their borders, Canada made a surprise decision to keep the country isolated from the United States. This was despite the declining daily cases of coronavirus. Analysts said the decision was reached based on two (2) factors. First, the delay in lifting covid restrictions will result in massive growth once all measures are eased. This ensures a win for PM Justin Trudeau’s party in the 2022 elections. In recent news, Trudeau survived a no-confidence vote due to his new stimulus proposal. Second, reopening the economy pre-maturely could result in another outbreak. The third wave of coronavirus saw retail sales plunged by -5.7% compared to the prior month’s result. Meanwhile, the year-over-year (YoY) figure was down -7.2%. These numbers were steeper than the -5.0% decline anticipated for both reports. The MACD and Signal lines are expected to form a “bearish crossover” until Friday, June 25, a bullish signal for the CADJPY pair.

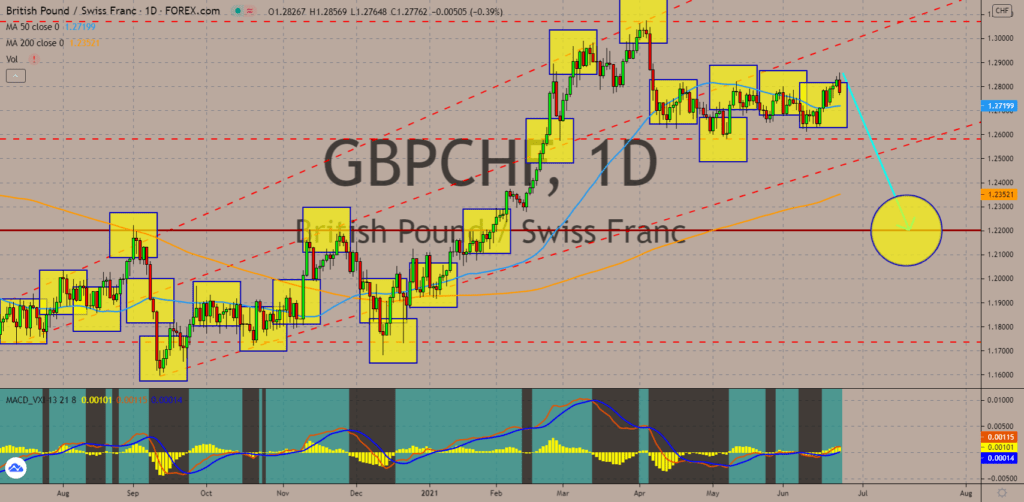

GBPCHF

A series of negative reports from the United Kingdom will send the British pound lower against the Swiss franc. The Bank of England (BOE) is at odds with Square Mile (London’s Wall Street counterpart) over the Monetary Policy Committee’s decision to keep the UK’s monetary policy unchanged. The interest rate remains at a record low of 0.10% while quantitative easing (QE) stood at 875 billion. This was despite the high vaccination rate in Britain with over 50% Britons already inoculated of which 47.6% were fully immune. Analysts fear that this might lead to a surge in inflation just like in the United States. But the recent purchasing managers index (PMI) reports for June’s preliminary result could justify this action. The Manufacturing, Services, and Composite PMIs were all down from their previous results. The manufacturing sector took the biggest hit with a 1.4 points decline to 64.2 points. Both the Composite and Services PMIs reported 61.7 points.

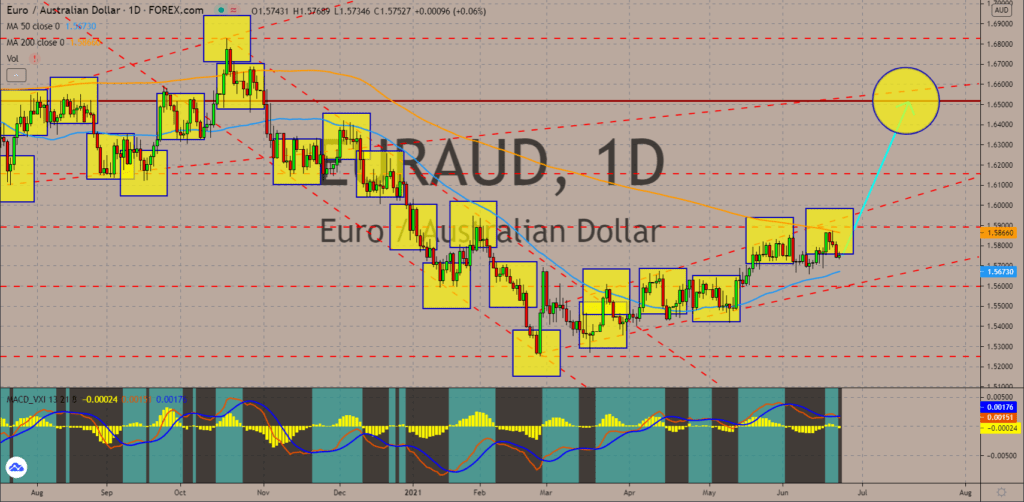

EURAUD

Australia and the EU had different results for PMI reports. Canberra’s preliminary data for the manufacturing and services sectors came in at 58.4 points and 56.0 points. These were a decline from May’s final result with 60.4 points and 58.0 points, respectively. Meanwhile, the Eurozone PMIs were up against the consensus estimates. Services and Markit Composite PMIs posted 59.2 points and 58.0 points while the Manufacturing PMI remained unchanged at 63.1 points, In Germany, all purchasing managers index figures were also better-than-expected. The upbeat results also translate to higher confidence among businesses. For the same month, the German Business Expectations report soared to a 3-year high of 104.00 points. Meanwhile, the Current Assessment data of 99.6 points suggests recovery from the pandemic. The pair trades between the 50 and 200 MAs at 1.56731 and 1.58660 shows a possible formation of a “bullish crossover”.

COMMENTS