Here are the latest market charts and analysis for today. Check them out and know what’s happening in the market today.

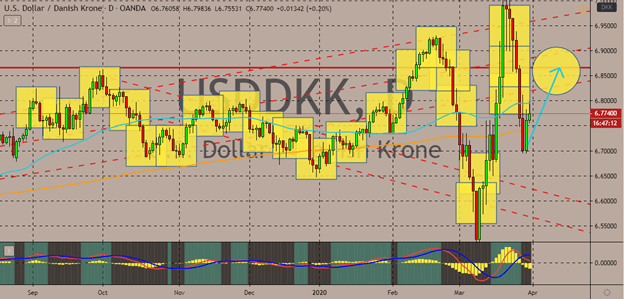

USDDKK

The US dollar rallies and attempts to make a recovery against the Danish krone. After crumbling following the unprecedented $2.2 trillion aid budget approved by the US House of Representatives, the buck finally gets back to the green territories. Bulls are hoping to keep the 50-day moving average significantly above the 200-day moving average, which indicates a confident upward momentum for the US dollar. If the upward trajectory continues, the pair has a huge potential to reach its resistance level soon. In fact, aside from the Danish krone, the US dollar is trading confidently against a vast number of major and minor currencies. As for the Danish krone, it has the potential to turn things around as the news of gradually reopening the lockdown can boost the confidence for the economy and krone. It’s reported that Denmark is looking to lift its lockdown after Easter if the number of cases remains stabilized, a good sign that it has managed the curb.

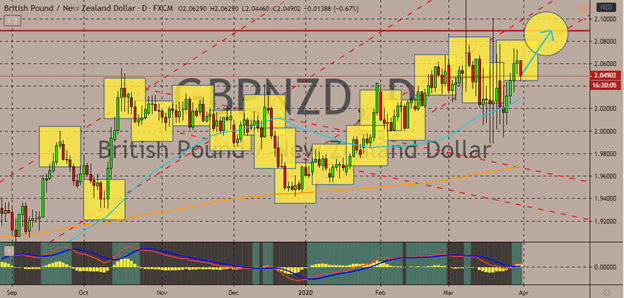

GBPNZD

The New Zealand dollar resists and brings the GBPNZD pair lower for today. However, unfortunately for investors of the New Zealand dollar, things are expected to remain widely bullish. Looking at the pair, it appears that bulls have successfully held on the reins as the 50-day moving average climbs higher and farther away from the 200-day moving average. In the United Kingdom, despite the restrictions expected to last for six months, the outbreak of the virus shows a good early sign of slowing down. Apparently, an expert from England said that it’s very evident because of the slowing number of new cases and hospital admissions. However, the lockdown may last longer as said previously by the UK’s Deputy Chief Medical Officer to avoid wasting the progress made and ensure the safety of the people. As for New Zealand, the swift decision of the country to impose strict restrictions earned praise as it lessens the number of new cases there.

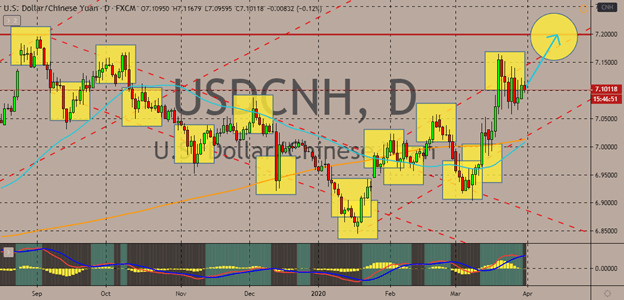

USDCNH

With a sudden and unexpected move from the People’s Bank of China, investors of the USDCNH pair were left baffled. The more slightly weakened the Chinese yuan, giving bulls the opportunity to push the 50-day moving average closer to the 200-day moving average. Yesterday, the Chinese central bank gave a surprise cut on its reverse repurchase agreement rates by 20 basis points. The deep cut is the largest one made after 20 years and its part of the measures planned by the authorities to boost the economy and relieve the pressure from businesses. According to an official from the People’s Bank of China, the bank still has ample room for more monetary adjustments and that the decision was largely made considering the return of Chinese companies to their work. As for the US dollar, investors are still advised to remain cautious as more uncertainties remain ahead as the United States battles the devastating pandemic.

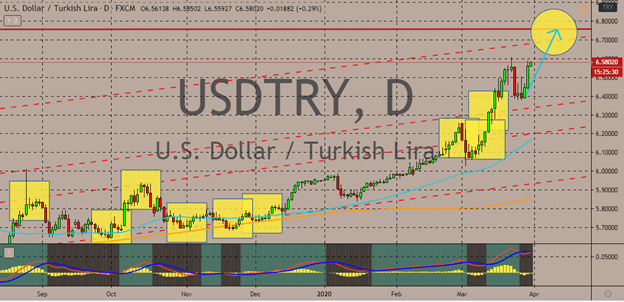

USDTRY

The Turkish lira remains highly vulnerable against the US dollar as it’s seen faltering in the USDTRY foreign exchange rate. Looking at the chart, it’s evident that bulls have this in control as the 200-day moving average is left in the dust by the rallying 50-day moving average, indicating a strong upward trajectory. In Turkey, the president has finally imposed stricter restrictions such as banning all international flights, prohibiting traveling from city to city through public transportation and closing public places. The decision comes after a Turkish official said that the Turkish economy will be one of the less damaged economies due to the pandemic. The tougher restrictions will definitely immobilize the economy as everything halts. However, such measures are deemed appropriate to help contain the virus and flatten the curb. And as for the dollar, it’s uncertain whether it could break its resistance as more turbulence comes ahead for the buck.

COMMENTS